To continue to monitor how the COVID-19 crisis is affecting housing in the Atlanta Fed's district, we conducted a Southeast Housing Market Poll from April 24 to May 1. Respondents included homebuilders and residential sales agents (referred to here as brokers).

What are builders and brokers seeing?

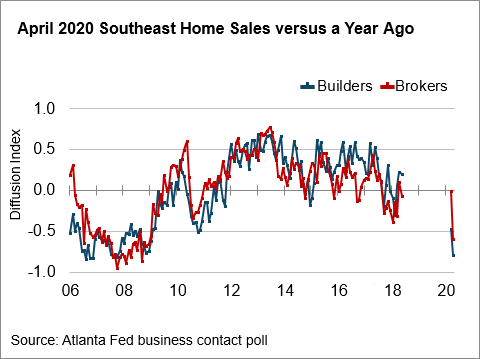

The majority of Southeast brokers and builders indicated that home sales came in below their plan for the period, down from both the month-ago and the year-ago levels.

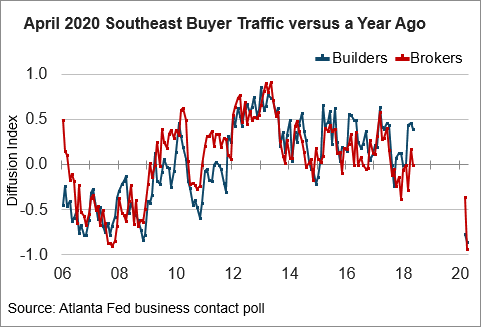

Most builders and brokers also reported that buyer traffic was down relative to the month-earlier and the year-earlier levels. As the results of the special questions continue to emphasize (see below), buyer traffic appears to be the dimension of business that COVID-19 has most adversely affected through April.

Most brokers and builders indicated that inventory levels remained flat compared to the previous month's levels. Compared to the year-ago level, builders said inventory had increased while brokers noted it was down. Most brokers and builders continued to report that home prices either held steady or were up slightly in April.

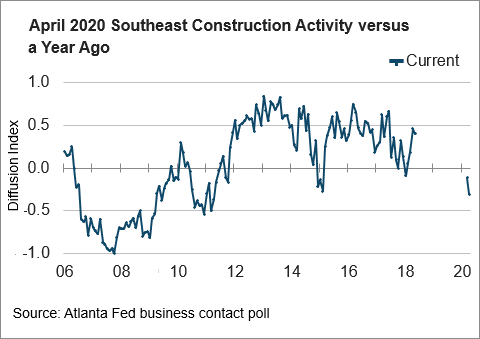

Many southeastern builders indicated that construction activity was flat to slightly down in April relative to both the month-ago and the year-ago levels.

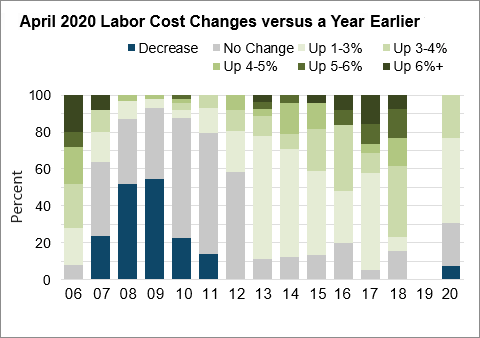

Most builders said material prices were flat relative to a month ago. More than half of builders reported increases in material prices from a year earlier. The rest were split evenly between reporting that material prices were flat and reporting they were down. While the majority of Southeast builders reported upward pressure on labor costs, a growing share of respondents indicated labor costs were flat or down from the year-ago level.

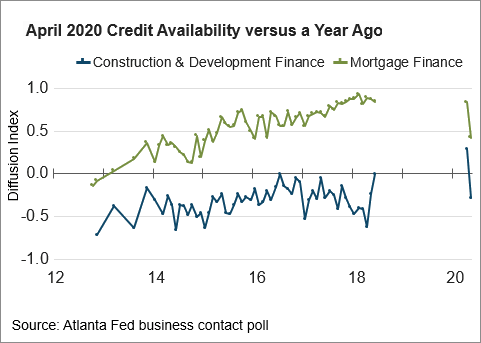

The majority of brokers and builders indicated that the amount of available mortgage credit was sufficient to meet demand, though there did appear to be an uptick in the number of respondents indicating a lack of credit (consistent with a slight uptick on the ability to secure financing noted in the special questions; see below). Most builders said construction and development finance was insufficient to meet demand.

