Key points

- Price growth in January 2021 reached its highest level since 2005

- More than 60 percent of metros saw double-digit percentage price increases

- Mortgage rates edged up

- 40 percent of metros had year-over-year erosion in affordability in January

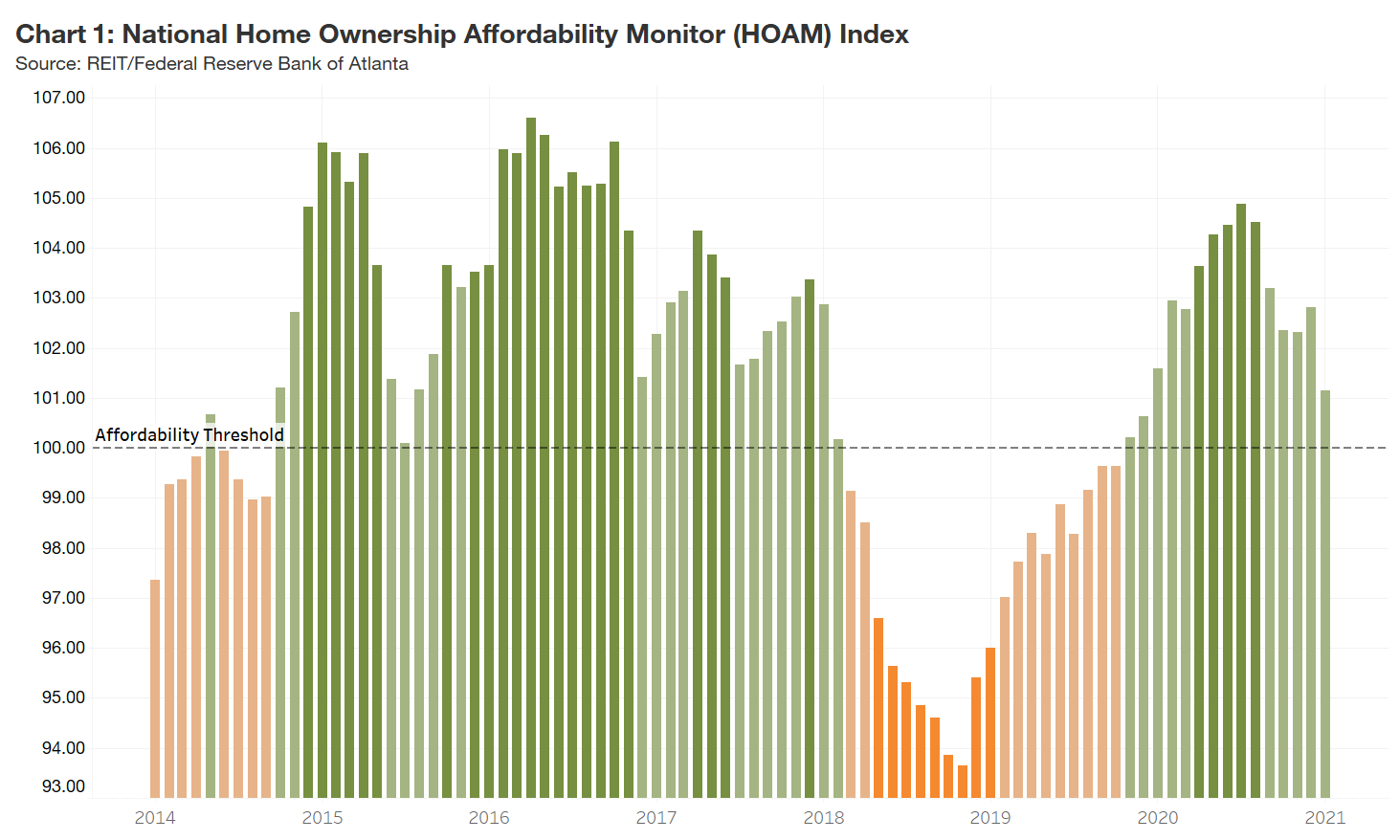

The Atlanta Fed’s Home Ownership Affordability Monitor (HOAM) index suggests the dream of home ownership is becoming less realistic for U.S. median-income households, as interest rates and both new and existing house prices have climbed. A HOAM index below 100 indicates that the median-priced home is unaffordable to the median-income household given the current interest rate.

Robust home price appreciation, the economic challenges of the lockdown, and recent increases in mortgage rates have eroded home affordability nationally. Heading into 2020, affordability was increasing even in the face of rising home prices as buyers benefited from historically low interest rates and steady income growth. Lockdowns stalled sales in April and May, but sales roared back as economies began to reopen. In August, the national HOAM index reached its highest point of 104.89. In September, however, affordability began to retreat as rising home prices overtook the positive effects of low rates and income growth. As of January 2021, housing remained affordable overall, with an index of 101.1 (see chart 1). However, it appears a turning point occurred when mortgage rates hit a historic low in early January before beginning to creep upward. With prices and interest rates continuing to rise into the second quarter of 2021, affordability is expected to keep declining, and median-income households will find it more and more difficult to purchase a home.

