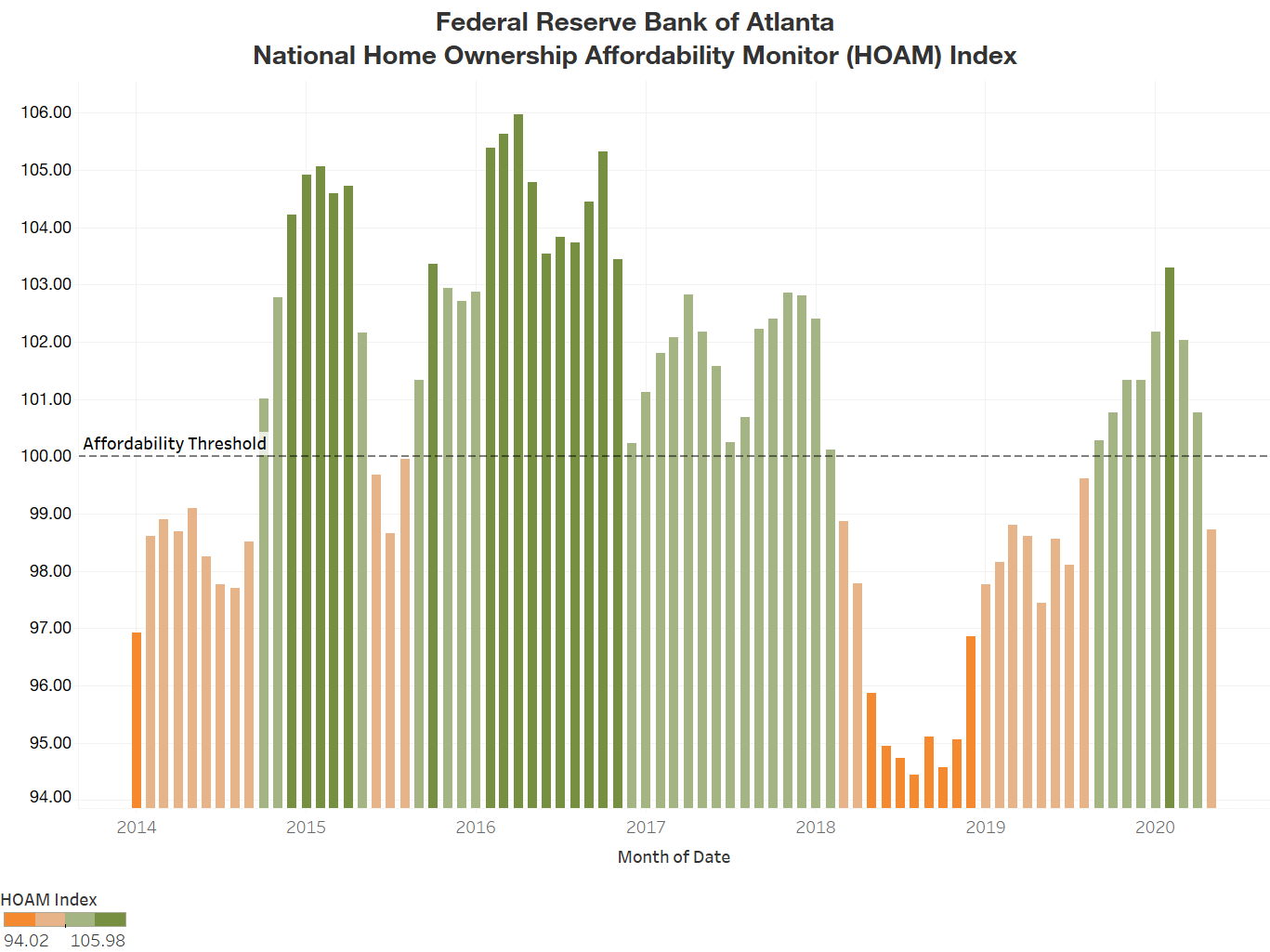

National affordability

Home ownership affordability declined in May from April as the median existing home sales price in the United States continued to rise, according to the Federal Reserve Bank of Atlanta’s Home Ownership Affordability Monitor (HOAM) index. In May, the HOAM index fell to 98.72 from a revised 100.76 for April, but it was up from 95.87 a year earlier. (Note: A HOAM index below 100 indicates that the median-priced home is unaffordable to the median-income household given the current interest rate.) Home ownership costs (as measured by principal and interest, taxes, and insurance) accounted for 30.4 percent of the annual median income of U.S. households, slightly above the 30 percent affordability threshold set by HUD. May was the first time since August of last year that the national HOAM index dropped below the affordability threshold.

