In our last post, we observed some deterioration in office market fundamentals in the face of the COVID-19 pandemic. Office market vacancy rates increased notably while asking rents remained relatively unchanged from 2019. Did the retail market respond similarly? Due to mandatory business closures and the increase in e-commerce revenue, one might expect retail market vacancy rates to increase and asking rents to decrease. However, the retail property market overall has been much less affected during the COVID-19 pandemic than the office market. As in our previous post, we explore the retail real estate market vacancy rate and asking rent in the 10 cities with the highest retail space stock square footage (according to CBRE-EA's market ranker).

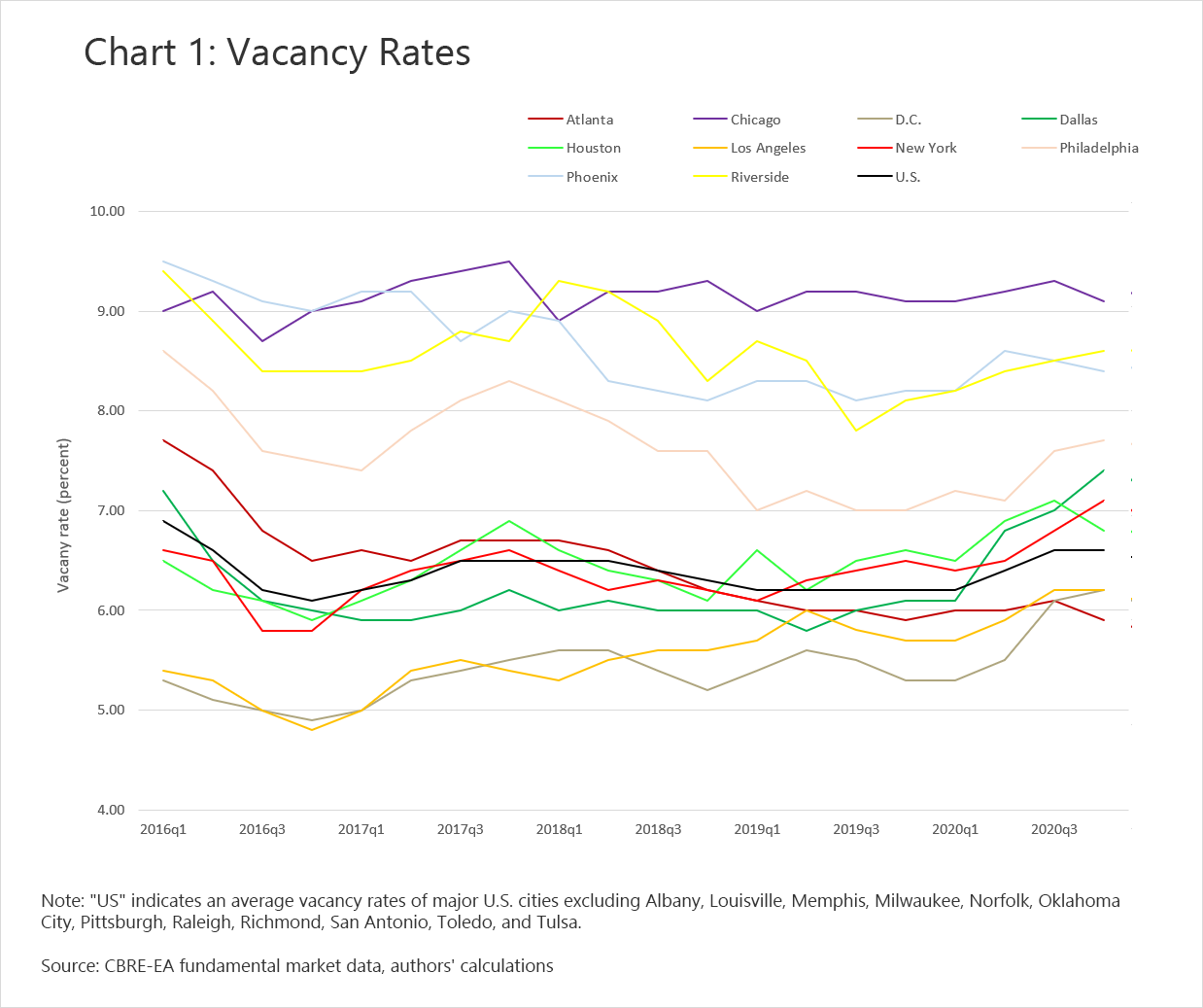

Unlike the office market, we observe that retail market vacancy rates did not behave nearly as uniformly (see chart 1). The overall retail market vacancy rate was 6.2 percent in the fourth quarter of 2019 (pre-COVID) and increased to 6.6 percent in the fourth quarter of 2020. The Dallas retail market experienced the largest change in the vacancy rate, increasing by 21.31 percent from the fourth quarter of 2019 to the fourth quarter of 2020 (from 6.1 percent to 7.4 percent). Washington, DC exhibited the next largest jump, where the vacancy rate increased by 16.98 percent during the same period (from 5.3 percent to 6.2 percent). While retail markets in Los Angeles, New York City, and Philadelphia saw an 8–10 percent increase in vacancy rates during the pandemic, other markets such as Houston and Phoenix experienced moderate vacancy rate increases—3.03 percent and 2.44 percent, respectively. In more positive scenarios, retail markets in cities such as Atlanta and Chicago saw only a slight increase in vacancy rates during the pandemic, with vacancy rates returning to their pre-COVID level at 5.9 percent and 9.1 percent in the fourth quarter of 2020, respectively.