National Affordability

Regional Trends

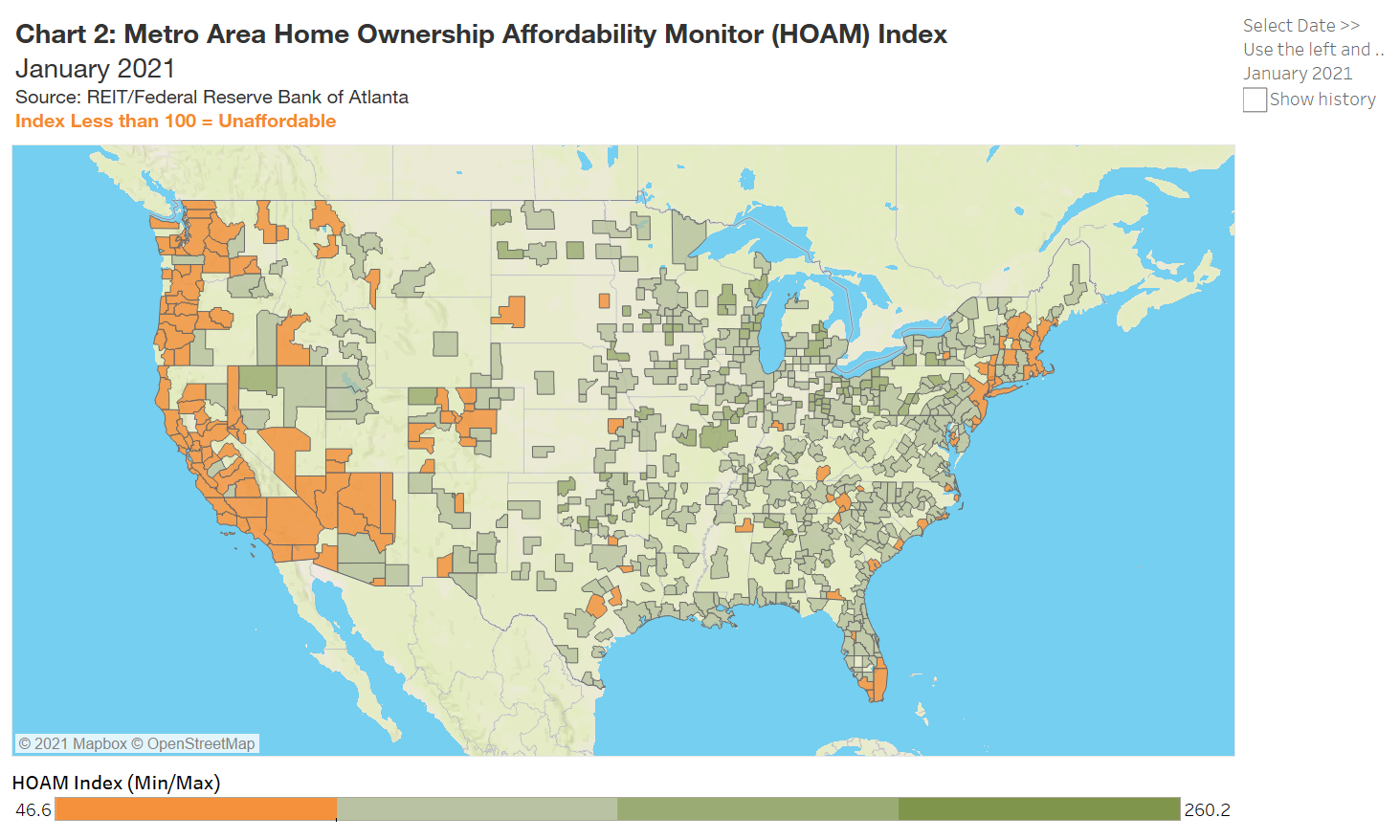

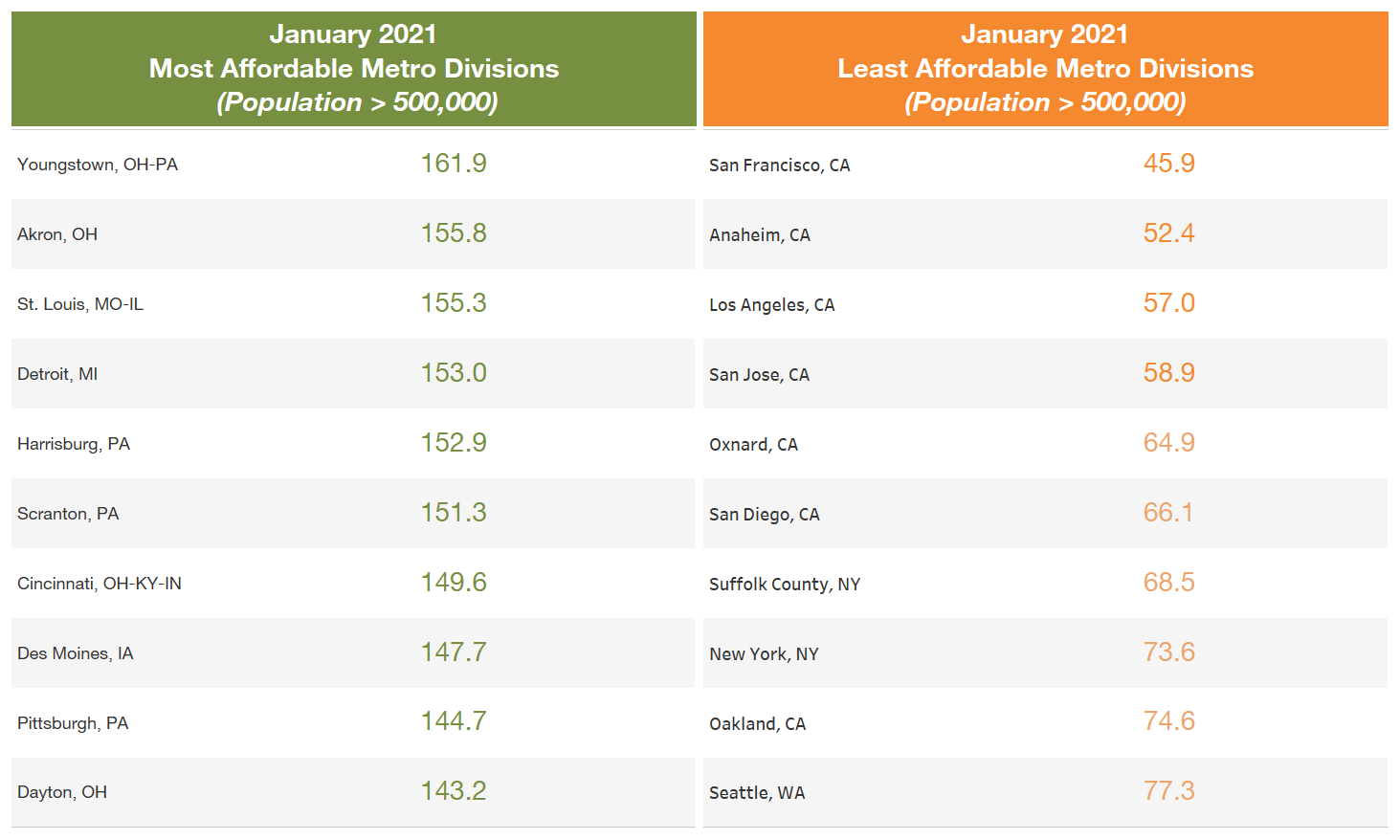

Midwestern U.S. markets tended to rank highest in affordability (see chart 2). Four of the 10 most affordable markets are in Ohio (Akron, Cincinnati, Dayton, and Youngstown). Three Pennsylvania metros also made the top 10 most affordable markets (Harrisburg, Pittsburgh, and Scranton). Meanwhile, coastal areas in the West, Northeast, and Southeast rank lowest in affordability. For the most part, the least affordable markets are dominated by California metros such as San Francisco, Anaheim, and Los Angeles. Outside of California, areas such as Suffolk County on New York’s Long Island, New York City, and Seattle, Washington, round out the 10 least affordable.