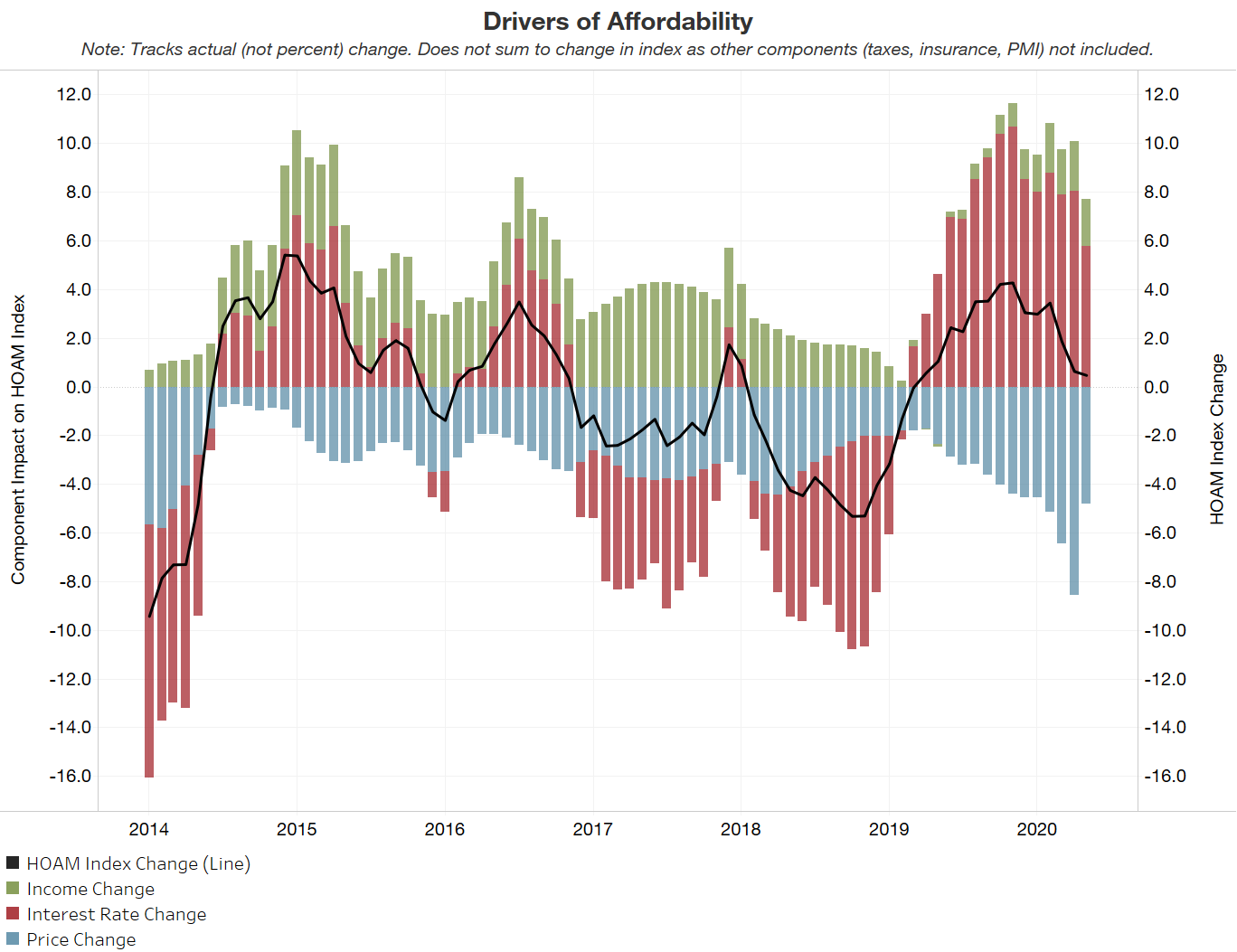

The 30-year fixed mortgage interest rate ended the month at 3.2 percent, a drop of seven basis points (bp) from April and a 57 bp decline from May 2019. The estimated national median household income in May was $63,473, up 2.7 percent from a year earlier. At $290,308, the May national median existing home price (three-month moving average) rose by 3.6 percent from a revised $280,274 in April. May’s median home price was up a sharp 11.2 percent from a year ago and marked the highest national median existing home price on record. Unlike in May 2019, when rising interest rates were the biggest contributor to declines in affordability, higher home prices are now the major culprit. Since the beginning of the COVID-19 pandemic, U.S. housing inventory has contracted significantly, creating substantial upward pressure on home prices. Historically low and declining interest rates have not been able to offset the strain on affordability from increasing home prices.

