The Federal Reserve Bank of Atlanta hosted southern mayors, city managers, public servants, and community-based organizations to kick off the first in-person convening of the Southern Cities Economic Inclusion Initiative (SCEI) in Birmingham, Alabama, on May 24–26.

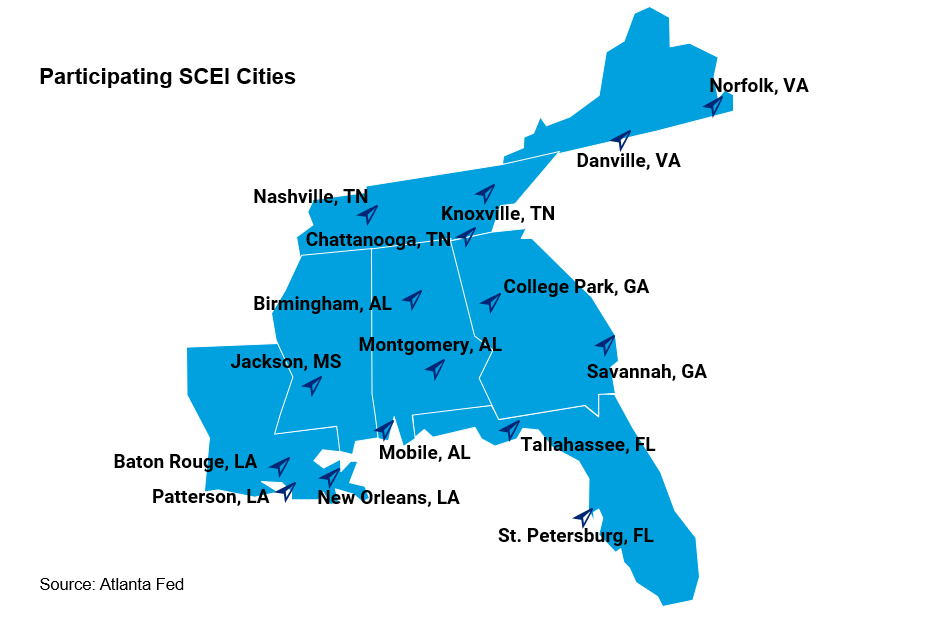

SCEI is a 20-month program led by the National League of Cities. The program is made possible with financial support from the W.K. Kellogg Foundation and the Annie E. Casey Foundation, and in collaboration with facilitation, research, and data support from the Atlanta Fed.1 The 16 cities participating in SCEI are: Birmingham, Mobile, and Montgomery, Alabama; St. Petersburg and Tallahassee, Florida; College Park and Savannah, Georgia; Baton Rouge, New Orleans, and Patterson, Louisiana; Jackson, Mississippi; Chattanooga, Nashville, and Knoxville, Tennessee; and Danville and Norfolk, Virginia.2

Building upon previous work that participating partner organizations led in several southern cities, SCEI participants will gain access to field experts and build a network of peers in cities across the Southeast to address economic challenges in the region, such as higher poverty rates and lower median incomes than other geographic regions.3 SCEI city teams will also learn from their peers' deep experience to develop southern-specific strategies that address economic disparities, many of which are correlated with race, ethnicity, and geography.4

By developing a thorough understanding of data, local economic conditions, community stakeholder networks, and federal programs such as the American Rescue Plan Act, SCEI participants will analyze opportunities to foster more inclusive and resilient local economies across the South. In addition to using data analytics, a key principle of the SCEI model recognizes the strength that southeastern cities possess—particularly, through committed community members who have a vested interest in seeing their cities, and the region, thrive.

In advance of the first SCEI convening, Atlanta Fed president Raphael Bostic noted that, "as a southern-based institution, we at the Federal Reserve Bank of Atlanta are proud to be part of an effort that helps national institutions partner with southern cities to build networks that unite leaders from across the region. We look forward to contributing data and evidence-based research to help southern city leaders learn from each other and lift up successful, scalable solutions to expand economic opportunity—while simultaneously supporting our Bank's strategic priority of promoting economic mobility and resilience."5

To learn more about SCEI, see the National League of Cities website. You can also learn about the Atlanta Fed's work on economic mobility and resilience.

By Charly van Dijk, CED senior adviser. The views expressed here are the author's and not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System. Any remaining errors are the author's responsibility.

_______________________________________

1 Note: the Atlanta Fed does not provide funding for grants, nor does it select participants for this initiative.

2 Danville and Norfolk, Virginia, are in the Richmond Fed's District, and Atlanta Fed staff are collaborating with the Richmond Bank to coordinate efforts in those two cities.

3 According to the 2019 American Community Survey, the South has the lowest median income and highest poverty rate compared to other parts of the country. The 2019 household median income for the South as defined by the US Census is $61,243, which is lower than the Northeast, Midwest, and West. Meanwhile, the poverty rate in the South was 13.3 percent compared with rates of 10.1 percent, 10.1 percent, and 10.6 percent in the Northeast, Midwest, and West, respectively. See US Census Bureau Income and Poverty in the United States: 2020.

4 See the Atlanta Fed's 2018 Annual Report, One Region. Many Economies. and the Pew Research Center's Facts about the US Black Population.

5 The Atlanta Fed defines the following terms accordingly: "economic mobility" means everyone has a fair chance of improving their income and achieving their full economic potential; "resilience" means a person, family, or community can withstand and rebound from life-changing negative economic events; "inclusive economic growth" means the economic pie grows for everyone, with more opportunity and prosperity for all—without inclusivity, our economy is less robust, has fewer jobs, and is less resilient than it could be otherwise.