Given the importance of commercial real estate (CRE) to the U.S. economy, monitoring changes in local and national trends is essential. To accomplish that, the Atlanta Fed developed a newly released Commercial Real Estate Momentum Index to compile individual market dynamics to help users better understand momentum in CRE markets across the country. As one of the most comprehensive quantitative market analyses publicly available, the tool provides one-of-a-kind information. Users of the CRE Momentum Index can access market-level details for the four major commercial real estate property sectors: retail, office, industrial, and multifamily.

Retail

Most of the early projections for 2020 have undoubtedly not come to fruition. At the end of the first quarter, the retail sector was already showing signs of downward momentum as local metrics such as vacancy rates and retail sales growth were well below historical averages. Then, the onset of the COVID-19 pandemic brought business closures and increased safety precautions, which dramatically affected the retail sector.

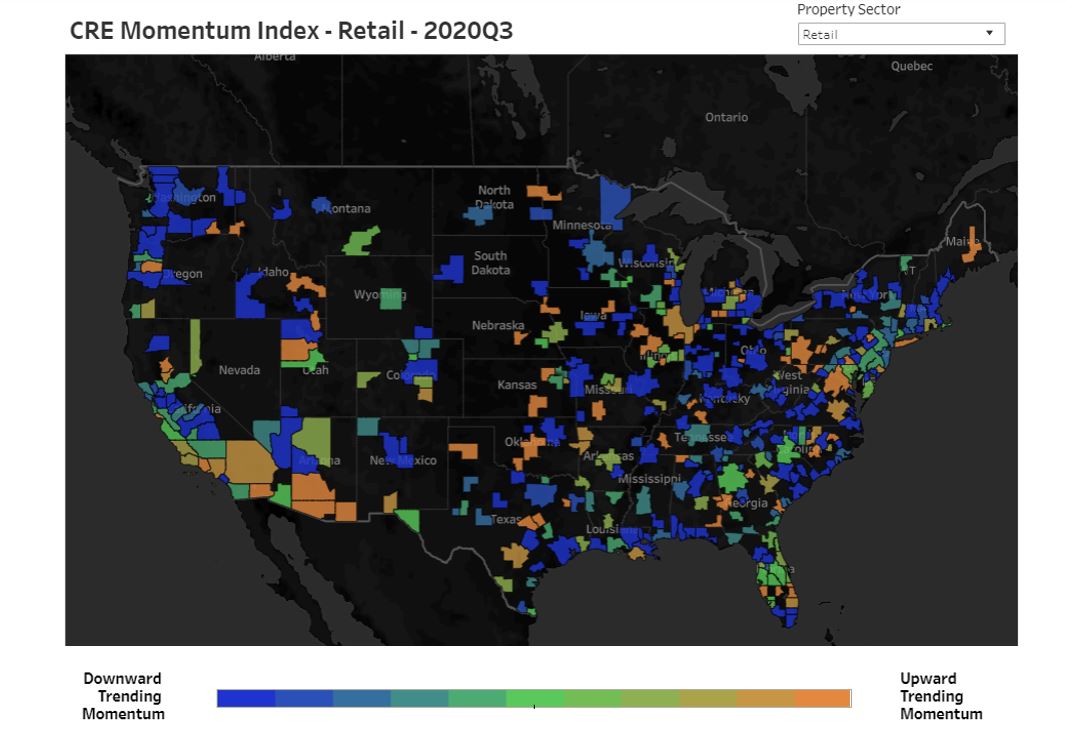

As of the end of the second quarter, the majority of markets tracked in the CRE Momentum Index showed increased downward momentum (see the map). A subset of markets—including Phoenix, Chicago, and Atlanta—had upward momentum at the beginning of 2020 that expanded further in the second quarter. Phoenix, Chicago, and Atlanta reflected similar market trends during this time, particularly rising mall vacancies coupled with stronger rent growth than historically experienced. Exploration of the individual variables that, combined, determine the retail sector indices show that the upward trending momentum signals areas of weakness within the markets.

The Small Business Administration’s (SBA) Paycheck Protection Program (PPP) has been a significant source of relief for small businesses after the original shocks of COVID-19. In total, more than 5.2 million loans were made with more than $525 billion in approvals. A significant portion of these dollars went to businesses operating in retail spaces, such as small shops and restaurants. Lender participation in the PPP was just shy of 5,500 institutions. While the loans are to be repaid to the government, there is the potential risk of the SBA rejecting foregiveness claims on loans made, which may pose a significant challenge for businesses as the effects of COVID-19 continue to unfold.

Moving into the third quarter, downward momentum continued broadly across the country, including within the subset of markets that had experienced some upward movement between the first two quarters of the year. This downward momentum was mainly the result of slowing new retail construction, slowing retail sales growth, and slowing rent growth for retail spaces. Since the industry continues to deal with the economic effects of COVID-19, uncertainty about the trajectory of the retail sector remains a risk and, subsequently, a potential peril to the institutions that lend to it.

