Become A State Member Bank

Any financially sound, state-chartered bank—including a de novo—can become a member of the Federal Reserve System. Contact the Federal Reserve Bank of Atlanta to discuss benefits and identify any perceived hurdles early in the process.

Learn about the different filing categories, requirements, and submission guidelines for regulatory and operational banking reports.

Any financially sound, state-chartered bank—including a de novo—can become a member of the Federal Reserve System.

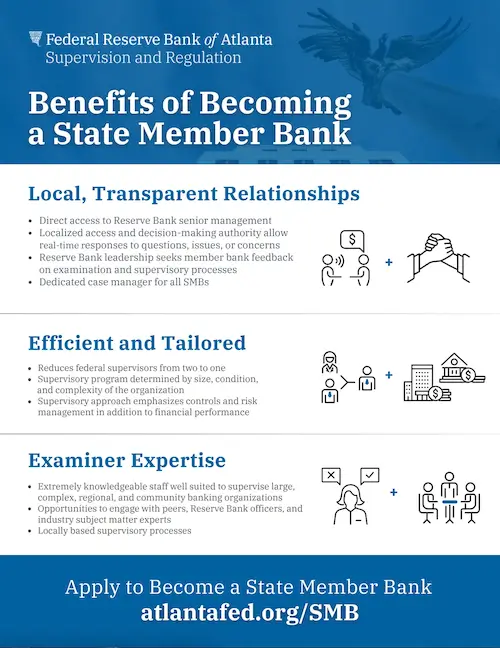

Benefits of Fed Supervision

Member banks vote for directors of the Atlanta Fed and are eligible to serve as directors. They can also provide valuable input to the Federal Reserve Board by joining the Community Depository Institutions Advisory Council (CDIAC).

In addition to our examination staff in Atlanta and Miami, we also appoint a central point of contact and a consumer affairs liaison for each state member bank.

Cost of Membership

We don't charge fees to community banks for supervision or applications. Each member bank must subscribe to capital stock in the Atlanta Fed, but the paid-in portion currently earns an annual dividend of 6 percent.

How to Join

Learn more about the process of joining the Federal Reserve System.

Learn more about the supervisory process and the usefulness of the bank holding company structure.

State Member Bank Applications

Generally, notice or approval by the Federal Reserve is required before engaging in certain transactions. These transactions include mergers and acquisitions, branches, changes in control involving certain shareholders, and a change in the general character of a bank's business.

Applicants are strongly encouraged to contact us for information prior to the submission of an application. Filing forms and general guidance and instructions can be accessed below.

Banking Applications

The primary function of the Banking Applications unit is to take actions and make recommendations on applications and notices filed by Sixth District state member banks, bank holding companies, savings and loan holding companies, and foreign banking organizations subject to Federal Reserve supervision. The unit also acts or makes recommendations with respect to notices by individuals to acquire controlling interests in Sixth District state member banks, bank holding companies, and savings and loan holding companies.

FedEZFile is the Federal Reserve System's single technology tool that offers an easy, immediate, and secure way for financial organizations supervised by the Federal Reserve Board, their authorized representatives, and individuals to submit filings, view the status of their filings, communicate with assigned Reserve Bank and/or Board analyst(s) and attorneys; and receive digitally signed correspondence from the Federal Reserve.

Competitive Analysis and Structure Source Instrument for Depository Institutions (CASSIDI)

Helpful Hints When Filing an Application with the Federal Reserve

Federal Reserve Bank of Atlanta Newspaper Notice

Below is a listing of links that may be helpful to your organization. We strongly encourage you to visit the Federal Reserve System's Reporting and Reserves website, where you will find information on regulatory and financial reporting, electronic submission and notification, forms and instructions, and reference material for the deposit reports.

- Call and Thrift Financial Reports, Federal Deposit Insurance Corporation

- Home Mortgage Disclosure Act (HMDA), FFIEC

- Regulations, Board of Governors

- Reporting and Reserves, Federal Reserve Bank Services

- Treasury International Capital (TIC), U.S. Department of the Treasury

- Trust Preferred Securities (TPS) Guidelines, Atlanta Fed

Savings and Loan Holding Companies (SLHCs)

- Final Rule for SLHCs Reporting Requirements, Board of Governors

- Federal Reserve Board proposes phase-in period for most savings and loan holding companies to file regulatory reports, Board of Governors

- Proposed Agency Information Collection Activities; Comment Request, Federal Register, vol. 76, no. 218, November 10, 2011

Agencies

Applications Officers

John Pelick, Vice President

Erien Terry, Assistant Vice President

Applications Director

Yashica Pope, Director of Examinations

Applications and Notices should be addressed to Assistant Vice President Erien Terry and submitted using FedEZFile. Please send requests for advance publication and requests for public information to Applications.Comments@atl.frb.org

Erien Terry

Assistant Vice President

Federal Reserve Bank of Atlanta

Department of Supervision & Regulation

1000 Peachtree Street N.E.

Atlanta, Georgia 30309-4470

Consumer Compliance and Applications: Waxing Boards for a Clean Ride - February 27, 2025

Our annual Banking Outlook Conference, sponsored by the Risk Analysis Unit of the Supervision and Regulation Division, provides an overview of banking conditions, risks, and issues expected over the next 12 months. The goal is for bank supervisors and industry participants to examine and discuss challenges confronting the financial services industry. The conference is designed to promote open and informal discussions on how economic trends, financial market activities, and the regulatory environment will affect the banking industry in the year ahead.

Upcoming: Sixth District Community Bank Holding Company Supervisory Perspectives - May 13, 2025