By Doris Quiros, Senior Vice President

Supervision, Regulation, and Credit

Federal Reserve Bank of Atlanta

Dear colleagues,

The US banking system entered 2022 in sound condition, but market dynamics are changing, and it is imperative we, as supervisors, keep pace as we enter the new year. As described in the Fed's semiannual Supervision and Regulation Report, large banks maintain sufficient liquidity to meet modeled stressed outflows.

Current state of the banking system

Banks continue to provide their core financial services of lending, deposit taking, payments, and market intermediation. Financial performance has been stable. Year to date, total loans have grown at an annualized rate of more than 10 percent, with robust growth across household and corporate borrowers. Return on equity remains in line with historical levels. Loan delinquencies remain near historic lows, and liquidity levels are still generally elevated. Despite continued loan growth and higher liquidity levels, a vast majority of firms maintain capital above regulatory minimums.

Increasing uncertainty about the economic outlook, however, might create new risks for firms to manage. In response, firms increased credit loss provisions during the first half of 2022 and began taking other steps to prepare for the possibility of deteriorating economic conditions. Still, most firms maintain satisfactory supervisory ratings, and the number of unresolved supervisory findings has been declining.

State of the District

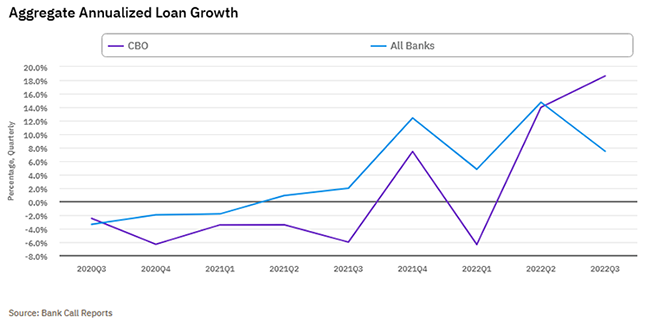

Our quarterly State of the District section assesses Sixth District banks' earnings and financial positions. Community banks continued to experience strong loan growth in the third quarter of 2022, fueled by the last wave of higher residential mortgage originations before higher mortgage rates began to cool housing demand. Yet, beyond the third quarter of 2022, there is evidence that loan growth is slowing rapidly, both due to lower demand and concerns over bank capital eroding, as this chart shows.

As 2022 comes to an end, the nation's community bankers have largely turned their focus to traditional concerns related to the economy, technology, and competition from nonbank providers as reflected in this year's Conference of State Bank Supervisors' National Survey of Community Banks. The survey of 500 bankers, conducted April through July 2022, addressed questions about the challenges and opportunities they face in the industry. The bankers surveyed cited net interest margins and economic conditions as the top external risks they face, which is not terribly surprising given that the survey was conducted during a period of the highest inflation in 40 years.

Although rising interest rates do provide an opportunity to increase margins, there are substantial risks, too. Loan demand remains a concern, but less so than last year, and it is virtually tied with regulation and the cost of technology as a major risk. Overall perception of operational risks declined from last year, however, cybersecurity, staff retention and technology implementation are risks that still concern surveyed bankers.

Technology, competition and regulation

According to the survey results, the share of bankers who say the adoption of new technology is extremely important continues to grow. Mobile banking services—which received a significant boost during the height of the pandemic—are now offered by 97 percent of responding banks, and remote deposit capture is available at 85 percent of these institutions. Advancements such as electronic signature verification, online loan closings, and online loan applications are other innovations more community bankers are seriously considering adopting over the next year.

Survey results also reflect that though community bankers still consider other community banks their biggest competitors, they now view credit unions as serious competitors for deposits. Additionally, although many bankers see fintech firms as competitors in the provision of several financial services, an increasing number of community banks are entering partnerships with fintech firms to offer these products and services.

Prior to 2017, regulatory burden was a dominant issue in survey responses, likely due in part to changes brought about by the Dodd-Frank Act. But a combination of regulatory burden reduction legislation, passed in 2018, and the advent of regulation technology (often called regtech) appears to have eased the burden. Regtech consists of several applications such as automation, advanced analytics, and cognitive computing, which assist banks in meeting their compliance responsibilities. The cost of compliance appears to be stabilizing in light of these developments, and median personnel costs related to regulatory compliance as a percentage of total personnel expenses dropped to 7.1 percent in 2017 and has remained below that level since.

Resources

Here, I want to share some regulatory guidance and webinars that provide relevant information on the banking sector this quarter:

- SR 13-21, which concerns inspection frequency and scope expectations for bank holding companies and savings and loan holding companies that are community banking organizations

- An Economy Matters podcast episode from September 29, 2022, "We Have Formed Really Good Relationships with Our Member Banks": A Conversation about Banking.

- A December 16 "Ask the Fed" discussion titled "Unrealized Losses at Community Banks in a Rising Interest Rate Environment"

- An Economy Matters podcast episode from December 19, 2022, "All These Factors Are Compounding": A Discussion of the Housing Market

The Atlanta Fed’s commercial and residential real estate experts offer their commentaries using these tools in articles, webinars, and podcast episodes.

This is the final edition of "ViewPoint" for this year as well as from me, as I am retiring from the Atlanta Fed in February 2023. I wish you and your families a happy and healthy new year.

Sincerely,