Small businesses are an important part of the country's economic engine, employing almost half the U.S. workforce, providing essential goods and services to their communities, and fostering local economic activity and innovation. Over the past year, small businesses in the Southeast have faced significant challenges during the COVID-19 pandemic. This public health crisis triggered economic fallout that exacerbated existing disparities, as even before the pandemic, small, young, and Black- and Hispanic-owned firms were more likely to be classified "at risk" of going out of business, or "distressed."

In February, the 2021 Small Business Credit Survey's (SBCS) Report on Employer Firms presented findings on small firms that were still in business when the survey was fielded in fall 2020, six months into the pandemic.1 The report provides insights on the toll the COVID-19 pandemic took on small businesses and the challenges they foresee as they navigate changes in the business environment. This article examines state-level data from the SBCS on five states in the Federal Reserve Bank of Atlanta's District—Alabama, Florida, Georgia, Louisiana, and Tennessee—on a selection of questions in the national report.2 The results show some notable differences between these southeastern states and the nation as a whole in terms of small business performance and pandemic response and expectations.

Some key takeaways include:

- Tennessee firms reported doing better than small businesses across the United States in 2020, with 69 percent reporting a revenue decline in the prior 12 months, while 78 percent did so nationally. Firms in Georgia and Tennessee were less likely to report poor financial conditions, with 16 and 13 percent of firms, respectively, reporting they were in poor financial condition versus 23 percent nationally.

- Black-owned firms faced significant problems with credit availability in Florida, Georgia, and Louisiana. In addition, Florida's Hispanic-owned small businesses were most frequently plagued by trouble making rent or debt payments.

- Smaller shares of Alabama and Tennessee firms were forced to reduce their operations due to the pandemic compared with the share of firms in the nation. Eleven percent of firms in both Georgia and Tennessee were able to expand their operations due to the pandemic, compared with 5 percent of firms nationally, and a significantly smaller share of businesses in these two states were forced to close temporarily compared with the U.S. share.

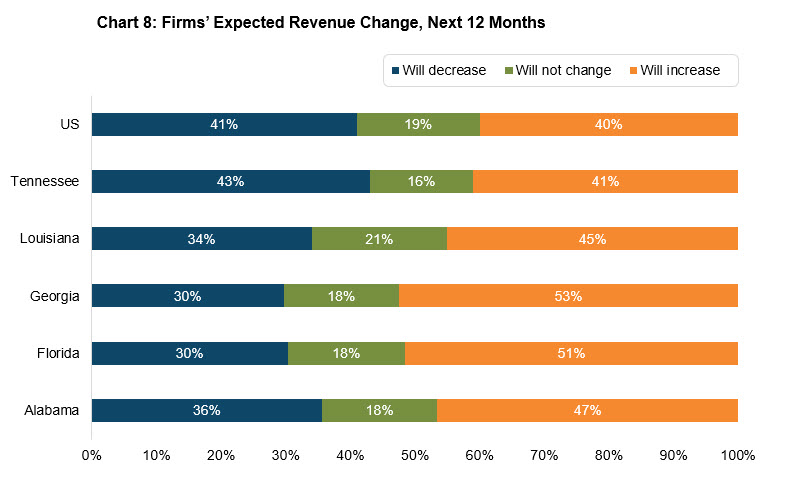

- A greater share of Georgia (53 percent) and Florida (51 percent) firms reported optimism than the U.S. share, as more than half of firms anticipated higher revenue growth in the next calendar year.

- Government-mandated restrictions and closures were less of a concern to firms in Florida and Georgia compared with firms nationally. Additionally, credit availability was a greater concern to firms in Florida than to businesses across the United States.

