Over the past decade, online shopping has become the primary shopping method for many. Consequently, concerns that ecommerce will replace traditional retail outlets and make physical stores obsolete have increased. However, the expansion of ecommerce drives online retailers to establish large fulfillment centers nationwide. To ensure that customers receive packages within two days, online retailers aggressively accelerated fulfillment center openings. A major online retailer, one that accounts for about 50 percent of total ecommerce sales, has opened more than 150 fulfillment centers, located across 88 U.S. counties as of 2018. Each fulfillment center hires its own workers, and thus a new fulfillment center's local economic impact might be the opposite of the typical negative belief about ecommerce's effects on brick-and-mortar stores. To estimate the overall effect of ecommerce on the local retail market, I use a fulfillment center of this online retailer as a proxy to an ecommerce local presence. Specifically, I focus in this post on retail real estate transaction prices, since store sales heavily influence property values. (Retail property sales price is commonly estimated using the direct capitalization method.)

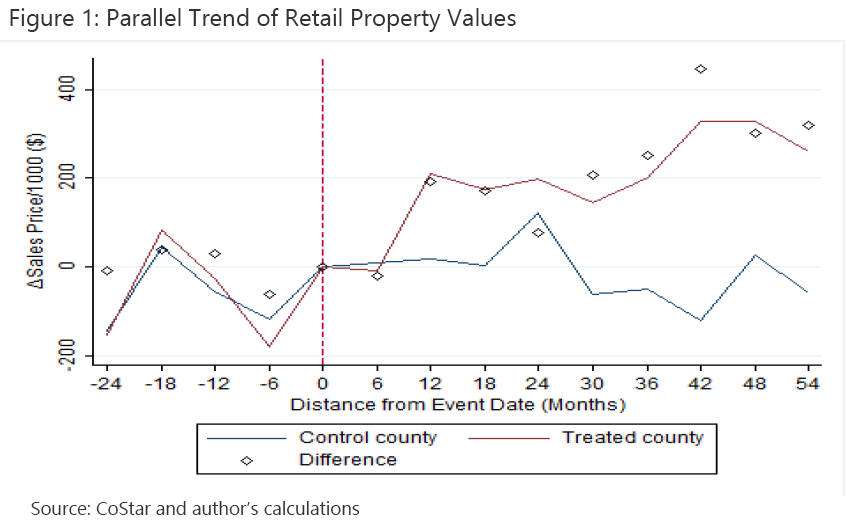

Among the counties that received a fulfillment center, I select counties with a fulfillment center that opened between 2013 and 2015, giving clear three-year periods before and after the opening. Control counties are the matched counties that are strong potential fits for a fulfillment center establishment yet did not receive one. Fulfillment centers are more likely to be in counties where population density and education level are higher than average but median household income and median age are lower than average. These counties experience slightly faster retail establishment growth, but other demographic or industry factors did not influence whether a firm decided to establish a fulfillment center or not. Using those economic and demographic factors that may affect fulfillment center establishment, I select control counties that have very similar growth rates to the treatment counties with a fulfillment center establishment. Figure 1 indicates the average retail property price changes relative to fulfillment center establishment between treatment and control counties. Both treatment and control counties exhibit similar price movement prior to a fulfillment center opening, thus meeting the parallel trend assumption. However, the average retail property values move differently following the local fulfillment center establishment.

Impact of ecommerce on retail property transaction values

Using a difference-in-difference specification, I test how the expansion of ecommerce affects local retail property values. The model includes property characteristics and market controls. If ecommerce affects brick-and-mortar stores negatively, we should expect to see lower transaction values for local retail properties, but results exhibit contrary behavior. The entry of an ecommerce fulfillment center has a positive effect on local retail store values. Retail properties located in counties where a fulfillment center operates sold at a 5.2 percent premium relative to properties in similar counties without a fulfillment center. The premium persists through the fifth year, with the largest gains seen in year three. The natural environment of commercial real estate transactions explains the delayed effect on the retail property market. The average time on market for a retail property in the full sample is 357 days, which helps explain why retail properties' transaction prices experience a delay.

This positive pricing effect is significant in the retail and multifamily markets, but not in the office and warehousing markets. This state of affairs indicates that the local market's stronger overall economic growth drives results. A concern stems from clustering effects—that is, the pricing effect will move upward if other retailers open their warehouses in the same counties at a similar time. Using the largest big box retailer as a means to isolate this effect, I exclude the counties where this retailer also opened a warehouse within three years of the opening of the proxy online retailer's fulfillment center. The results are robust as they persist even after I account for the clustering effects involving another retailer.

