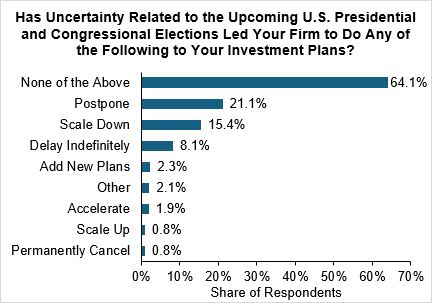

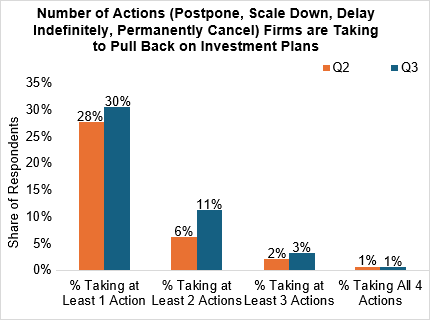

In the most recent CFO Survey, we explore the extent to which firms noted that election-related uncertainty has impacted their investment plans. We find that 30 percent of respondents reported having "postponed," "scaled down," "delayed indefinitely," or "permanently canceled" their investment plans because of this uncertainty—slightly higher than the 28 percent expressing similar views last quarter. Additionally, a larger share of firms took more than one action with respect to pulling back their investment—suggesting an impact on investment plans that spanned more dimensions than in the prior survey. In the remainder of this post, I explore how firms whose investment plans were negatively impacted by election-related uncertainty differ from non-impacted firms in optimism levels, growth expectations, and investment motivations.

Impacted Firms Are Less Optimistic, Expect Lower Revenue and Employment Growth During 2024

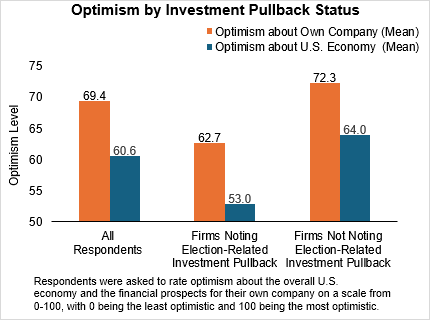

Firms whose investment plans were negatively impacted by election-related uncertainty were distinctly less optimistic than their peers. The difference is similar in magnitude across own-firm and economy-wide optimism, and negatively impacted firms were around 7 points less optimistic than the panel at large, and around 10 points less optimistic than their non-impacted counterparts.

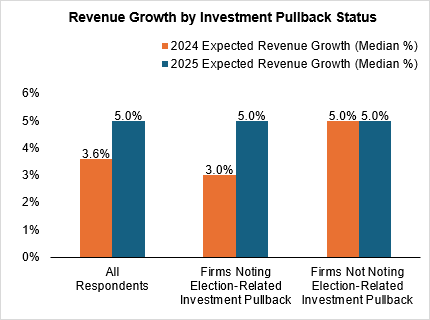

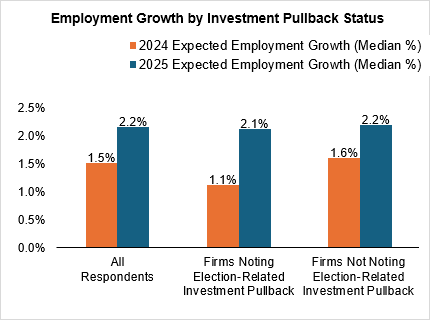

In addition to being less optimistic, firms whose investment plans were negatively impacted by election-related uncertainty also expected lower revenue and employment growth this year than their peers. Furthermore, negatively impacted firms expect revenue and employment growth in 2025 equal to that of non-impacted firms. As a result, impacted firms with lower growth trajectories this year do not expect to "catch up" to their peers, but instead expect to permanently lose 1-2 percentage points of growth this year, before returning to the same growth trend as their peers next year.

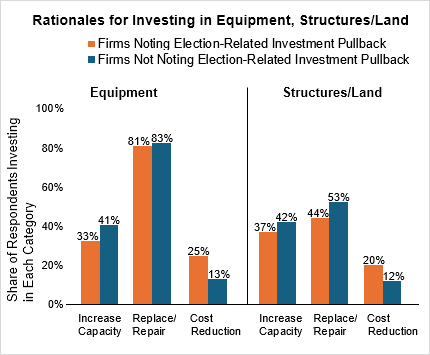

Impacted Firms Are Less Likely to Invest in Expanding or Maintaining Capacity

Firms who reported that election uncertainty caused them to pull back on planned investment were less likely to invest for the purpose of increasing capacity or replacing and/or repairing existing assets. These firms were also more likely to invest in equipment and structures/land for cost reduction purposes, suggesting that impacted firms may be redirecting investment away from expanding or maintaining capacity and toward reducing costs.

Conclusion

Although most firms do not expect election-related uncertainty to negatively affect their investment plans, a meaningful minority of respondents reported a negative impact. Relative to their non-impacted peers, impacted firms are less optimistic, are less likely to invest in expanding or maintaining capacity but more likely to invest in cost reduction, and expect slower revenue and employment growth in 2024. According to respondents in The CFO Survey, the slower growth in 2024 will not be regained next year, as the affected firms expect growth that matches non-affected firms in 2025.