Research and Monetary Policy

The 2018 Financial Markets Conference, presented by the Center for Financial Innovation and Stability (CenFIS), explored the potential impact of machine learning and artificial intelligence on the financial system, the economy, and regulatory and monetary policy. Attendees included representatives from central banks, financial firms, Federal Reserve banks, government agencies, and universities.

CenFIS and Georgia State University's Center for the Economic Analysis of Risk cosponsored a conference that brought together economists, regulators, and finance and risk management professionals to discuss how changing technology is likely to affect financial stability.

Research economists published papers and articles on a range of timely topics, including effects of low unemployment periods on labor market outcomes; the role of social capital in migration decisions; fiscal implications of the Fed's balance sheet normalization; the economic effects of China's financial policies; technology innovations in banking; bank runs during the recent financial crisis; and house price and subprime booms in the early 2000s.

The Center for Human Capital Studies (CHCS) held its annual employment conference at which economists from prominent academic departments and central banks discussed various aspects of inequality. The center and Georgia State University hosted the 16th Annual Southeastern Health Economics Study Group. CHCS released the Labor Report First Look, which is a quick take on the monthly employment report, and refreshed its Labor Market Sliders, a tool that allows users to explore the relationship between economic growth and labor market indicators.

The Survey of Business Uncertainty, conducted in collaboration with the University of Chicago Booth School of Business and Stanford University, was introduced online in November 2018. The survey measures the one-year-ahead expectations and uncertainties of firms throughout the United States and in every industry sector except agriculture and government.

The Federal Reserve Banks of Dallas and Atlanta co-organized the conference Technology-Enabled Disruption: Implications for Business, Labor Markets, and Monetary Policy. Its goal was to provide a better understanding of technology-enabled disruption and explore its implications for the broader economy.

The Center for Quantitative Economic Research and the International Monetary Fund cosponsored the third annual conference on China's economy. The conference assembled experts from around the world to discuss a number of pressing issues facing China: trade and misallocations, capital account liberalization, and growth and inequality.

The Americas Center and World Affairs Council of Atlanta hosted a discussion on the impact and future of the North American Free Trade Agreement. Atlanta Fed president Raphael Bostic moderated a panel that featured Canadian consul general Nadia Theodore, Mexican consul general Javier Diaz de Leon, and Laura Dawson of the Woodrow Wilson Center.

The Americas Center, the University of South Florida Sarasota-Manatee, and the Global Interdependence Center hosted a discussion on Cuba and disaster recovery in the Caribbean. Panel discussions featured former U.S. House delegate Stacey Plaskett of the Virgin Islands and former representative Carlos Curbelo of Florida.

The Americas Center brought together specialists from central banks, universities, and financial technology (fintech) companies for a workshop on De-risking, Financial Exclusion, and Resiliency in the Caribbean. Participants commented that the workshop was a rare chance for dialogue and policy discussion among people who do not normally interact with one another.

The Regional Economic Information Network, or REIN, of the Research Division joined the steering committee of the Conference on Central Bank Surveys, playing a lead role in the annual planning of the conference. REIN helped lead the conference's standing session on nonsurvey methods of gathering and synthesizing anecdotal input. Twenty-five central banks were represented at the 2018 Conference on Central Bank Surveys, which was hosted by the Bank of Sweden (Sveriges Riksbank) and held in Stockholm.

Community and Economic Development

The Community and Economic Development (CED) program published a comprehensive workforce development resource for policymakers, employers, nonprofits, funders, and program administrators titled Investing in America's Workforce: Improving Outcomes for Workers and Employers. This free three-volume book is the capstone of an initiative of the Federal Reserve System, the John J. Heldrich Center for Workforce Development at Rutgers University, the Ray Marshall Center of the Lyndon B. Johnson School at the University of Texas, and the W.E. Upjohn Institute for Employment Research. Chapters, videos, and other resources are available at www.investinwork.org.

The Center for Workforce and Economic Opportunity forged a partnership with the National Skills Coalition and the Federal Reserve Bank of St. Louis to produce Building a Skilled Workforce for a Stronger Southern Economy, a report that is being used to help southern states launch strategies to improve workforce development efforts.

The Atlanta Fed cohosted several gatherings to provide District stakeholders shared learning opportunities to address community issues. These included the Creating a More Inclusive Economy: Igniting Systems That Produce Results for Youth Employment conference, the 2018 National Interagency Community Reinvestment conference in Miami, the Growing Regional Food System Opportunity: Capital and Beyond forum, and the Fair Housing: A Look Back and Forward at Racial Equity in Atlanta (and the Southeast) conference.

