The Mortgage Analytics and Performance Dashboard (MAPD) gives policymakers at the national, state, and local levels the ability to see where owner-occupant homeowners in their jurisdictions have fallen behind on mortgage payments or used mortgage forbearance as a means of economic relief during the COVID-19 pandemic.

In the previous recession, tracking mortgage delinquency measures was one of the primary methods for understanding the amount of distress in the mortgage market. Unlike the previous downturn, where there was no uniform and widespread response, mortgage forbearance has been one of many tools used by the federal government to provide economic relief to U.S. homeowners. Mortgage forbearance is a policy that provides borrowers the flexibility to miss mortgage payments without immediate penalty during a specified period, normally six months. These missed payments usually are rolled into a repayment plan of some kind after the forbearance period has ended. Forbearance is typically available to borrowers experiencing temporary hardship, and historically it has been used only in areas where homeowners suffer from natural disasters such as hurricanes.

On March 10, 2020, the Federal Housing Finance Agency, which regulates Fannie Mae and Freddie Mac, released a public statement encouraging mortgage borrowers nationwide to take advantage of forbearance programs in light of the growing economic impact of COVID-19. Borrowers whose loans are not backed by Fannie Mae or Freddie Mac were also offered forbearance plans similar to those offered by the government-sponsored enterprises. By the end of April 2020, nearly 4.5 million mortgages in the United States were in forbearance.

In addition to the extended payment plan for missed payments, mortgage servicers generally do not report missed payments to credit bureaus when a mortgage is in forbearance. (A mortgage servicer is the company responsible for administering the payment plan for mortgages; it is sometimes the lender and sometimes a third party.)

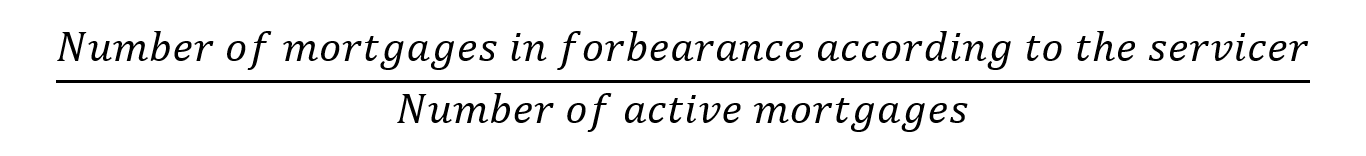

The Mortgage Analytics and Performance Dashboard uses Black Knight's McDash Flash daily mortgage performance data (available also from Black Knight with a two-day lag) to identify forbearance. The tool previously used the Equifax and Black Knight McDash Credit Risk Insight Mortgage Servicing (CRISM) data set to estimate forbearance rates; the current data set went into effect in March 2021. The addition of the Flash data set was made possible through collaboration with Xudong An, Larry Cordell, Liang Geng, and Keyoung Lee at the Federal Reserve Bank of Philadelphia.