Survey of Business Uncertainty

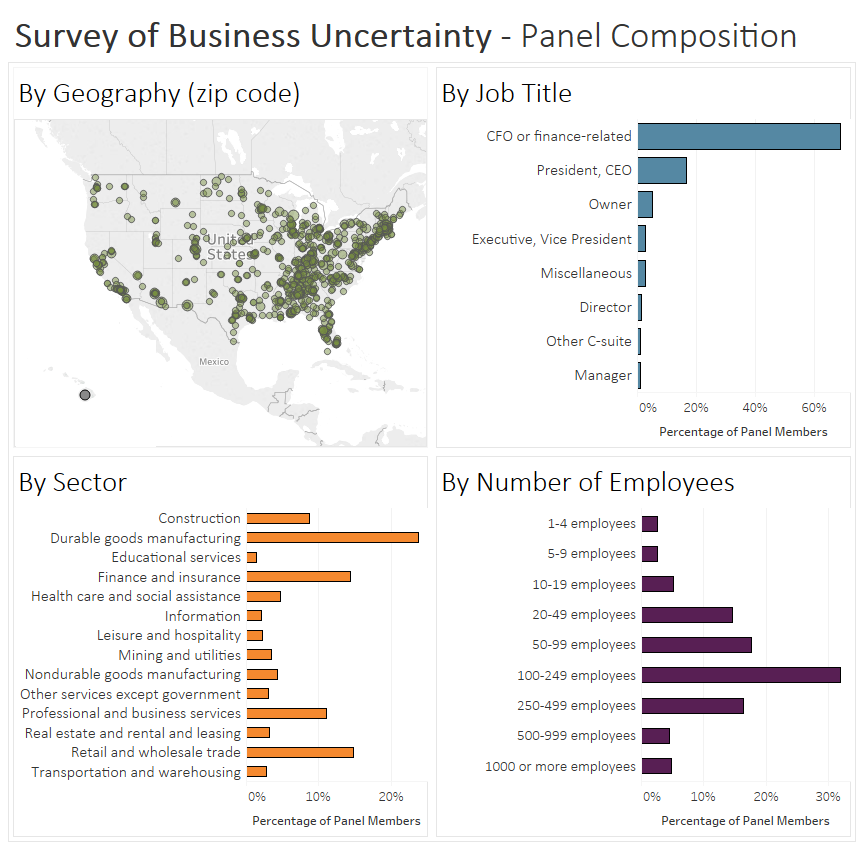

The Survey of Business Uncertainty (SBU) is an innovative panel survey that measures one-year-ahead expectations and uncertainties that firms have over their own employment and sales. The sample covers all regions of the U.S. economy, every industry sector except agriculture and government, and a broad range of firm sizes. The SBU was created in consultation with Steven Davis of the Hoover Institution and Nicholas Bloom of Stanford University.

3.95%

Sales Revenue Growth (Unsmoothed)

Updated: February 25, 2026

Watch this and other videos from the event

Latest Media Mentions

- "There's no magic in a 4-day workweek," The Hill, 24 January 2024.

- "Even as companies crack down, execs predict a rise in remote work," The Business Journals, 29 August 2023.

- "What Impact Does Remote Work Have On Inflation?," Forbes, January 19, 2023.

- "How technology is redrawing the boundaries of the firm," The Economist, 8 January 2023.

- "Getting Rid of Remote Work Will Take More Than a Downturn," New York Times, 7 January 2023.

- "Remote work may be an unlikely ally in Federal Reserve's inflation fight," CNBC, 15 July 2022.

- "Why requiring workers to spend more days in the office could backfire," CNN Business, 13 July 2022.

- "Companies are letting you work from home so they can pay you less – and so you'll be happier," Business Insider, 12 July 2022.

- "Remote Work Leads to Slower Wage Growth for Workers," CBS News, 13 July 2022.

- "Working from home has become a perk like free lunch, and it could be replacing higher salaries," Fortune, 8 July 2022.

- "Working from Home Isn’t a Free Company Benefit," Washington Post, 7 July 2022.

- "Hutchins Roundup: Inflation expectations, remote work, and more," Brookings, 30 June 2022

- "Remote Work Could Ease Inflation, Study Shows," Yahoo!Finance, 27 June 2022.

