The Commercial Real Estate Momentum Index (CREMI) provides easy access to various metrics for individual markets by sector and facilitates comparisons of conditions across markets. The index tracks movements in specific metrics (such as occupancy/vacancy rate, rent growth, and the construction pipeline) and provides a targeted view of real estate conditions in the industrial, multifamily, office, and retail sectors. Additional metrics, including employment and population growth, provide information specific to each sector as appropriate. CREMI derives a momentum index value for each sector within a market and gives an overall momentum index value for the entire market. Upward and downward momentum correspond with aggregated trends in the market metrics, not necessarily indicating "good" or "bad."

Be sure to explore the tool's newest feature under the

June 2021 Spotlight: The Multifamily Sector

Every month, we explore another aspect of the Commercial Real Estate Momentum Index (CREMI) and how it can inform us about commercial real estate conditions. This month, we'll focus on indicators of multifamily sector health and how they have changed since inflection points during the pandemic. Variables that contribute to the multifamily momentum index include construction forecast, homeownership rate, mortgage rate, occupancy rate and trend, population growth, and rent growth.

National multifamily sector overview

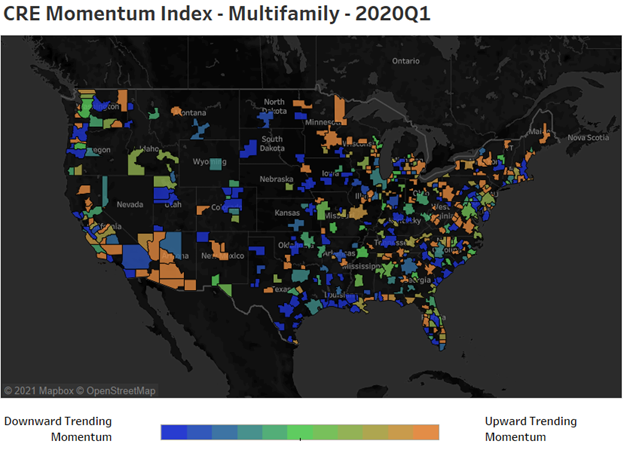

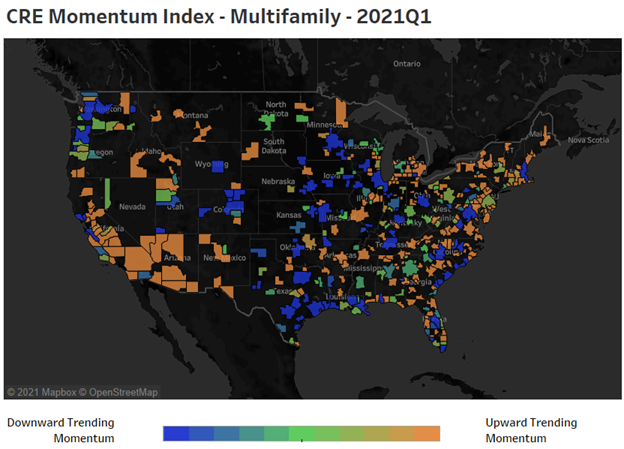

The overall CRE momentum index for multifamily shows a dramatic increase in upward trending momentum between March 2020 and March of 2021 in many U.S. markets. This can be seen by comparing the U.S. map graphics (see below) for these periods. The areas that continue to show downward momentum tend to be the largest U.S. cities most affected by the longest and most stringent lockdowns to combat the spread of COVID-19, such as New York, Los Angeles, Miami, Dallas/Fort Worth, Washington DC, and Chicago. Southern Texas and Louisiana Gulf Coast areas continue to have the most negative multifamily momentum as that economy in recent years has also suffered multiple shocks to the area’s oil industry-driven economy. Rural, midsized, and smaller cities have seen multifamily demand increase as coronavirus restrictions were lifted earlier in those areas. Additionally, work-from-home options have allowed many employees to seek out lower costs of living in rural areas with little or no commuting requirements.

Pandemic shutdown impacts occupancy

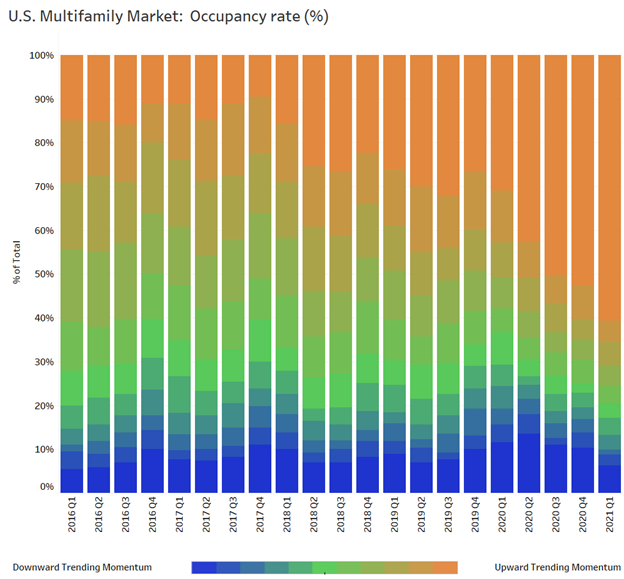

Multifamily momentum is increasing, but why? Pandemic lockdowns, the eviction moratorium, slowing construction, rapidly increasing housing market prices, and limited inventory for those homes left an ever-increasing group of people resorting to multifamily living as the next best option. As of the first quarter of 2021, roughly 75 percent of the surveyed markets had occupancy rates increase to above their long-term average. The graphic below details national trends in multifamily occupancy rates over time, reflecting the percentage of markets at each level of momentum, with the most distinct orange and blue colors representing the largest deviation from market norms. The data suggest that occupancy has been increasing for more markets since the onset of the pandemic in late 2019, but only recently have markets seeing upward trending occupancy far exceeded those seeing a downward trend.

