The terms "dividends" and "return of capital" are familiar ones, especially for those in the banking industry. However, do you truly know the difference between the two? Data suggest that more than occasionally banks themselves misreport a dividend transaction as a return of capital or vice versa. Beyond data accuracy, this type of error begs the question of whether confusing the two when filing regulatory reports carries noteworthy ramifications.

Hidden reporting crevices aren't really all that hidden, but—like an unexplored cave—it's never clear how deep they go or how much effort it will take to get to the destination. Regardless, the effort is not for naught as guidance, regulation, and general views are ever evolving and influenced by better understandings and more information. Thus, the pursuit of an answer to this reporting question better equips you, by illustrating a process, to tackle future areas that might be unclear.

Although returns of capital and dividends might appear to be the same thing because both involve a company's distribution to its shareholders, it is the source of the funds that sets them apart. This article will discuss the reporting of these two different transactions and will attempt to clarify the difference between the accounting for dividends and that of return of capital. Reporting these two transactions correctly is of paramount importance, because accurate reporting can help regulatory supervisors and other stakeholders draw the right conclusions. As such, the Federal Reserve Bank of Atlanta (for example, through this article) seeks to build awareness of and provide insightful information on dividends and return of capital to help improve the accuracy of regulatory reporting data and provide clarity to both the banking industry and consumers.

Reporting guidance can differ

The Financial Accounting Standards Board (FASB) Accounting Standards Codification (Codification or ASC) only acknowledges return of capital transaction for a narrow scope of organizations, which do not include banks or bank holding companies, and frame the codification within a tax perspective. Whereas the ASC portrays dividends as applying to all organizations' accounting, the ASC does not define specifically what is a dividend is. Instead, the Codification identifies the stock dividend subset—that is, noting that it has no net equity impact and does not change shareholder's proportional ownership1. A nonauthoritative FASB guidance, which is a pronouncement that is not part of the ASC, identifies that the reporting of distributions from companies to owners is useful. However, it does not delineate information for different types of owner distributions as being more useful than another. Therefore, it does not appear that the FASB distinguishes between dividends and return of capital for accounting purposes for banks.

The joint, nonauthoritative regulatory reporting guidance of the Federal Reserve System (FRS) and Federal Financial Institutions Examination Council (FFIEC) suggests that a dividend requires elements of formality, which is generally a formal dividend declaration by an organization's board of directors. Furthermore, a bank's unilateral decision to reduce contributed capital stock (for example, common/preferred stock or surplus) would be labeled as a return of capital. However, bank reporting guidance does not provide preceding criteria or economic triggers that would require any event to be reported as a return of capital. Consequently, allowing for an interpretation that any organizational distribution to owners—absent a formal board of director's dividend declaration or that the organization does not want to account for as a reduction to contributed capital—can instead be reported elsewhere at the organization's discretion (such as an unreconciled consolidation entry).

Internal Revenue Service (IRS) tax regulatory guidance suggests all distributions to owners are considered dividends until all retained earnings are exhausted, at which point any additional distributions would become a return of capital. Figure 1 shows a comparison of definitions across the three agencies.

Figure 1: Comparing Definitions Across Agencies

| FASB ( GAAP ) | IRS | FRS/FFIEC | |

|---|---|---|---|

| Authoritative2 | Nonauthoritative2 | Nonauthoritative2 | |

| Dividends | Dividends paid or payable in cash, other assets, or another class of stock and does not include stock dividends or stock splits.3 | Distribution of property (i.e., cash, stock of another corporation, or any other property) to a stock owner is a dividend.4 | Payments of cash to stockholders in proportion to the number of shares they own. Cash dividends are to be reported on the date they are declared by the bank's board of directors (the declaration date) … A liability for payable dividends may not be accrued in advance of the formal declaration of a dividend by the board of directors.5 |

| Return of Capital | Distributions by investment companies in excess of tax-basis earnings and profits.6 Banks and bank holding companies are not investment companies.7 |

Return of some, or all, of an owner's investment in the stock of the organization. The IRS explicitly states that, "a distribution generally qualifies as a return of capital if the corporation making the distribution doesn't have any accumulated or current year earnings and profits".8 | Return of capital transactions are described as transactions in which contributed capital (i.e., surplus) is reduced without retiring stock and cash is distributed to the institution's stockholders.9 However, the transaction is not definitively defined within the Glossary. |

Why choose one over the other?