Small business performance and challenges in the Southeast

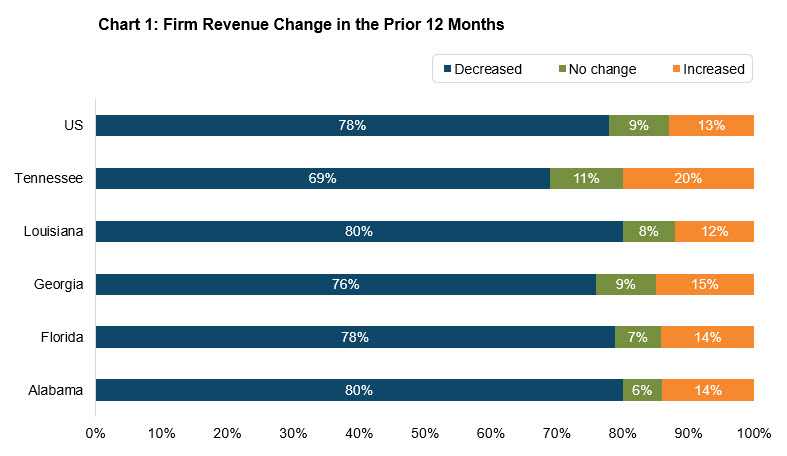

The pandemic has had wide-reaching effects on small businesses' financial conditions. This was quite notable in the survey, which reported more businesses experienced decreases in revenues and employment than increases for the first time since the national survey's inception in 2016. Chart 1 shows that most firms in the United States and the Southeast experienced decreased revenues in 2020, with only 13 percent of U.S. firms reporting increased revenues. Small businesses in southeastern states largely followed the national patterns, with one notable exception: Tennessee firms appear to have fared comparatively better than peers across the United States in 2020, with 69 percent reporting a revenue decline in the prior 12 months compared with 78 percent of businesses nationally.

Source: Authors' calculations using Small Business Credit Survey data

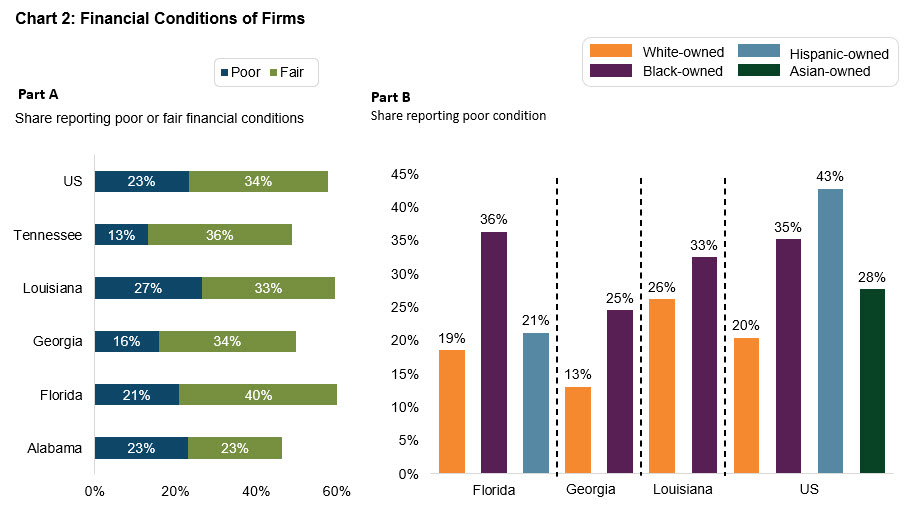

Many small businesses reported struggling financially in 2020, with 23 percent of U.S. small businesses classifying themselves as being in poor financial condition, and a further 34 percent in fair condition. Chart 2, part A shows that firms in Florida and Louisiana experienced similar financial conditions compared with the national average when considering the share of firms in poor and fair condition combined. Firms in Georgia and Tennessee fared somewhat better, with 16 and 13 percent of firms reporting they were in poor financial condition, respectively.

