Small businesses are a crucial part of the U.S. economy. In 2016, 5.1 million small firms—those with fewer than 500 employees—made up 99.6 percent of all businesses with employees in the United States, and they employed about half (48 percent), or 59.7 million, of non-self-employed workers.1 The annual Federal Reserve System Small Business Credit Survey (SBCS) provides information on small business economic conditions, financing needs, and credit availability across the country.2

In May, the 2017 survey's Report on Employer Firms presented findings on small firms with one to 499 full- or part-time employees. The report provides data on the experiences of small businesses in applying for and obtaining credit (or not) across the United States. This article examines the answers to a selection of questions presented in the national report in four states in the Federal Reserve's Sixth District: Alabama, Florida, Georgia, and Tennessee.3 The results show some notable differences between these southeastern states and the nation as a whole in terms of small business performance and borrowing patterns.

Small firms' financial performance

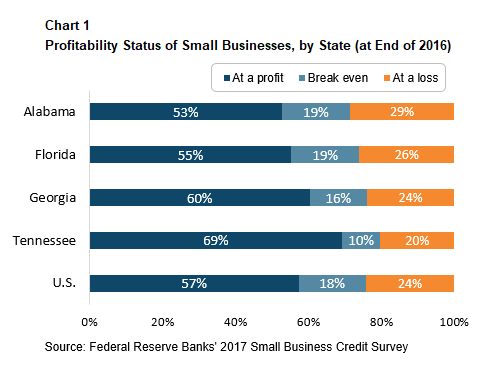

The survey includes several questions on self-reported small business performance, including profitability, revenues, and employee growth. Owners of small businesses in Georgia and Tennessee report they are relatively profitable, compared with firms nationally and in other southeastern states. Sixty-nine percent of Tennessee firms and 60 percent of Georgia firms report they were profitable at the end of 2016, compared with 55 percent in Florida and 53 percent in Alabama (see chart 1). In contrast, just 20 percent of Tennessee and 24 percent of Georgia businesses report they operated at a loss, compared with 26 percent of firms in Florida and 29 percent in Alabama. Across the United States, 57 percent of firms were profitable, and 24 percent reported operating at a loss.

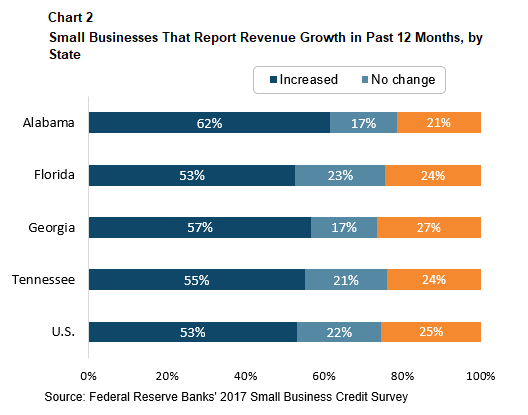

Small businesses in Alabama showed strong growth. Sixty-two percent of Alabama small businesses reported revenue growth over the 12-month period studied, compared with 53 percent in Florida, 57 percent in Georgia, and 55 percent in Tennessee (see chart 2). Given these differences in business performance across the Southeast, we examine variation in the type of challenges faced by firms that indicated they were struggling.

Small firms' financial challenges

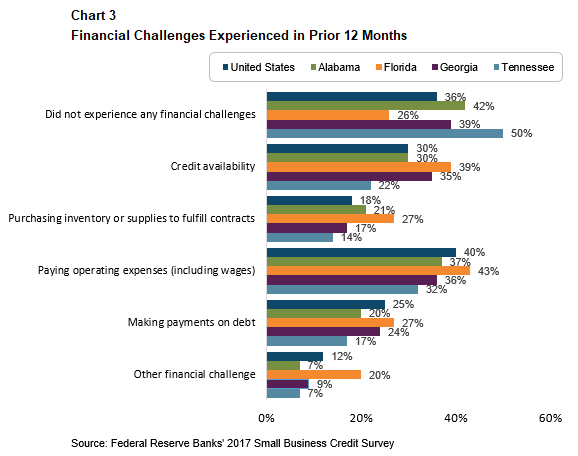

Firms were asked about the financial challenges they experienced in the prior 12 months. Notably, firms in Alabama and Tennessee were significantly less likely to experience financial challenges than small businesses across the United States. Nationally, about 64 percent of businesses reported they experienced some sort of financial challenge in the prior 12 months. In comparison, 58 percent of Alabama firms, 61 percent of Georgia firms, and 50 percent of Tennessee firms reported the same (see chart 3). However, Florida firms were significantly more likely to experience financial challenges than the other southeastern states, with about 74 percent reporting such challenges.

