The Commercial Real Estate Momentum Index (CREMI) provides easy access to various metrics for individual markets by sector and facilitates comparisons of conditions across markets. The index tracks movements in specific metrics (such as occupancy/vacancy rate, rent growth, and the construction pipeline) and provides a targeted view of real estate conditions in the industrial, multifamily, office, and retail sectors. Additional metrics, including employment and population growth, provide information specific to each sector as appropriate. CREMI derives a momentum index value for each sector within a market and also gives an overall momentum index value for the entire market.

The Atlanta Fed is developing continuous enhancements to the tool and will release them as they become available. For example, CREMI recently received more analysis functionality. The newest view is the Index Bell Curve, which shows user-selected markets on a bell curve, color-coded with the index values. For a given property type, users can explore where markets fall on the index scale relative to each other. Enjoy exploring a new perspective on the data!

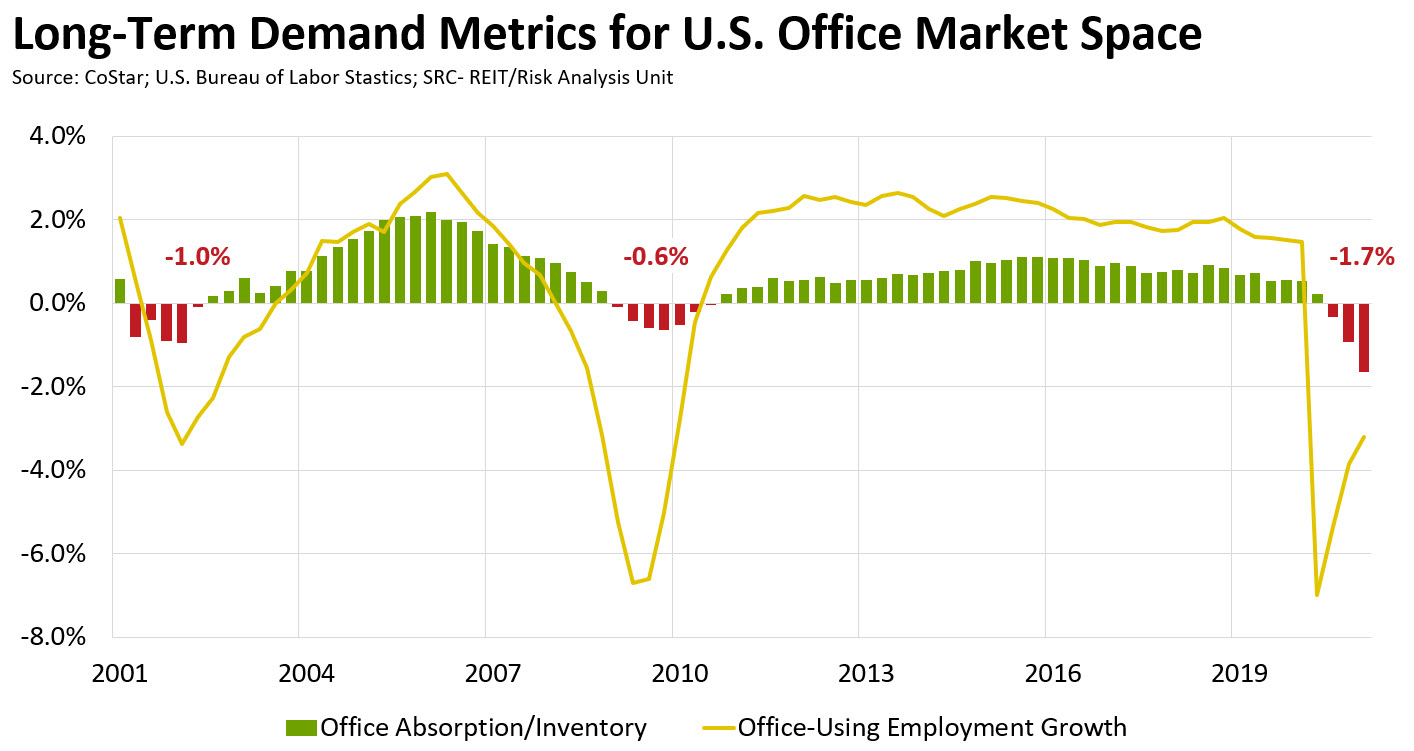

This month, we’re using the Commercial Real Estate Momentum Index (CREMI) to take a closer look at the nation's office markets. The effects of the pandemic and the subsequent lockdowns designed to contain more widespread transmission of the virus have had a chilling effect on office-using employment. Office space absorption plummeted by an estimated historic 134.7 million square feet (12-month moving sum) in the fourth quarter of 2020, which progressively worsened during the second half of 2020, according to data from CoStar. For context, negative net absorption in the United States in the first quarter of 2021, as a share of total inventory, was 1.7 percent, nearly three times the peak-loss quarter during the financial crisis of 2007–¬08 (see the chart).

