A problem facing many emerging markets is the boom-bust cycle of international capital flows. The cycle starts with an excess of investable funds in developed countries, which results in their investors seeking higher returns in emerging markets. Capital inflows into emerging markets support new bank lending and an economic boom in those countries. However, at some point financial conditions tighten in developed economies, resulting in the bust part of the cycle for emerging economies. That is, capital suddenly and rapidly flows out from the emerging country, which adversely affects the local economy and can result in substantial loan losses. In an effort to moderate the boom-bust cycle, central banks in emerging markets have used macroprudential policies: financial policies designed to reduce the overall amount of risky lending. Examples of such policies include setting maximum loan-to-value ratios for mortgage loans or minimum reserve requirements by currency. Our recent paper provides a case study of such use of macroprudential regulation in Romania before and after the global financial crisis of 2007–08. We show that more restrictive macroprudential policies can reduce risky bank lending associated with capital inflows during credit booms. That said, relaxing such policies during a downturn is unlikely to result in increased bank lending.

The aim of our research is to shed light on the role of macroprudential policies in mitigating the impact of fluctuations in global financial conditions and foreign capital on emerging markets. The country we study, Romania, is particularly well-suited to answer this question for several reasons. First, Romania witnessed a full boom-bust cycle around the global financial crisis—an experience that was shared by many other countries at similar levels of development. The expansion phase of the cycle coincided with abundant global liquidity; that is, capital searching for yield, driven in part by a period of very low interest rates. Second, the National Bank of Romania (NBR) tried to manage financial stability risks during the period we analyze by adopting a wide range of macroprudential measures that targeted both banks and borrowers. Third, the banking system in Romania relies on foreign funding, which is mainly denominated in foreign currencies, thus making it vulnerable to sudden changes in the availability of foreign capital.

To conduct the analysis, we use confidential loan-level data on bank credit to households and firms from two credit registers, coupled with bank and firm balance sheet data covering the period between 2004 and 2012. We ask the following specific questions. First, do tighter macroprudential policies reduce risky household lending? Second, how do macroprudential policies for household loans affect, if at all, the supply of commercial loans? For each question, we explore whether the effects of macroprudential policies before the global financial crisis (during the boom phase of the cycle) are different from those during and after the crisis (the bust). Our measure of global financial conditions is the US VIX—the one-month option-implied volatility based on the S&P 500 index (discussed in greater detail in Miranda-Agrippino and Rey 2020). The VIX is widely viewed as a gauge of uncertainty and risk in financial markets, with low values indicating tranquil times of high risk appetite and economic expansion, and high values indicating turbulent times of low risk appetite and economic contraction.

What mechanism links global financial conditions, bank leverage, and lending?

Our analysis starts from the observation that bank leverage—an important determinant of bank credit supply—tends to increase during expansions and decline during contractions. One explanation for this phenomenon is that bank net worth fluctuates in response to changes in economic conditions that affect bank value (Adrian and Shin 2014). In particular, during an expansion, both asset prices and bank net worth increase, supporting higher leverage and more lending. This mechanism links the VIX as a barometer of global financial conditions to the flow of capital across borders, bank leverage, and bank lending (Bruno and Shin 2015a

, 2015b

). To document the basic links in this chain of causation, we first explore bank balance sheet data during the period between 2004 and 2012. We show that when the VIX is low, banks take advantage of favorable liquidity conditions and increase their loan books and total assets by borrowing internationally. These finding suggests a causal link might run from global liquidity to the provision of bank credit in emerging markets that critically depends on banks' access to foreign funding. Next, we analyze how macroprudential policies might mitigate this relationship.