Local labor market structure changes

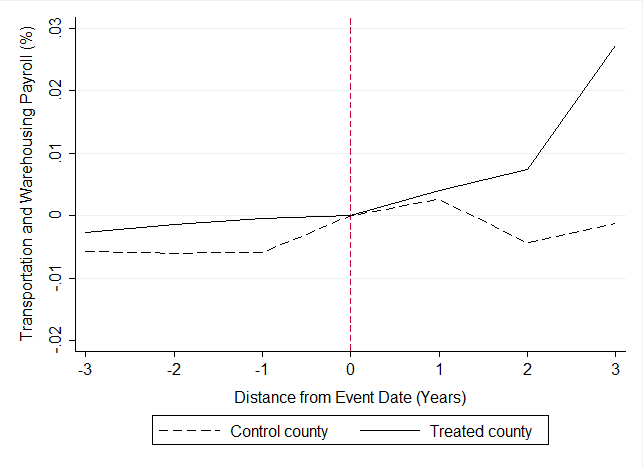

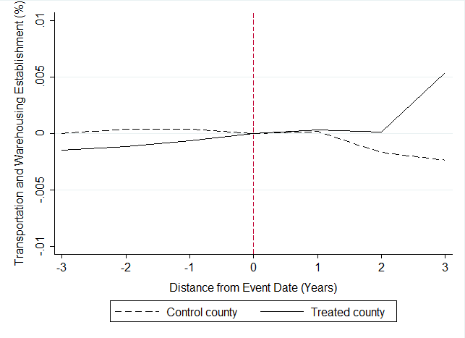

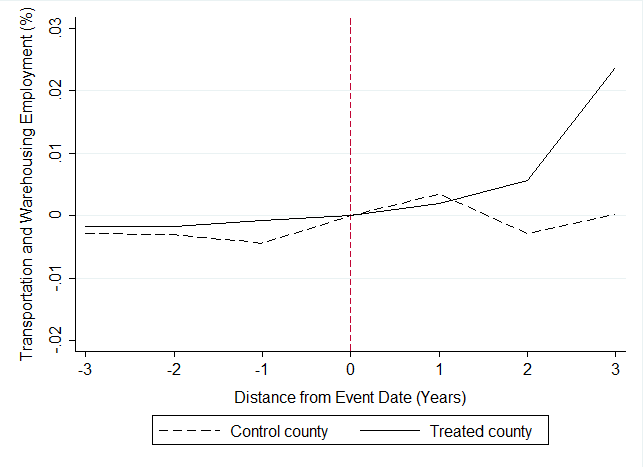

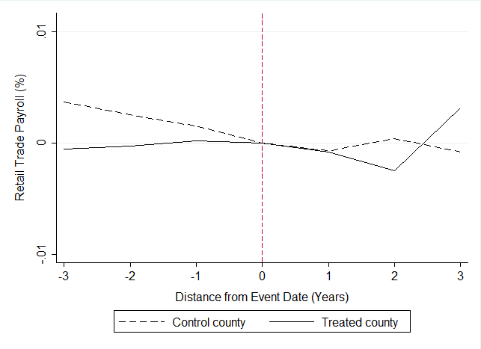

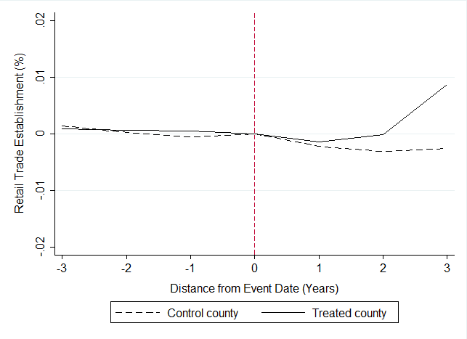

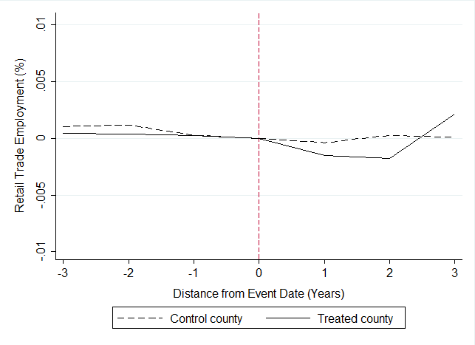

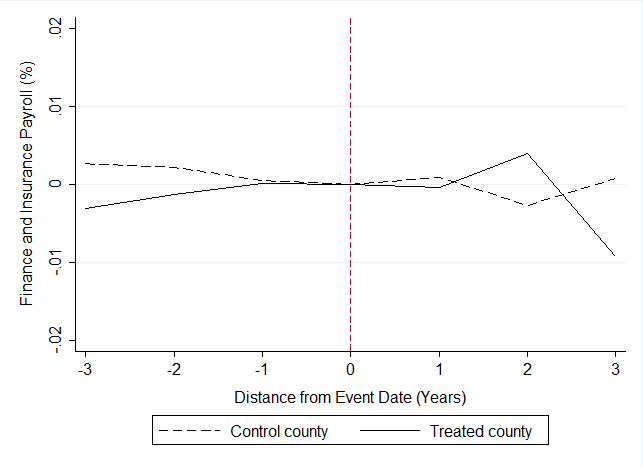

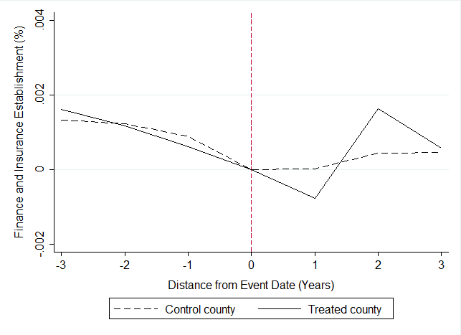

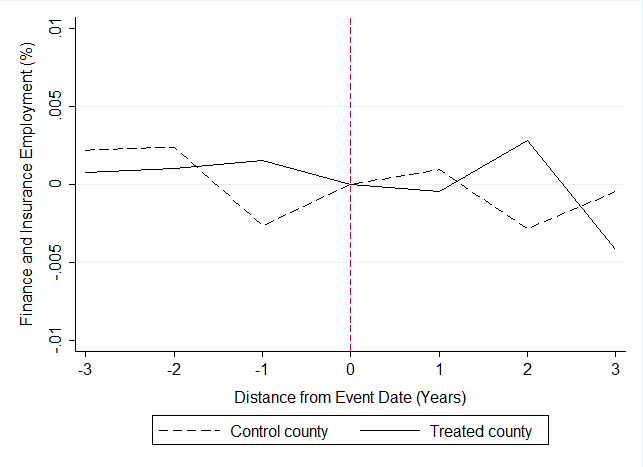

Establishing fulfillment centers changes the composition of the local labor market of treatment counties as businesses focus on warehousing services and generate greater demand for labor. The share of employment in the warehousing-related industries (NAICS codes 48 and 49), their salaries relative to a county's average, and the number of warehouse establishments relative to total business establishments increase by 0.9 percent, 1.1 percent, and 0.5 percent, respectively, relative to control counties following a local fulfillment center opening. The positive effects may spill over into the local retail labor market as overall labor demand increases. The retail trade sector also exhibits positive spillover effects on establishment and payroll in the third year (see figure 2). However, the increase in retail employment is not statistically significant. If general economic growth of the treatment counties drives positive labor market effects, I might expect to find that the finance and insurance industry (NAICS code 52) also grows following the establishment of a fulfillment center, which is not the case.

Figure 2: Trends in Payroll, Establishment, and Employment

Transportation and WarehousingRetail Trade

Finance and Insurance

Which areas are most sensitive to these effects?

Areas where warehousing employees tend to live—that is, areas with higher population densities, lower median incomes, higher renter-occupied rates, lower levels of education, younger population, and lower rates of internet access—tend to pay higher premiums for retail properties and exhibit a stronger, positive effect on local retail property values after the establishment of a fulfillment center.