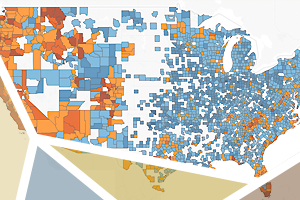

CED produced and updated analytics including Following the Money, a second iteration of the online tool that allows the public to explore funding flows for community and economic development from foundations to local neighborhoods, and the Opportunity Occupations Monitor, which provides metro-level information on jobs that do not require a bachelor's degree but pay a median wage. CED also launched the Southeastern Rental Affordability Tracker in partnership with the University of Florida's Shimberg Center for Housing Studies.

The Atlanta Fed continues to support the Federal Reserve Banks' Small Business Credit Survey and used this data to publish two papers in 2018: Mind the Gap: How Do Credit Market Experiences and Borrowing Patterns Differ for Minority-Owned Firms? and How Do Firms Respond to Hiring Difficulties?

Several additional papers and reports were published that provide evidence and strategies to address barriers to economic mobility. These include Strength in Numbers: The Growth and Evolution of CDFI Partnerships and Rental Housing Affordability in the Southeast: Data from the Sixth District.

Corporate Citizenship, Economic Education, and Public Outreach

Seventy-nine Atlanta Fed employees served on the boards of directors or advisory councils for more than 120 nonprofit organizations working to address critical community needs such as access to affordable housing, services for the homeless, and job training and placement for low- to moderate-income individuals.

Contributing more than 2,500 hours of volunteer time, 360 employees and their families and friends read to students, offered career advice and résumé and interviewing assistance, prepared and delivered meals to seniors, cleaned up public spaces, and donated new and used goods to benefit veterans, seniors, and youth.

More than 9,300 teachers participated in Bank-sponsored economic education workshops, webinars, and presentations. Through its economic education programs, the team exceeded a strategic objective to reach 75 percent of high schools in the Sixth District that are identified as inner city, majority-minority, or girls' schools.

The Bank opened its doors to the public for guided tours and a special town hall, A Community Conversation with President Bostic, in October. Bostic discussed the work of the Federal Reserve and took questions from the audience. The weekend event drew more than 200 visitors.

Public Affairs Forums brought leading authorities to Atlanta Fed offices to offer economic perspectives on public policy issues such as immigration, income inequality, and the world's food needs. Atlanta Fed president Raphael Bostic spoke to business and community leaders at forums in Nashville and Miami.

The Atlanta Fed Speakers Bureau facilitated 376 presentations in which employees shared research, data, and information with community groups and professional associations.

Retail Payments Office

The Retail Payments Office received positive customer feedback about its Check and Automated Clearinghouse (ACH) service in areas of quality, price, product, service, and value in a national survey.

Progress was made on two new Check and FedACH

services. A reporting service for the Federal Reserve's Check business line, which launched in December,

provides the bank of first deposit with advance notice of return items, enabling the institution to assess the impact of a returned check earlier in the business day. Additionally, the FedACH® Exception Resolution Service,

developed in 2018, will give customers the ability to manage disputes, notifications, questions, or requests for additional information tied to FedACH transactions when it launches in 2019.

The Retail Payments Office implemented the third and final phase of enhancements in an industrywide effort to expedite clearing and settlement of ACH transactions, referred to as FedACH® SameDay Service. Additionally, support was provided in the U.S. Treasury's implementation of Same Day ACH origination. Same Day ACH represents the most significant change to the ACH network in more than 40 years.

Office of Minority and Women Inclusion

The Bank received external recognition for its commitment to diversity and inclusion in 2018. The Atlanta Fed was ranked seventh on DiversityInc's list of top regional companies and earned a perfect score on the Human Rights Campaign's Corporate Equality Index

.

The Bank continued its strong commitment to supplier diversity, making 25.8 percent of its reportable procurement spending with minority- and woman-owned businesses in 2018. That compares with 15.2 percent in 2015 and 5.0 percent in 2011.

Supervision, Regulation, and Credit

In 2018, the Supervision, Regulation, and Credit Division continued to reach out to inform the banking industry and general public on key topics and trends, including the impact of the Economic Growth, Regulatory Relief, and Consumer Protection Act. Division staff also offered a supervisory perspective on the risks posed by migration to cloud environments at an industry cybersecurity conference.

The Division produced the annual Banking Outlook Conference, "ViewPoint" articles, and ViewPoint Live! webcasts, which provided information on regulatory developments, supervisory issues, and hot topics, including fintech.