Institutional setup

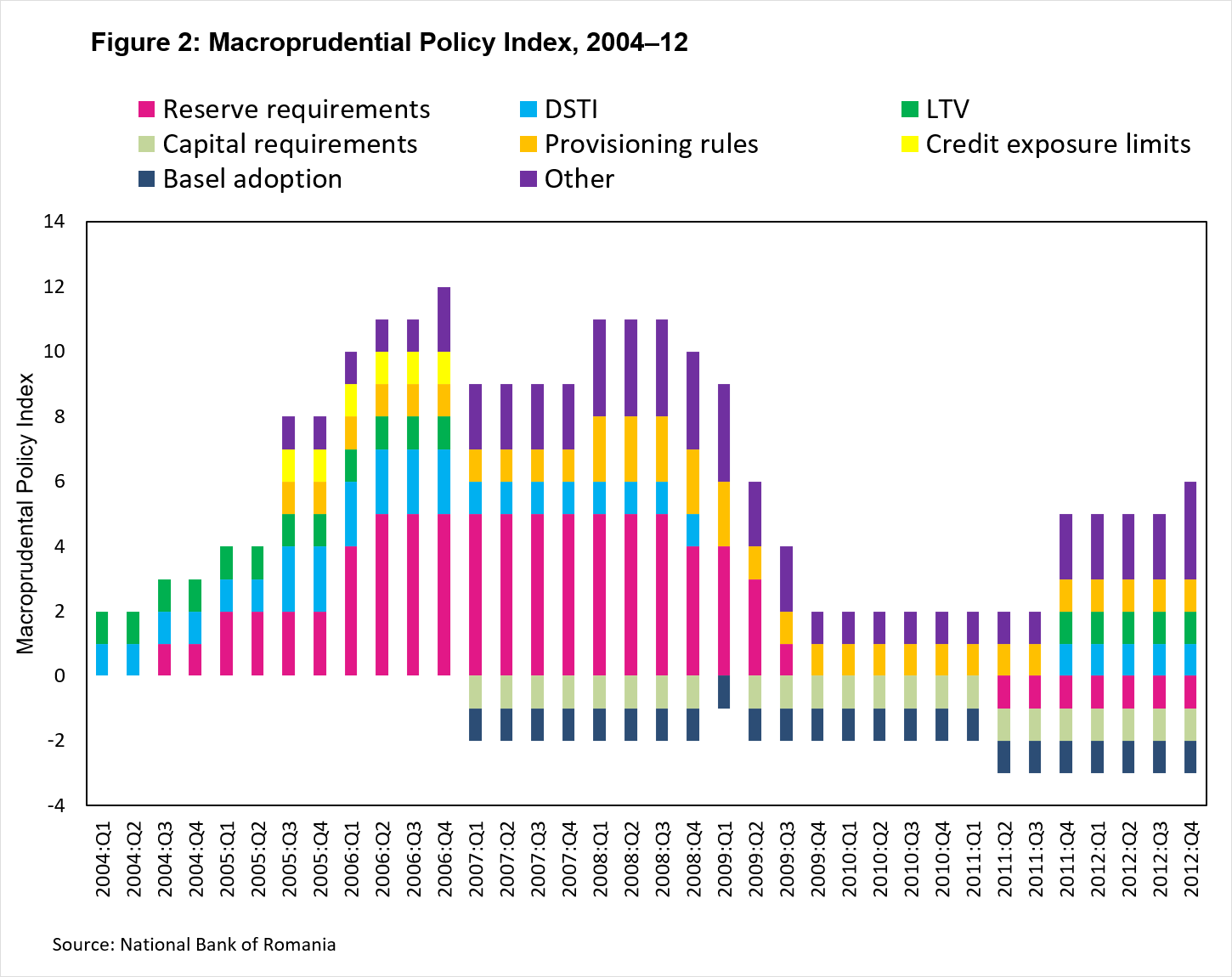

Romania experienced a boom-bust cycle around the global financial crisis and adopted numerous macroprudential policies over the cycle. Before the crisis, economic growth was fueled by strong capital inflows, foreign investment, and foreign bank entry. Figure 1 plots the growth in bank credit to households during 2004–12, when the banking sector expanded significantly amid two key factors. The first factor is the entry of foreign banks with access to nonresident deposits in foreign currencies (including West European banking groups from Austria, France, and Italy with access to retail deposits from households in these countries). The second factor is the expansion of domestic banks thanks to increased access to foreign capital. During the sample period, the average share of foreign funding (mostly denominated in euros) relative to total assets was 20 percent in the full sample and was significantly higher for foreign banks (23 percent) compared to domestic banks (14 percent).