Firms that experienced financial challenges most frequently cited the inability to pay operating expenses such as wages, rent, insurance, and utilities. Forty percent of firms did so nationally, and this was the most commonly cited challenge in the four southeastern states we studied. Interestingly, firms in Florida were significantly more likely to cite credit availability challenges than firms in other southeastern states or the United States as a whole. Florida firms also cited problems with purchasing inventory or supplies to fulfill contracts. Thirty-nine percent of Florida firms reported the former issue, and 27 percent the latter, compared with 30 percent and 18 percent nationally.

The above challenges could well be related to the impact of Hurricane Irma, which made landfall in Florida on September 10, 2017, one day before the SBCS was fielded. A significantly larger share of Florida businesses also cited other financial challenges besides the categories in chart 3; 20 percent versus 12 percent nationally. While the responses describing these challenges include issues like late payments from clients and theft, a significant share of responses lists the effects of Hurricane Irma. The descriptions of the hurricane's impacts range from damage to equipment or buildings; loss of inventory; delayed or canceled orders, and thus diminished or no revenues; or forced closure due to the hurricane.

With 49 out of the state's 67 counties designated for individual disaster assistance by the Federal Emergency Management Agency (FEMA), the effects of the hurricane were widespread throughout the state. Indeed, 70 percent of firms that reported other financial challenges indicated they were affected by Hurricane Irma, and they cited damage or forced closure due to the natural disaster. The recent SBCS Report on Disaster-Affected Firms examines the business conditions, insurance coverage, and credit environment of firms located in FEMA-designated disaster zip codes. Some 58 percent of Florida firms indicated they suffered direct or indirect losses from a natural disaster (in the past 12 months), compared with some 10 percent of firms across the United States. Of Florida firms that suffered some natural disaster-related loss, 82 percent cited some sort of financial challenge, compared with 60 percent that did so among firms not affected by a natural disaster, a significant difference.

Hurricane Irma is thus likely an important driver behind Florida's relatively high share of businesses with financial challenges. For example, a study by the JPMorgan Chase Institute found Irma had a dramatic short-term impact on cash balances of firms in Miami. Cash inflows for most small businesses there dropped by over 63 percent, and overall small business cash balances declined by 7.4 percent between September 8 and September 14, though these balances largely recovered within two weeks.4

The impact of Hurricane Irma could be behind several other small business financing trends that set these businesses in the state apart from the rest of the country. For instance, Florida small businesses were significantly more likely to apply for financing in 2017 than were firms nationally; 53 percent did so in Florida compared to 40 percent across the United States. The state also had a relatively high share of applicants who applied for Small Business Administration (SBA) loans or lines of credit: 46 percent, compared with 26 percent across the United States. Indeed, nationally, 71 percent of firms that applied or planned to apply for disaster relief turned to the SBA for support, and 80 percent did so in Florida.5 Despite these challenges, Florida firms remain relatively optimistic about the future. A net 71 percent expect to see revenue growth, and a net 53 percent expect employment at their businesses to increase, compared with a net 64 percent and 43 percent nationally, respectively.

Small business financing, sources

Previous research has shown that access to capital is important to small business success. Better capitalized businesses have higher sales, profits, and employment, and are less likely to shut down than are firms that receive less start-up capital.6 It is thus important to analyze small businesses' access to financing and their borrowing patterns, as this affects how small businesses contribute to the economic growth and development of entrepreneurs and their communities.

Nationally, most small business applicants turn to large banks, small banks, and online lenders to secure financing for loans, lines of credit, and/or cash advances. Community development financial institutions (CDFIs) and credit unions also play important, albeit more limited roles in the small business financing space.

