Villagers gather on bridge remnants to receive needed supplies. The village was cut off by the Rio Charco Abajo's flooding that made the village road and bridge impassable. A cable-pulley system ferries a shopping cart from shore-to-shore. Photo by Andrea Booher, courtesy of the Federal Emergency Management Agency

Villagers gather on bridge remnants to receive needed supplies. The village was cut off by the Rio Charco Abajo's flooding that made the village road and bridge impassable. A cable-pulley system ferries a shopping cart from shore-to-shore. Photo by Andrea Booher, courtesy of the Federal Emergency Management AgencyAfter Hurricane Maria ravaged Puerto Rico last fall, the island converted to a purely cash economy.

The hurricane struck the U.S. territory on September 20, just two weeks after Irma had hit. During September and October, the Federal Reserve supplied more than $1 billion to Puerto Rico's financial institutions, seven times the amount the Fed paid out to the island's banks in the same period in 2016, according to the Federal Reserve Bank of New York.

The category 5 Hurricane Maria knocked out electricity throughout Puerto Rico. The island's 3.4 million residents could not use a debit or credit card, nor could they make online payments of any kind.

"Puerto Rico was a textbook case for why currency remains an essential component of our payments system," said Amy Goodman, vice president and head of the Federal Reserve Bank of Atlanta's Cash Function Office, which is based at the New Orleans Branch.

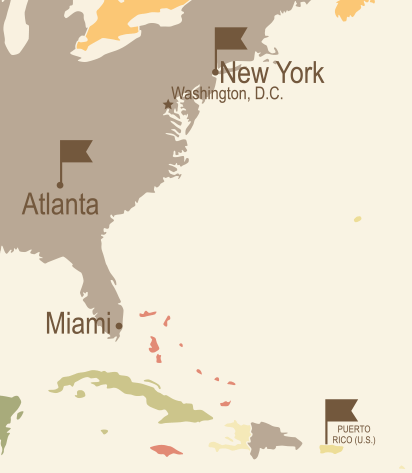

Atlanta Fed's Miami Branch stepped in after Maria

The New York Fed—the Federal Reserve's busiest cash shop in terms of handling overseas currency distribution—typically supplies currency to Puerto Rico's financial institutions. But Maria disabled the island's airports, so no commercial flights could land for days after the hurricane hit. Even as flights resumed, planes from New York could not travel to Puerto Rico—only daylight arrivals and departures were possible because of damaged airport equipment.

Planes from Florida could meet the daylight requirement, however, so the Atlanta Fed's Miami cash operation stepped in. Starting with a chartered plane out of Orlando on September 26, the Atlanta Fed's Miami Branch shipped $670 million in currency to Puerto Rico in the two weeks after Maria struck. After another chartered flight out of Fort Lauderdale on September 27, commercial flights resumed normal transport of currency.

The Federal Reserve had a careful strategy in place. Atlanta Fed staff in Miami and New Orleans cooperated with officials at the New York Fed and the System Cash Product Office in San Francisco to enact a prearranged contingency plan. The plan involved not just the logistics of currency distribution, but also accounting procedures and communications protocols.

In fact, communication helped launch the emergency currency shipments. Herb Kelleher, former chair of the Dallas Fed board of directors and the cofounder and former chief executive officer of Southwest Airlines called on aviation industry contacts to help arrange the initial charter flight from Orlando.

Post-Maria logistics complicated cash distribution in Puerto Rico

The Fed provides currency to financial institutions in Puerto Rico just as it does to banks in the 50 states. Once cash arrives on the island, armored couriers hired by Puerto Rican banks deliver it to the island's hundreds of bank branches. Immediately after the hurricane, some areas faced cash shortages. That was not for lack of currency on the island, explained Bevery Ferrell, assistant vice president and manager of the Atlanta Fed's Miami Branch.

Rather, the problem lay in distributing currency from the central cash depot to bank offices across the devastated island where vast swaths lacked electricity. (Even in mid-December, 35 percent of Puerto Rico remained without power, according to the Puerto Rican government.) Many bank branches remained closed, and numerous roads were impassable because of downed trees and other damage.

Keeping nimble

The post-Maria intervention in Puerto Rico was not the first time the Miami Branch filled an emergency role. The Miami office and the New York Fed back each other in emergencies. The two cash teams hold annual emergency drills.

"Thankfully the exercises kept our procedures fresh in mind so that when New York called to do this, we were ready and willing to step in," said Linet Blondet, cash services section manager in Miami.

But this situation was different. Contingency cash operations typically last only a couple of days, such as in the aftermath of Superstorm Sandy in 2012. Maria so disrupted Puerto Rico's transportation infrastructure that emergency cash shipments from Miami continued for two weeks, often sent twice a day with just an hour's notice, Ferrell said. Staff members were reporting at 4 a.m. to prepare 6 a.m. shipments.

And those unusual payouts affected the Branch's currency supply. Officials had to rapidly arrange shipments of new cash from the U.S. Bureau of Engraving and Printing, which produces currency.

"Our team had to be extremely nimble," Ferrell said. "We were making unusually big payouts, very quickly."

Cash contingency was not the only role the Atlanta Fed played after Maria. The Miami Branch's regional executive, Karen Gilmore, fielded calls from businesspeople and bankers with operations in Puerto Rico who were concerned about getting cash to their employees on the island.