The extraordinary credit boom preceding the global financial crisis helped increase Romania's credit-to-GDP ratio—an indicator of financial development—but also created financial stability risks. During 2005–08, household debt grew at a staggering average rate of 77 percent per year. Most mortgage loans and some consumer loans were denominated in foreign currencies (mainly euros, but also US dollars and Swiss francs) and were extended to unhedged borrowers with revenues in local currency. Such borrowers would ultimately have difficulties servicing their loans if the Romanian currency depreciated relative to foreign currencies. As the global financial crisis unfolded, the economy experienced capital outflows and a severe exchange rate depreciation. Moreover, banks pulled back from extending credit amid loan losses, and the cost of new bank loans rose sharply as the economy contracted.

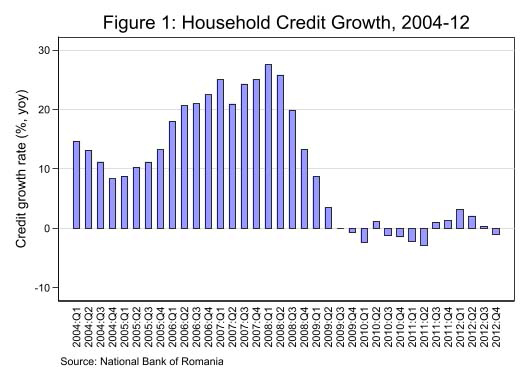

To mitigate financial crisis risks, the NBR employed a wide range of macroprudential policies during this cycle. To capture changes in macroprudential policy, we construct a macroprudential policy index as the cumulative sum of policy tightenings and easings (coded as +1 or −1 for each policy change) in the quarter when policies are implemented, as in Cerutti et al (2017). The resulting index is shown in figure 2 and groups the macroprudential measures into several major categories, including changes in reserve requirements (mostly targeting funding in foreign currencies), loan-to-value limits, debt-service-to-income (DSTI) limits, loan loss provisioning rules, and capital requirements. Figure 2 also shows that the NBR scaled back some macroprudential policies when Romania joined the European Union in 2007 so as to align the prudential framework with Basel II recommendations. Furthermore, the NBR eased its macroprudential stance during the downturn to stimulate the economy.

Macroprudential policies and risky household lending during booms

We conduct the main analysis using the household credit register with data on all the mortgages and consumer loans that banks granted to individual borrowers. Our goal is to examine how banks make lending decisions, especially when it comes to very risky loans, in response to changes in macroprudential policies and global financial conditions. We measure loan risk with indicator variables for loans extended in foreign currencies, loans with high (above-median) borrower DSTI at loan origination, and loans from banks with high (above-median) reliance on foreign funding. We measure global financial conditions with an indicator variable for the expansionary period of high risk appetite (low VIX) before the global financial crisis. We also make sure that the results do not pick up the effects of concurrent macroeconomic conditions (such as the monetary policy rate, gross domestic product growth, and inflation), or those of bank or borrower characteristics, by including these factors in the empirical models.

We have two key findings. First, tighter macroprudential policies are associated with lower levels of risky household lending and are particularly effective during the boom phase of the cycle. Second, when the VIX is low, tighter macroprudential policies are associated with a reallocation of household lending away from foreign-currency loans to relatively safer local-currency loans. These results are consistent with the notion that macroprudential policies affect both the level and the composition of bank credit by changing the relative cost of funding sources. Higher reserve requirements and provisioning rates for foreign-currency deposits and loans, respectively, increase the relative cost of foreign-currency lending compared to local-currency lending. Similarly, DSTI ceilings directly discourage lending to leveraged borrowers. Economically, our estimates indicate that a tightening of macroprudential policy by half of a standard deviation (corresponding to the addition of almost two policy measures) is associated with a decline in the volume of foreign-currency loans of 17.8 percent. This effect is higher by 2.4 percentage points for leveraged borrowers and 3.5 percentage points for banks more reliant on foreign funding.

