Black and Hispanic homeowners have been unable to tap into their home's equity at the rates of White homeowners, according to a working paper released in November 2022 by the Federal Reserve Bank of Atlanta.

Black and Hispanic homeowners have been unable to tap into their home's equity at the rates of White homeowners, according to a working paper released in November 2022 by the Federal Reserve Bank of Atlanta.

Summary

- Non-White borrowers are denied access to home equity loans at rates greater than White borrowers.

- Disparity reaches into billions of dollars over a four-year period.

- Findings raise questions about nation's incentives for homeownership.

The significant barriers Black and Hispanic borrowers face in qualifying for home loans are surpassed by the difficulty they have in borrowing against the equity in their homes, according to a working paper released in November 2022 by the Federal Reserve Bank of Atlanta.

As a result, Black and Hispanic homeowners have been unable to tap into their home's equity at the rates of White homeowners. Asian homeowners also trail Whites in mortgage equity withdrawal (MEW) rates, according to findings that show that "seemingly race-neutral underwriting criteria in the MEW product space explain large differences in the extent to which minority homeowners can access their home equity."

The working paper evaluates loan applications, taken from broad samples collected in all 50 states from 2018 through 2021, with a credit decision. Due in large part to a lack of detailed, nationally representative micro data, this is one of the first analyses of racial disparities in access to MEW products.

The paper, "Can Everyone Tap Into the Housing Piggy Bank? Racial Disparities in Access to Home Equity," was coauthored by James N. Conklin of the University of Georgia Terry College of Business; Kristopher Gerardi, a financial economist and senior policy adviser at the Atlanta Fed; and Lauren Lambie-Hanson of the Consumer Finance Institute at the Federal Reserve Bank of Philadelphia.

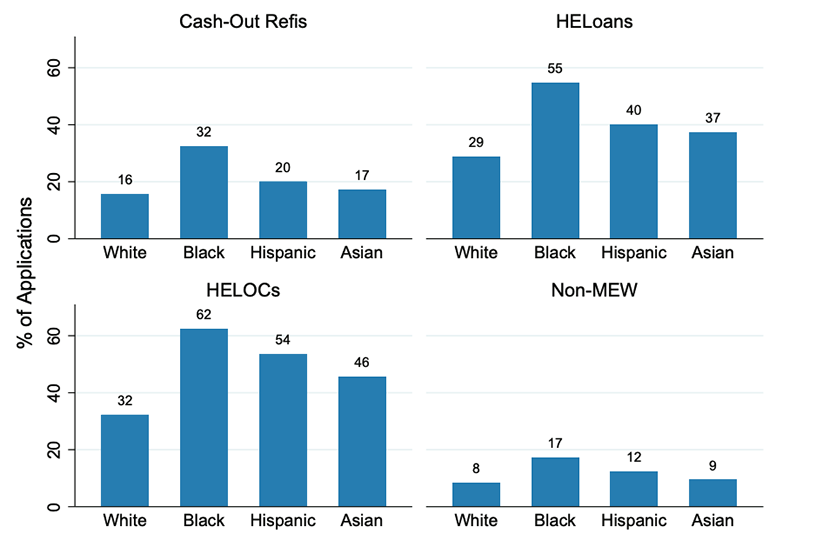

The authors' findings were especially pronounced in the run-up of real estate prices in 2020 through 2021. Because lenders have denied their applications at significantly higher rates, minority homeowners have not been able to access their accumulated home equity to the same extent as White homeowners using products such as home equity loans, cash-out refinances, and home equity lines of credit (see chart 1).

Chart 1: Denial rates by race and type of loan requested

The greatest proportion of disparity in denial rates can be explained by factors including credit scores, debt-to-income ratios, combined loan-to-value ratios, the requested loan amount, and the applicant's income, the paper observes. However, the disparity continued to exist even when the authors controlled for standard borrower and loan characteristics.

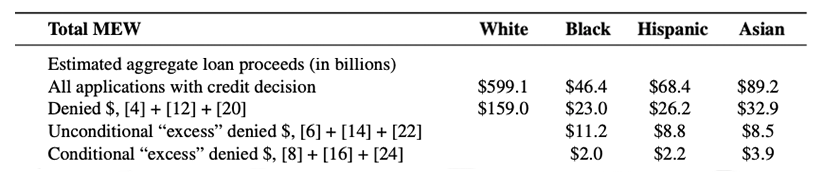

For example, Black borrowers were unable to access $2 billion in household equity even after the authors controlled for loan and borrower characteristics. The figure for Hispanic borrowers was $2.2 billion and was $3.9 billion for Asian borrowers, according to the paper.

To put these figures into context, the authors' analysis showed White borrowers had sought $599.1 billion; Black borrowers, $46.4 billion; Hispanic borrowers, $68.4 billion; and Asian borrowers, $89.2 billion (see chart 2).

Chart 2: Amounts of requested loans and amounts denied, by race

This inaccessible wealth could significantly affect homeowners because they don't typically spend money borrowed through mortgage equity withdrawal on impulse buys. Rather, they tend to use the proceeds to navigate life events such as smoothing over a break in income, funding a mom-and-pop business, paying medical bills, making a home repair or improvement, or covering costs for college or technical school.

The findings in the working paper have implications for the nation's efforts to promote homeownership. A widely accepted view of the American Dream is that homeownership is a key to accruing household wealth, especially for low-income and minority households. For many households, the home is the largest single financial asset and represents both accumulated wealth for the homeowner and a legacy for heirs.

The nation has enacted a series of incentives to promote homeownership, many since the 1940s and continuing today. In June, the Federal Housing Finance Agency unveiled the Equitable Housing Finance Plans. The purpose of this latest program by Fannie Mae's and Freddie Mac is to address racial and ethnic disparities in homeownership and wealth, particularly among Black and Hispanic borrowers.

The working paper states that these types of efforts to promote homeownership won't eradicate the practical effects of household wealth disparity if non-White borrowers continue to encounter difficulties in accessing their household equity:

- "In other words, the results suggest that even if policymakers are able to close the large gap in the minority-White homeownership rate, there would still be an important source of racial inequality stemming from the differential ability to access the financial benefits of owning a home."

The paper's final sentence observes: "Policymakers and researchers should not assume this newfound housing wealth will be equally liquid among all homeowners."