Despite the strength of the past two employment reports, labor markets still have a ways to go to regain their prepandemic levels. And there is a fair amount of uncertainty regarding how quickly employment levels can fully recover, especially given the rising number of coronavirus cases starting in mid-to late June.

Whether firms anticipate sharply ramping up hiring over the second half of the year is of particular importance to understanding the likely path of the recovery. Should firms be aggressive in their hiring, the recovery could take something of a V-shaped path. Conversely, a slow slog back to pre-COVID employment levels would suggest a more prolonged recovery, with more significant labor market disruption.

In our latest CFO Survey—which was in the field June 15–26 and which gathered nearly 300 responses—businesses were fairly pessimistic about the path of employment growth. In fact, the typical firm in our panel does not expect to regain their pre-COVID employment levels until sometime after the end of 2021.

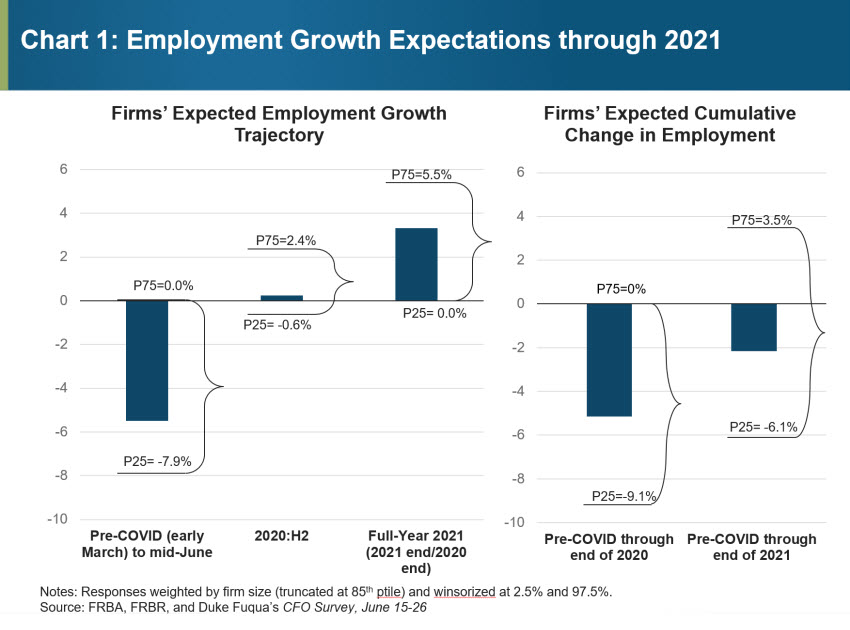

One question in our June survey asked firms what their employment levels were on March 1 (pre-COVID), what they were in June 2020, and what they expected their employment levels to be at year-end 2020 and year-end 2021. Chart 1 shows those results.

Firms’ current employment levels are, on average, a little more than 5 percent lower than they were pre-COVID. Firms anticipate holding their employment levels roughly constant over the second half of 2020 and then ramping up hiring in 2021.

However, these results suggest that the pace of hiring during the next 18 months won’t be enough to bring the average firm back to pre-COVID employment by the end of 2021. Although there is a wide range of responses among our panel, there is a definite tilt downward.

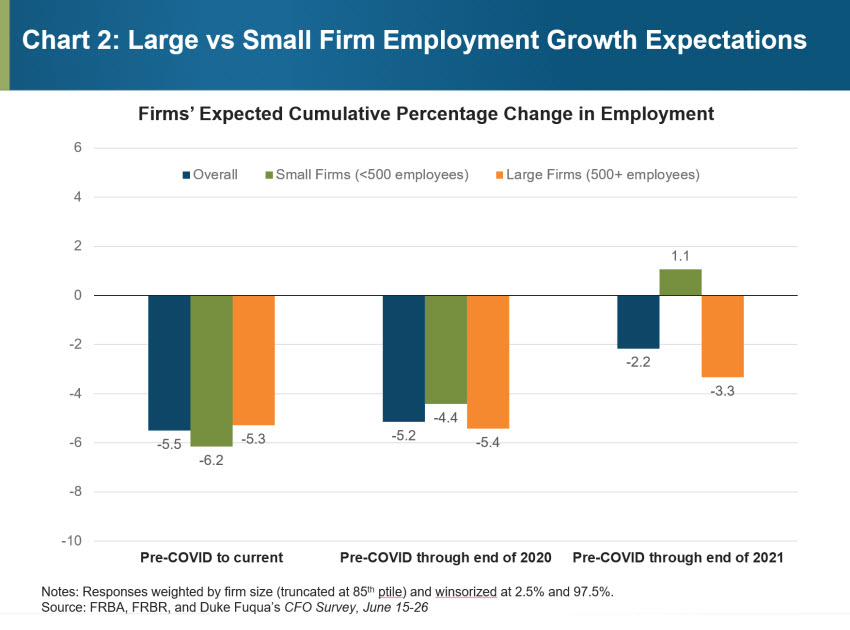

Digging a bit deeper into these results and separating these trajectories by large firms (those with 500 or more employees) and small firms (those with fewer than 500 employees), we see that small firms have shed a greater proportion of their full-time staff from March until mid- to late June. However, small firms anticipate much stronger hiring during the next 18 months and expect to surpass their pre-COVID employment levels by the end of 2021. Larger firms, on average, anticipate their head counts to remain well below their pre-COVID levels (see chart 2).

These results are largely consistent with what researchers at the Fed’s Board of Governors and the University of Chicago found using weekly payroll data. Their administrative data show that through the end of May, smaller firms took a larger initial hit to their employment levels but have rebounded more quickly than larger firms. Our results suggest this dichotomy is likely to continue.

In sum, despite the strong gains we saw over the past two employment reports, these results suggest that the path forward for employment is going to be more of a marathon than a sprint.

John Graham, the D. Richard Mead Jr. Family Professor of Finance at Duke University's Fuqua School of Business,

John Graham, the D. Richard Mead Jr. Family Professor of Finance at Duke University's Fuqua School of Business,

Roisin McCord, associate regional economist at the Federal Reserve Bank of Richmond,

Roisin McCord, associate regional economist at the Federal Reserve Bank of Richmond, Nicholas Parker, the Atlanta Fed's director of surveys, and

Nicholas Parker, the Atlanta Fed's director of surveys, and Sonya Ravindranath Waddell, a vice president and economist at the Federal Reserve Bank of Richmond

Sonya Ravindranath Waddell, a vice president and economist at the Federal Reserve Bank of Richmond