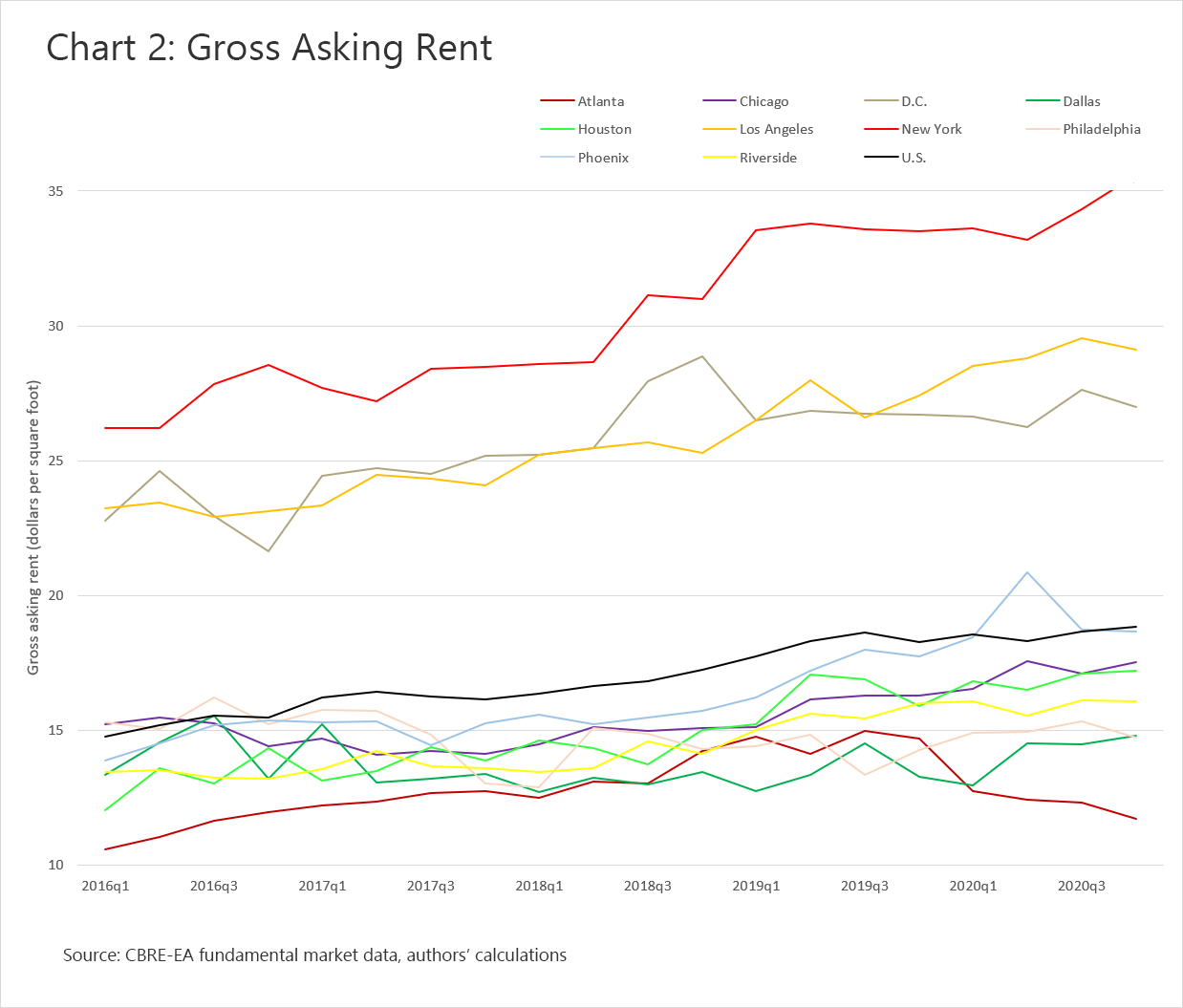

Chart 2 illustrates that the asking rent in most markets increased during the pandemic. The biggest jump in gross asking rents occurred in Dallas where, perplexingly, vacancy rates also increased the most. Dallas's gross asking rents increased from $13.26 per square foot (psf) to $14.79 psf from the fourth quarter of 2019q4 to the fourth quarter of 2020. New York City also experienced a noticeable increase in gross asking rents, with a 6.3 percent increase from the fourth quarter of 2019 ($33.51 psf) to the fourth quarter of 2020 ($35.62 psf). Other markets experienced moderate increases or mirrored rent rate changes experienced between 2018 and 2019. Atlanta was the only market where gross asking rents decreased. However, Atlanta's downward trend in retail rent rates started in the fourth quarter of 2019, so it is difficult to determine to what extent this trend was preexisting or influenced by the pandemic.

These observations all beg the question: why did the retail market experience only moderate changes in vacancy rates relative to the office market during the pandemic?

