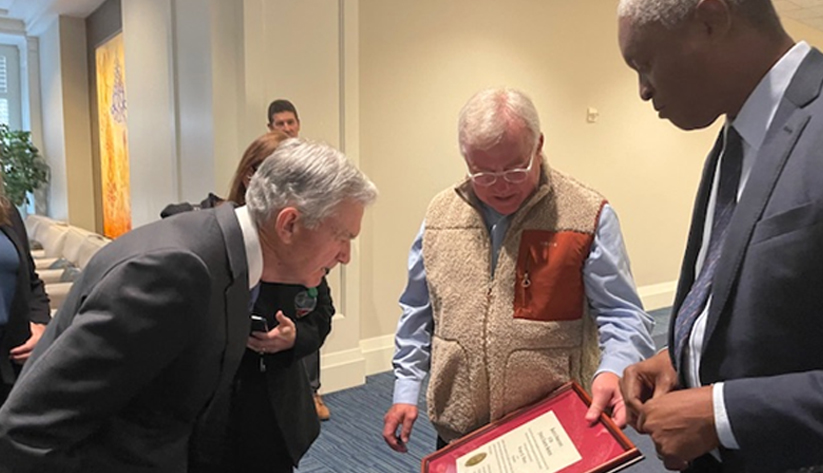

Fed chair Jerome Powell and Atlanta Fed president Raphael Bostic look at Greg Waters's bank examiner commission certificate.

By Joe Davidson, Senior Vice President

Supervision and Regulation

Federal Reserve Bank of Atlanta

Greetings,

I hope this letter finds you well during this time of change and evolution in the banking and regulatory environment. There have likely been many things put on your radar recently, but one particular update I would like to draw attention to is the confirmation of Michelle Bowman as the new vice chair for supervision for the Board of Governors. She has served as a governor since 2018 and is the first appointed governor with a background in community banking. She has previously worked with many state member banks, state commissioners, and trade associations, so she possesses a unique level of connection to the stakeholders she is serving, experience that will serve her well in her new role.

Vice Chair Bowman stated in a speech on June 6 that her plan of action as vice chair for supervision involves:

- enhancing supervision to more effectively and efficiently meet the Fed's safety and soundness goals;

- reviewing and reforming the capital framework to ensure that it is appropriately designed and calibrated;

- reviewing regulations and information collections to ensure that this framework remains viable; and

- considering approaches to ensure the applications process is transparent, predictable, and fair.

Due to her background in community banking, she has taken a keen interest in promoting the viability and importance of small banks, ensuring they have opportunities to grow and thrive. She recognizes that the risks of these banks differ greatly from those of larger ones, further noting that not all banks face the same issues; she emphasizes the importance of tailoring regulations to the specific needs of a financial institution. Vice Chair Bowman also takes time to discuss the rating system and the importance of it accurately communicating the financial condition of an institution. We appreciate the level of thought that she has put into her priorities.

Consistent with these priorities, we are executing in alignment throughout our district. We continue to focus our supervision on safety and soundness of our firms and core financial risk. We continue to commit to proactive, clear, and transparent communication with the banks we supervise, a thorough and up-to-date understanding of firm-specific risks, and prioritizing supervisory mandates. This commitment starts with making sure we continue to give all of our examiners, new and experienced, the support and resources they need to succeed. It's important that we all keep our supervisory and communication skills sharp and remain informed on emerging risks, technologies, and trends that affect our industry and district. This plan contains many elements that are also present in Vice Chair Bowman's new approach for supervision and regulation, as both the Atlanta Fed and she value the educational experiences and accomplishments of our examiners.

