One year after COVID-19 stalled economic activity and sparked rampant uncertainty, spring 2021 is bringing hope to business leaders across the Southeast.

In hundreds of interviews conducted in the past six weeks by staff of the Federal Reserve Bank of Atlanta’s Regional Economic Information Network (REIN), business contacts said optimism is even spreading to industries pummeled by the pandemic downturn, such as entertainment, hotels, and restaurants. Many business leaders expect demand for various consumer services, bottled up for months by the pandemic, to be released by three critical developments: expedited vaccine rollouts, unusually high levels of household savings for many, and continued fiscal relief that will likely fuel spending. Similar to what Economy Matters reported in February, business leaders view the vaccine rollout as particularly essential to recovery, and they are cautiously optimistic as COVID-19 vaccination numbers increase.

Optimism a welcome guest to the hospitality industry

Several major entertainment and leisure and hospitality companies noted hopeful signs in recent weeks, although their optimism was dampened somewhat by an expectation that international travel—a sizeable portion of many companies’ customer segment—will rebound more slowly than domestic travel. An operator of theme parks and resorts said monthly results had increased steadily since the middle of 2020 in part because per-customer spending exceeded 2019 levels. That increase seems to indicate that the people who have been visiting theme parks are flush and willing to spend. A national commercial construction company noted the reinstatement of several large entertainment projects it had postponed because of the pandemic.

Meanwhile, in a clear sign of the release of pent-up demand, a large lodging company reported that advance bookings for 2022 through 2025 matched, or perhaps even outstripped, the record levels set before the pandemic. And a hotel analytics firm expects the industry to recover solidly in the second half of 2021 and gain more momentum as meetings and conventions resume, likely in early 2022, a point echoed by several contacts at firms that service the events industry.

Optimism, yes. A hiring binge, maybe not

Despite the sunnier outlook, employers might not embark on the sort of hiring spree one might expect from a surge in economic activity. Numerous companies cited a postpandemic intention to stay as lean as possible. Several firms said they trimmed payroll by encouraging early retirements, consolidating locations, outsourcing, and investing in technology.

Such reluctance to hire full-time workers in 2021 is reminiscent of what REIN staff heard following the economy’s emergence from the Great Recession more than a decade ago. In fact, the years after June 2009 were widely described as a “jobless recovery,” as even though the economy grew, nonfarm employment didn’t regain its prerecession level until roughly five years after the recession ended.

Today, even amid newfound optimism, other complications remain. In the battered leisure and hospitality industry, numerous managers said erratic business conditions are complicating their ability to guarantee workers consistent schedules. At the same time, many laid-off workers remain hopeful, convinced they will return to their old jobs.

It appears this is keeping some from seeking work in new occupations or new places. But as companies devise ways to function with fewer workers, how many lost hospitality jobs will return is an open question. It is well documented that lower-wage workers in industries that rely on face-to-face contact—such as hospitality, travel, and restaurants—have suffered especially steep pandemic-induced job losses, and the employment hole remains deep.

The state of the labor market is of critical concern to the Federal Reserve, as full employment is one element of its dual mandate from Congress. The other half of its mandate—price stability—has recently received heightened attention as inflation fears have drawn abundant commentary from analysts and observers.

Contacts see short-term demand surge, not emerging persistent inflation

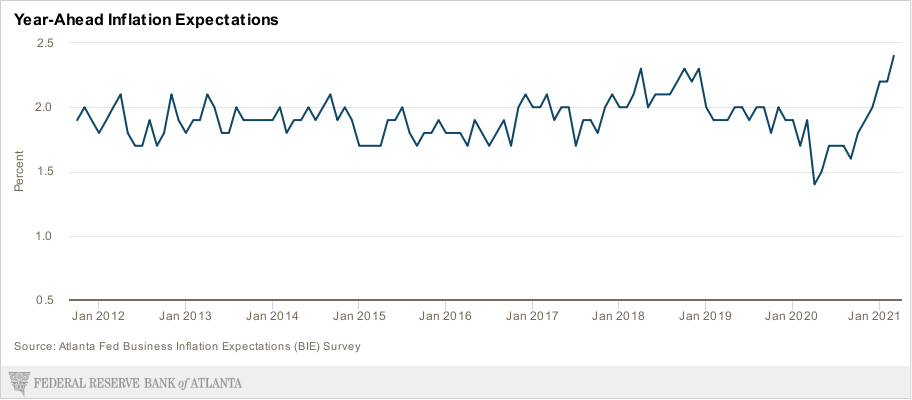

Atlanta Fed contacts, however, expressed little alarm about the possibility of resurgent inflation over the long term. Although inflation expectations—sometimes a harbinger—have ticked up in recent months, most respondents to the Atlanta Fed’s Business Inflation Expectations survey think sharp price increases in the near term for goods including plastic and chemical raw materials, construction materials, and semiconductors will likely fade as volatile economic conditions settle later in the year (see the chart). In particular, most executives attributed these price bumps to spikes in demand for certain goods along with supply chain disruptions caused by pandemic conditions, meaning the increases are likely transitory.

Some REIN contacts suggested additional relief payments via the recently passed $1.9 trillion American Rescue Plan could juice consumer buying at a time when supply chain bottlenecks are already complicating their ability to meet demand. To circumvent snags in global supply lines, some contacts are stocking unusually large inventories to ensure enough goods to satisfy customers.

For example, strong home sales have stimulated great demand for appliances, but the supply of refrigerators, dishwashers, and ovens—appliances whose manufacture relies on a nimble supply chain—has been hard pressed to meet that demand. To ensure adequate supplies, a major home builder was buying appliances in the retail market and stockpiling them to fully outfit and finish homes in a timely fashion.

Although buying at retail is costlier than the builder’s normal method of acquiring appliances wholesale, strong housing demand has allowed the firm to raise prices and absorb the expense.

Signs of progress in LMI communities

Like workers in the hospitality industry, many people with low to moderate incomes (LMI) have absorbed an especially harsh blow from the pandemic recession. Though their long-term financial health remains uncertain, several nonprofit agencies and companies that serve this population noted federal and state aid programs have significantly helped LMI communities. Further, some discount retailers reported that the newest relief payments, coupled with income tax refunds, could boost spending by lower-income shoppers.

In another sign that consumer finances are holding up, some Atlanta Fed contacts have been pleasantly surprised at the relatively small number of delinquent rent and utility payments across the Southeast. They attribute this mainly to fiscal stimulus and other relief programs such as eviction moratoriums. A large utility, for instance, noted that by the end of January, the number of customers late on their bills had fallen nearly 9 percent, and the dollar value of past-due payments was down nearly 50 percent from its peak. The utility expects the new round of federal relief payments to further reduce those numbers.

But many organizations remain concerned about the effects of the pandemic on the long-term financial health of LMI households. At publication time, the federal eviction moratorium was extended and is now set to expire on June 30. The Atlanta Fed continues to closely monitor the recovery of LMI communities and other facets of the region’s economy.

Optimism hinges on continued public health progress

Overall, REIN’s most recent findings indicate the green shoots of resurgent demand for consumer services after a year of muted spending on dining out, travel, and entertainment. As vaccinations proliferate and consumers appear willing to open their wallets, business leaders across the Southeast hope that not only might the worst of the pandemic economic crisis be behind, but also that a vigorous rebound could be at hand. Nevertheless, their economic optimism hinges on continued progress against the coronavirus.