The survey found stark disparities in the share of firms in poor financial condition by the race or ethnicity of business owners. In the United States, larger shares of minority-owned firms reported experiencing poor financial conditions compared with White-owned firms: 28 percent of Asian-owned, 35 percent of Black-owned, and 43 percent of Hispanic-owned businesses did so, compared with 20 percent of White-owned firms. In the Southeast, similar trends played out, with some notable differences. Given the number of responses received in the Southeast states, we did not have enough data to report on Asian-owned firms across the region, or on data disaggregated by owner race and ethnicity beyond White-owned firms for Alabama and Tennessee. However, similar to the United States as a whole, Black-owned firms in Florida and Louisiana much more frequently characterized their financial condition as poor compared with White-owned firms in those states (see chart 2, part B). Interestingly, Hispanic-owned firms in Florida reported being in poor financial shape (21 percent) to a similar degree as White-owned firms in the state (19 percent), and to a lesser degree compared with Hispanic-owned firms across the United States as a whole (43 percent).

Note: Results for firms in Alabama and Tennessee were excluded in part B of this chart because a too-limited number of observations prevented us from reporting results for all but White-owned businesses in those states. The same is true for results on Hispanic-owned firms in Georgia and Louisiana, as well as for Asian-owned firms in all Sixth District states.

Source: Authors' calculations using Small Business Credit Survey data

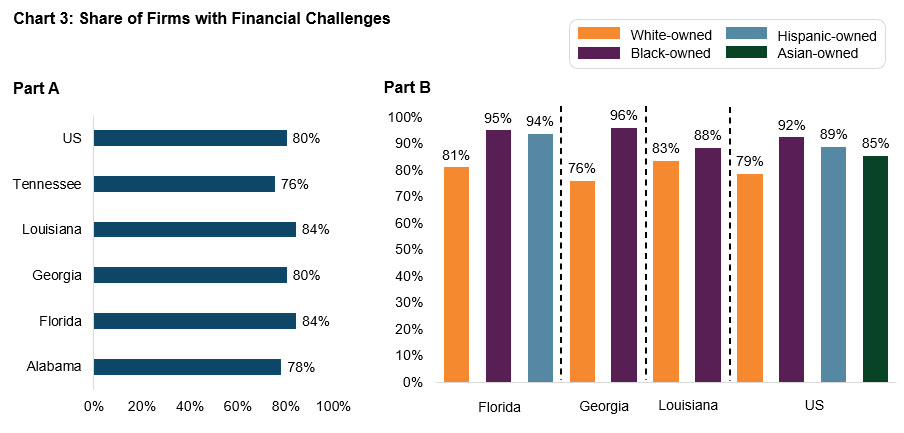

Nationally, 80 percent of employer firms experienced financial challenges in the prior 12 months (see chart 3, part A), an increase of 14 percentage points from the previous year, no doubt due to pandemic-related disruptions. A similar trend emerges when we examine the share of firms that experienced financial challenges in the Southeast; a large majority of firms in Alabama (78 percent), Florida (84 percent), Georgia (80 percent), Louisiana (84 percent), and Tennessee (76 percent) reported challenges. These challenges can include a firm's ability to pay its operating expenses and/or rent, make debt payments, or purchase inventory. Challenges may also include the availability of credit, the ability to fulfill ongoing contracts, and other issues.

While firms in southeastern states overall fared similarly to firms nationally, the share of small businesses that reported having had financial challenges in the past year varied by the business owners' race and ethnicity. Nationally, as well as in Georgia and Florida, larger shares of minority-owned firms reported having experienced financial challenges than White-owned firms (see chart 3, part B).

The prevalence of specific types of financial challenges differed by firms' geographic location as well as the race and ethnicity of their ownership. Hispanic-owned firms in Florida were significantly more likely to have trouble making debt payments (56 percent compared with 43 percent among White-owned firms in the state), having difficulty paying rent (52 percent compared with 38 percent among White-owned Florida firms), or with having credit available (51 percent compared with 33 percent among White-owned Florida firms). In contrast, Florida Black-owned firms' main challenges were based on difficulty maintaining operating expenses (78 percent compared with 64 percent among White-owned Florida firms), credit availability difficulties (57 percent compared with 33 percent among White-owned Florida firms), and difficulties making rent payments (57 percent compared with 38 percent among White-owned Florida firms). For Black-owned businesses in other southeastern states, credit availability challenges were relatively more prevalent in Georgia (68 percent compared with 33 percent among White-owned Georgia firms) and Louisiana (53 percent compared with 31 percent among White-owned Louisiana firms). Nationally, 53 percent of Black-owned small businesses cited credit availability as a challenge compared with 30 percent of U.S. White-owned firms.

