For some workers, career advancement and higher pay can trigger a loss of means-tested public assistance. Planning for that loss can be difficult for these workers due to the complexity of public assistance rules and a lack of projections about their income and expenses.

The Atlanta Fed’s Career Ladder Identifier and Financial Forecaster (CLIFF) tools help workers make more informed financial decisions about job training and employment in the context of public assistance loss. Beginning in early 2021, nearly two dozen organizations throughout the country joined the CLIFF tools national pilot program.1 Participants—including human services, workforce development, and financial coaching and counseling organizations —described their typical clients as low income, without post-secondary education, receiving government benefits, or single mothers.

The CLIFF tools national pilot implementation evaluation was conducted to collect feedback on the tools’ functionality and to identify challenges that organizations face when adopting calculators like CLIFF. The complete results of the implementation evaluation were published in a 2024 Atlanta Fed discussion paper entitled "Benefits Cliffs Coaching with the Atlanta Fed's CLIFF Tools: Implementation Evaluation of the National Pilot." Following a brief discussion of the CLIFF tools, this Partners Update article summarizes the findings.2

What Are the CLIFF Tools?

The CLIFF tools are designed to help families make more informed financial decisions about job training and employment by including estimates of occupational wages, public assistance receipt, and the cost of paying for basic needs such as housing, childcare, and health care.

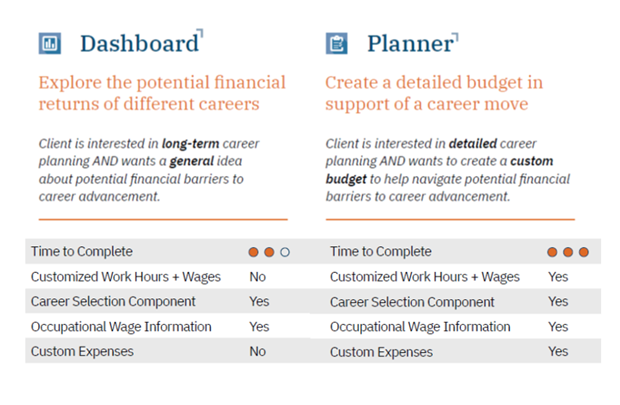

At the time of the pilot, the CLIFF suite included two tools: the Dashboard and the Planner.3 The CLIFF Dashboard allows users to explore the long-term financial returns of up to two occupations at a time. The Dashboard requires relatively few inputs from the user: location, the number and age of individuals in a household, the public assistance programs the user receives, and the user’s occupational choices. The tool estimates household expenses, such as rent, transportation, and childcare costs.

The CLIFF Planner is a more intensive version of the CLIFF Dashboard that allows for more detailed results tailored to each user, such as expenses, training costs, supplemental financial supports and grants, and customized starting wage. Figure 1 lists the main features of the Dashboard and Planner and highlights the differences between the two tools.

Figure 1: Basic Features of the CLIFF Tools

Source: authors

Findings from the Pilot

Based on an analysis of interviews and focus groups of those who implemented CLIFF tools, the discussion paper identified three broad themes:

- Identifying the appropriate population of users

- Integrating CLIFF into existing organization operations

- Integrating CLIFF into the coaching sessions

Identifying the appropriate population of users

Coaches frequently noted that CLIFF is most useful for individuals who are seeking positive change in their lives and are ready to think longer term about their career and finances. Coaches typically viewed CLIFF as less relevant for clients "in crisis" who are seeking help with immediate challenges such as paying unexpected bills, securing reliable and affordable housing, or finding mental health resources.

Integrating CLIFF into existing organization operations

Staffing and time constraints were the most-cited challenges to integrating CLIFF into organization operations. Staff turnover, exacerbated by COVID-19 disruptions at the time of the pilot, created significant challenges for many organizations.

Additionally, the numerous responsibilities placed on coaches often left limited time for CLIFF implementation. For these coaches, CLIFF could be too time-consuming to fit into short sessions already filled with programmatic and administrative requirements. Organizations that had formal processes to adopt CLIFF into coaching sessions typically had a higher uptake and more positive experience.

Integrating CLIFF into coaching sessions

Coaches frequently cited two main challenges to integrating CLIFF into counseling sessions. First, they sometimes struggled to collect all the client information necessary to use the CLIFF tools. Second, some coaches felt they needed specific training on how to coach clients facing benefits cliffs. While the CLIFF tools pilot team provided technical training on how to use the tools, this information did not include strategies for navigating difficult financial situations.

Implications for Practice

The CLIFF pilot and implementation evaluation provided many valuable insights. For organizations that want to adopt tools to coach clients on career advancement, public assistance changes, and benefits cliffs, understanding client readiness is critical. Stabilizing the individual’s financial situation, for example, is often an important step to take before using longer-term planning tools like the CLIFF Dashboard or CLIFF Planner.

Successful implementation of the CLIFF tools and similar calculators also requires a careful consideration of how such tools will be integrated into counseling workflows. The utility of these tools may be limited unless coaches have adequate time to walk through them and thoroughly discuss the findings with clients.

Finally, improved training can help coaches discuss the findings with clients. Coaches should know the basic details of major public assistance programs and be prepared with a set of coaching strategies to help workers manage public assistance loss.

By Brittany Birken, CED director and principal adviser, Federal Reserve Bank of Atlanta; John Rees, senior adviser, Federal Reserve Bank of Atlanta; Alex Ruder, CED director and principal adviser, Federal Reserve Bank of Atlanta; and Ellyn Terry, formerly of the Federal Reserve Bank of Atlanta and now PhD candidate, University of Washington. The views expressed here are the authors' and not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System. Any remaining errors are the authors' responsibility.

_______________________________________

1 The Federal Reserve Bank of Atlanta does not provide grants or funding to the public or to partner organizations. We do not endorse or make any representations as to the suitability of partner organizations, their products, or their programs, and we do not advise on the distribution of funds by partners.

2 Short-term outcomes will be reported in future research.

3 After the pilot, we released a third tool, called CLIFF Snapshot. CLIFF Snapshot models immediate employment changes more suited to workers trying only to stabilize their finances rather than to develop a long-term career plan.