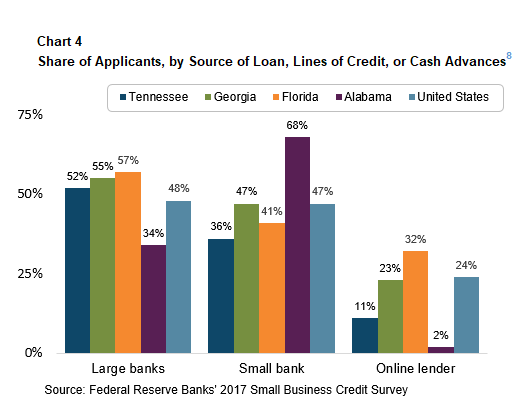

There are notable differences in the composition of these financing sources among Southeast states. For instance, large banks7 play a relatively important role in Georgia and Florida's small business financing landscape. Fifty-five percent of Georgia firms and 57 percent of Florida firms that applied for financing did so at a large bank, compared with 48 percent of applicants across the country (see chart 4). Large banks played a significantly smaller role in Alabama, where only 34 percent of applicants turned to these institutions for loans, lines of credit, or cash advances. Nationally, applicants more frequently cite lower costs or interest rates as reasons to apply to large banks, but they cite long waits for credit decisions or funding as a challenge.

Small banks9 are crucial to Alabama's small business financing sector. Alabama small businesses are more likely to turn to small banks for financing than are businesses nationally; 68 percent did so compared to 47 percent nationally. Indeed, commercial and industrial (C&I) small business loans make up a larger share of the portfolio for Alabama banks with less than $10 billion in deposits than in all other southeastern states or than the United States as a whole.10 For instance, C&I small business loans made up 5.6 percent of total consolidated assets for Alabama banks with less than $1 billion in assets, and 9 percent for banks between $1 billion and $10 billion in assets, compared with 4.9 percent and 3.3 percent, respectively, at similar banks across the United States. In contrast, small banks play a less important role in Florida, where just 41 percent of applicants applied for financing at such institutions.

The number of small banks within southeastern states may well be related to the role such institutions play in small business lending in these states. Notably, at the end of 2017, Alabama had 117 small banks, slightly fewer than the 126 located in Florida, a state with more than four times Alabama's population.11 Small community banks are well suited to the collection of soft or qualitative information and relationship lending as well as the incorporation of context-specific factors such as the reliability and character of a business's owner and a community's characteristics. This information is particularly useful in lending to small firms and start-ups with a short or unclear credit history.12

Nationally, small banks enjoy some of the highest satisfaction rates of all types of small business financing institutions; 79 percent of applicants approved for loans at small banks were satisfied with their lenders, compared to 63 percent at large banks. Applicants at small banks are least likely to cite a "lack of transparency," "unfavorable repayment terms," or "high interest rates" as challenges, and are most likely to say they've faced no challenges at all, compared with applicants at large banks and online lenders. However, applicants at small banks are least likely to say they did not require collateral or that the product they were offered was flexible, compared with these other types of lenders.13

Over the past few years, online lending14 has become an increasingly important source for small business loans. Across the United States, 24 percent of applicants turned to online lenders in 2017, up from 20 percent in 2015.15 Online lenders play a relatively large role in Florida's small business landscape: 32 percent applied to these lenders, a significantly greater share of small business applicants than did so nationally. Applications to online lenders were significantly less common in Alabama's small business financing landscape; just 2 percent applied to online lenders.

Notably, in a study of the online peer-to-peer lenders Prosper and LendingClub, Havrylchyk et al. (2017) find online peer-to-peer lenders, "online intermediaries that match lenders with borrowers," have made inroads particularly in areas with a smaller market concentration and lower branch density of banks.16 Access to and the type or speed of local internet was not found significantly related to the diffusion of online peer-to-peer lending. As such, the low prevalence of online lending in small business financing in Alabama may well be because local (small) banks are well represented to serve small businesses throughout the state, and vice versa in Florida. One caveat: this research only addresses a segment of nonbank online lenders and includes multiple types of loans beyond those to small businesses. Indeed, lack of fast internet access may well be an impediment to small businesses' ability to access financing from online lenders throughout rural parts of the Southeast.