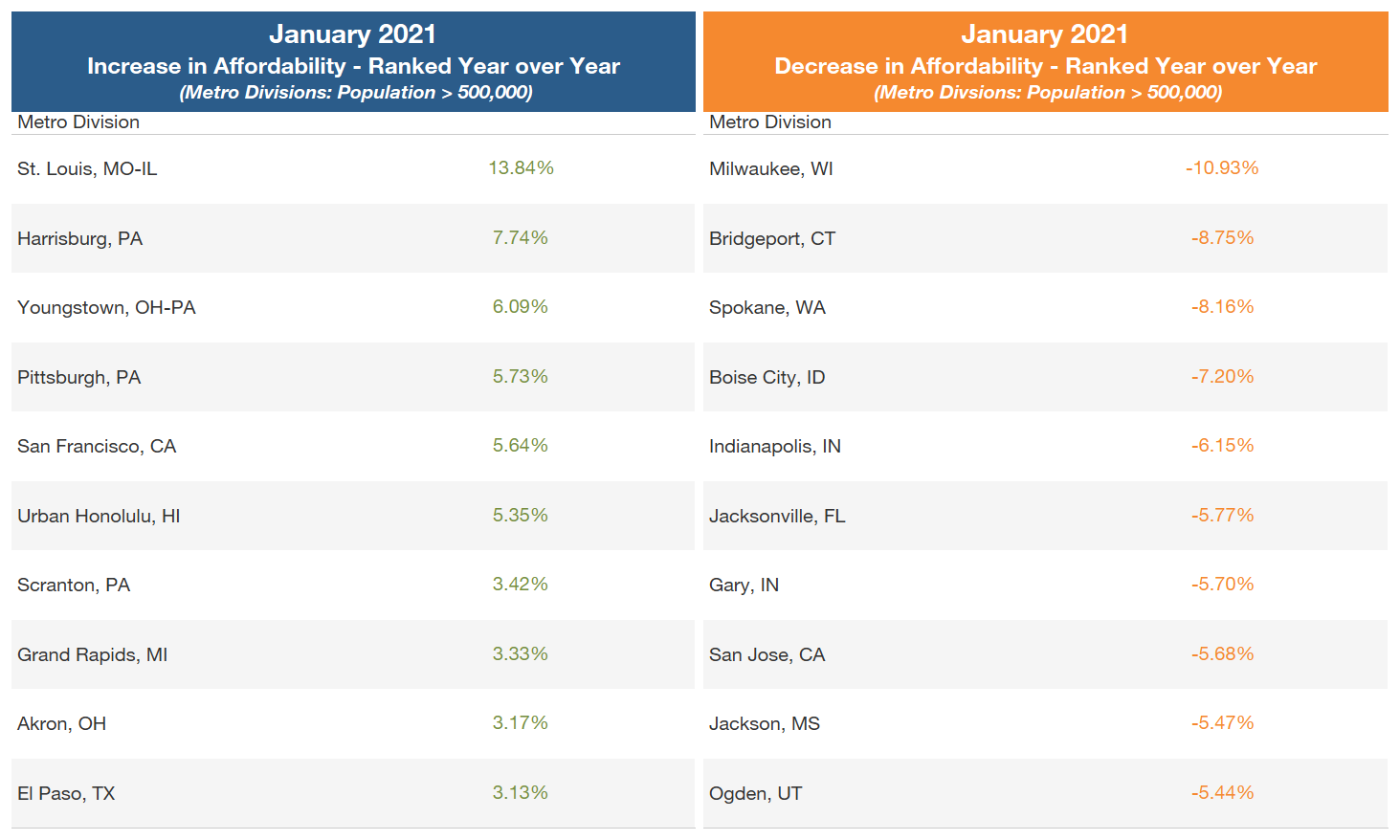

Overall, 22 percent of metro areas tracked by HOAM were unaffordable in January 2021. Even so, 40 percent of HOAM markets had a deterioration in affordability over the past year as home prices went up. Of these, Milwaukee, Wisconsin; Bridgeport, Connecticut; and Spokane, Washington, saw the sharpest declines in affordability as rising prices offset the benefit from low interest rates. Markets with more moderate home price growth such as St. Louis, Missouri; Harrisburg, Pennsylvania; and Youngstown, Ohio, had the strongest improvement in affordability.