- "Remote Work Could Save Firms $206 Billion and Ease Pressure on the Fed," Bloomberg, 24 June 2022.

Latest Research

- Brent H. Meyer, Emil Mihaylov, "Where Managers and Employees Disagree About Remote Work", Harvard Business Review, 5 January 2023.

- José Maria Barrero, Nicholas Bloom, Steven J. Davis, Brent Meyer, and Emil Mihaylov, "The Shift to Remote Work Lessens Wage-Growth Pressures", FRBA Working Paper 2022-7, July 2022.

- Brent H. Meyer, Emil Mihaylov, Jose Maria Barrero, Steven J. Davis, David Altig & Nicholas Bloom, "Pandemic-Era Uncertainty", NBER Working Paper 29958, April 2022.

De-identified SBU microdata is now available for use by external researchers. Please complete the request form.

Latest Results as SBU Monthly Report:

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- October 2022

- September 2022

- August 2022

- July 2022

Special Questions Archive:

macroblog articles:

- Hybrid Working Arrangements: Who Decides? January 12, 2022

- Onboarding Remote Workers: A Hassle? Maybe. A Barrier? No. July 15, 2021

- WFH Is Onstage and Here to Stay February 24, 2021

- "COVID, Election Uncertainty Weigh Heavily on Firms' Outlook," October 22, 2020

- "Post-COVID Recovery? Not So Fast, My Friend," October 1, 2020

- "Firms Anticipate COVID-19 Uncertainty to Persist, but Not Worsen", September 2, 2020

- "Businesses Anticipate Slashing Postpandemic Travel Budgets," August 4, 2020

- "COVID Won't Kill Demand for Office Space," July 10, 2020

- "Firms Do Not Anticipate Regaining Pre-COVID Employment Levels through 2021," July 8, 2020

- "Seven in 10 Firms Sought Financial Help during the COVID-19 Crisis," June 18, 2020

- "Firms Expect Working from Home to Triple," May 28, 2020

- "U.S. Firms Foresee Intensifying Coronavirus Impact," May 4, 2020

- "COVID-19 Caused 3 New Hires for Every 10 Layoffs," May 1, 2020

- "American Firms Foresee a Huge Negative Impact of the Coronavirus," March 23, 2020

- "New Evidence Points to Mounting Trade Policy Effects on U.S. Business Activity," November 1, 2019

- "Tariff Worries and U.S. Business Investment, Take Two," February 25, 2019

- "Are Tariff Worries Cutting into Business Investment?" August 7, 2018

- ?"Now"What Are Businesses Saying about Tax Reform March 23, 2018

- "What Businesses Said about Tax Reform," January 17, 2018

Latest Research

- Brent H. Meyer, Emil Mihaylov, "Where Managers and Employees Disagree About Remote Work", Harvard Business Review, 5 January 2023.

- José Maria Barrero, Nicholas Bloom, Steven J. Davis, Brent Meyer, and Emil Mihaylov, "The Shift to Remote Work Lessens Wage-Growth Pressures", FRBA Working Paper 2022-7, July 2022.

- Brent H. Meyer, Emil Mihaylov, Jose Maria Barrero, Steven J. Davis, David Altig & Nicholas Bloom, "Pandemic-Era Uncertainty", NBER Working Paper 29958, April 2022.

- Philip Bunn, David E. Altig, Lena Anayi, Jose Maria Barrero, Nicholas Bloom, Steven Davis, Brent Meyer, Emil Mihaylov, Paul Mizen, Gregory Thwaites. COVID-19 uncertainty: A tale of two tails. VoxEU.org, 16 November 2021

- Lena Anayi, Jose Maria Barrero, Nicholas Bloom, Phillip Bunn, Steven Davis, Julia Leather, Brent Meyer, Myrto Oikonomou, Emil Mihaylov, Paul Mizen, Gregory Thwaites. Labour market reallocation in the wake of Covid-19. VoxEU.org, 13 August 2021

- Barrero, Jose Maria. "The micro and macro of managerial beliefs." Forthcoming in the Journal of Financial Economics. June 2021

- Jose Maria Barrero, Nicholas Bloom, Steven J. Davis, "Why Working From Home Will Stick", NBER Working Paper 28731, April 2021.