Office

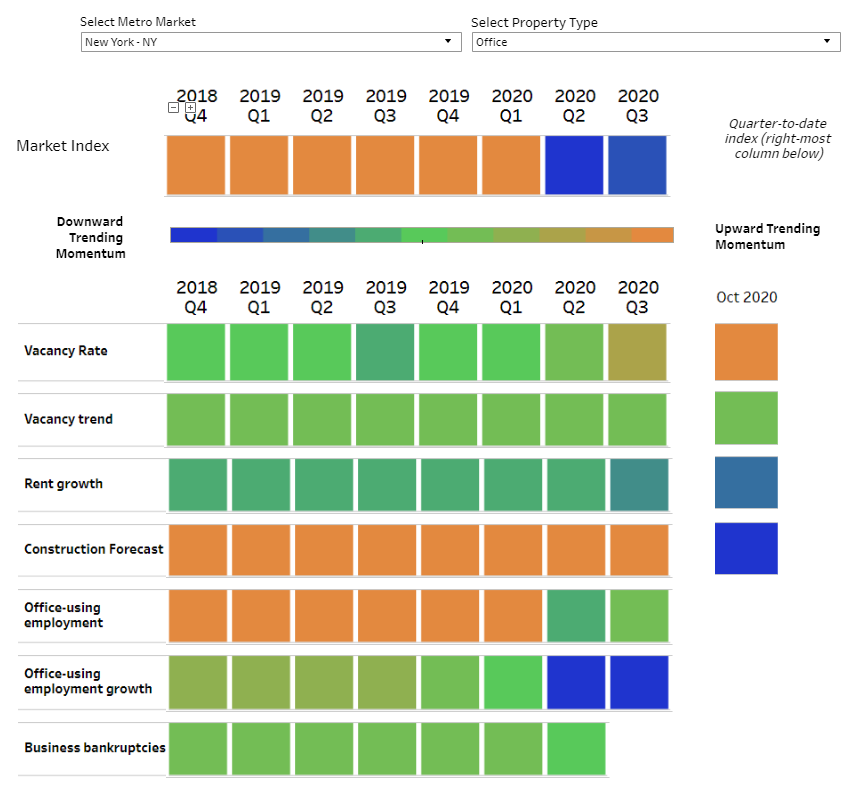

Indices in the office sector in markets around the country varied greatly in the first quarter of 2020, highlighting the importance of market-specific dynamics on the index values. Regionally, no clear patterns could be discerned. However, there was a distinct change across markets to downward momentum through the end of the second quarter. The primary driver of this phenomenon was, unsurprisingly, the contraction in office-using employment growth. Major markets such as New York and Los Angeles saw a contraction of over 8 percent in office-using employment, while secondary markets like St. Louis and Atlanta experienced a 5 percent reduction. Data through the third quarter show some rebound toward more stable conditions (which is to say that they are trending closer to the long-term average). However, office-using employment growth only marginally recovered, and increasing vacancies—though minor—are beginning to appear in some markets.

The impact of the work-from-home approach to addressing COVID-19 workplace health concerns will take time to be fully realized. Recently, the amount of national sublease office space on the market has grown this year as less space is absorbed. Conversations with industry contacts indicate that companies are being more thoughtful with future leasing decisions as there appear to be more and faster-changing inputs. However, the longer-term leasing structure of office space (five or more years) may mitigate some of the immediate impacts on office space (see the chart). This dynamic has the possibility to unfold over the next few years as impacts of the pandemic have shifted both companies’ and employees’ perspectives on where and how to work.

Industrial

Generally, the industrial sector was stable in most markets across the country at the end of the first quarter of 2020, with many markets reflecting characteristics similar to long-term trends. Given restrictions put in place to combat the spread of COVID-19 as well as general health uncertainty, many consumers turned increasingly to online shopping as a safer alternative to the in-person purchase of goods. As a result, the industrial sector has been regarded as a stable sector, with demand remaining constant or growing during this time.

Progression to the third quarter of the year shows the indices for the majority of markets with downward-trending momentum, which comes from a pullback in year-over-year transportation and warehousing employment growth in many markets. Transportation and warehousing sector employment growth is representative of industrial sector-related jobs, such as fulfillment center workers and product delivery drivers. While transportation and warehousing employment levels have regained some traction after initial job losses caused by pandemic-related closures in the spring, the current levels remain below levels for the same time last year. Generally, vacancy rates remain tight within the industrial sector and construction levels remain stable.

Multifamily

Since the beginning of 2020, market dynamics in the multifamily sector have been extremely market-specific, with no particular trends relatable across many markets. Markets with the strongest upward momentum include Portland, Maine; Dover, Delaware; and Knoxville, Tennessee. These markets are experiencing strong occupancy levels and rent growth and a stable-to-strong construction pipeline. Markets with the most notable downward momentum are San Francisco, California; Odessa, Texas; and Wheeling, West Virginia. Conversely, these markets are experiencing significantly low occupancy levels, a sharp contraction of rent growth, and a pullback in the amount of new construction.

In addition to mortgage deferral programs in response to the financial impact experienced by many households because of the pandemic, there was a moratorium on eviction filings related to nonpayment of rent established by the CARES Act, which expired on July 25, 2020. However, the Centers for Disease Control issued a moratorium to stop evictions through the end of 2020 due to the significant impact of COVID-19. Freddie Mac, as well as some smaller institutions, have rent relief programs in place to help combat financial hardship related to COVID-19. San Francisco, for example, is the least affordable market in the United States for residential housing, according to the Atlanta Fed’s Home Ownership Affordability Monitor. If challenges arise in the multifamily living situation, residents would face tough challenges for affordable housing options.

The CRE Momentum Index will be updated monthly and each release will include a discussion of the findings.