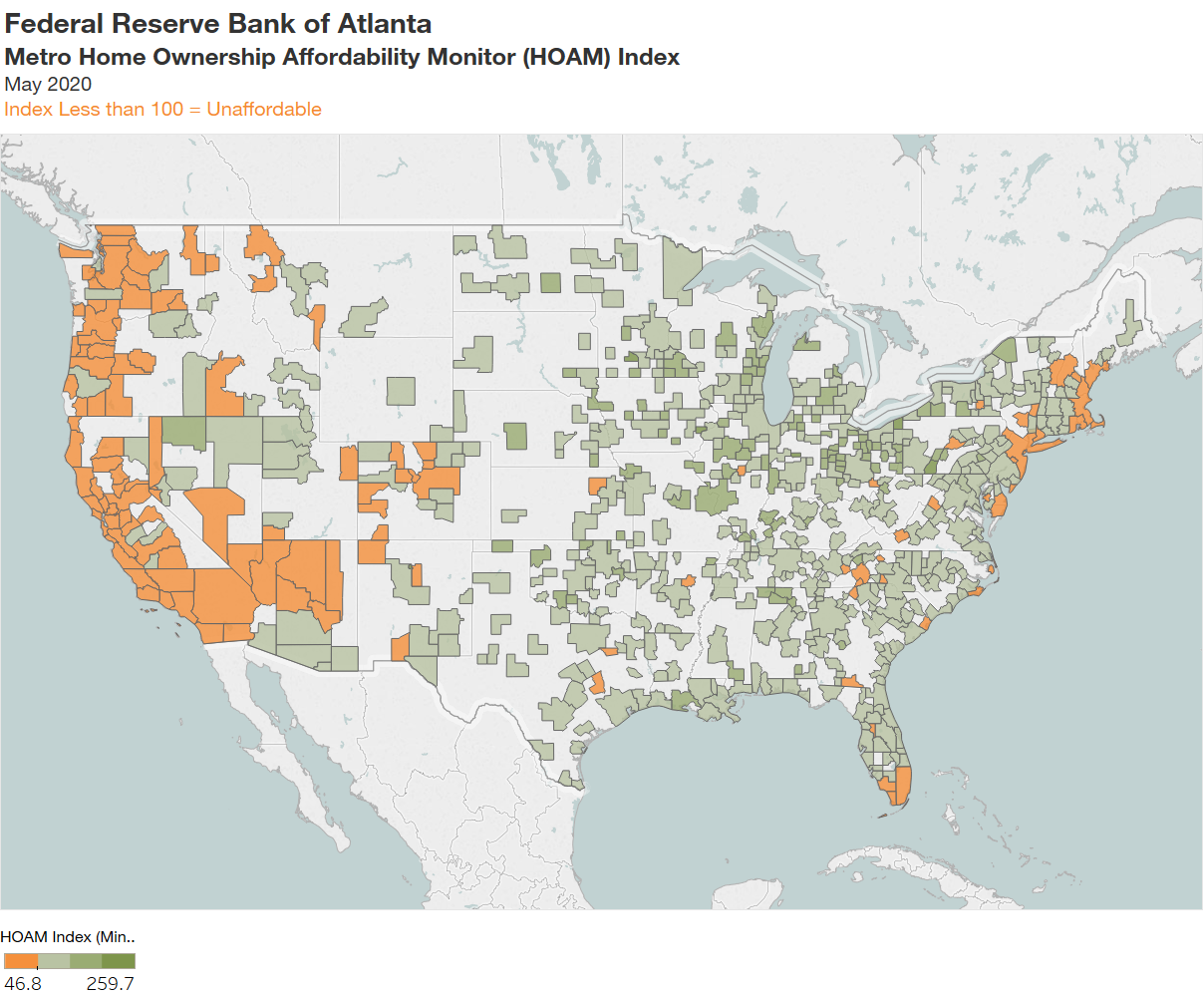

Regional affordability

Although homes became less affordable in the nation as a whole in May, lower interest rates helped improve affordability in many metro areas. Nearly 19 percent of metro areas included in the HOAM had an index below 100 in May, indicating that they were unaffordable to median-income households. A clear majority of metro areas—81.2 percent—had an index above 100 and were considered affordable. In general, high-cost metro areas on the West Coast as well as in the Northeast and South Florida were among the least affordable, while metros in the middle of the country, particularly in the Midwest, tended to be the most affordable.