- David E. Altig, Jose Maria Barrero, Nicholas Bloom, Steven J. Davis, Brent Meyer, and Emil Mihaylov, "Employers Say Remote Work Will Remain in Their Plans", Chicago Booth Review, March 4, 2021.

- Barrero, J M, N Bloom, S J Davis, and B Meyer (2021), "COVID-19 is a Persistent Reallocation Shock", AEA Papers and Proceedings 111: 287-91

- Brent H. Meyer, Emil Mihaylov, Steven J. Davis, Nicholas Parker, David Altig, Jose Maria Barrero, and Nick Bloom. "Pandemic-Era Uncertainty on Main Street and Wall Street" (December 2020)

- Jose Maria Barrero and Nick Bloom. "Economic Uncertainty and the Recovery" (August 2020). Prepared for the 2020 Jackson Hole Symposium.

- D. Altig, S. Baker, J.M. Barrero, et al., "Economic uncertainty before and during the COVID-19 pandemic," Journal of Public Economics, Volume 191, November 2020.

- José María Barrero, Nicholas Bloom, and Steven J. Davis, "COVID-19 Is Also a Reallocation Shock", Research Briefs in Economic Policy No. 232, September 16, 2020.

- David Altig, Jose Maria Barrero, Nicholas Bloom, Steven J. Davis, Brent Meyer, Nicholas Parker, "Surveying business uncertainty," Journal of Econometrics, September 2020.

- David E. Altig, Scott Baker, Jose Maria Barrero, Nicholas Bloom, Philip Bunn, Scarlet Chen, Steven Davis, Julia Leather, Brent Meyer, Emil Mihaylov, Paul Mizen, Nicholas Parker, Thomas Renault, Pawel Smietanka, Gregory Thwaites, "Economic uncertainty in the wake of the COVID-19 pandemic", 24 July 2020.

- Dave Altig, Scott Brent Baker, Jose Maria Barrero, Nick Bloom, Phil Bunn, Scarlet Chen, Steven J. Davis, Brent Meyer, Emil Mihaylov, Paul Mizen, Nick Parker, Thomas Renault, Pawel Smietanka, and Greg Thwaites, "Economic Uncertainty before and during the COVID-19 Pandemic," Atlanta Fed Working Paper 2020-9, July 2020.

- José María Barrero, Nick Bloom, and Steven J. Davis. "COVID-19 is also a reallocation shock," Brookings Papers on Economic Activity, June 25, 2020.

- Rebecca Stropoli, "COVID-19 Will End Some Jobs, and Transform Others", Chicago Booth Review, May 22, 2020.

- Steven J. Davis, "Trade Policy Is Upending Markets—but Not Investment", Chicago Booth Review, March 18, 2019.

Technical information about the SBU:

- "Surveying Business Uncertainty" by David Altig, Jose Maria Barrero, Nicholas Bloom, Mike Bryan, Steven J. Davis, Brent H. Meyer, and Nicholas Parker

- Additional information about the methods used for the survey

Related surveys and data:

Dave Altig

Dave Altig is executive vice president and chief economic adviser at the Federal Reserve Bank of Atlanta. He serves on the executive leadership team for the Bank's economic mobility and resilience strategic priority, is an executive cosponsor of the Working Families Employee Resource Network, and is an adviser to the executive leadership committee.

Jose Maria Barrero

Jose Maria Barrero is an Assistant Professor of Finance at Instituto Tecnológico Autónomo de México, where he conducts empirical and quantitative research in macroeconomics and finance, focusing on firm behavior under uncertainty. He joined the SBU research team while he was a PhD student at Stanford University. He holds a BA in Economics and Mathematics from the University of Pennsylvania and an MA and PhD in Economics from Stanford University.

Nicholas (Nick) Bloom

Nick Bloom is a professor of economics at Stanford University and a codirector of the Productivity, Innovation and Entrepreneurship program at the National Bureau of Economic Research. His research focuses on management practices and uncertainty. He previously worked at the U.K. Treasury and McKinsey & Company. He holds a bachelor's degree from Cambridge University, a master's degree from Oxford University, and a PhD from University College London.