Division staff continued to share their knowledge in numerous educational settings, including training events for foreign bank supervisors to promote sound supervisory practices abroad and address developing issues, such as trends in correspondent banking. These efforts also build relationships with central banks and bank supervisory authorities of other countries.

The Credit and Risk Management Department and the Bank's Financial Statistics and Structure Analysis Department conducted training for the District's depository institutions on reporting requirements and reserves administration.

Financial Statements

The Board of Governors and the Federal Reserve Banks annually prepare and release audited financial statements reflecting balances (as of December 31) and income and expenses for the year then ended.

Audit Statement

The Federal Reserve Board engaged KPMG to audit the 2018 combined and individual financial statements of the Reserve Banks*

In 2018, KPMG also conducted audits of internal controls over financial reporting for each of the Reserve Banks. Fees for KPMG services totaled $7.0 million. To ensure auditor independence, the Board of Governors requires that KPMG be independent in all matters relating to the audits. Specifically, KPMG may not perform services for the Reserve Banks or others that would place it in a position of auditing its own work, making management decisions on behalf of the Reserve Banks, or in any other way impairing its audit independence. In 2018, the Bank did not engage KPMG for any non-audit services.

* In addition, KPMG audited the Office of Employee Benefits of the Federal Reserve System (OEB), the Retirement Plan for Employees of the Federal Reserve System (System Plan), and the Thrift Plan for Employees of the Federal Reserve System (Thrift Plan). The System Plan and the Thrift Plan provide retirement benefits to employees of the Board, the Federal Reserve Banks, the OEB, and the Consumer Financial Protection Bureau.

Each year, the Office of Minority and Women Inclusion (OMWI) at the Federal Reserve Bank of Atlanta provides a congressional report summarizing the office's actions with regard to the requirements under Section 342 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. This report highlights the work OMWI performed in the previous year to take the affirmative steps that the Dodd-Frank Act addresses—specifically, ensuring workforce and supplier diversity, as well as advancing financial literacy in inner-city, majority/minority, and girls' schools. The Atlanta Fed undertakes these efforts in the Sixth Federal Reserve District.

The Atlanta Fed's annual reports highlight the work of the Atlanta Fed over the preceding year. Reports before 2012 were printed publications, and many of these are available online on our website in PDF. Since 2012, we have published online-only annual reports. These contain topical essays, dynamic charts, and videos and imagery, as well as links to the Bank's financial statements and lists of our current directors and officers.

About the Atlanta Fed

The Federal Reserve Bank of Atlanta is one of 12 regional Reserve Banks in the United States that, with the Board of Governors in Washington, DC, make up the Federal Reserve System—the nation's central bank. Since its establishment by an act of Congress in 1913, the Federal Reserve System's primary role has been to foster a sound financial system and a healthy economy. To advance this goal, the Atlanta Fed helps formulate monetary policy, supervises banks and bank and financial holding companies, and provides payment services to depository institutions and the federal government. Through its six offices in Atlanta, Birmingham, Jacksonville, Miami, Nashville, and New Orleans, the Federal Reserve Bank of Atlanta serves the Sixth Federal Reserve District, which comprises Alabama, Florida, and Georgia, and parts of Louisiana, Mississippi, and Tennessee.

Annual Report Staff

Mike Chriszt

Vice President and Public Affairs Officer

Robin Ratliff

Assistant Vice President and Public Information Officer

Nancy Condon

Managing Editor, Content and Publishing Director

Carole Starkey

Web Communications Director

Charles Davidson

Karen Jacobs

Writers

Peter Hamilton

Odie Swanegan

Graphic Designers

David Fine

Photographer

Michael Zavarello

Web Developer

Cassie Gage

Cassie Gooding

Sadat Karim

Odie Swanegan

Marketing and Social Media

Jean Tate

Media Relations

Mark McElroy

Creative Services Director

Scott Fisher

Jason Palmer

Jordan Stockton

Video Producers

Raphael Bostic

President and CEO

Dave Altig

Raphael Bostic

Karen Leone de Nie

Donna Salazar

Whitney M. Strifler

Paula Tkac

Advisers and Contributors

Branches & Offices

Atlanta Office

1000 Peachtree Street N.E.

Atlanta, Georgia 30309-4470

Birmingham Branch

524 Liberty Parkway

Birmingham, Alabama 35242-7531

Jacksonville Branch

800 Water Street

Jacksonville, Florida 32204

Miami Branch

9100 N.W. 36th Street

Doral, Florida 33178-2425

Nashville Branch

333 Commerce Street

Suite 1000

Nashville, Tennessee 37201

New Orleans Branch

525 St. Charles Avenue

New Orleans, Louisiana 70130-3480