By Joe Davidson, Senior Vice President

Supervision and Regulation

Federal Reserve Bank of Atlanta

Dear colleagues,

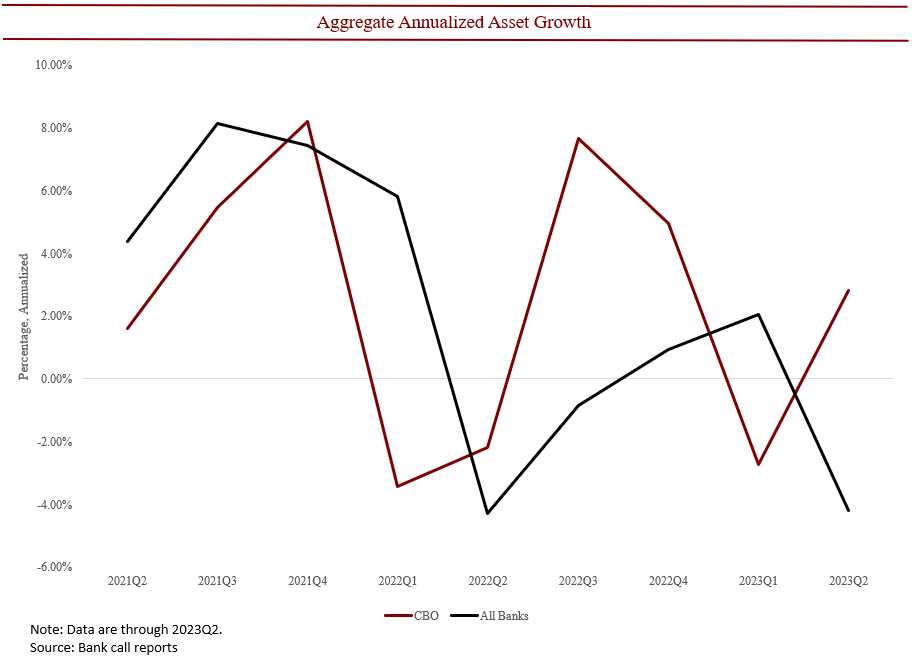

I am happy to share that a majority of our Sixth District banks remained well capitalized in the second quarter. With understandably modest asset growth, the level of noncurrent loans remained stable, with low current levels of delinquencies. Slowdowns in commercial real estate sales as well as deposit declines remain a concern for banks in our district, although they are consistent with national trends. Housing prices and demand throughout the Sixth District remained resilient through August despite headwinds created by mortgage rates being at a 20-year high. Additionally, securities portfolios demonstrate stability, although efficiency ratios generally continue to climb as noninterest expenses rise.

Following the failures of Silicon Valley Bank, Signature Bank, and First Republic Bank, the Federal Reserve’s vice chair for supervision Michael Barr vowed to "improve the speed, force, and agility" of bank oversight. Regulatory scrutiny is particularly focused at category IV banks (those with assets of more than $100 billion).

Since March of this year, banking regulatory agencies have requested comments on proposed rules to require large banks to maintain long-term debt to improve financial stability and resolution planning. In August, the agencies also invited public comment on proposed guidance to help certain large bank holding companies further develop their Dodd-Frank Act Title I resolution plans. We encourage banks to provide their comments during this rule-making process.

In August, Hurricane Idalia made landfall in Florida, battering a housing market already beset by significant woes around homeowners insurance. Leading up the storm, Corelogic estimated that more than 800,000 dwellings along Florida’s Gulf Coast were at risk for damages whose reconstruction costs could total $238.4 billion. Hurricane Idalia is also expected to spur more delinquencies and new forbearances similar to Hurricane Ian in 2022 and Hurricane Ida in 2021. Florida has one of the nation’s hottest housing markets, despite homeowners paying the highest average property insurance premiums in the country. According to a recent article in the Wall Street Journal, homeowners across the country are increasingly forgoing home insurance as some can no longer afford the rising premiums. Bankers at the Florida Director’s Forum held in September expressed concerns about the rising cost of windstorm insurance in Florida and the refinance risk with commercial real estate.

Regulatory agencies recognize the serious impact of Hurricane Idalia on the customers and operations of many financial institutions, and they will provide appropriate regulatory assistance to affected institutions subject to their supervision. The agencies encourage institutions operating in the affected areas to meet the financial services needs of their communities. To this effect, regulators issued a joint release on September 1. A complete list of the affected disaster areas can be found at fema.gov/disasters.

