Over the last year, inflation has eased meaningfully from its postpandemic peak, but it has remained above the Federal Open Market Committee's 2 percent target. Given policymakers' focus on further reducing inflationary pressures and the proliferation of news articles about the pervasiveness of automation

and artificial intelligence

and their impact on jobs

and wages

, we wanted to examine whether automation could help firms lower their price growth.

In the most recent CFO Survey, we explore expectations for price growth by asking financial leaders nationwide for their anticipated growth in prices in 2024 and how this anticipated growth compares to prepandemic growth rates. We find that most CFOs expect price growth to remain above normal through at least 2024. We also asked about the adoption of automation and find that, on average, firms experiencing above-normal price growth and implementing automation expect slower price growth both this year and next year compared to their non-automating peers.

Firms expect above-average price growth to persist during 2024

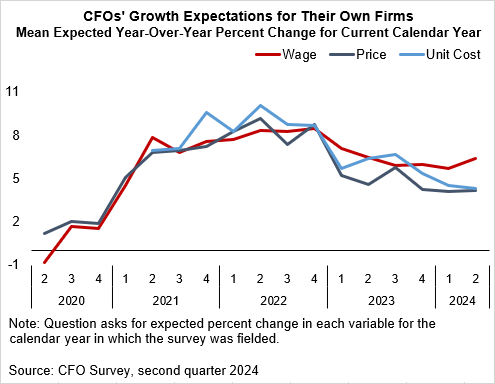

The combination of higher input costs and wages in the aftermath of the COVID-19 pandemic led to higher price growth. While growth in unit costs, wages, and prices has moderated from their peaks in 2021 and 2022, price growth expectations among surveyed financial leaders have not returned to their prepandemic levels, suggesting that elevated price growth may be more persistent than initially thought despite a restrictive stance of monetary policy (see the chart).

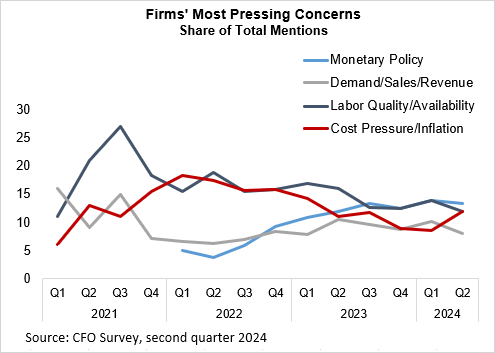

In the second quarter CFO Survey, monetary policy was listed as the top concern among CFOs, though nearly as many cited cost pressures and inflation, as well as hiring and retaining qualified employees. The fact that concerns about cost pressures and inflation remain so prominent—and these concerns even increased in the most recent quarter—supports the notion that despite more moderate inflation, price growth remains a foremost concern among CFOs (see the chart).

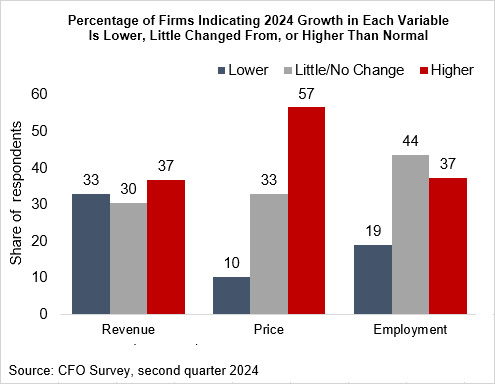

To better understand whether CFOs expect growth in pricing to return closer to normal during 2024, the CFO Survey asked firms to compare their 2024 expected annual growth in prices—specifically, the price of the product/product line or service responsible for the largest share of their firm's domestic revenue—to growth rates prior to the COVID-19 pandemic. For the past three quarters, nearly 60 percent of respondents expect growth in prices during 2024 to remain higher than prepandemic price growth (see the chart).

Pricing pressures: what role for automation?

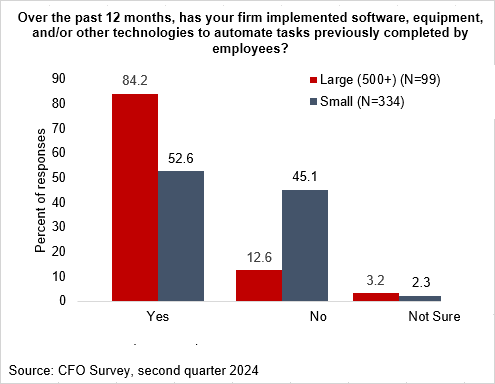

In our most recent CFO Survey, we asked firms whether they adopted labor-replacing automation in the last 12 months and their motivations for doing so (see the chart). These results, combined with information from our core survey module on price growth expectations, allow us to gain further insight on the relationship between automation and firms' pricing behavior.

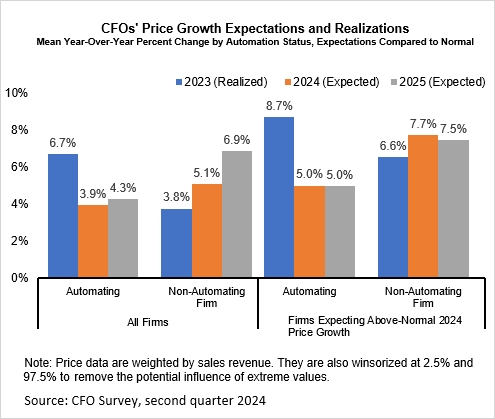

Around 60 percent of all firms, and nearly 85 percent of large firms, implemented automation over the last 12 months. Firms that automated over the last 12 months experienced faster price growth last year but anticipate slower price growth in 2024 and 2025 relative to their nonautomating peers (see the chart). One possible explanation is that firms experiencing elevated growth in prices and wages may have sought to automate as a means of cost reduction. Interestingly, the typical automating firm anticipates a near-immediate payoff in terms of slower price growth. In stark contrast, firms that did not engage in automation see continuing and significant price growth for this year and next year.

Of equal interest is the segment of the panel experiencing above-normal price growth during 2024. For this category of firms, average price growth for both automating and nonautomating firms is higher than their "all firms" counterpart (which is reassuring from a survey practitioner's point of view). Importantly, we notice a similar differential between the expected price growth of automating and nonautomating firms. In other words, firms that have recently engaged in automation anticipate slower price growth than their nonautomating counterparts across several dimensions of the data.

Conclusion

The second quarter CFO Survey indicates that most firms expect price growth to remain "above normal" this year (relative to before COVID-19). However, we identify a notable divergence among respondents: Firms that implemented automation over the last 12 months expect slower price growth than nonautomating firms. Time will tell whether the bifurcation of price growth expectations by automation status is borne out and whether automating firms return to "normal" price growth more quickly than their nonautomating peers.