Readers of this blog know that we at the Retail Payments Risk Forum have for years scratched our heads at the tepid growth of contactless card payments:

- Doug King in 2017: Wouldn't it be nice to tap and pay?

- Dave Lott in 2019: Contactless cards: the future king of payments?

- Me in 2020: Are contactless cards having their moment?

Now, data released in December by the Federal Reserve Payments Study![]() find that amid the decline in the number and value of in-person card payments from 2019 to 2020, in-person contactless card pay increased both by number and value. You can see the appeal of contactless card pay in the COVID-19 pandemic: The ability to tap or wave a card or mobile device at the in-person point of sale could be perceived to reduce the risk of contagion.

find that amid the decline in the number and value of in-person card payments from 2019 to 2020, in-person contactless card pay increased both by number and value. You can see the appeal of contactless card pay in the COVID-19 pandemic: The ability to tap or wave a card or mobile device at the in-person point of sale could be perceived to reduce the risk of contagion.

From 2019 to 2020:

- The number of contactless card payments more than doubled (up 140 percent from 1.6 billion payments to 3.7 billion)

- The total value of contactless card payments also more than doubled (up 120 percent from $50 billion to $110 billion)

The number and value of contactless card payments also doubled from 2018 to 2019, although on a smaller base. The 2020 growth is especially impressive in the context of the overall decline in the number and value of in-person card payments that year. But am I convinced that contactless pay is having its moment? Well, no. That’s because looking at percentage increases can be misleading when the base is so small.

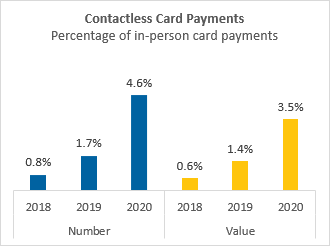

With their 2020 growth, contactless card payments remain less than 5 percent of in-person card payments by number (figure) and 3.5 percent of in-person card payments by value. Maybe not the "king of payments" quite yet.

I am willing to believe, however, that throughout 2020 and 2021 merchants ramped up their ability to accept contactless cards for in-person payments (along with screens and procedures to separate employees and customers)—even as they pushed customers toward delivery and curbside pick-up. With acceptance more widespread, consumers should be less likely in 2022 to run into the sort of difficulties my friend encountered in August 2020, when she tried to find a merchant that could successfully accept a completely contactless payment.

For more on newer and emerging payment methods, see the most recent report of the Federal Reserve Payments Study![]() .

.