Steven J. Davis

Steven J. Davis is a senior fellow at the Hoover Institution, a senior fellow at the Stanford Institute for Economic Policy Research (SIEPR), and professor emeritus at the University of Chicago Booth School of Business. His research focuses on labor market outcomes, business performance, economic fluctuations, and uncertainty. He is an elected fellow of the Society of Labor Economists, former editor of the American Economic Journal: Macroeconomics, economic adviser to the U.S. Congressional Budget Office, and senior fellow with the Asian Bureau of Finance and Economics Research. He is also a co-creator of the Economic Policy Uncertainty Indices, and he co-organizes the Asian Monetary Policy Forum, held annually in Singapore. Davis received a PhD in economics from Brown University in 1986 and joined the Booth faculty in 1985.

Brent Meyer

Brent Meyer is an assistant vice president and economist in the research department at the Federal Reserve Bank of Atlanta. His primary research interests include firm behavior, survey methods, inflation, inflation expectations, macroeconomics, and monetary policy. In addition to providing monetary policy support, Meyer heads up our Economic Survey Research Center (ESRC), is involved in research using our Business Inflation Expectations (BIE), Survey of Business Uncertainty (SBU), and CFO surveys, contributes to the Atlanta Fed's Inflation Project, and to the Atlanta Fed's macroblog, which provides commentary on economic topics, including monetary policy, macroeconomic developments, and the Southeast economy. Meyer earned a bachelor's degree in economics from Hillsdale College and a master's degree in economics from Bowling Green State University.

Kevin Foster

Kevin Foster is a Survey Director at the Federal Reserve Bank of Atlanta. He has been leading survey efforts in the Federal Reserve System since 2009, and before that at the United States Census Bureau starting in 2004. Foster contributes to policy and research through his roles on the Survey & Diary of Consumer Payment Choice, the Business Inflation Expectations survey, and the Survey of Business Uncertainty.

Emil Mihaylov

Emil Mihaylov is a Quantitative Research Analysis Specialist at the Federal Reserve Bank in Atlanta. He has been responsible for analyzing the SBU data since 2019. His other areas of research include macroeconomics, forecasting, and data and statistical analysis.

Grace Guynn

Grace Guynn is a survey manager in the Research Department at the Federal Reserve Bank of Atlanta. She is responsible for leading survey operations for the Economic Survey Research Center, including the recruitment and retention of business leaders in the Survey of Business Uncertainty (SBU), the CFO Survey and Business Inflation Expectations Survey (BIE).

Past Contributor

Mike Bryan

Michael Bryan was a vice president and senior economist in the research department of the Federal Reserve Bank of Atlanta, where he was responsible for organizing the Atlanta Fed’s monetary policy process. He came to the Atlanta Fed in 2008, and retired from there in 2016. Before coming to Atlanta, Bryan was at the Cleveland Fed, where he had spent 30 years in positions of increasing responsibility. Bryan is currently serving on the faculty of the University of South Carolina.

Lead Coordinators

Avery Best

John Brumbaugh

Sage Crittenden

Madeline Fiebig

Joseph Gomez

Matias Gonzalez

Charles Jones

Aidan McNew

Isa Padilla

Annemarie Rosebrock

Brooke Smith

Cordelia Tranfield

Garrett Warner

Micah Xu

Panel Coordinators

Madeline Fiebig

Natalie Forman

Jane Kresnadi

Sarah Lepkowitz

Kelley Lu

Jayne Beth Martin

Emma McAleese

Kaylie Milton

Kali Morton

Sakib Mowla

Delia Neufeld

Isa Padilla

Annemarie Rosebrock

Lars Rostad

Roshni Sangani

Abigail Shi

Brooke Smith

Sasha Stanley

Luke Thorell

Maxwell Tingom

Trisha Vemulapalli

Garrett Warner

Eric Wenz

Adam Whalen

Micah Xu

Why do we conduct this survey?

The SBU elicits a 5-point probability distribution over 12-month-ahead sales, and employment for each firm. It also elicits current values of these quantities. The survey's innovative design allows the calculation of each firm's expected growth rate over the next year and its degree of uncertainty about its expectations. Policy makers and researchers can use SBU data to help forecast economic activity and better understand how business expectations and uncertainty affect employment, sales, investment, and other economic outcomes.

For information on how the Atlanta Fed handles participant data from this survey, please refer to our online privacy policy.