The agencies encourage financial institutions to work constructively with borrowers in communities affected by Hurricane Idalia. The agencies also support prudent efforts to adjust or alter terms on existing loans in affected areas, and such efforts will not be subject to examiner criticism. In accordance with generally accepted national accounting principles, institutions should individually evaluate modifications of existing loans to determine whether they represent troubled debt restructurings or modifications to borrowers experiencing financial difficulty, as applicable. In making this evaluation, institutions should consider the facts and circumstances of each borrower and modification. In supervising institutions affected by Hurricane Idalia, the agencies will consider the unusual circumstances these institutions face. The agencies recognize that efforts to work with borrowers in communities under stress can be consistent with safe-and-sound practices as well as in the public interest.

The agencies' staffs stand ready to work with affected institutions that may be experiencing problems fulfilling their reporting responsibilities, considering each institution's particular circumstances, including the status of its reporting and recordkeeping systems and the condition of its underlying financial records. Institutions affected by Hurricane Idalia that expect to encounter difficulty meeting the agencies' reporting requirements should contact their primary federal and/or state regulator to discuss their situation. The agencies do not expect to assess penalties or take other supervisory action against institutions that take reasonable and prudent steps to comply with the agencies' regulatory reporting requirements if those institutions are unable to fully satisfy those requirements because of Hurricane Idalia.

Community Reinvestment Act (CRA)

Financial institutions may receive CRA consideration for community development loans, investments, or services that revitalize or stabilize federally designated disaster areas in their assessment areas or in the states or regions that include their assessment areas. For additional information, refer to the Interagency Questions and Answers Regarding Community Reinvestment at ffiec.gov/cra/qnadoc.htm.

State of the District

Our quarterly State of the District section assesses Sixth District banks’ earnings and financial positions, among other snapshots of their condition, as of June 30, 2023.

Resources and events

- On August 7, the Fed Listens event, a listening session hosted by the Atlanta Fed, explored how workers, businesses, and communities in the Southeast are navigating the economy. Federal Reserve governor Michelle Bowman and Atlanta Fed president Raphael Bostic moderated a conversation with two panels of leaders from the public as well as from the private and nonprofit sectors. The conversation focused on two important groups in the economy: workers in lower-wage jobs and small businesses. See parts of the event at Fed Listens: Community Listening Session - YouTube.

- As financial institutions prepare for instant, real-time payment offerings, the key risk-management components they should consider are liquidity risk management, third-party risk management, and fraud and compliance risk management. Read more about how to prepare for these risks here.

- On September 14, staff from the regulatory authorities released guidance to explain the revisions and additions to the policy statement Policy Statement on Prudent Commercial Real Estate Loan Accommodations and Workouts, which was issued June 29, 2023. The guidance includes best practices for managing deteriorating and problem commercial real estate loans and workout arrangements, how supervisors assess the management of commercial real estate loan accommodations and workouts, and reviews of supervisory expectations for valuations.

- How can the Discount Window work for you? Learn about its benefits and eligibility at frbdiscountwindow.org as liquidity becomes a concern for financial institutions.

- Log into Ask the Fed sessions to get the most current data from our real estate experts. (In addition, the Atlanta Fed’s commercial and residential real estate experts offer their commentaries via articles, webinars, and podcast episodes.) Our Residential Real Estate Expert series for the Midwest sector aired on June 20, 2023, with additional webinars for the Mountain and Southeast regions airing in September and November this year.

Supervisory and regulatory updates

Here, I want to share some regulatory guidance and webinars that provide relevant information on the banking sector this quarter.

- The Federal Reserve released results of a survey of senior financial officers at banks about their strategies and practices for managing reserve balances. The Board uses the Senior Financial Officer Survey to obtain information about banks' reserve balance management strategies and practices, deposit pricing strategies, expectations for potential changes in both the size and composition of their balance sheets, and views regarding Federal Reserve facilities.

- SR 23-5: Prudent Commercial Real Estate Loan Accommodations and Workouts

- SR 23-7: Creation of Novel Activities Supervision Program. Novel activities include complex, technology-driven partnerships with nonbanks to provide banking services to customers, as well as activities that involve crypto assets and distributed ledger or blockchain technology.

- SR 23-8: Supervisory Nonobjection Process for State Member Banks Seeking to Engage in Certain Activities Involving Dollar Tokens

- Take advantage of our Home Ownership Affordability Monitor (HOAM) to track the relative changes in home ownership affordability in your geographic region or target market.

We hope you will visit our website at atlantafed.org and explore the many ways we operate in the Sixth District to ensure banking stability and support our communities.

Yours sincerely,