Office-using employment growth appears highly correlated with negative net absorption nationally. Last April, the nation lost more than 2.75 million office-using jobs in a single month, according to the U.S. Bureau of Labor Statistics. The rebound in employment started in May, but the pace has generally moderated since. In February 2021, the office sector added 55,000 jobs but was still down 3.4 percent on a year-ago basis.

The ability of many employees to work remotely has hindered the rebound in office absorption. A significant number of businesses have indicated that they will allow more employees to work remotely. The added uncertainty surrounding the future work environment has fostered pessimism about office absorption.

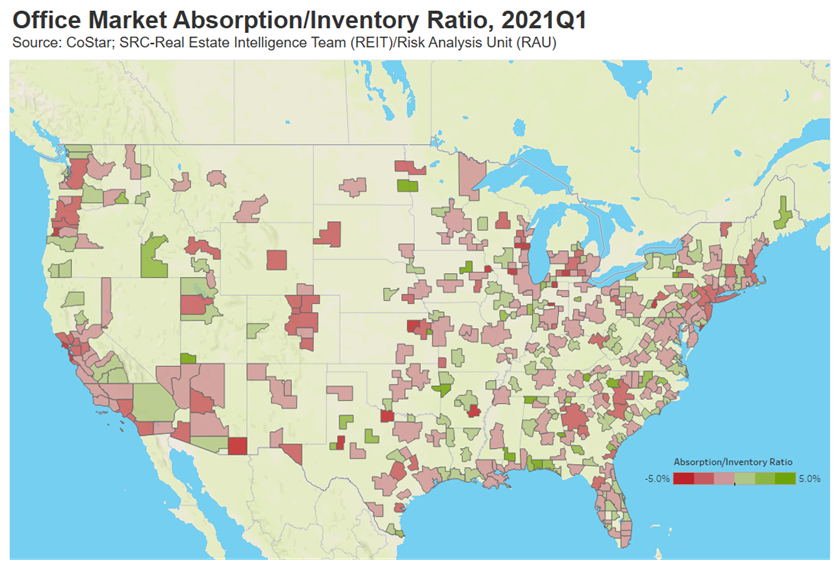

Weak demand for office space was widespread (see the map). Of the markets tracked by CREMI, nearly two-thirds reported negative net absorption in the first quarter of 2021. Still, negative absorption rates appeared more heavily concentrated in areas with a population greater than one million, where nine out of 10 markets had negative net absorption, according to data from CoStar. Of these, San Francisco suffered the worst performance, with an estimated decline in the net absorption/inventory ratio of 5.5 percent. Higher-cost markets (such as San Francisco, Chicago, and New York City) might confront greater challenges due to their current fiscal situation, which will most likely necessitate tax increases and reductions in services. Areas with perceived challenging fiscal conditions may experience an exodus of businesses moving to lower-cost markets to avoid higher taxes and a lower level of services.