As organizations face the decision of how to report equity distributions to owners, the factors highlighted below might drive their decision to choose dividends versus return of capital:

- Supervisory treatment

- Both transactions essentially result in the same economic outcome for an organization: the disbursement of organizational resources to (or consumed by) owner(s). Thus, the organization now has less resources to deploy toward its operations. GAAP's lack of differentiation of the underlying types of distributions to owners is evidence that FASB does not believe a dividend versus a return of capital is an economically substantive distinction that gives additional information on organizational financial flexibility, capacity to generate future cash flows, or risk. Additionally, banking regulation focuses on capital adequacy, as opposed to distinguishing between dividends and return of capital. Nonetheless, a belief of favorable supervisory treatment could be a consideration when reporters choose one classification versus the other.

- Tax evasion

- Questionable reporting of dividends and return of capital may be driven by organizations attempting to obtain the more beneficial tax treatment of a return of capital compared to that of a dividend. However, as tax filings differ from financial and regulatory filings, actual tax outcomes might not align with financial and regulatory filings.

- Investor activism hurdles

- Accounting for distributions to owners as return of capital can result in the number of shares outstanding being more difficult to ascertain, preventing an existing shareholder or a potential future shareholder from easily determining what the cost would be to obtain a majority of outstanding shares.

- Public versus private

- There can be a different level of treatment between a publicly held company versus a privately held company, to the extent that labeling a distribution as a dividend causes less confusion for owners as opposed to calling it a return of capital. Furthermore, publicly held companies are less likely to report a reduced level of dividend overtime due to shareholders’ expectations. Additionally, irregular dividend payouts might cause market volatility.

What do the data tell us?

