An Atlanta Fed analysis of results from the Small Business Credit Survey show

a steady recovery in the Southeast from the COVID-19 pandemic-induced

recession.

An Atlanta Fed analysis of results from the Small Business Credit Survey show

a steady recovery in the Southeast from the COVID-19 pandemic-induced

recession.

Small businesses in the Southeast continue to post a steady recovery from the depth of the COVID-19 pandemic-induced recession, according to an Atlanta Fed analysis of a nationwide survey's results.

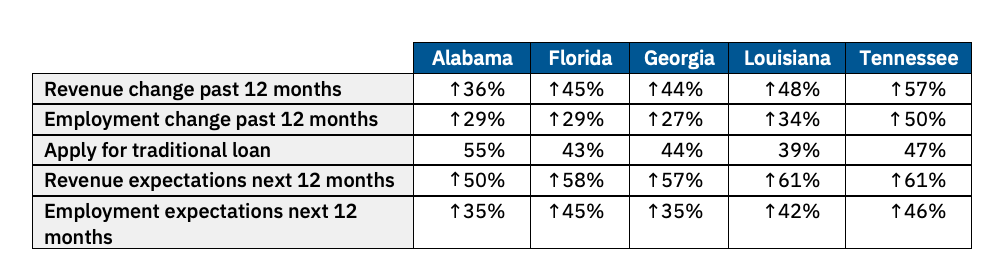

The Southeast outpaced the national outlook on indicators including future employment and revenue expectation for the 12-month period following the survey conducted in fall 2022. The Southeast was generally consistent with national averages on the proportion of firms that face financial challenges and the nature of those concerns, the analysis shows.

The report, "Small Business Credit Survey 2022: Key Insights from the Southeast," focuses on Alabama, Florida, Georgia, and parts of Louisiana and Tennessee. It omits the Sixth District's portion of Mississippi because of an insufficient number of survey responses.

The Southeast analysis gleans economic details from the national Small Business Credit Survey, a collaboration of the 12 Federal Reserve Banks and their partners. The national report received 7,864 respondents from businesses that employ fewer than 500 employees, excluding nonemployers.

The national results show small businesses citing postpandemic improvements even as they face challenges including higher inflation and interest rates. The report in the Atlanta Fed's Partners Update notes that "firms' self-reported financial condition remains little-changed from 2021" and 94 percent of firms reported operational and financial challenges. Firms cited their return to traditional financing as the government wound down pandemic loan programs.

Signs of apprehension about the future economy appear in the national report's category of access to capital. For example, the positive indicator of rising rates of fully approved applications for loans, lines of credit, and cash advances was tempered by an approval rate significantly below that of 2019. The rate of fully approved applications in 2019 was 62 percent, followed by 46 percent in 2021, and 53 percent in 2022.

Firms applied for traditional financing in 2022 at a higher rate than in 2019: 40 percent compared to 37 percent. The reasons for seeking loans grew by the greatest proportion in the category of expanding a business, followed by meeting operating expenses. The only category to decline was sensitive to interest rates: to refinance or pay down debt, which fell from 33 percent to 28 percent.

Southeastern small businesses portray an economy that is generally growing, according to the analysis provided by Community and Economic Development (CED) policy specialist Mary Hirt, CED analyst Aaliyah Price, CED senior analyst Alvaro Sanchez, and former CED intern Anthony Tringali.

Looking to the 12 months following the survey, 58 percent of southeastern firms expected revenues to increase and 42 percent expected to hire employees. Nationwide, 56 percent expected revenues to increase and 39 percent expected to hire.

Firms intended to fund this growth with traditional financing, given that the government's pandemic programs were winding down. The report notes that the loan applications "indicate that firms remain interested in seeking capital to expand their businesses, pursue new opportunities, acquire business assets, and meet their operating expenses."

The proportion of southeastern firms applying for a loan, line of credit, or cash advance was 44 percent, compared to the national average of 40 percent. The primary intended use of funds across the nation and region was to meet operating expenses. Only Tennessee had a close second for intended use, with 64 percent planning to meet operating expenses and 63 percent planning to expand a business, pursue new opportunities, or acquire business assets.

Tennessee led the region in growth-related categories. Tennessee firms reported both the greatest proportion of revenue increases in the Southeast, as well as the smallest proportion of firms with revenue decreases. Sixty-one percent of Tennessee's small businesses expected their revenue to increase in the 12-month period following the survey. That compares to expected revenue growth of 58 percent for southeastern small businesses and 56 percent for the nation. Tennessee led in the category of anticipated growth in employment, with 46 percent of firms expecting to hire, compared to 42 percent in the Southeast and 39 percent in the nation.

Highlights for each of the states in the report:

The 2023 Small Business Credit Survey is in process. Results are to be released in early 2024.