This survey fills a gap in knowledge about the role of consumers in the transformation of payments from paper to electronic.

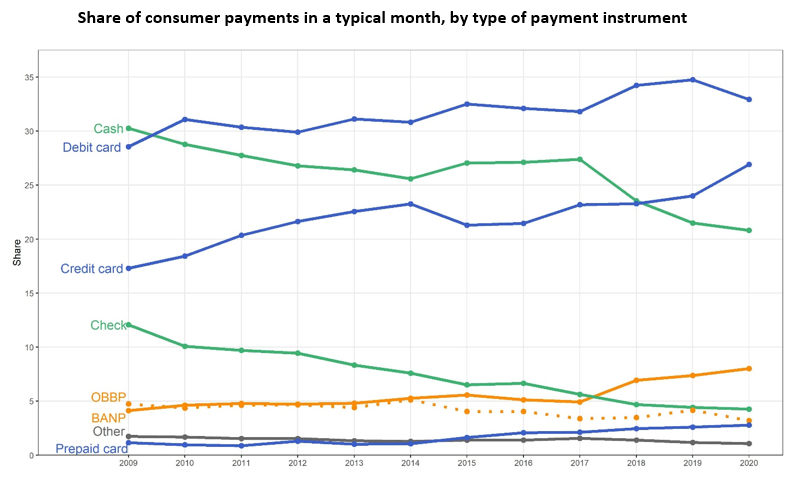

- Consumers report adoption of of nine payment instruments, including cash.

- Consumers report frequency of use of the nine instruments.

- Consumers rate instrument characteristics like security, cost, and convenience.

For information on how the Atlanta Fed handles participant data from this survey, please refer to our online privacy policy.