For Federal Reserve officials from Chair Jerome Powell to Atlanta Fed president Raphael Bostic to field staff who harvest economic anecdotes, inflation remains the dominant issue of the day.

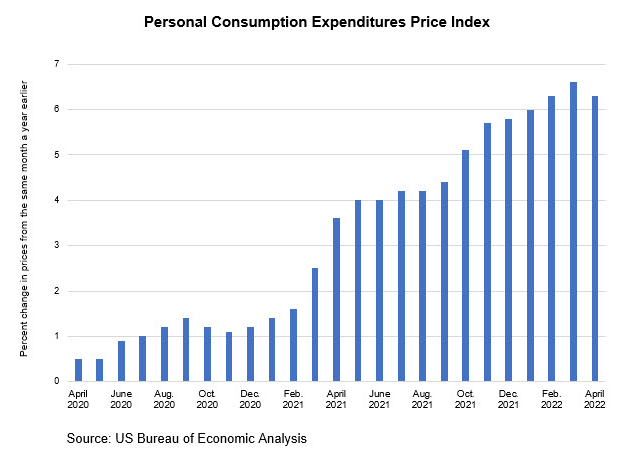

That makes sense, as pursuing stable prices is one of the two major duties of the central bank and inflation has run well above the Fed's 2 percent goal, as measured by the personal consumption expenditures price index, for more than a year. The most recent reading, in May, from the Fed's preferred measure was 6.3 percent (see the chart).

Meanwhile, the employment market, the other part of the Federal Reserve's dual mandate, is by most measures vibrant, as people seeking jobs generally can choose among multiple openings.

Members of the Atlanta Fed's Regional Economic Information Network (REIN) team stay in touch with hundreds of business leaders in the Southeast to help determine the course of economic activity generally and, these days, inflation specifically. In recent weeks, the influence of high inflation has deepened throughout the region, according to business contacts across a range of industries and company sizes.

Even as many of the companies represented by contacts continued to enjoy record profits, some of them report that customer demand has weakened and shifted toward lower-priced goods and services, especially among those with low to moderate incomes. On the other hand, higher prices appear to have had less impact on more affluent consumers. In fact, one contact noted that high-income consumers seem largely oblivious to inflation.

That split is most apparent in the retail sector. Retailers across the Atlanta Fed's district—Alabama, Florida, Georgia, and parts of Louisiana, Mississippi, and Tennessee—in April and May said that some budget-conscious customers began forgoing optional purchases to cover the rising costs of necessities like rent, food, and gasoline.

A large discount retail chain reported rising transaction volumes, possibly indicating “trading down” by consumers. Similarly, a restaurant operator said diners are opting for lower-cost choices at all 19 of its locations. Further, the firm said its lowest-cost restaurants are outperforming its slightly pricier outlets. In particular, sales have declined more sharply at the company's sit-down restaurant chains than at less expensive fast-casual or buffet options.

The Atlanta Fed's Laurel Graefe (right), vice president of the Nashville Branch, goes to the grassroots to get economic information about Tennessee.

On the other hand, a high-end boutique clothing retailer said inflation is having “zero effect” on its customers' spending decisions. Those shoppers, the Atlanta Fed contact related, are hardly even looking at price tags.

Likewise, an executive of a large marketing firm told REIN staff that, so far at least, high-income households seem essentially unfazed by inflation. Yet, this contact figured spending by richer consumers could slow amid dramatic fluctuations in the value of their stock market holdings.

Pricing power waning?

Many of those anecdotes describe firms' pricing power, defined as the ability to pass along rising costs to their customers in the form of higher prices. Up until the past month or so, firms generally have reported little trouble passing through higher costs. For example, an executive told the Atlanta Fed their firm had raised prices eight times over 18 months without losing its customers.

But that level of pricing power could be changing, at least in some industry sectors and among some consumers, a view that is especially prevalent among the scattered contacts reporting lower demand.

By contrast, the leisure and hospitality industry appears to be thriving. As consumer spending shifts back toward services after a surge in goods purchases earlier in the pandemic, some hotels and resorts report record bookings, occupancy rates, and prices. Even business and group travel, which evaporated during COVID lockdowns, is rallying in certain markets. Amid this rebound, hospitality contacts still smarting from the difficult days of 2020 and 2021 said they probably won't lower prices even if demand softens.

The producer side of the price equation

Although the Fed is charged with trying to stabilize prices American consumers pay, those prices broadly reflect costs that goods and services producers pay for labor and materials.

Start with labor. Nominal wages overall—that is, wages before factoring in inflation—have risen briskly during the past year or so as employers vie to attract and keep workers in a tight labor market, one in which job openings far outnumber job seekers.

Atlanta Fed REIN staff have heard about rising wages for months, and that refrain continues. Firms report considering large wage increases to keep pace with inflation, or as a measure to retain workers as inflation eats into last year's wage increases. Many contacts fret that wage hikes spurred by inflation will be difficult to undo. Basically, the concern is that these companies might lack the financial flexibility and resources to continue raising wages at well above historical norms.

As an example, one REIN contact said their firm awarded 4 percent pay bumps to employees making less than $100,000 a year even after 8 to 10 percent raises, the biggest in company history. Still, the contact is concerned that wage hikes may not be enough to keep some key staff who might earn more elsewhere.

This company is wrestling with a thorny calculus that is characteristic of the tight labor market. That is, should the firm try and keep up with inflation through ongoing raises of 4 to 6 percent? Or would it make more sense to pause and gauge whether inflation slows before boosting the entire pay structure to unprecedented heights?

It could be that more firms take the latter course. The latest feedback from business contacts indicates that some feel wage pressures could be plateauing. At the same time, many contacts are adding nonwage compensation such as increasing 401(k) matching levels and issuing gasoline gift cards to workers who must commute by car.

Inflation affects consumers and businesses in various and complex ways. The Atlanta Fed's REIN staff will continue to gather real-world, real-time information to inform monetary policy.