In a recent post, we described the outlook for housing growth in the Atlanta Fed's district as "slow and steady." In this post, we look at what other Fed districts are hearing about housing growth and attempt to reconcile those anecdotes with recent signs from the Atlanta Fed's GDPNow.

The most recent Beige Book![]() characterized residential real estate activity as "constrained across the country." Of the 12 districts, only one (the Federal Reserve Bank of Chicago) raised its classification of the pace of residential construction, and five lowered their assessments. The other districts remained at little or no change, including San Francisco, whose pace was still strong despite shortages of land and labor. Indeed, several districts cited tight labor conditions as limiting new construction.

characterized residential real estate activity as "constrained across the country." Of the 12 districts, only one (the Federal Reserve Bank of Chicago) raised its classification of the pace of residential construction, and five lowered their assessments. The other districts remained at little or no change, including San Francisco, whose pace was still strong despite shortages of land and labor. Indeed, several districts cited tight labor conditions as limiting new construction.

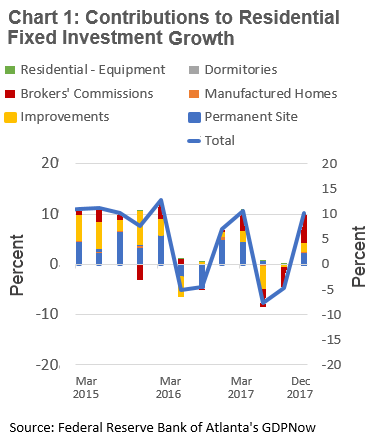

With labor and, to a certain extent, land market conditions holding back construction, we might expect the prospects for residential fixed investment (RFI) in the fourth quarter of 2017 to be dreary. However, recent releases of GDPNow indicate that residential fixed investment should make a relatively strong contribution to fourth-quarter real GDP growth after being a drag in the second and third quarters (see chart).

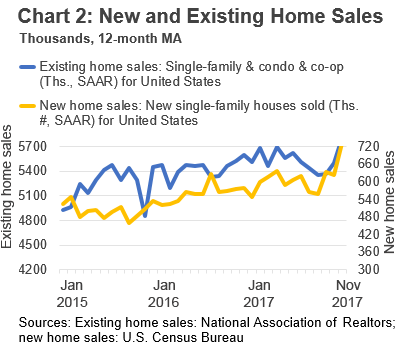

Interestingly, brokers' commissions are making the largest contribution to RFI, followed by permanent site (single and multifamily construction) and improvements. The increase in brokers' commissions reflects the increase in the real value of home sales that resulted from the acceleration of house prices as well as from a sharp increase in the number of existing and new home sales reported for October and November 2017 (see chart).

An increase in both house prices and the number of houses sold is consistent with strength in housing demand. We look to the supply of housing to understand the Beige Book's description of constrained real estate activity. Housing inventory provides an indication of supply conditions. Eleven Fed districts reported that residential inventory conditions were tight (the remaining district did not mention inventory). Several stated specifically that low inventory was restraining sales and that the low number of available houses is putting upward pressure on house prices.

Constrained residential real estate and construction activity does not mean that the sector is doing poorly. It just means that, the housing market's positive contribution to economic activity could be greater if land and labor market conditions were more favorable.

The national Beige Book comments are consistent with our view of housing sector conditions in the Southeast—specifically, that supply-chain constraints imply that near-term residential investment growth will be steady and measured.