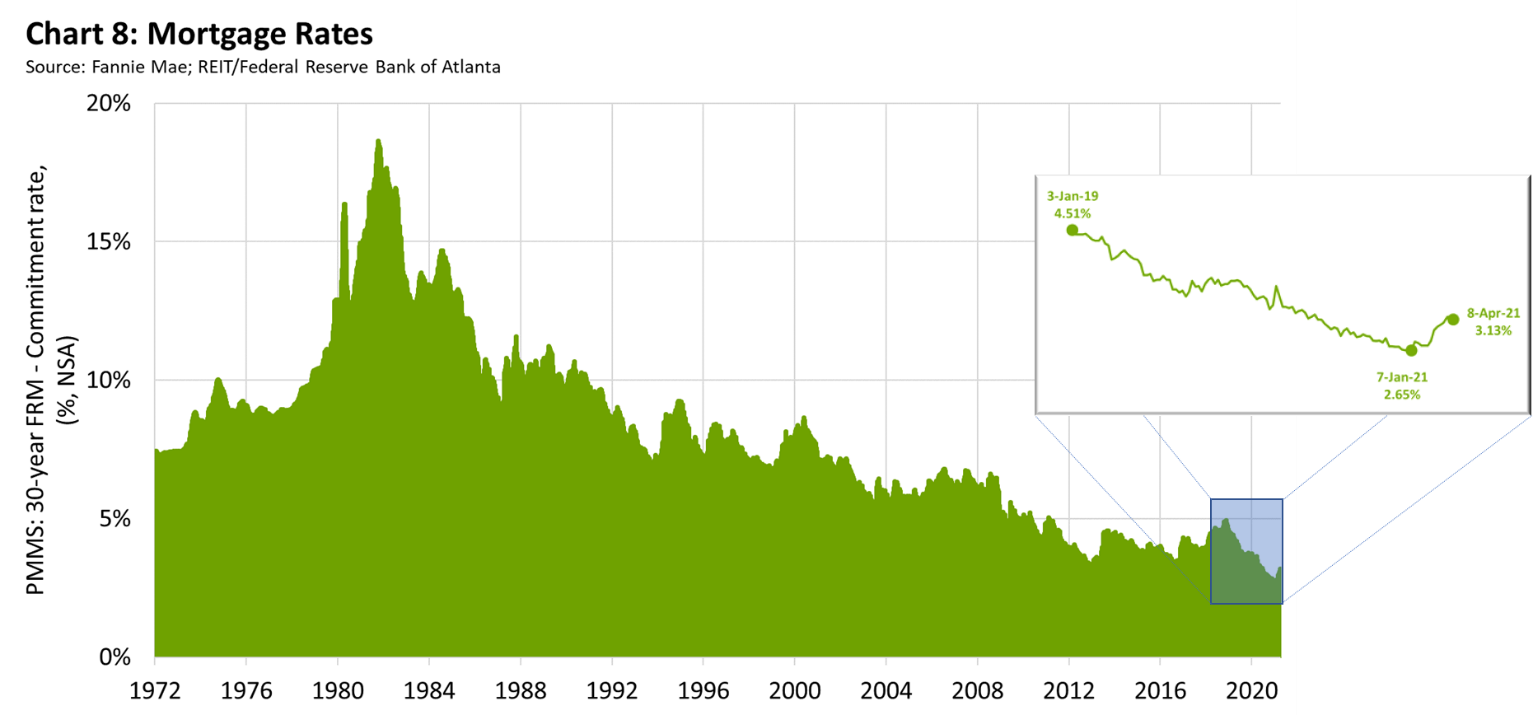

Additional increases in mortgage rates would further erode affordability, especially if prices keep rising. On April 9, the benchmark 30-year fixed mortgage rate was 3.18 percent, according to Bankrate.com. That rate would equate to a monthly payment of about $863 on a $200,000 mortgage. If mortgage rates were to rise to 4 percent with no other changes, for example, that monthly payment would climb to $955.

National Housing Market Roundup

Here’s a look at recent trends with important housing sector indicators.

