Since the launch of payment wallets in 2014–15, several of my colleagues and I have facetiously joined in the chorus of mobile payment advocates that "20xx (pick your year) is the 'Year of the Mobile Payment.'" Well, it appears that 2021–22 can be legitimately declared as the year when consumer adoption of mobile devices (smartphones and tablets) for payments reached the tipping point.

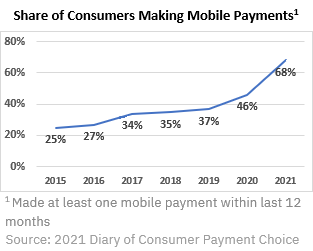

The Federal Reserve's Survey and Diary of Consumer Payment Choice showed that in October 2021, a little over two-thirds (68 percent) of a nationally representative sample of more than 4,600 consumers used their mobile devices for at least one payment in the previous 12 months. This was an increase from 46 percent from the October 2020 study, as the chart shows.

Clearly, the increased adoption was significantly assisted by the COVID pandemic. That's when consumers shifted to online shopping due to health concerns or physical retail businesses closed or reduced their operating hours. Responding to this change, retailers have made major investments in their ecommerce channel to be able to provide shopping convenience to their customers with a variety of delivery options.

One of the pressing questions we're faced with as the consumer economy comes out of the post-lockdown period is whether these shifts in payment use will continue or will slowly return to pre-COVID patterns. If the recent Thanksgiving-Black Friday-Cyber Monday shopping numbers are any indication, payments with mobile devices are here to stay. One firm reported that 55 percent of online sales on Thanksgiving Day came through a smartphone, an increase from 51 percent in 2021. Mobile sales continued to represent most sales (51 percent) during Cyber Week. The report noted one interesting change in consumer shopping habits: curbside pickup was used in only 13 percent of online orders on both Thanksgiving and Black Friday, which was a decrease from 21 percent in 2021. Christmas sales figures have yet to be reported but I expect more of the same trend.

So I ask you with a loud voice to join me in the mobile payments chorus as we acknowledge that the Year of the Mobile Payment has finally arrived!