What's ahead?

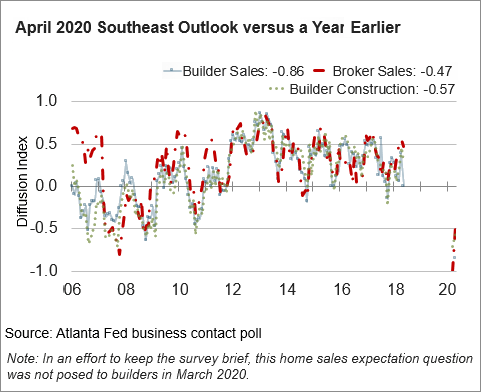

With regard to the outlook, the majority of Southeast broker and builder respondents anticipate a decline in home sales activity over the next three months relative to one year ago. The majority of builders continue to expect declines in construction activity over the next three months relative to the year-ago level.

Results from special questions on COVID-19

Last month, the poll's special questions homed in on aspects of business that were adversely affected. This month, we borrowed a few additional special questions from the Atlanta Fed's Business Inflation Expectations Survey to help round out the insights.

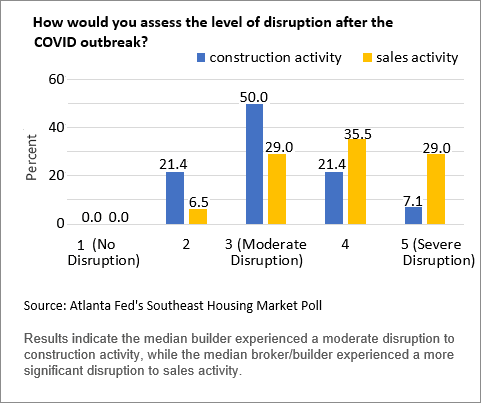

First, we asked business contacts to assess the overall level of disruption to construction and sales activity. Results indicate moderate disruption to construction activity (the median builder response was 3 on a scale of 5) and a more significant level of disruption to sales activity (the median broker response was 4 on a scale of 5).

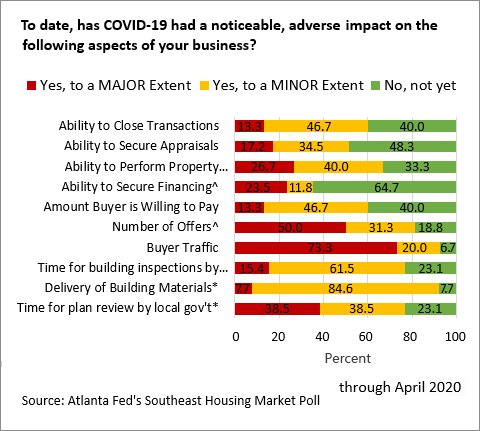

We revisited the special questions from last month on actual and expected adverse impacts. The profile of responses was relatively unchanged from March to April, with many contacts continuing to indicate a major adverse impact on buyer traffic and the number of offers. There was a slight uptick in the share of contacts who reported an adverse impact on delivery time for building materials and the amount buyers were willing to pay.

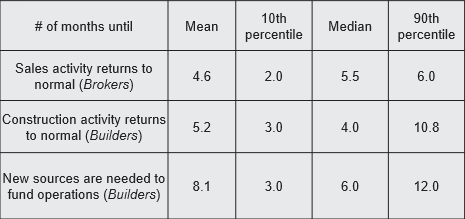

Lastly, a big question that seems to be on everyone's mind is, "When will things return to normal?" Recognizing that this question is tough to answer with any degree of certainty, we asked builders and brokers to provide their best guess of the number of months until activity returns to "normal."" We also asked builders to indicate how many months they could sustain their business operations until they would have to seek out new sources of funding. Many contacts responded with ranges. The results below reflect the most optimistic responses in the range.

- The median broker respondent guessed that normal sales activity would resume in five-and-a-half months.

- The median builder respondent guessed that normal construction activity would resume in four months.

- The median builder respondent said they could operate for the next six months before they would need to seek out new funding sources (for example, credit lines, emergency loans, debt markets).

We'll continue to keep an eye on the housing situation as it unfolds and report back periodically with updates. In the meantime, feel free to share observations from your local market or questions you'd like to have answered in the comments section below.

This poll was conducted April 24 to May 1, 2020, and reflects activity in April 2020. Thirty-three business contacts across the Sixth District participated in the poll: 15 homebuilders and 18 residential brokers.