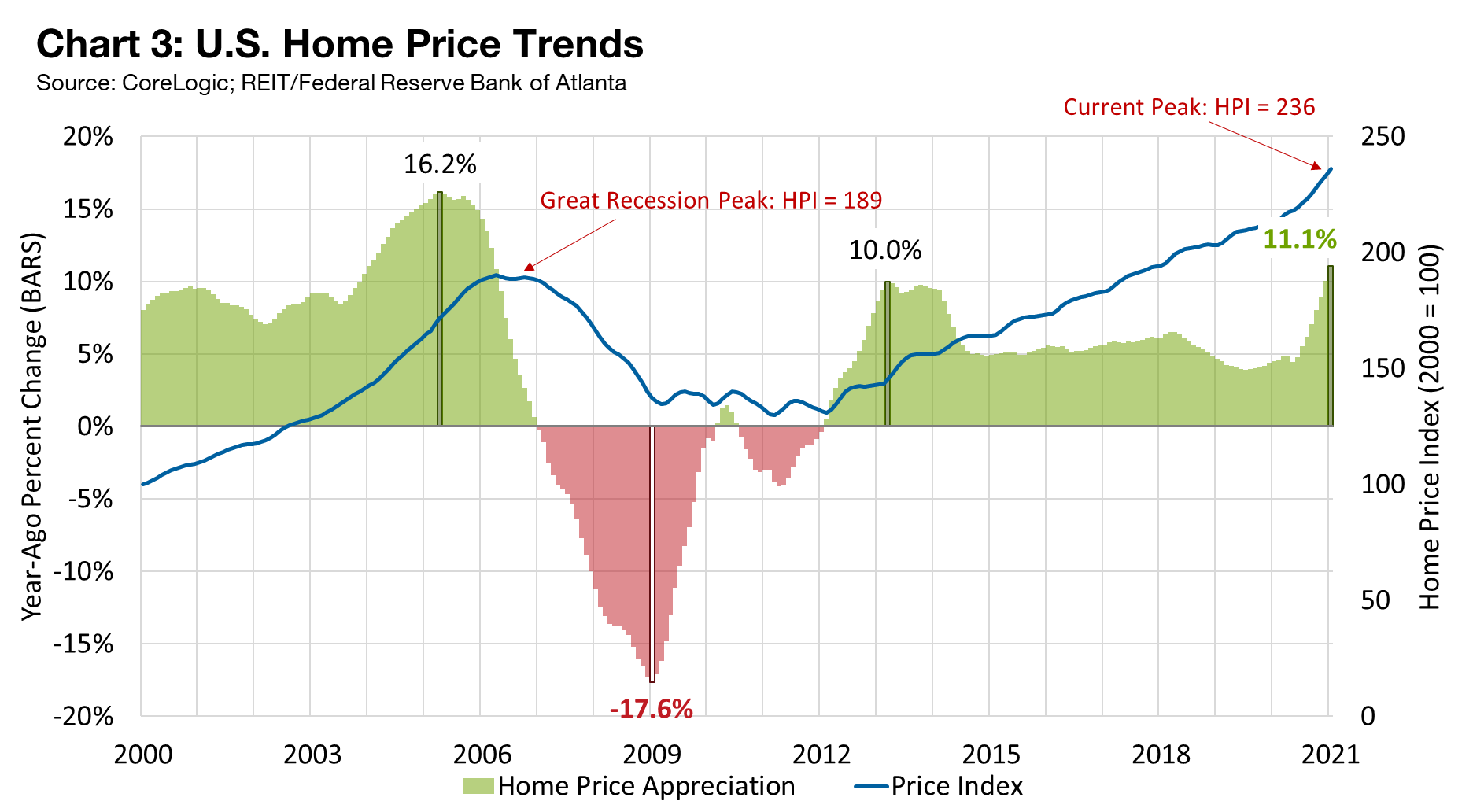

Home Price Appreciation: In January, home prices rose 11.1 percent year over year (see chart 3). This level marked the highest growth since 2005, when prices jumped 16.2 percent. Home values are now 24.7 percent higher than their peak before the Great Recession.

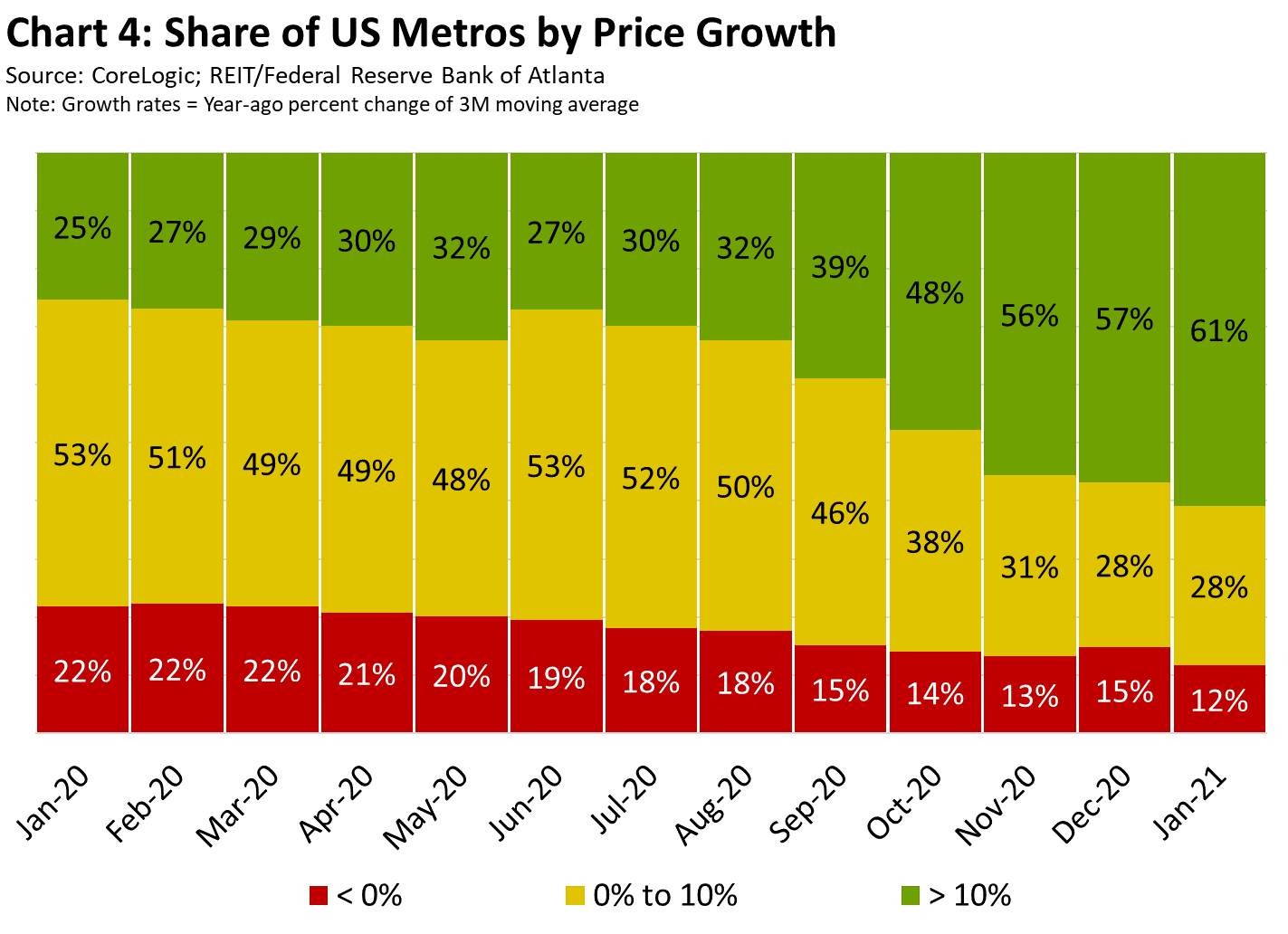

What's more, the share of U.S. metro areas with double-digit percentage gains in home prices surged from 25 percent in January 2020 to 61 percent in January of this year (see chart 4).