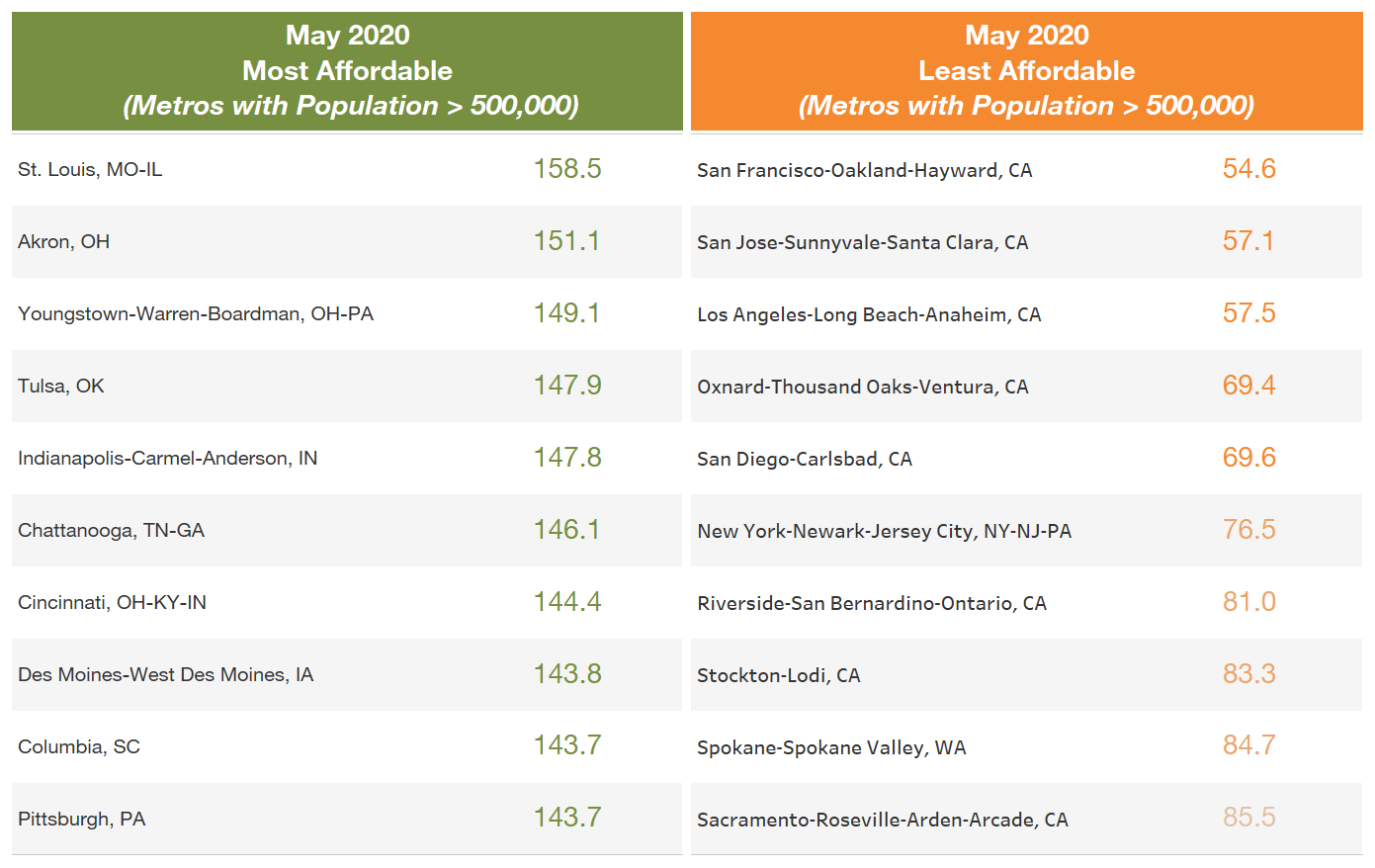

Among the nation’s largest metro areas (those with populations greater than 500,000), San Jose-Sunnyvale-Santa Clara, California, was the most expensive in May with a median existing home price of $1.14 million. Median prices rose by 10 percent over the past year in the region. Meanwhile, San Francisco-Oakland-Hayward, California, was the nation’s least affordable large metro in May with a HOAM index of 54.6. Even though homes in San Jose were more expensive, household incomes there were generally higher than in San Francisco ($130,955 for San Jose compared with $113,841 in San Francisco), making San Jose slightly more affordable.

With a median existing home price of $1.1 million, the annual share of income needed to own a home in San Francisco was 56.6 percent, the highest home ownership cost among large metros and well above the 30 percent that is considered affordable. Still, the increasing home prices continue to be somewhat offset by falling interest rates, which led to a modest improvement in overall home ownership affordability in San Francisco compared with the previous month.

The least expensive large metro area in May was Youngstown-Warren-Boardman, Ohio, where the median sales price was $137,567. Home prices in Youngstown rose 12.2 percent over the past year. St. Louis, Missouri, was the most affordable large metro in the nation with a HOAM index of 158.5. The area’s estimated median household income in May was $64,467, and the median existing home sales price was $177,883. The median income household in the area would spend 19.6 percent of its earnings for housing annually, the lowest home ownership cost among large metros and well below the 30 percent affordability threshold. Home prices in St. Louis fell 12.6 percent over the year that ended in May. The decline in home prices, coupled with lower interest rates, increased home ownership affordability in the area.

With a median existing home price of $790,000 and a HOAM index of 57.2, Santa Cruz-Watsonville, California, was both the most expensive and least affordable small metro area in the United States (metros with populations below 500,000) in May. The least expensive small metro during the month was Ottumwa, Iowa, where the median existing home price came to $69,000. Kokomo, Indiana, remained the most affordable small metro with a HOAM index of 229.4; it had a median home price of $115,158 and median household income of $57,637. The median existing home price in the region declined 14.8 percent year over year.