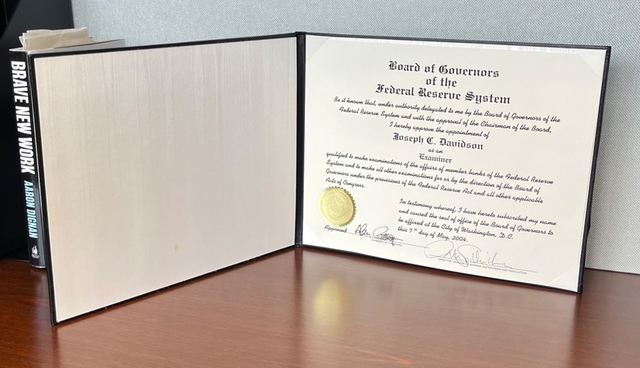

In her confirmation speech, Vice Chair Bowman highlighted the importance of the examiner commission. Newly hired examiners go through a rigorous curriculum of self-study modules, in-class instruction, knowledge tests, and on-the-job training. This process takes multiple years to complete and are central to examiners' primary responsibilities. I obtained my commission in 2004 and display it proudly in my office as do many of my colleagues who have achieved this important milestone.

We applaud Vice Chair Bowman's prioritization of this prestigious certification, and we will continue to commit to this foundational credential for our examiners. Our commitment gives bankers and the public confidence that your Federal Reserve Bank of Atlanta examiners are fully prepared and have the necessary experience, training, and sound judgment to understand the environment, assess risks, and communicate results effectively—thus fulfilling the expectations of what it means to examine banks.

In addition to our foundational examiners' commission, the Federal Reserve Bank of Atlanta maintains a strong commitment to continuing education to help all employees tap into their potential and ensure examiners possess the skills to navigate an ever-evolving financial services landscape. This includes extensive internal curriculums and programs, investment in people to maintain industry certifications, obtaining advanced degrees such graduate banking schools and attending conferences and training events that advance understanding of current banking trends and emerging risks.

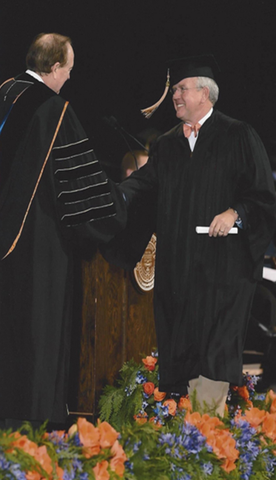

Someone I would like to highlight is Greg Waters, a senior examiner who joined us after spending a portion of his career in banking. A lifelong learner, Greg joined us in 2015, when he was obtaining his second degree, in accounting, from Auburn University. Here are photos from Greg's graduation events from Auburn University, taken nearly 40 years apart.

When we hired Greg, we were supportive of his ambitions to complete his second degree while on-boarding and learning a new role. But his ambitions didn't stop there. Since 2015, Greg obtained his bank examiner commission while studying for and passing all four CPA exams. And yes, Chair Powell and President Bostic took great interest in Greg's framed commission.

After his commissioning, Greg enrolled in internal capital markets and leadership development training programs at the Fed. He maintains his Continuing Professional Education requirements as a Certified Fraud Examiner and a Certified Treasury Professional and has participated in multiple FFIEC courses to advance his knowledge in risk areas of capital, liquidity, distressed commercial real estate, artificial intelligence, and fraud. Greg is now on his way to becoming an instructor for our examiner commissioning program to advance the development of others. I offer this as a shining example of the type of learning and training that we encourage, celebrate, and support throughout one's career.

Atlanta Fed Supervision and Regulation partners with the Graduate School of Banking at LSU for our annual Banking Outlook Conference and send faculty and students alike to share and learn at top-flight graduate banking programs like GSB at LSU along with other conferences and training events. These programs offer beneficial educational experiences and collaboration opportunities that give our seasoned examiners banking industry insights and knowledge to apply in our supervisory work. Through these educational and certification programs, we've been able to have some of our best people certified as anti–money laundering specialists, system security professionals, data privacy solution engineers, investment risk specialists, and more. We value the certifications and knowledge our examiners carry given the importance of these skills to carry out our core responsibilities, while aligning with the priorities of the vice chair for supervision.

Even as changes are occurring throughout the Federal Reserve System, our ongoing commitment to staff development will not change: we will ensure supervisory staff are equipped to deliver on core supervisory mission and exercise strong supervision focused on financial conditions and key risks. I wish everyone the best, encourage you to always invest in yourself as a life-long learner, and look forward to what the future has in store.

Sincerely,