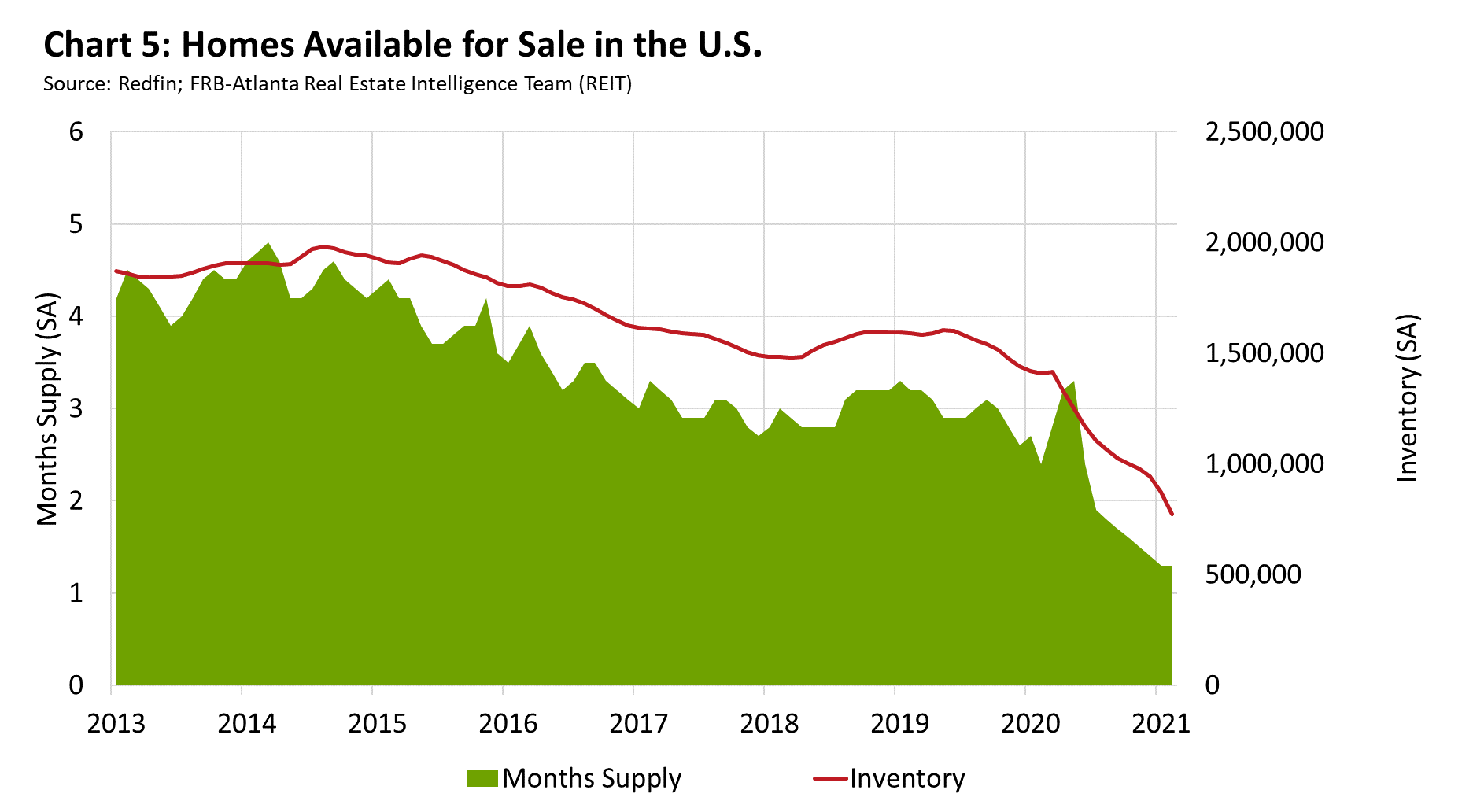

Inventories: The current housing cycle has been marked by a seemingly inexorable decline in inventory, and early 2021 data suggest this trend is continuing. In the year that ended in January 2021, the supply of homes for sale was cut nearly in half, according to Redfin, a national real estate brokerage. Subsequently, the supply of available homes plummeted to just 1.3 months, showing that demand greatly exceeds supply (see chart 5). Generally, a four- to six-month supply of inventory is considered balanced.