Metro areas that showed the greatest improvement in homeownership affordability over the past year tended to have flat or declining growth in home prices, stronger increases in incomes, or both. St. Louis, Missouri; Greenville-Anderson-Mauldin, South Carolina; and Chattanooga, Tennessee, experienced the greatest improvement in affordability among large metro areas. In St. Louis, affordability rose 20.1 percent over the past year, while Greenville and Chattanooga had increases of 15.7 percent and 15.4 percent, respectively. The improvement in affordability in those markets was primarily attributed to lower home prices. Meanwhile, Spokane-Spokane-Valley, Washington, had the sharpest falloff in home ownership affordability—down 18.3 percent—from May 2019 to May 2020. Home prices in Spokane increased 40.5 percent to $354,263 in May from $252,167 a year earlier.

COVID-19 impact

The housing market has remained resilient despite significant economic disruptions from the COVID-19 pandemic. As many states began to reopen in May after coronavirus lockdowns, demand recovered from severe contractions in March and April. However, supply remained constrained as the number of homes available for sale has been unable to keep pace with demand. As a result, home prices have remained stable in most markets and increased nationally. Home ownership affordability will stay restrained should this trend continue. In addition, with unemployment remaining high, consumer purchasing power could come under significant pressure, a factor that could further weigh on affordability. For now, although rising home prices suppress affordability nationally, historically low interest rates continue to boost demand and keep housing affordable in many regions. Meanwhile, the number of mortgage loans in forbearance has dropped from peak levels and now accounts for 7.8 percent of all mortgages, according to data provided by Black Knight. This decline reflects the expiration of short-term forbearance agreements in June. However, information from Black Knight indicates that a growing share of borrowers in forbearance had not made payments heading into June, a potentially disturbing sign. Should mortgage defaults and foreclosures rise as forbearance periods expire, there would be significant implications for home prices and affordability.

For more details, including metro level analysis, please visit the interactive Home Ownership Affordability Monitor tool.