Overall, the findings in this post seem to provide another silver lining to the consolidation among retailers and the increased focus on digital rather than physical footprints. Contrary to the common belief that online retailers destroy local communities, the data appear to indicate that ecommerce could positively contribute to local economies and the value of retail property. In a county with a fulfillment center, retail properties transact 5.2 percent higher compared to properties in counties that appeared to be a strong fit for a fulfillment center but did not receive one. Growth in labor demand for the warehousing sector and a potential positive spillover effect to the retail sector also support these findings. The expansion of ecommerce anchored by the establishment of a fulfillment center might help local economies and could cause local labor markets to specialize in warehousing. Finally, a heterogeneity test suggests that the positive pricing effect on local retail values is stronger in areas where fulfillment center employees are more likely to live.

While these results perhaps cast online retailers in a positive light, the persuasiveness of this post's findings are limited. Higher property values could be the result of local government subsidies to online retailers, and I don't assess the long-term impact on warehousing and retail labor markets. As this analysis concerned only the county level, its ability to capture the overall effects of ecommerce on the servicing areas is limited. To promote a mutually beneficial relationship between ecommerce firms and brick-and-mortar retailers, I suggest that local governments and policymakers need to be aware of the spillover effects resulting from fulfillment centers and implement proactive, clearly beneficial policies for both the warehousing and retail industries.