Note: Results for firms in Alabama and Tennessee were excluded here because a too-limited number of observations prevented us from reporting results on anything but White-owned businesses in those states. The same is true for results on Hispanic-owned firms in Georgia and Louisiana, as well as for Asian-owned firms in all Sixth District states.

Source: Authors' calculations using Small Business Credit Survey data

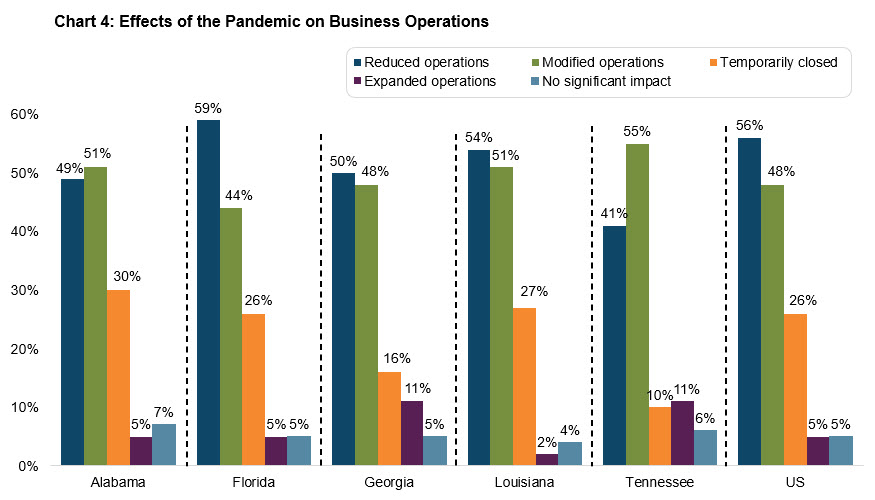

One of the most pressing challenges faced by small businesses is the effect of the pandemic on business operations, which chart 4 examines. Overall, 95 percent of employer firms across the United States reported that the pandemic significantly affected their operations in some way. Compared with the United States, smaller shares of Alabama and particularly Tennessee firms were forced to reduce their operations due to the pandemic. Additionally, 11 percent of firms in both Georgia and Tennessee were able to expand their operations due to the pandemic compared with 5 percent of firms nationally, and significantly fewer businesses were forced to close temporarily. Based on SBCS survey responses, some of the drivers behind operational changes included the changing demand for products and services, government mandates and their effects on business operations, as well as the necessity to adapt to new health and safety guidelines. On average, a greater share of businesses in Alabama, Florida, Georgia, and Tennessee were closed for shorter periods of time than firms across the country were. Tennessee firms, in particular, were more likely to report significantly shorter closures, with 76 percent reporting closures of less than two months compared with 33 percent of businesses across the country that did so.

