"Location, location, location" is a truism associated with residential real estate. What we're hearing from our construction contacts could be another sort of truism: "Labor, lumber, lots." They are referring to the ongoing tight labor market in the construction trades, the skyrocketing price of lumber, and the difficulty of obtaining lots on which to build. While it's true that housing sector fundamentals—employment growth, household formation, tight inventory—continue to support an optimistic outlook, our industry contacts continue to report challenges regarding the supply chain. This post will focus on lots in the Southeast.

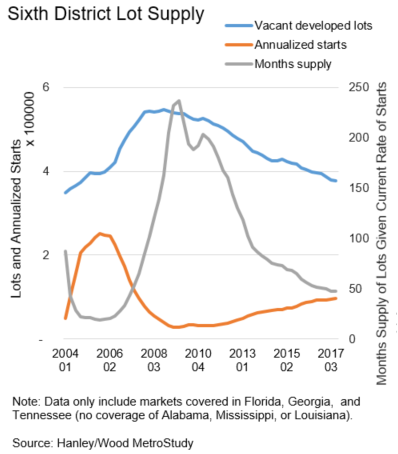

Data from MetroStudy indicate the supply of vacant developed lots in the Southeast has steadily declined since 2011 in absolute number and relative to housing starts (see the chart). While the current lot inventory appears similar to 2005 levels, there may be important differences. Anecdotal information indicates that lots are quite scarce, especially in desirable locations. That is, while the number of lots seems healthy, many of the lots developed from 2005 through 2007 were "bubble" lots—they have inferior locations and would not have been developed if not for the frothy environment of the time. When landing in Atlanta, for example, you can see scores of lots around the airport ready to go vertical, but being in the landing path of one of the world's busiest airports does not make the location exactly "prime."

So, the number of lots may be overstated, and the need to develop lots in better locations persists.

We heard of one possible roadblock from our business contacts. In the Atlanta Fed's most recent Construction and Real Estate Survey, the majority of builders continued to report that the amount of available credit for construction and development was insufficient to meet demand. The difficulty in obtaining bank loans, a traditional source of funding for small developers, has made it challenging for them to convert raw land to buildable lots.

Bank lending remains strong

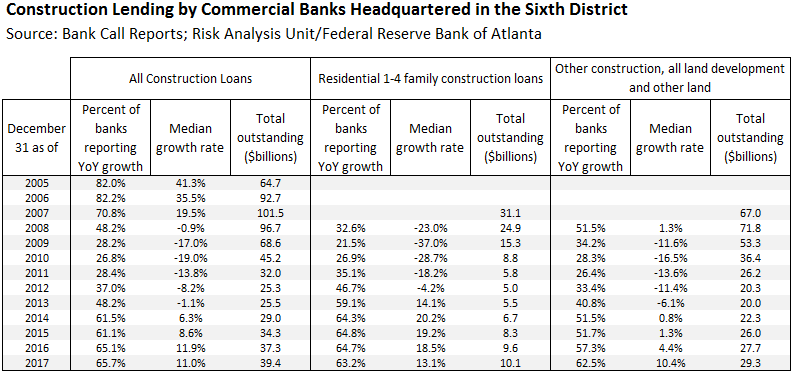

Given the comments on the survey, it seems somewhat surprising that, according to bank call reports, construction lending remains the highest growth portfolio among banks headquartered in the Atlanta Fed's district (which encompasses Alabama, Florida, Georgia, and sections of Louisiana, Mississippi, and Tennessee). Exposures for construction have risen steadily over the past three years as optimism about the economy has increased (see the table).

In 2005, before the banking downturn, over 80 percent of the banks in the district were reporting construction loan growth year over year, with median growth rates exceeding 40 percent. From the time of the banking downturn through the early recovery, however, construction loan growth turned negative. Banks experienced significant losses on partially finished projects, making them hesitant to lend on other projects. Growth finally turned positive again in 2014. From 2015 to 2017, the percentage of banks reporting year-over-year growth in construction increased slightly, from 61 percent to 65 percent.

Still, the percentage of banks reporting growth in their residential construction portfolio has declined slightly while the overall growth rate of construction loans has dropped from 20 percent in 2014 to just over 13 percent as of December 31, 2017.

Looking deeper into the primary drivers of loan growth, we broke down total construction lending into two categories: Residential 1–4 family construction loans and Other loans, all land development, and other land.

Though the Other category includes all land development, it mostly includes only construction loans for nonresidential and multifamily properties. Loans for development of lots that will have one to four family houses built on them are routinely put in the Residential 1–4 family category of construction loans. What this means is that the data cannot tell us the amount of lending going to develop new lots.

What the data can tell us is that overall construction lending is growing, though at a measured pace and starting from a relatively low level. And anecdotes tell us that the growth is not coming from lot development loans, but, rather, commercial real estate projects and "vertical" residential construction—that is, the actual building of houses.

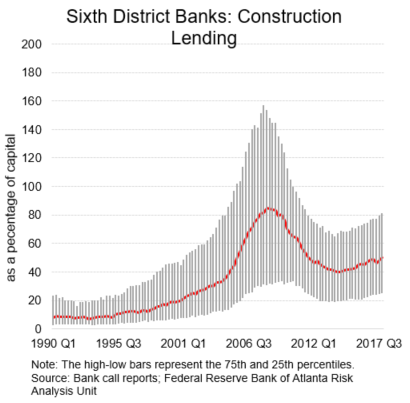

It is worthwhile noting that, as construction lending growth has progressed, construction as a percentage of capital has drifted towards the point such that the median level for all banks is approaching precrisis levels (see chart).

So while construction loan growth is strong, our industry contacts continue to tell us that not much of that money is going toward lot development. Recent Senate action may make regulatory capital constraints less of a concern, so the smaller community banks in the district may increase construction lending. However, given conversations with banking experts, it does not appear that banks' appetite for lot development loans has improved much since the crisis.

Lots likely will remain relatively scarce, and our contacts will continue their lament of "labor, lumber, lots."

Robert Canova, senior financial specialist, Supervision, Regulation, and Credit Division, and