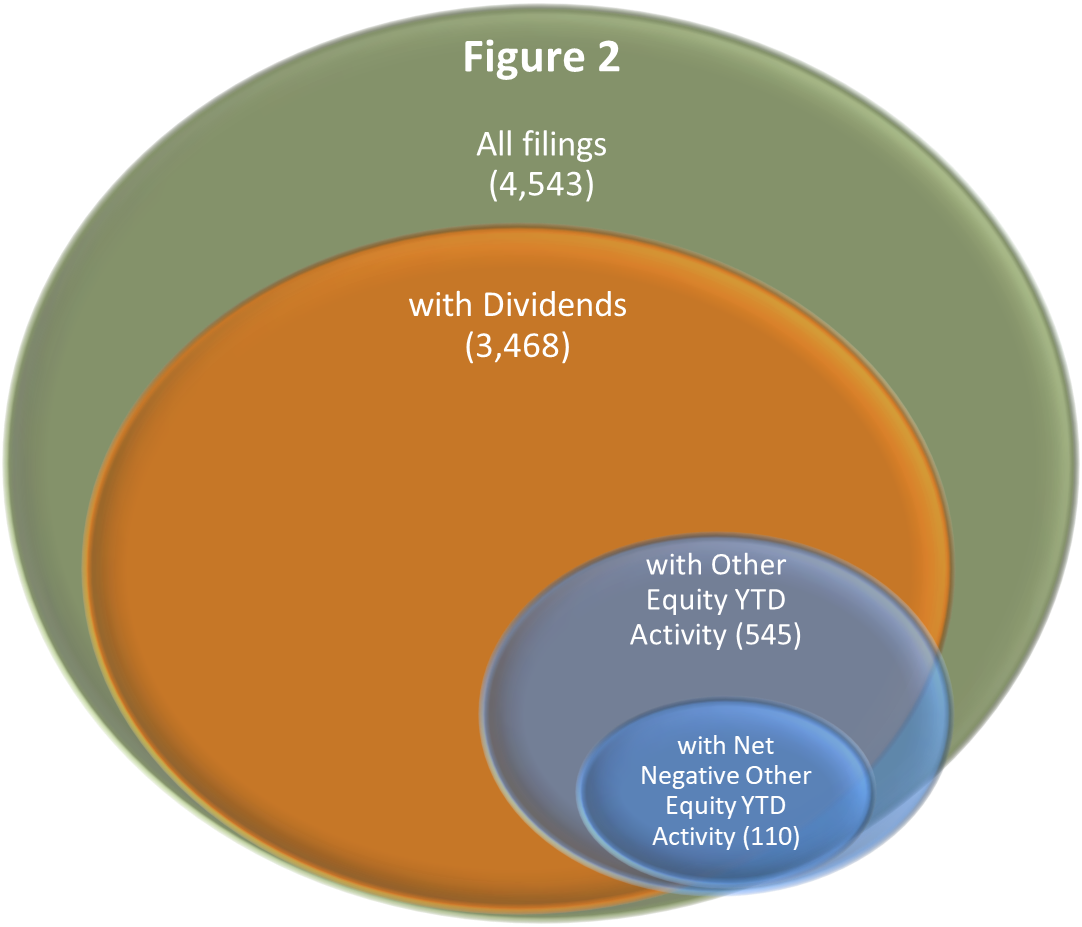

To properly focus this article, it should be noted that 4,543 call reports (or, as they are more formally known, the FFIEC's Consolidated Report of Condition and Income) were filed nationwide for the calendar year ending December 31, 2024. As figure 2 shows, of these filings, 545 had reported on Schedule RI-A (Changes in Bank Equity Capital) in line item 11 (Other Transactions with Stockholders), which includes return of capital activity commingled with other equity-related transactions. Out of the 545 reporters, only 110 (or 20 percent) had net negative balances, which would have been expected if the only reported equity activity was a return of capital. Thus, for this data section, only the 110 net negative filings could be reasonably assumed to be a return of capital and therefore will be included for analysis.

Although any of the 545 entities with year-to-date ("YTD") other equity activity included might have returned capital, it's not apparent as it could have been offset by some larger activity.

An additional data limitation of the ensuing analysis is that there is not a discrete line that solely reports return of capital activity. As such, even though there are 110 filings with a net negative balance (including return of capital) in the line, the reported net negative activity could be due to something other than return of capital, such as nonowner capital (for example, grant repayment/penalty or nonrecourse government programs).

As for dividends, there is a discrete line item that includes no other activity (that is, on Schedule RI-A, line item 8, "Cash dividends declared on preferred stock," and line item 9, "Cash dividends declared on common stock"). Therefore, there is higher confidence in ascertaining dividend activities from reported data as opposed to return of capital activities.

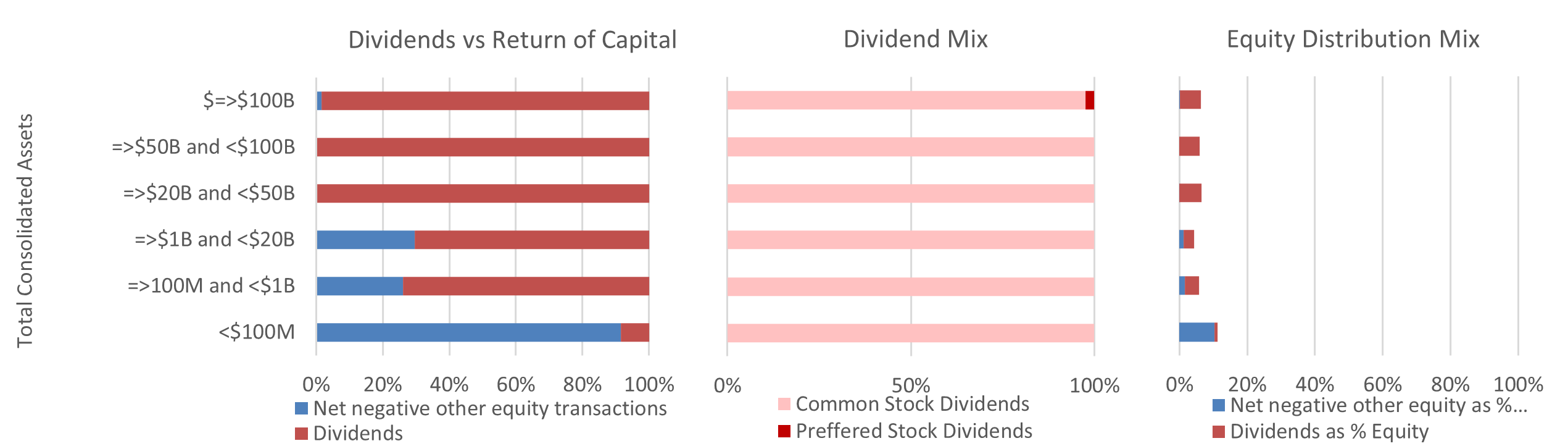

Here are the main dividend and return of capital data takeaways:

- Banking entities declare dividends more often than they do a return of capital. For the 2024 year-end data, of

the

4,543 call report filers:

- 3,339 entities reported only declaring dividends;

- 41 entities reported only potential return of capital; and

- 69 entities reported both dividends and potential return of capital.

- Overall, the dividend dollar size is larger than the return of capital dollar size (96 percent or $7.3 billion for dividends compared to 4 percent or $0.3 billion for return of capital).

- Of dividend declarers, 2 percent (65 of 3,468) had negative net income for the year.

- Of potential return of capital activity reporters, 95 percent (105 of 110) had positive net income for the year.

- As figure 3 indicates, entities with smaller asset sizes (less than $20 billion in assets) appear to engage in potential return-of-capital activity more than their larger counterparts.

- The impact on total equity is proportionally larger for entities with smaller asset sizes than compared to those with larger asset sizes.

Figure 3: Return-of-Capital Activity among Banking Entities

Recommendation for stakeholders interested in the data

Stakeholders in the banking industry—such as bankers, regulators, analysts, researchers, public accountants, and others—who want to discern between the reporting of dividends and return of capital are encouraged to review all distributions for:

- Tax treatment.. If the distribution is taxable to the owner, it is likely not a return of capital.

- Economic substance. If the organization is still in custody of any of their lifetime profits (for example, retained earnings), try to understand why any distribution to owners would not have come out of accumulated profits and earnings.

- Motives. If investor actions are being coordinated (such as minority shareholder partnering, takeover attempts through market share acquisition, etc.), consider if the organization's choice to report a dividend versus return of capital is an attempt to thwart those actions.

- Consistency and comparability.If, over time, the organization has reported the same transaction in different ways or is reporting it differently from the majority of its peers, it would be prudent to understand the reason(s) for the difference in reporting practices and to seek consistency in reporting, as appropriate.

Final takeaway

Regardless of how a financial organization chooses to label its distribution to its owners (whether it's dividend, return of capital, or another label), the Federal Reserve actively supervises and provides guidance that aims to ensure financial organizations can absorb unexpected losses and are able to lend to creditworthy businesses and consumers without failing or approaching the brink of failure. To foster public confidence in the capital positions and resiliency of financial organizations, the Federal Reserve conducts stress testing for larger banks to ascertain the adequacy of capital levels amid various possible adverse economic scenarios, the outcome of which can restrict capital distributions. Dividends and return of capital payments are also influenced by factors including banks' capital levels, financial condition, supervisory ratings, and economic outlook.

1 FASB.org (ASC 260-20 and ASC 505-20)

2 FASB.org (ASC 105-10-05-03) Accounting and financial reporting practices not included in the Codification are nonauthoritative.

3 FASB.org (ASC 323-20)

4 IRS publication 550 (2024), pp. 27-30, and IRS.gov tax topic no. 404 (https://www.irs.gov/taxtopics/tc404)

5 FFIEC call report instructions (March 2025): Glossary [Dividends]

6 FASB.org (ASC 946-20)

7 An investment company for application of ASC 946 is defined as an entity regulated under the Investment Company Act of 1940 [ASC 946-10-15-4]. Banks are specifically excluded from Investment Company Act of 1940, and bank holding companies generally do not fall under it as they are engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting, or trading in securities (https://www.sec.gov/investment/im-guidance-2017-03.pdf).

8 IRS.gov tax topic no 404 (https://www.irs.gov/taxtopics/tc404)

9 FFIEC call report instructions (March 2025): RIA-11 [item 3] (https://www.ffiec.gov/resources/reporting-forms)

Carlton Fields is a statistics expert in the Statistics Department of the Atlanta Fed