Source: Authors' calculations using Small Business Credit Survey data

Emergency funding and looking ahead

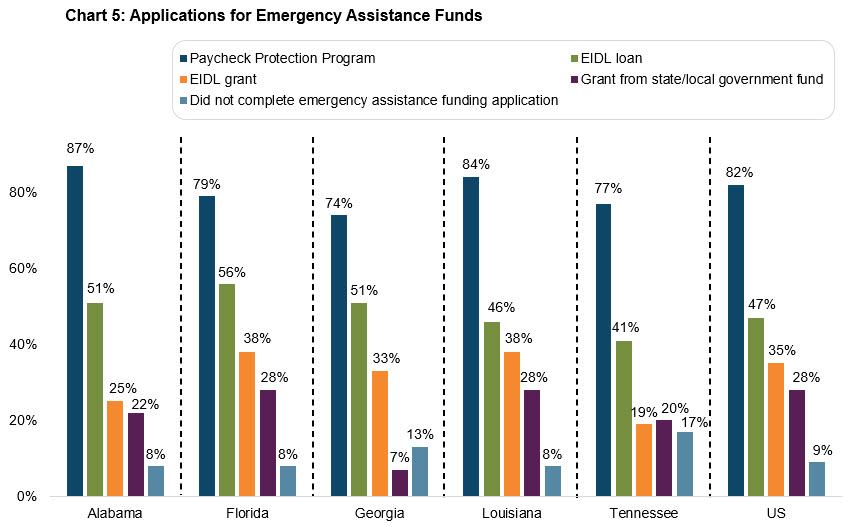

The challenges almost all small businesses have experienced during COVID led more than 90 percent of firms across the country to seek emergency funding in 2020 to weather the pandemic (see chart 5). The most common emergency funding source sought was the Paycheck Protection Program (PPP), with 74 to 87 percent of all firms by southeastern state applying for a PPP loan. Various analyses have found disparities in access to this program by the geographic location and the race or ethnicity of a small business's ownership. The next three most common sources that firms applied to for emergency funding were Economic Injury Disaster Loans (EIDL), EIDL grants from the U.S. Small Business Administration, and grants from state or local governments. Applications for state and local grants in the Southeast were comparable with national averages.

Source: Authors' calculations using Small Business Credit Survey data

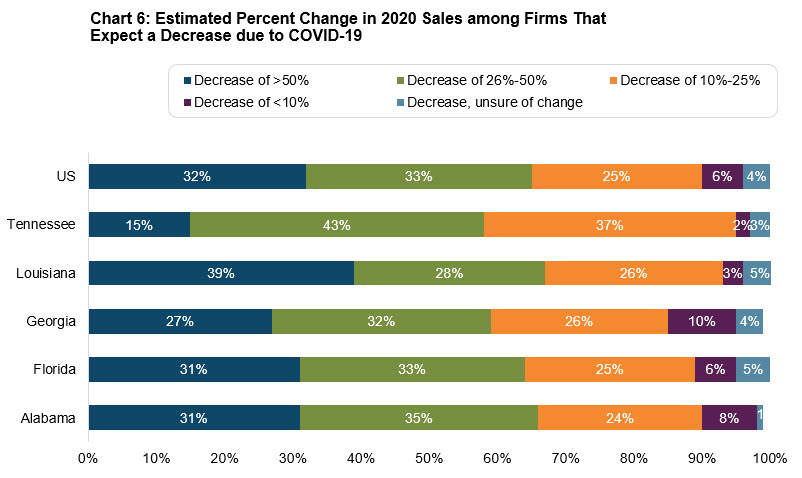

In fall 2020, when the survey was administered, 81 percent of U.S. firms expected present year (2020) sales to decline. Chart 6 shows that among U.S. small businesses that expected sales to decline, 65 percent anticipated the decline to be greater than 25 percent. Firms in Georgia, Florida, and Alabama had similar expectations. Tennessee firms, however, were less pessimistic, with only 15 percent expecting a decrease in sales greater than 50 percent.