By contrast, during the bust phase of the cycle, these effects are small or statistically insignificant. Thus, our analysis indicates that macroprudential policies have an asymmetric effect on risky bank lending during good versus bad times. Such policies are less able to boost economic activity during downturns, when banks pull back from risk taking amid uncertainty and deteriorating balance sheets. Conversely, such policies are better able to constrain bank growth during expansions because balance sheets are more stretched and closer to hitting regulatory limits. That said, limits on household lending induced by macroprudential policies can also create perverse incentives to circumvent regulations and reshuffle resources toward less-regulated activities. We explore this issue next by studying the effects of macroprudential policies on commercial loans.

Spillovers of macroprudential policies to commercial loans

So far, our results suggest that tighter macroprudential policies are associated with lower levels of risky household lending. Next, we ask if such policies are also associated with an increase in commercial loans. A reallocation of banks' funds from household to commercial lending would occur if banks responded to tighter macroprudential policies by deploying capital to less-regulated activities instead of shrinking their loan books. To explore this issue, we use the business credit register with data on all loans banks made to nonfinancial firms.

This analysis offers three takeaways. First, macroprudential policies specifically aimed at limiting household lending are associated with increased lending to nonfinancial firms, especially to firms in the real estate and construction sector. We interpret this finding as a "spillover effect" of tighter macroprudential policies on household credit. Second, this spillover effect takes the form of lending in relatively safer local currencies as opposed to lending in foreign currencies. Third, tighter macroprudential policies are associated with a reduction in total (household plus corporate) lending volume. Economically, an increase in the macroprudential policy index by half of a standard deviation is associated with reducing total credit by 11.8 percent and foreign-currency credit by 15.7 percent. We conclude that tighter macroprudential policies are associated not only with a slowdown in bank credit growth but also with a change in the composition of bank credit toward safer local currencies, especially when the VIX is low.

The effects of macroprudential policies on the real economy

Finally, we turn to the real effects of macroprudential policies. For this purpose, we use data on several measures of economic activity at the local (county) level. These measures include house prices, the number of residential construction permits, and nighttime luminosity, a widely used measure of local economic activity. We find that the effects on bank credit documented above have quantitatively important economic consequences, especially in areas that are more likely to be affected by macroprudential policies (in particular, those areas with a higher initial share of foreign currency lending). During expansion, tightening macroprudential policies by half of a standard deviation leads more exposed areas to experience a decline in the growth rate of house prices, construction permits, and nighttime luminosity by up to 2 percentage points compared to less exposed areas. These effects are economically small or statistically insignificant during contraction, suggesting once again that the effects of macroprudential policies over the boom-bust cycle are asymmetric.

Conclusions

Our research argues that macroprudential policies play a critical role in mitigating the effects of global financial conditions on the local bank credit cycle in emerging markets. We study the case of Romania, a country that experienced a full boom-bust credit cycle around the global financial crisis and that made ample use of macroprudential policies to reduce financial stability risks.

We show that tighter domestic macroprudential policies dampen the effects of global financial conditions on local bank credit, reducing financial stability risks associated with "excessive" credit growth. Ignoring other economywide effects not captured by our analysis, we calculate that foreign currency household credit would have grown almost three times faster in the years leading up to the global financial crisis if no macroprudential policies had been put in place. Put differently, the macroprudential policy tightening resulted in a smaller bust than would otherwise have occurred, a result that echoes previous research for other emerging markets such as Turkey (see Di Giovanni et al 2022 ). Overall, our results support Keynes's "pushing on a string" metaphor in that macroprudential policy, much like monetary policy, appears to be more effective during good times than during bad times.

Overall, our results suggest that macroprudential policy provides central banks and financial stability authorities with a powerful set of tools for "leaning against the global financial cycle." As such, our findings have important policy implications for emerging markets where global financial conditions might constrain monetary policy.

Authors' note: We thank Larry Wall for extensive and constructive feedback on this essay, which greatly improved it. The views expressed herein are those of the authors and should not be attributed to the National Bank of Romania, the Federal Reserve System, or their management or policies.