The Survey of Business Uncertainty Partnership

The Federal Reserve Bank of Atlanta fields the Survey of Business Uncertainty in partnership with Steven Davis of the University of Chicago Booth School of Business and Nick Bloom of Stanford University. Davis and Bloom are the creators of the Economic Policy Uncertainty (EPU) indices and experts in the field.

For Technical Information about the SBU

Please consult "Surveying Business Uncertainty" by David Altig, Jose Maria Barrero, Nicholas Bloom, Mike Bryan, Steven J. Davis, Brent H. Meyer, and Nicholas Parker. Additional information about the methods used for the survey can be found in the accompanying slide deck.

Sample Survey Forms

Panel members are split evenly into two groups. A given panel member will rotate between the sales revenue and employment forms, responding to each questionnaire every other month. In addition to the core survey questions posed in the forms below, we typically ask at least one special question each month.

Survey Release Dates

The Survey of Business Uncertainty will be released by 11 a.m. ET on the following dates:

2026

January 28

February 25

March 25

April 29

May 27

June 24

July 29

August 26

September 30

October 28

November 25

December 30

- "When Businesses Say Inflation Is Over, Listen," New York Times, 17 January 2024.

- "There's no magic in a 4-day workweek," The Hill, 12 January 2024.

- "Even as companies crack down, execs predict a rise in remote work," The Business Journals, 29 August 2023.

- "What Impact Does Remote Work Have On Inflation?," Forbes, January 19, 2023.

- "How technology is redrawing the boundaries of the firm," The Economist, 8 January 2023.

- "Getting Rid of Remote Work Will Take More Than a Downturn," New York Times, 7 January 2023.

- "Remote work may be an unlikely ally in Federal Reserve's inflation fight," CNBC, 15 July 2022.

- "Why requiring workers to spend more days in the office could backfire," CNN Business, 13 July 2022.

- "Companies are letting you work from home so they can pay you less – and so you'll be happier," Business Insider, 12 July 2022.

- "Remote Work Leads to Slower Wage Growth for Workers," CBS News, 13 July 2022.

- "Working from home has become a perk like free lunch, and it could be replacing higher salaries," Fortune, 8 July 2022.

- "Working from Home Isn’t a Free Company Benefit," Washington Post, 7 July 2022.

- "Hutchins Roundup: Inflation expectations, remote work, and more," Brookings, 30 June 2022

- "Remote Work Could Ease Inflation, Study Shows," Yahoo!Finance, 27 June 2022.

- "Remote Work Could Save Firms $206 Billion and Ease Pressure on the Fed," Bloomberg, 24 June 2022.

- "The Shift to Remote Work Lessens Wage-Growth Pressures," Becker Friedman Institute Economic Finding, 23 June 2022.

- "Remote Work Could Save Firms $206 Billion and Ease Pressure on the Fed," Bloomberg, 24 June 2022.

- Global risks cloud Fed's policy pivot as Powell heads to Congress, Reuters News, March 01, 2022

- Powell Seeks to Reassure Lawmakers Fed Will Curb Hot Inflation, Bloomberg, March 01, 2022

- Fed chief to Congress: Russia invasion in Ukraine has 'highly uncertain' implications for U.S. economy, Washington Post, March 02, 2022

- "Foundations offer cities help convincing workers to relocate", Associated Press, September 24, 2021.

- "To Better Measure Economic Uncertainty, Look Beyond the Stock Market", Kellogg Insight, August 2, 2021.

- "How Leaders Can Keep Culture Intact in a Virtual Workplace", Forbes, December 9, 2020.

- "Stocks Laugh at Economic Uncertainty, for Now", Wall Street Journal, December 6, 2020.

- "Is the Five-Day Office Week Over?", New York Times, July 2, 2020.

- "Did Coronavirus Ruin Your Plans For Retirement?," Forbes, June 26, 2020.

- "How the rise of automation can inform our upskilling during the pandemic," Forbes, June 23, 2020.

- "New research casts light on the pandemic’s effects on resource allocation", The Economist, June 20, 2020.

- "Free Exchange" Column in the Economist, June 20, 2020.

- "Which jobs are coming back first? Which may never return?," Marketplace, June 17, 2020.

- "Washington Wants To Pay You To Go Back To Work. Experts Say It's Not That Simple," Forbes, June 16, 2020.

- "Coronavirus has kicked off a 'massive' economic shift and no one knows where it's going," Philadelphia Inquirer, June 14, 2020.