Source: Authors' calculations using Small Business Credit Survey data

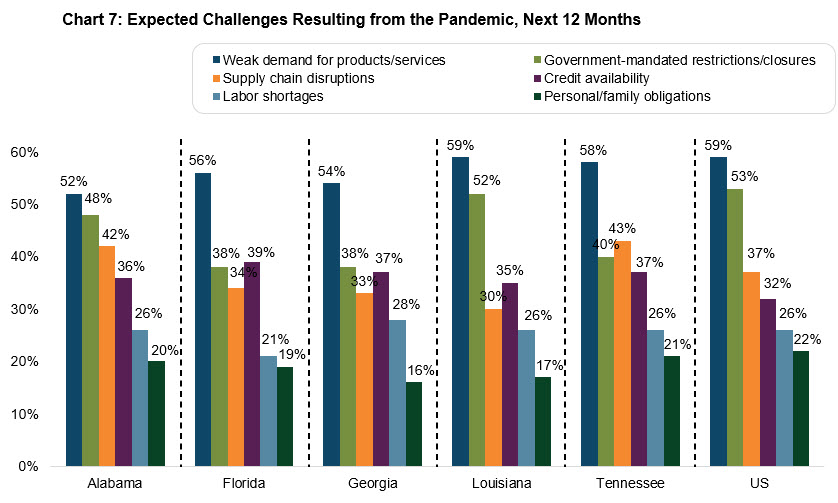

Most firms anticipated a challenging road to recovery. Across the country, 95 percent of firms expected to face at least one or more pandemic-related challenge in the next 12 months (see chart 7). Expected challenges ranged from weak demand for products and services, government-mandated restrictions or closures, supply chain disruptions, credit availability, labor shortages, and owners' or employees' personal and family obligations. The most important challenge stemming from the pandemic is weak demand for products and services, with 59 percent of U.S. firms expecting lower demand. Within the Southeast, a low of 52 percent of Alabama firms to a high of 59 percent of Louisiana firms expect weak demand. Chart 7 highlights that government-mandated restrictions and closures were less of a concern to firms in Florida and Georgia compared with firms nationally. Additionally, credit availability was a greater concern to firms in Florida than to businesses across the United States.

Source: Authors' calculations using Small Business Credit Survey data

Chart 8 shows how firms expected their next year's revenues to change, which can be considered a proxy of how optimistic firms are about the future. Across the United States, 41 percent of firms expected their revenues to decline over the next 12 months (roughly fall 2020 through fall 2021), and 40 percent of firms expected growth. Interestingly, a larger share of firms in Florida and Georgia expected higher revenue growth than peers across the country. Georgia (53 percent) and Florida (51 percent) firms reported a greater degree of optimism, as more than half of firms anticipated higher revenue growth in the next calendar year.

Source: Authors' calculations using Small Business Credit Survey data

Conclusion

The Small Business Credit Survey data collected in late 2020 show the magnitude of the pandemic's impact on the U.S. small business landscape and the challenges these firms anticipate as they navigate ongoing disruptions and changes in the business environment. The 2021 SBCS Report on Employer Firms finds that few firms escaped the negative impacts of the pandemic, and economic impacts varied by firm and by ownership demographics, such as the firm's geographic location and the race or ethnicity of a firm's owners.

Across the Southeast, small firms and minority-owned firms were similarly affected, with some notable differences. Overall, firms in Tennessee fared somewhat better than firms nationally, and Florida and Georgia businesses expressed greater optimism about firm revenues in the next 12 months. Notable differences exist in the types of challenges faced by Black- and Hispanic-owned firms in the Southeast based on Florida, Georgia, and Louisiana data, with credit availability problems relatively prevalent compared with White-owned firms among southeastern minority-owned firms in these states.

By Mary Hirt, CED research analyst II, and Mels de Zeeuw, senior CED research analyst. The views expressed here are the authors' and not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System. Any remaining errors are the authors' responsibility.

_______________________________________

1 Whenever we refer to firms, small firms, or small businesses here, we refer to businesses with fewer than 500 employees.

2 The state-specific survey results presented here have been weighted to be representative of the small business population within each state. The SBCS only creates these weights for states with at least 100 observations or that surpass a standard error threshold. Due to an insufficient number of survey responses, we cannot calculate state-specific (weighted) results for Mississippi, which is part of the Federal Reserve Bank of Atlanta's Sixth District. The survey includes weighted responses from 236 employer firms in Alabama, 1,235 in Florida, 262 in Georgia, 330 in Louisiana, and 100 in Tennessee. For more information, see the methodology section in the 2021 Report on Employer Firms. Where differences between groups or states are highlighted in this article, we find them statistically significant at the 10 percent significance level.