Economists have tried for years to better understand how businesses begin with an idea and ultimately become employers. The Atlanta Fed has released a working paper that addresses part of the enigma.

Four researchers—Veronika Penciakova, a research economist and assistant adviser at the Federal Reserve Bank of Atlanta, Emin Dinlersoz of the Census Bureau, Timothy Dunne of the University of Notre Dame, and John Haltiwanger of the University of Maryland and the National Bureau of Economic Research—have introduced a new set of data to the examination of entrepreneurship.

The Atlanta Fed's Veronika Penciakova

The Atlanta Fed's Veronika Penciakova

The researchers published their findings in a working paper, "The Local Origins of Business Formation." (An Atlanta Fed Policy Hub paper also summarizes this research.) This work complements the researchers' work on the trajectory of business applications and their transitions to start-ups during the Great Recession of 2007 to 2009 and the COVID-19 pandemic recession from February to April of 2020, published as "Business Formation: A Tale of Two Recessions" in the May 2021 edition of AEA Papers and Proceedings.

"We were motivated by understanding the inequality across locations in business formation," Dinlersoz said. "Do some locations generate more business ideas and, if so, what are some key characteristics of these locations? At the same time, not all business ideas succeed in becoming employer businesses: where is the success rate higher?"

The authors combined several sources of information to examine the geographic location of each new business in the country and local demographic, economic, and financial and business conditions that could affect start-ups. The premise was to answer this question: "What locations generate more business ideas, and where are ideas more likely to turn into businesses?"

The findings could help inform policies intended to foster the formation and growth of businesses nationwide. The Atlanta Fed has an interest in start-ups because, as the working paper notes, "start-ups contribute disproportionately to job creation and innovation" and thus promote the objective of "an economy that works for everyone."

"The answers to these questions are important for understanding how variation in entrepreneurship contributes to differences in economic mobility across locations," Dinlersoz said. "We have a unique dataset with comprehensive information on early-stage business formation activity that allows us to separately measure the creation of business ideas and their rates of transition to businesses across granular geographic units. We wanted to utilize this dataset to answer our research questions."

The Policy Hub paper warns that results "do not imply a causal relationship between local conditions and start-up activity," calls for more research into causality, and identifies in its conclusion a possible linkage between certain conditions and start-ups:

Finally, we find that the predicted ranking of start-ups per capita based only on the parsimonious set of local observable conditions we consider is closely related to the actual ranking. This finding is useful for characterization of localities with high start-up activity per capita. Policymakers and analysts exploring the sources of variation in entrepreneurship can thus use variation in these local observable conditions as a useful indicator of the start-up potential of an area.

The project benefits from access to micro data from the Census Bureau's Business Formation Statistics, which provides high-frequency information on new business applications and formations and is a joint effort of the Federal Reserve System's Board of Governors, the Atlanta Fed, the University of Maryland, and the University of Notre Dame.

The micro data allowed researchers to consider start-ups as the end of a two-step process by entrepreneurs: first, devise an idea; second, transition the idea into an employer business. Researchers also evaluated the data for a start-up's location and a range of factors associated with different outcomes.

The results shed light on aspects of entrepreneurship not widely observed previously and shows an enormous difference in the rate of start-ups across the country and in the range of local conditions.

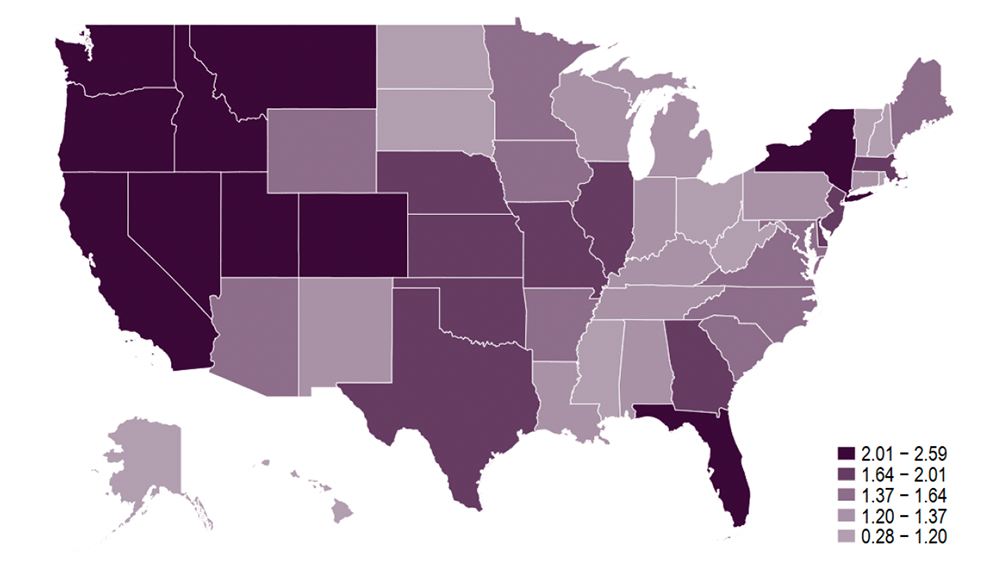

In terms of prolific states for start-ups, eight western states, plus Florida and New York, had more than two for every 1,000 prime-age adults between 2010 and 2016. States with fewer than one start-up per 1,000 prime-age population include Alaska, Hawaii, New Hampshire, North Dakota, Ohio, Rhode Island, South Dakota, Vermont, and West Virginia.

Researchers parsed out aspects of local conditions that are associated with ideas, transitions, and start-ups, and how these conditions are associated with various phases of entrepreneurship. Variations in local conditions seem to explain two-thirds of the variation in idea formation and one-third of the variation in transitions. Factors associated with start-up activity, idea generation, and the transition of ideas to businesses include age, education, per capita income, debt level, and population demographics.

The working paper concludes with a call for further research into the causal effects of local conditions on start-ups, noting that successful business start-ups have the potential to help address inequalities in intergenerational mobility documented in research including "Where Is the Land of Opportunity? The Geography of Intergenerational Mobility in the United States," published in 2014 in The Quarterly Journal of Economics.