- "One-Third of U.S. Job Losses Are at Risk of Becoming Permanent," Bloomberg, June 14, 2020.

- "Millions of Job Losses Are at Risk of Becoming Permanent," Bloomberg, June 14, 2020.

- "Save America. Start A Company," Forbes, June 12, 2020.

- "Some Americans return to work, but is the job market recovering?," ABC News, June 4, 2020.

- "Pandemic Economics: A Case for Optimism," radio interview with Tess Vigeland, WAMU National Public Radio, May 28, 2020.

- "Millions of U.S. Jobs Are Never Coming Back from the COVID-19 Recession," Forbes, May 27, 2020.

- George Will. "How Congress Can Expedite – or Continue to Delay – Economic Recovery," Washington Post, May 27, 2020.

- "How COVID-19 Is Disrupting Business, Financial Markets, and Public Policy," Chicago Booth Review, May 26, 2020.

- "Economic recovery will be slow and difficult," The Hill Times, May 25, 2020.

- "Central bank printing presses might be in overdrive, but inflation is not the real threat here," Financial Post, May 25, 2020.

- "How 2 of of every 5 jobs lost during COVID-19 may not come back," World Economic Forum, May 25, 2020.

- "Banks, Defense Firs Rush to Nab Newly Unemployed Workers," Wall Street Journal, May 24, 2020.

- "Dealing with Troublous Times," The Hill, May 22, 2020

- "COVID-19 will end some jobs, and transform others," Chicago Booth Review, May 22, 2020.

- "Will Coronavirus-related job losses eventually return?" UChicago News, May 19, 2020.

- "'Major reallocation shock' from coronavirus will see 42% of lost jobs evaporate," Javier E. David, Yahoo Finance, May 18, 2020.

- "Occupational Licensing, Zoning, and Other Regulations Will Delay Recovery from COVID-19, " Adam Milsap, Forbes, May 18, 2020.

- "Why the Pandemic Could Eventually Lower Inequality," Economist, May 16, 2020.

- Kenneth Rapoza. "Some 42% of Jobs Lost in Pandemic Are Gone for Good," Forbes, May 15, 2020.

- "Why this Economist Says 42% of Coronavirus-Related Job Losses Will Be Permanent," CNBC, May 15, 2020.

- "Hutchins Roundup: Lockdowns, Commutes and More," Brookings Institution, May 14, 2020.

- Renee Morad. "As New Jobless Claims Reach 3 Million, It's 'Another Sickening Punch to the Gut,' Economist Says,"Forbes, May 14, 2020.

- Interview with Poppy Harlow on economic fallout of the pandemic, CNN Newsroom, May 13, 2020. Transcript

- "Baker, Bloom, Davis, Terry – COVID-Induced Economic Uncertainty," C.D. Howe Institute, April 22, 2020.

- Scott Baker, Nick Bloom, Steven J. Davis, and Stephen J. Terry. "COVID-Induced Economic Uncertainty and its Consequences," Vox CEPR Policy Portal, April 13, 2020.

- "US companies are bracing for a big blow from COVID-19," Chicago Booth Review, March 26, 2020.

- Theo Francis and Thomas Gryta. "U.S. Firms Pull Back on Investment," The Wall Street Journal, November 24, 2019.

- John D. Stoll. "Hey CEOs, Have You Hugged the Uncertainty Monster Lately?," The Wall Street Journal, September 14, 2019.

- Rebecca Stropoli. "Executive surveys forecast business outcomes," Chicago Booth Review, September 10, 2019.

- Steven J. Davis. "Trade policy is upending markets—but not investment," Chicago Booth Review, March 18, 2019.

- "US private sector cuts $32.5b capital spending due to tariff, trade tensions: Survey," China Daily, February 27, 2019.

- William Mauldin. "Tariff Fears Led U.S. Manufacturers to Trim Spending," The Wall Street Journal, February 26, 2019.

- James Mackintosh. "Trading on Uncertainty About Tariffs," Wall Street Journal, December 4, 2018.

- Steven J. Davis. "Trump's trade-policy uncertainty deters investment," Chicago Booth Review, November 14, 2018.

- Steve Matthews. "Tariffs Prompt U.S. Manufacturers to Review Plans: Fed Survey," Bloomberg, August 7, 2018.