Nationally, large shares of small business applicants report turning to online lenders because of their perceived chance of being funded (applicants at online lenders experienced higher approval rates than at small or large banks or at credit unions), because of the speed of decisions, or because no collateral was required.17 Additionally, Robb, Barkley, and de Zeeuw (2018) find that black- and Hispanic-owned small businesses are significantly more likely to turn to these lenders for financing compared to white-owned firms,18 indicating such lenders may be serving an important and historically underserved population of small businesses. However, applicants to nonbank online lenders are more frequently those with higher credit risks, and they more frequently cite high interest rates or unfavorable repayment terms as challenges compared to other financing sources. Finally, just 52 percent of those approved for financing at online lenders were satisfied with their lender, compared with 63 percent satisfaction for large banks and 79 percent for small banks, though net satisfaction with online lenders has rapidly increased over the past several years.19

Loan approval and reasons

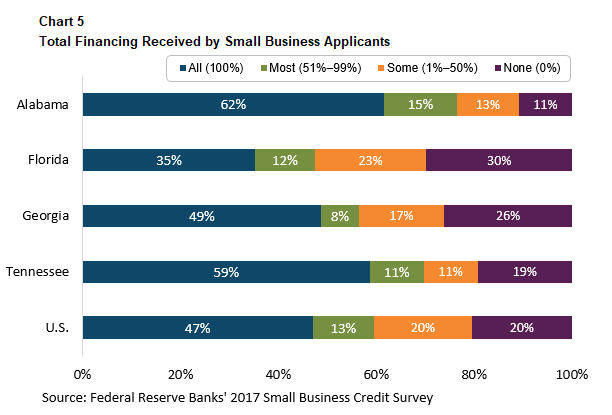

Across the country, about 40 percent of small businesses applied for financing in 2017, down from 46 percent of businesses two years before. Most firms seek financing to expand business, pursue new opportunities, or replace capital assets (59 percent); meet operating expenses (43 percent); or refinance or pay down debt (26 percent). There are significant differences in the approval rates received by those firms that decide to apply for financing across southeastern states (see chart 5). For instance, we see that financing gaps, defined as the share of firms not receiving all or any of the financing they applied for, are significantly larger in states like Florida and Georgia than in Alabama. Particularly in Florida, a significantly smaller share of small business applicants (35 percent) received all the financing they sought than did applicants across the United States (47 percent).

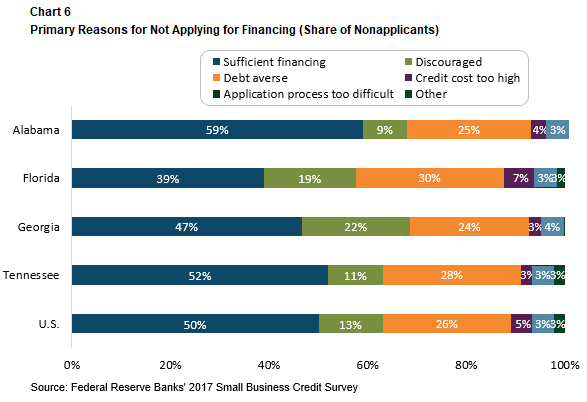

The 2017 SBCS also provides information on firms that opted not to apply for financing (60 percent of firms). Nationally, the most frequently reported reason for firms not to apply was they had "sufficient financing" in place; 50 percent of nonapplicants reported this reason (see chart 6). A significantly larger share of Alabama firms (59 percent) and a relatively small share of Florida firms (39 percent) did not apply for financing because they had sufficient financing in place. Interestingly, and arguably encouragingly, firms in Alabama are significantly less likely to seek financing to meet operating expenses (32 percent) or to refinance debt (17 percent), and a high share (70 percent) seek financing to pursue new opportunities, expand their business, or replace capital assets.

Finally, relatively large shares of Florida (19 percent) and Georgia (22 percent) nonapplicants chose not to apply for financing because they were afraid they would be turned down. A relatively small share of Alabama firms (9 percent) felt similarly discouraged from applying for financing.

Conclusion

Analyzing the SBCS results at a state level reveals some interesting differences between southeastern states in how small businesses perform generally and in how their borrowing patterns vary. Florida small businesses appear particularly challenged, with lower credit approval rates and a greater incidence of financial challenges, and this appears to be at least partially an effect of Hurricane Irma. Among Florida firms that did not apply for credit, smaller shares had sufficient financing in place and a larger share reported being discouraged from applying because they expected to be turned down.