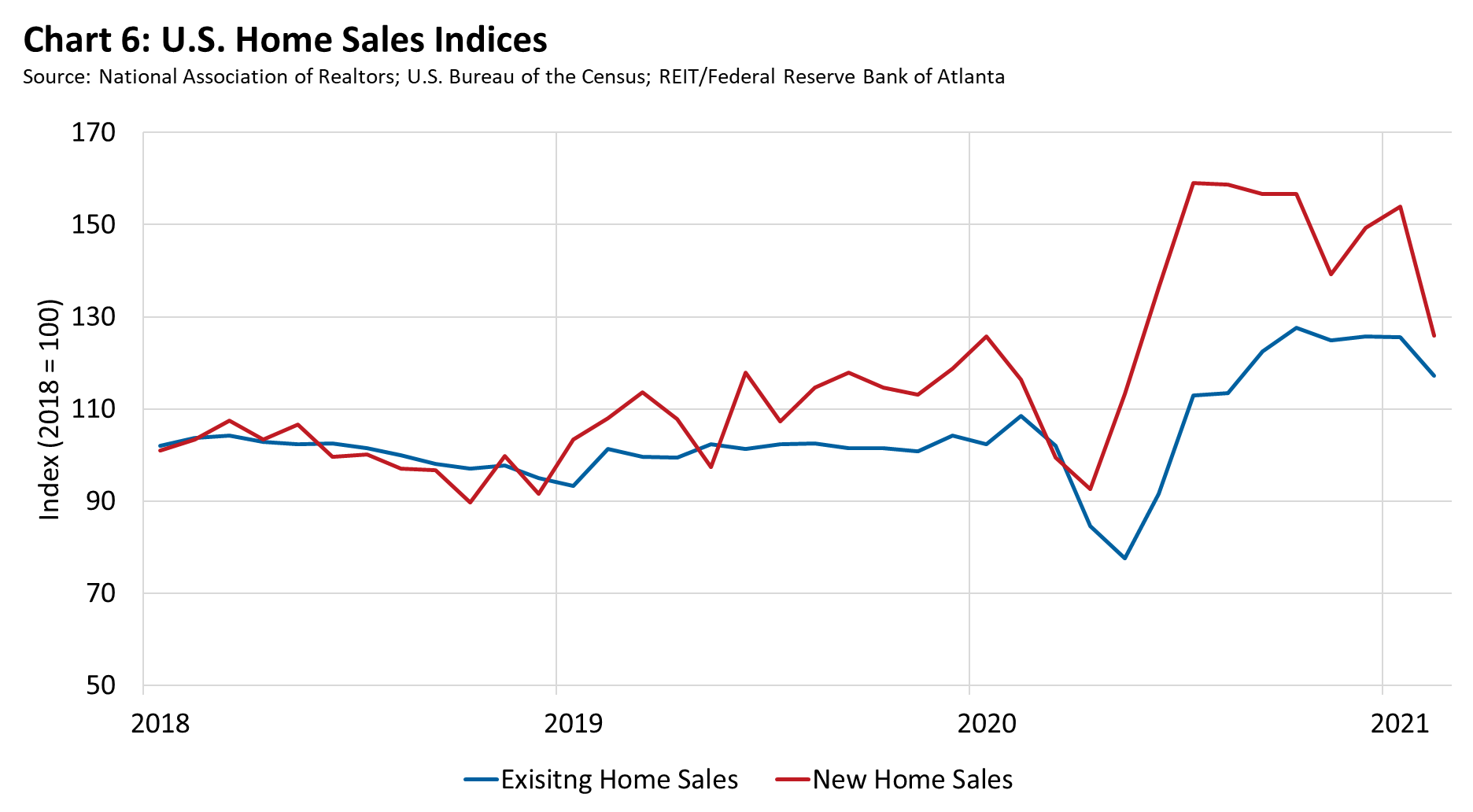

Home Sales: After falling early in the pandemic, home sales increased sharply starting midyear of 2020. By February 2021, however, both new and existing home sales fell from the prior month (see chart 6). Over the three months that ended in February 2021, home sales fell year over year in 47 percent of metro areas, while 35 percent of metros had double-digit percentage increases. The sales decrease mostly correlates with a rise in interest rates, limited supply, and the subsequent decline in affordability.

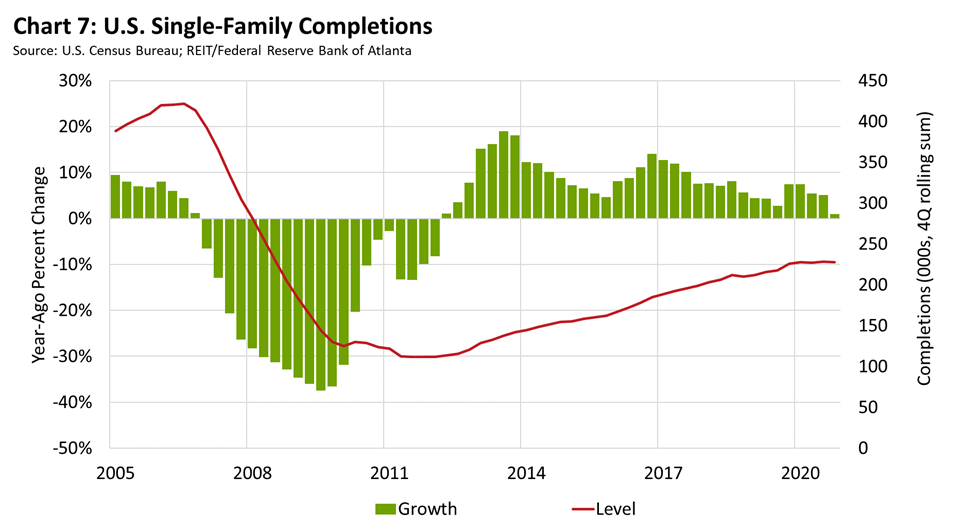

Construction Acivity: Construction activity leveled off last year, likely because of the material and labor constraints tied to homebuilding during the pandemic. By the fourth quarter of 2020, construction was nearly flat on a year-ago basis, despite rising demand for new housing (see chart 7). Data from real estate consultant Zonda Intelligence showed that Texas continued to dominate homebuilding nationally. It includes four of the top 10 markets (Dallas-Fort Worth, Houston, Austin, and San Antonio) for completions. Atlanta; Phoenix; Washington, DC; Charlotte, North Carolina; and the Florida cities of Orlando and Tampa rounded out the top 10 new construction markets.

Mortgage Rates and Underwriting: In early April, 30-year fixed-mortgage rates were up 48 basis points from a historic low in early January, according to data from Fannie Mae. Rates have been above 3 percent since early March (see chart 8). Though rates are still low by historical standards, the recent slight increase and sharply rising home prices are beginning to take a toll on housing activity. According to the Mortgage Bankers Association, the rise in rates has cooled mortgage applications for purchases and refinancing. Higher rates have also contributed to a modest net share of banks reporting that they expect weaker demand for government-sponsored enterprise–eligible residential mortgages, according to a Federal Reserve survey of senior loan officers from January 2021.

