The Federal Reserve Bank of Atlanta's Community and Economic Development (CED) Department recently released a refined version of its Small City Economic Dynamism Index that includes more than 400 new U.S. cities and a richer trove of data.

Users can browse the index to find economic and demographic information on 816 places that the U.S. Census Bureau defines as metropolitan areas with a population of 50,000 to 500,000 and micropolitan areas, which encompass a core city of 10,000 to 50,000 residents.

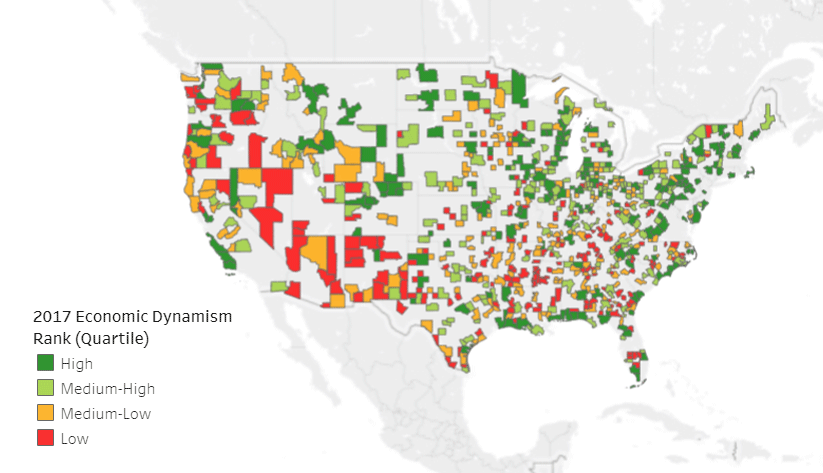

Every place's rank is based on its economic trends, or dynamism. The Atlanta Fed's CED introduced the index in 2016 as a way for policymakers and investors to gauge the trajectory of small cities. Officials in small cities, who often lack the resources to conduct their own research, can use the index to compare their towns to peers.

"A lot of rural areas, especially, are struggling," said Mels de Zeeuw, the Atlanta Fed senior CED analyst who compiled the data for the index's revision. "But some other small- or mid-sized cities, like Asheville, North Carolina, or Burlington, Vermont, are doing really well for a variety of reasons." So now, with a convenient way to spot them, policymakers can better learn from places with economic promise.

Among the beacons of promise, the five most economically dynamic small- and mid-sized locales, according to the index, are Trenton-Princeton, New Jersey; Asheville, North Carolina; York-Hanover, Pennsylvania; Reading, Pennsylvania; and Boulder, Colorado.

Southeast small cities a mixed bag

Small cities in the Southeast do not rank especially high on the list. Seventy percent of the 133 cities in the six states of the Atlanta Fed's district—Alabama, Florida, Georgia, Louisiana, Mississippi, and Tennessee—fall in the bottom half of the new index. The highest ranked southeastern cities are Lafayette, Louisiana; Pensacola, Florida; Savannah, Georgia; Naples, Florida; and Huntsville, Alabama.

The index reflects wide economic disparities among small towns and cities across the region, de Zeeuw said. For instance, in Summerville, Georgia, population (24,770 for its county), employment, and median household income were all lower in 2017 than in 2000. Larger cities in the index tend to show more promise than their smaller counterparts. For example, Pensacola, on Florida's Panhandle, saw its population climb nearly 20 percent since 2000, alongside steady employment and income growth.

Each city's dynamism score is based on 13 indicators drawn from four categories: demographics, economics, human and social capital, and infrastructure. Demographics include net migration and population change since 2000, among other statistics. The economic data include employment growth, median household income, the GINI coefficient (a gauge of income inequality), and the poverty rate.

Human and social capital measures include the share of the population with a college degree, the portion of businesses that are startups, and the revenue of nonprofit organizations. Finally, the infrastructure statistics cover the quantity of building permits issued, number of commuters, population density in the core city, and the percentage of commercial properties that are vacant.