By Doris Quiros, Senior Vice President

Supervision, Regulation, and Credit

Federal Reserve Bank of Atlanta

Dear colleagues,

As we enter the last quarter of 2022, I want to emphasize the role community banks play in the banking structure and the national economy. In the Small Business Administration’s Paycheck Protection Program (PPP), community banks accounted for almost 60 percent of total dollars loaned. The regulatory agencies are here to support your banks. The recent article in Economy Matters, coauthored by Atlanta Fed president Bostic and me, discusses this matter further. During the past several years, we have seen no more than five de novo banks per year. Although some of this decline in community banks reflects banks growing above the $500 million asset threshold, much of it is the result of consolidation. Projections for 2023 show a slowdown in mergers and acquisitions activity. To strengthen the relations with our stakeholders, on August 30, Atlanta Federal Reserve officers met with the Florida Bankers Association and had productive sessions about key issues facing the industry and opportunities for partnerships.

In my letter in the previous quarter’s “ViewPoint,” I touched upon the introduction of the FedNow service. The Federal Reserve Banks have now narrowed the timing of the FedNow Service launch to midyear 2023, specifically targeting a production rollout of the service in the May to July timeframe. This target further defines the previously communicated 2023 launch window for the anticipated instant payments service and comes as the FedNow Pilot Program entered technical testing in September.

Keeping up with innovation in our applications process, for easier onboarding and submission of a bank application, our district will soon introduce a new filing process. FedEZFile will replace E-Apps to facilitate the application filing process. It will improve access, transparency, and ease of use and will be accessible from multiple devices, providing real-time status tracking, personalized dashboards/home pages, digital signatures, messaging within the app, and other convenient features. Please note you will no longer have access to E-Apps after October 14, 2022. Any active applications will be transferred, and processing will continue in FedEZFile.

State of the District

Our quarterly State of the District section assesses Sixth District banks’ earnings and financial positions. After two years of double-digit growth, fueled by pandemic-related stimulus and savings, annualized asset growth is now on a downward trend. Deposit growth also remained elevated but continues to be moderate each quarter and will likely return to longer-term averages by year-end. Data from the beginning of the third quarter of 2022 indicates that banks may be starting to slowly increase deposit rates. Earnings at Sixth District community banks rebounded in the second quarter of 2022 after two quarters of median return on average assets reaching 1.06 percent, 10 basis points lower than the second quarter of 2021. The percentage of banks reporting a loss dropped to 4.35 percent. The second quarter was the first full quarter fully affected by the recent interest rate increases, pushing the median net interest margin at community banks in the district up by 20 basis points, though it still remains below the prepandemic level.

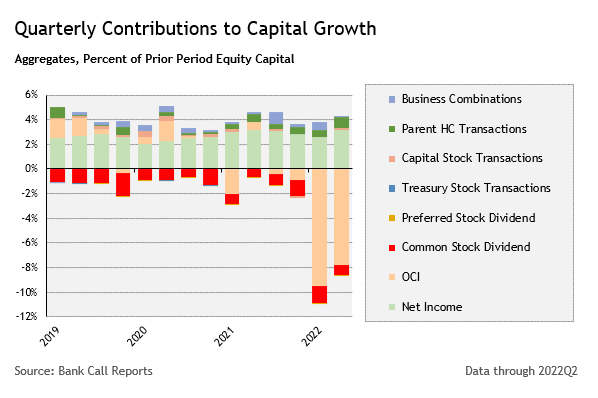

For the first time in five quarters, community banks reported new nonaccrual loan activity, on a median basis, though it was still not close to prepandemic levels. Some data from early in the third quarter of 2022 suggests that more loans are entering into an early delinquency stage, and more loans could be reported past due more than 90 days by the time banks file their third quarter call reports. On an aggregate basis, capital ratios declined in the second quarter of 2022 as changes in asset mix and higher interest rates affected capital calculations. To guard against recording higher unrealized losses, some banks are moving securities to a held-to-maturity portfolio, which places a greater restriction on selling securities from an accounting perspective before their maturity and could have an additional negative impact on earnings. Banks should closely monitor their tangible capital positions and monitor the impact on their regulatory ratios should there be a need to sell available-for-sale securities as a result of a liquidity crunch. The chart below reflects the negative equity trends through the end of the second quarter of 2022 due to large other comprehensive income (OCI).

Regulation of crypto assets

Let me say a bit about how innovation fits into our goal of making the financial system fairer. We should welcome financial innovation as a positive force that can increase access and lower costs for individuals and businesses. As innovative financial products develop and grow rapidly, however, excitement can outrun the proper assessment of risk. As we have seen with the growth of crypto assets in a rapidly rising and volatile market, participants may come to believe that they understand new products only to learn that they don’t, and then suffer significant losses. Crypto asset–related activity, both outside and inside supervised banks, requires oversight so that people are fully aware of the risks they face. You can read the new SR letter 22-6, Engagement in Crypto-Asset-Related Activities by Federal Reserve-Supervised Banking Organizations.

The supervisory letter outlines the steps Board-supervised banks should take prior to engaging in crypto asset–related activities, such as assessing whether such activities are legally permissible and determining whether any regulatory filings are required. Additionally, the supervisory letter states that Board-supervised banking organizations should notify the Board prior to engaging in crypto asset–related activities.

The supervisory letter also emphasizes that Board-supervised banking organizations should have adequate systems and controls in place to conduct crypto asset–related activities in a safe and sound manner prior to commencing such activities. We plan to work with other bank regulatory agencies to ensure that crypto activity inside banks is well regulated, based on the principle of same risk, same activity, same regulation, regardless of the technology used for the activity. Banks engaged in crypto-related activities need to have appropriate measures in place to manage novel risks associated with those activities and to ensure compliance with all relevant laws, including those related to money laundering.

Resources

Here, I want to share some regulatory guidance and webinars that provide relevant information on the banking sector this quarter.

- In SR 22-7, you can read the Fed’s policy statement on whistleblower claims.

- On October 3 and 4, the Technology-Enabled Disruption conference will take place, with the theme “Lessons from the Pandemic and the Path Ahead.” (Registration is required.)

- On October 4, join the webinar Sixth District Community BHC and Applications Supervisory Perspectives.

- On October 11, the Ask the Fed webinar series looks at residential real estate. You can register here.

- Finally, I want to note that the Atlanta Fed’s commercial and residential real estate experts regularly offer their perspectives through articles, webinars, and podcast episodes.

Sincerely,