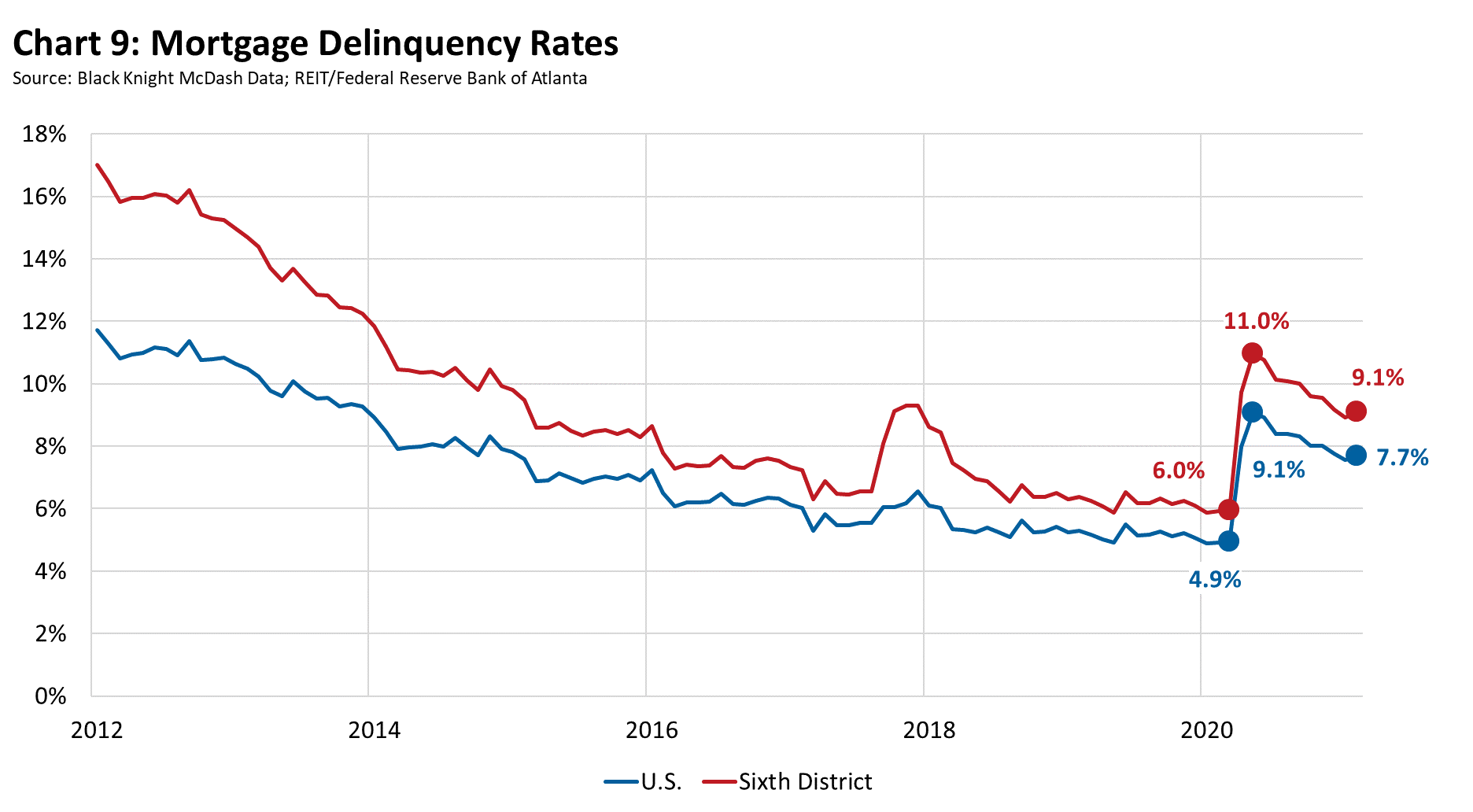

Mortgage Delinquencies: At the onset of the pandemic, national mortgage delinquencies jumped to 8 percent in April 2020 from 4.9 percent the previous month. Though the number of people behind in their payments drifted down for the remainder of 2020, delinquencies rose at the beginning of 2021 and remain well above pre-pandemic levels at 7.7 percent (see chart 9). For now, federal forbearance guidelines have helped stave off a rise in foreclosures. Still, the Consumer Financial Protection Bureau (CFPB) recently warned mortgage servicers to dedicate sufficient resources and staff to prepare for a surge in borrowers who will need help when federal emergency mortgage protections expire this summer and fall. The CFPB is seeking comment on a proposal that would generally prohibit servicers from starting foreclosure proceedings until after December 31, 2021.

A Note on Revised Income Projections

This month, the HOAM Index is using improved income data and projections from the Atlanta Fed’s Real Estate Intelligence Team (REIT) in the Supervision, Regulation and Credit Division. The additional data more accurately gauge median household income trends. Data revisions had a distinct effect on the national affordability index. In our last installment, affordability at the national level was reported as slightly less than the critical level of 100, compared with 101.1 in this latest report. New median household income estimates are revised upward, possibly influenced by aspects of the recovery in employment or fiscal stimulus programs. According to data from Opportunity Insights' Economic Tracker, employment among higher-income segments (greater than $60,000) has recovered to pre-pandemic levels, while employment among lower-income groups lags.

Let's Have a Conversation about Housing Affordability

We appreciate the feedback we have received about the HOAM index over the past year. We want to provide more opportunities to connect with readers and start a conversation to further develop our tools. To make it easier to reach us, we have a new email address: HOAM@atl.frb.org. We invite you to share comments and questions on the following: Please keep in touch so we can learn and build a better index.

Previously, the HOAM index relied on median household income projections based on the Census Bureau's American Community Survey (ACS) one-year estimates. For metropolitan areas and the nation, we used an analytical technique based upon employment levels, unemployment rate, and a time factor to predict income to the most recent employment and unemployment rate data (which lags about two to three months). For county projections, we analyzed actual (not projections) income data to determine the trend. Readers will likely see further revisions to income projections in 2021 as more Census data become available.

For more details, including metro level analysis, please visit the interactive Home Ownership Affordability Monitor.