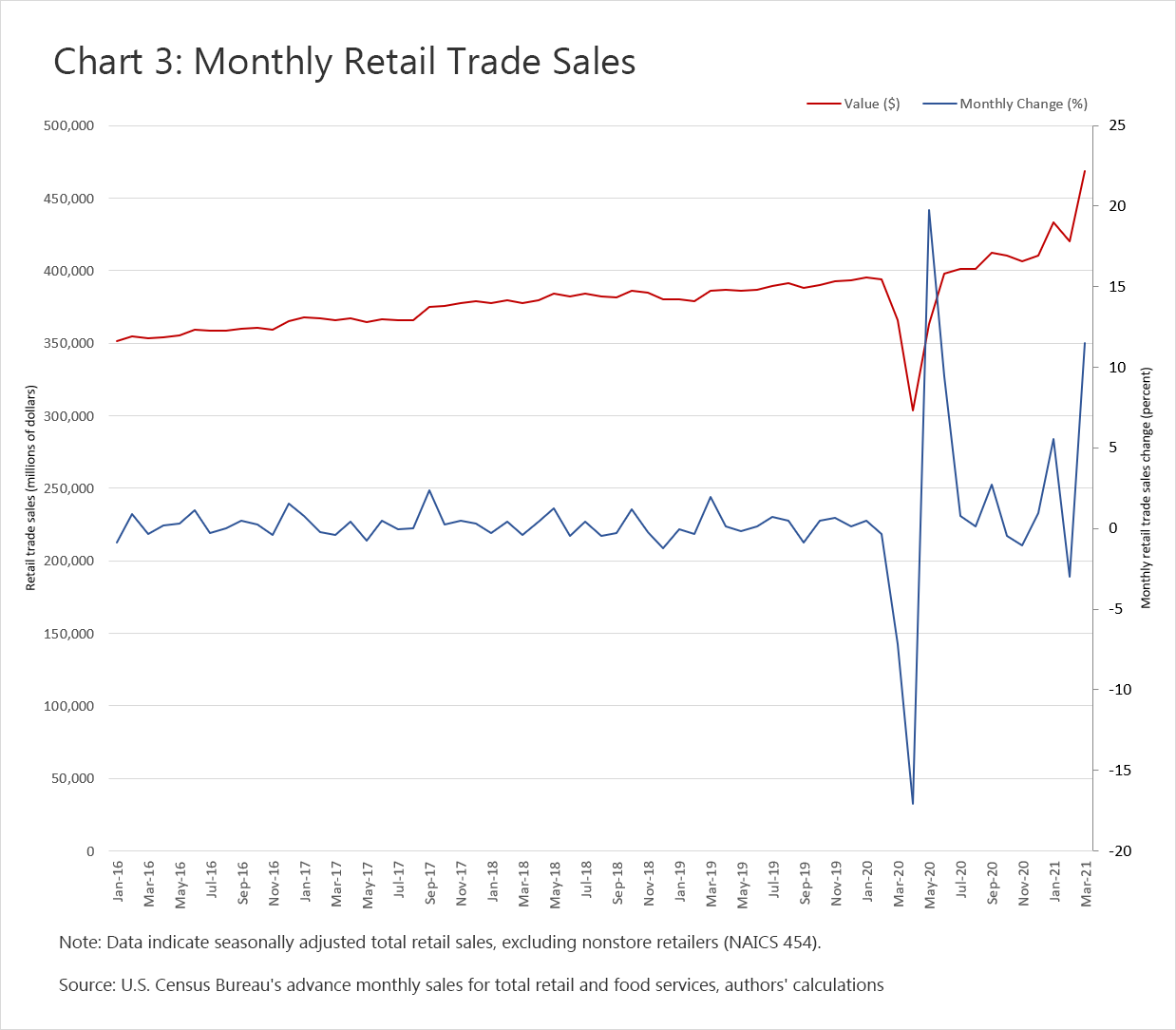

We cannot say for certain why the retail market and office market fundamentals for the top 10 markets followed such different paths. However, just as office-using employment drives demand for office space, we also know that the retail market relies heavily on household consumption. The relatively modest changes in vacancy rates and increased asking rental rates in the retail market could potentially be explained by the rebound in retail sales as shoppers returned to reopened stores (as you can see here). Chart 3 illustrates that retail trade sales temporarily decreased in the early stages of the COVID-19 pandemic (February–April 2020), but they rebounded strongly in May and June 2020, returning the total dollar value of retail trade sales (excluding nonstore retailers) to its pre-COVID level.

However, surveys conducted by our Atlanta Fed colleagues (discussed here) show that retail and wholesale firms expressed increased optimism in August 2020 when compared to April 2020. This improved sentiment may have further supported overall retail real estate market performance.

After putting forth these observations, though, one caveat is in order. Although the overall retail market appears to have been much less affected than the office market, the effects could vary by the size and type of business. For example, larger firms often have more financing options. They also tend to have online platforms that can help to offset temporarily sluggish sales at brick-and-mortar locations. The data we reviewed for this post does not discriminate between firm size or type, and we did not explore these dimensions.

We'll continue to monitor market fundamentals and report what we find. Meanwhile, you can track trends in the commercial markets with the Atlanta Fed's Commercial Real Estate Momentum Index.