Small businesses1 are the backbone of the economy, driving job creation and economic growth.2 The Federal Reserve's annual Small Business Credit Survey (SBCS) provides valuable insights into the experiences, opportunities, and challenges faced by small firms across the nation.

The Federal Reserve's SBCS is a national sample of small businesses with fewer than 500 employees that provides timely information on firms' needs and experiences with accessing capital and managing debt.3 The Fed conducted the 2024 survey from September through November 2024 and reached over 7,600 small employer firms nationwide.

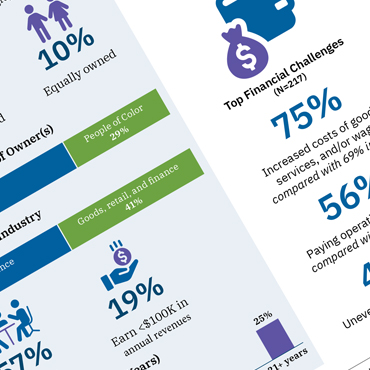

Findings of the 2024 national survey are now available in the 2025 Report on Employer Firms . With that data, we compiled eight regional profiles from the Sixth District that are linked below.4 These eight infographic fact sheets offer a view into small business conditions in several southeastern geographies including state profiles of Alabama, Florida, Georgia, Tennessee, and Louisiana, and profiles of metropolitan statistical areas including Atlanta—Sandy Springs—Roswell MSA, Miami—Fort Lauderdale—West Palm Beach MSA, and the Tampa—St. Petersburg—Clearwater MSA.5 The profiles shed light on the financial conditions, financing needs, and financial and operational challenges faced by small businesses in this region.

States

Cities

Atlanta

The SBCS data reveals that small businesses in the Sixth District continue to navigate a challenging environment, with 60 percent of firms reporting poor or fair financial conditions. Compared to US firms, Sixth District firms were more likely to apply for financing in the 12 months prior to the survey, but less likely to receive partial or full financing approval. Common financial challenges include increased costs of goods, paying operating expenses, and uneven cash flows.

These profiles provide valuable insights that can inform the efforts of service providers, lenders, and policymakers to support the small business community and foster an economy that works for all. We encourage small business owners in the region to participate in the 2025 Small Business Credit Survey to ensure their voices are heard and their experiences are captured. Take the survey by November 14th to help us foster an economy that works for all.

By Mary Hirt, CED policy specialist, Aaliyah Price, CED analyst Emily Carrillo, CED intern, and Nylah Martinez, CED intern. The views expressed here are those of the authors' and not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System. Any remaining errors are the authors' responsibility.

The Federal Reserve Bank of Atlanta's Community and Economic Development function supports the Central Bank's mandate of stable prices and maximum employment by helping improve the economic opportunity of low- and moderate-income (LMI) individuals and underserved places for a stronger economy for all Americans. Community development is one of the Federal Reserve's core functions and this responsibility is rooted in its mandates from Congress. Partners Update articles address community and economic development trends, issues, and events. Find more research, use data tools, and sign up for email updates at atlantafed.org/commdev.

1 Whenever we refer to firms, small firms, or small businesses here, we refer to businesses with fewer than 500 employees.

2 Karen Mills, "Small Businesses Are Important to the Economy," Fintech, Small Business & The American Dream (Palgrave Macmillan, 2019), 13-25. DOI 10.1007/978-3-030-03620-1 .

3 The SBCS is nationwide convenience sample of small employer firms; results should be analyzed with awareness of potential biases that are associated with convenience samples. Get detailed information about the survey design and weighting methodology .

4 The Atlanta Fed territory covers the Sixth Federal Reserve District, which includes Alabama, Florida, and Georgia, and portions of Louisiana, Mississippi, and Tennessee.

5Due to an insufficient number of survey responses we cannot share results for Mississippi, though they are part of the Federal Reserve Bank of Atlanta's Sixth District. States and MSAs with 100 responses or more are eligible for additional weighted analysis. For more information, see the methodology section in the 2025 Report on Employer Firms.