In contrast, small businesses in other southeastern states like Alabama and Tennessee look stronger on various performance metrics when compared to the nation overall. Furthermore, states exhibit significant differences in the composition of their small business financing sector. For instance, online lenders appear to have a relatively large presence in Florida, but they play a much smaller role in Alabama small business lending. Large banks are important players in Florida and Georgia's small business financing landscape, but small banks are more essential in Alabama.

Given the important role small businesses play in the U.S. economy, and given the importance of financing for small business success, the 2017 SBCS can provide policymakers with valuable information to gauge the performance and financing experiences of small businesses in the Southeast.

By Mels de Zeeuw, senior CED research analyst, and Tamilore Toyin-Adelaja, CED intern

_______________________________________

1 U.S. Census Bureau, Business Dynamics Statistics, 2016. Small business or firms refers to businesses with fewer than 500 employees.

2 The 2017 SBCS was conducted among owners of firms with one to 499 employees in the third and fourth quarters of 2017 to examine their experiences applying for and obtaining financing. It also looks at some measures of business performance. Businesses are generally invited to participate in the survey by a large number of intermediary partner organizations. Although the responses represent a convenience sample, a system of weights is employed to ensure the results are nationally representative of the U.S. small business population. For more information on the findings and methodology, visit FedSmallBusiness.org.

3 The SBCS restricts data for states with less than 100 observations or that surpass a standard error threshold, which means we cannot calculate state-specific results for Louisiana and Mississippi. The survey includes responses from 241 employer firms in Alabama, 543 in Florida, 311 in Georgia, and 178 in Tennessee. The state-specific survey results presented here have been weighted to be representative of the small business population within each state. For more information, see the methodology section in the 2017 Report on Employer Firms.

4 Farrell, D. and Wheat, C. 2018. "Bend, Don't Break: Small Business Financial Resilience after Hurricanes Harvey and Irma." JPMorgan Chase Institute.

5 Small Business Credit Survey: 2017 Report on Disaster-Affected Firms.

6 Fairlie, R. and Robb, A. 2008. Race and Entrepreneurial Success: Black- Asian- and White-Owned Businesses in the United States. Cambridge, MA: MIT Press.

7 Large banks have at least $10 billion in total deposits operating in a state.

8 These three sources of financing were not mutually exclusive, respondents could select multiple options. Other sources of financing were left out of this chart due to a low number of responses.

9 Small banks have less than $10 billion in total deposits.

10 Sutaria, N. Forthcoming. "The State of Small Business Lending in the Southeast." The analysis considers C&I loans of less than $1 million to be small business loans.

11 Ibid. The number of small banks (with less than $10 billion in assets) in Georgia totals 170; there are 119 in Louisiana, 71 in Mississippi, and 147 in Tennessee.

12 Jagtiani, J. and Maingi, R.Q. 2018. "How Important Are Local Community Banks to Small Business Lending? Evidence from Mergers and Acquisitions," Working Paper 18-18, Federal Reserve Bank of Philadelphia; Brainard, L. 2015. "Community Banks, Small Business Credit, and Online Lending." Speech by Fed Governor Lael Brainard at the Community Banking in the 21st Century Research and Policy Conference, St. Louis, Missouri. https://www.federalreserve.gov/newsevents/speech/brainard20150930a.htm.

13 Small Business Credit Survey: 2017 Report on Employer Firms.

14 Nonbank online lender; examples include retail/payments processors such as PayPal Working Capital, Square Capital, and Amazon Capital Services; peer-to-peer lenders such as LendingClub, Prosper, and Funding Circle; merchant cash advance lenders such as RapidAdvance, CAN Capital, and Bizfi; and direct lenders such as OnDeck, Kabbage, Fundation, and BlueVine.

15 Small Business Credit Survey: 2017 Report on Employer Firms.

16 Havrylchyk, O., Mariotto, C., Rahim, T.U., and Verdier, M. 2018. "What Has Driven the Expansion of the Peer-to-Peer Lending?" https://dx.doi.org/10.2139/ssrn.2841316

17 Small Business Credit Survey: 2017 Report on Employer Firms.

18 Robb, A., Barkley, B., and de Zeeuw, M.G. 2018. "Mind the Gap: How Do Credit Market Experiences and Borrowing Patterns Differ for Minority-Owned Firms?" Federal Reserve Bank of Atlanta Community and Economic Development Discussion Paper 03-18, September.

19 Small Business Credit Survey: 2017 Report on Employer Firms.