Mitigating factors

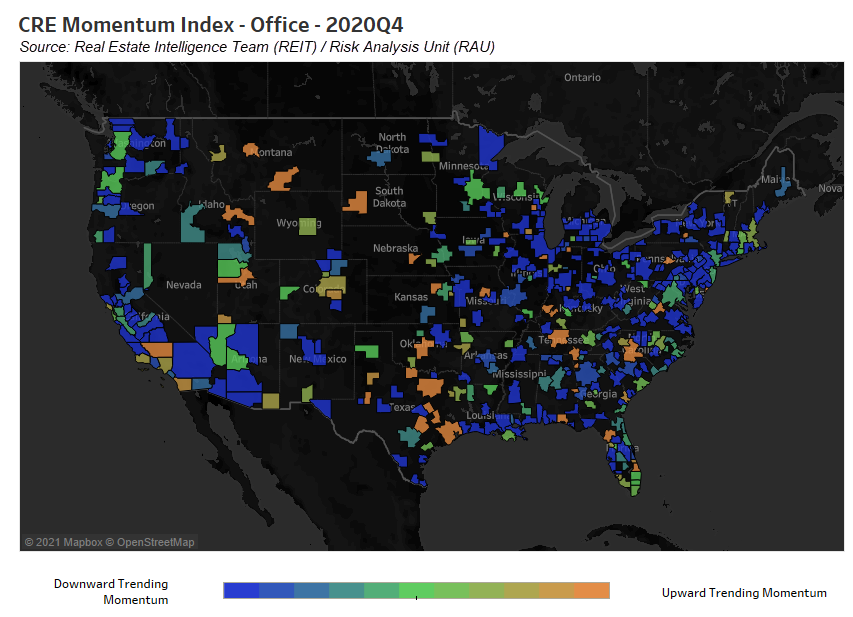

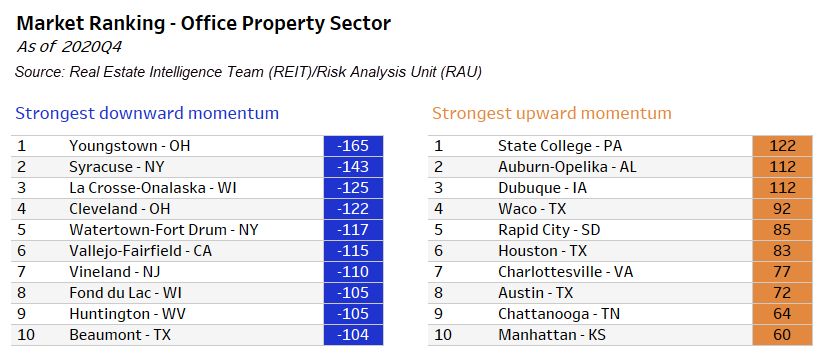

Despite the fact that two-thirds of markets experienced negative absorption rates early in 2021, the overall impact on individual markets can vary (see the map and tables). Delving into the mechanics of CREMI reveals factors that could mitigate weakness in absorption rates. One example of this might be Nashville. Although the city saw declining rates of office absorption in late 2020 and early 2021, its market continues to perform above its long-term trend, especially with its more robust recovery in office-using employment. Other examples include Austin, Charlotte, Chattanooga, Dallas-Fort Worth, Houston, and San Diego. These performances contrast with observations from other markets such as Youngstown, Ohio, and Syracuse, New York, where the recovery in office-using employment has languished.

Long-term challenges for the office market

The pandemic forced a rapid, significant shift in how and where office employees work. Once the pandemic ends, will firms and workers continue to embrace working remotely? And as leases begin to come up for renewal, how will long-term demand for office space change? Any changes might have a greater impact on higher-cost real estate in cities’ central business districts, where major employers often have offices. Some surveys indicate that structural demand for office space will shift as many firms consider having a mix of in-office and remote work, affecting the office densification trend seen in recent years. Although remote work holds benefits such as a lower cost of maintaining home offices versus office space and reduced commuting, the benefits of in-person contact in an office environment could suffer.

Let’s talk more about CRE

We’ve heard from some CREMI users in recent weeks, and we invite further conversation. What does CREMI tell you about your market and its net absorption rates? What issues would you like us to spotlight in future updates? Would you participate in a monthly survey of CRE market conditions? To facilitate more direct communication, we have a new email address: CREMI@atl.frb.org. Please keep in touch.