High occupancy demand drives rent growth

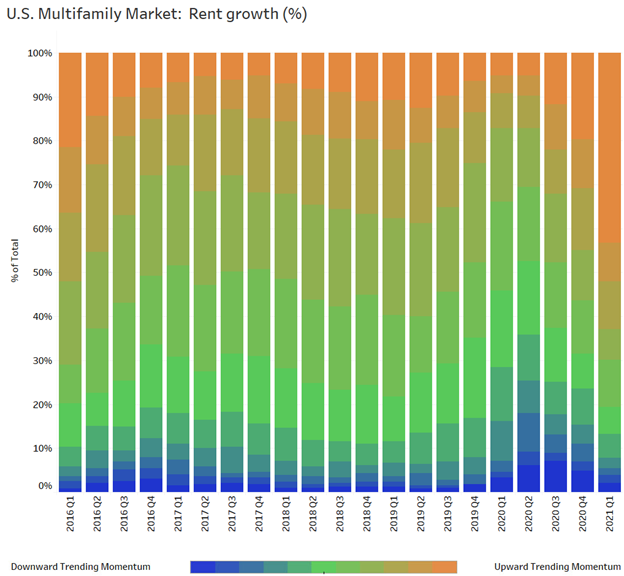

Rents increases were generally stable to modest throughout from 2017 through 2019. COVID-19 created sizeable challenges in 2020, but renters returned to the market at the beginning of 2021 as uncertainty was reduced. In the first quarter of 2021, demand returned and properties providing concessions, which amounted to two months of free rent ceased providing those inducements. The number of markets increasing rents significantly more than the historical average roughly doubled between the fourth quarter of 2020 and the first quarter of 2021 (see orange area of the last two columns in the chart). From the perspective of effective rents, some operators reported that while 2020 was by far their most challenging, 2021 was on pace to be their most rewarding in the last 20 years.

Multifamily overall momentum. It's complicated...

The pandemic slowed multifamily construction and the eviction moratorium minimized displacements. In turn, in many cases occupancy and rents are up, and rising single-family home valuations are influencing people towards multifamily properties. So why aren't more markets illustrated with higher momentum? It's complicated. Lower interest rates have made homes more affordable, even though this has accelerated rising valuations. More apartment construction is returning as reopenings occur. Additionally, the heightened level of unemployment continues to create headwinds for most commercial properties. Compounding that dynamic is uncertainty regarding the level of evictions once the eviction moratorium expires.

Hotlanta...just in the time for the summer, Atlanta heating up.

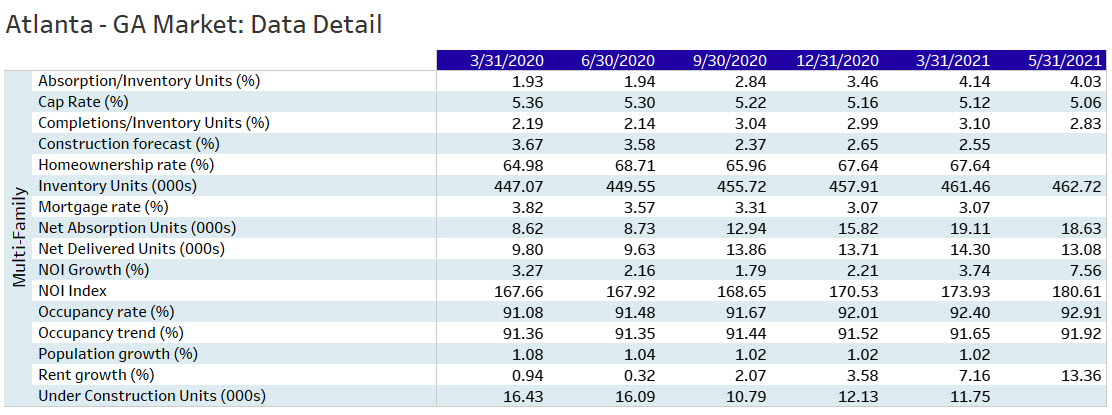

Along with the majority of markets, Atlanta showed significant improvement over results for 2020 (see chart). Compared to March 2020, the rate of absorption doubled from less than 2 percent to over 4 percent, and Net Operating Income (NOI) growth accelerated markedly. Occupancy rose by over 150 basis points in the span of a year. Additionally, investors who had fled the market returned, and Multifamily Cap Rates declined by 30bps, which combined with growing NOI have led to increasing prices.

Risky business...

Along with Hotlanta, the vast majority of markets are experiencing robust tailwinds. Since Multifamily fundamentals have improved markedly and look good, we may have to paraphrase a movie soundtrack line, "the future's so bright, we have to wear shades" to describe current conditions. However, while muted, risk remains an important fundamental and an ever-present dynamic. According to the Consumer Financial Protection Bureau, there may be as many as nine million renters behind on their rent. If the eviction moratoriums begin to be lifted, this could create a rapidly developing headwind for Multifamily conditions.

Let's talk more about CRE

We’d like to hear from you. What does CREMI tell you about multifamily conditions in your market? What are you seeing in terms of rents, expenses and construction/development? Are there issues that you would like us to spotlight in future updates? Are you interested in participating in a monthly survey of CRE market conditions? To facilitate communication, we have a new email address: CREMI@atl.frb.org. Please keep in touch.