As we near the end of 2022, the Regional Economic Information Network (REIN) looks back at the year. After we emerged from lockdowns and a COVID-19 vaccine was released in 2021, there was a sense of cautious hopefulness that we would return to some sense of normalcy. In many ways we did, but in other ways this year was as much a roller coaster as the previous two.

Inflation and demand

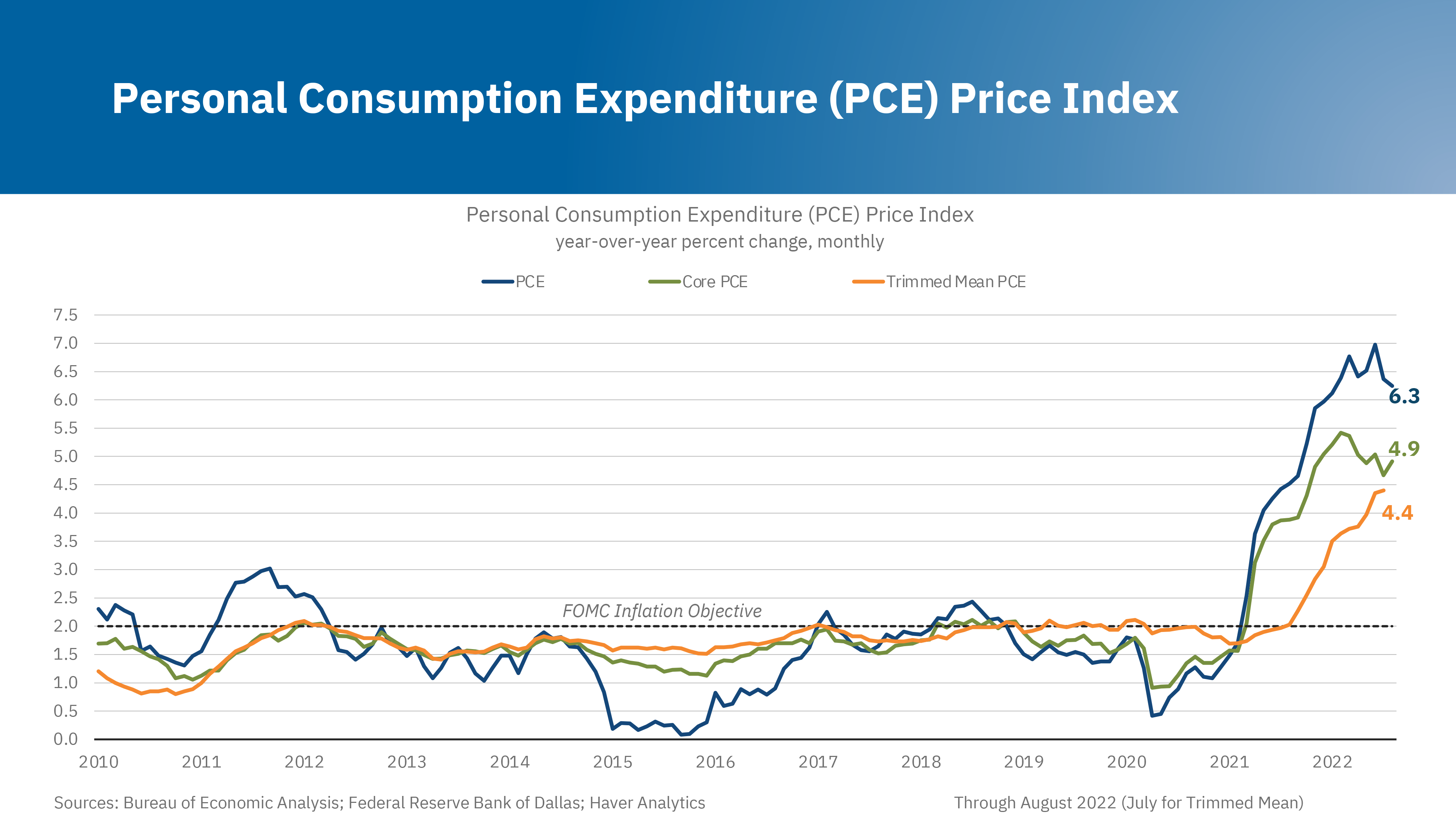

This year began with relative optimism from Sixth District firms about sustained strength from 2021 demand. However, with 2021 stimulus payments and enhanced child tax credits in the rear view, some uncertainty about low- to middle-income consumers' demand fundamentals arose. Most contacts expressed concerns about sustained inflation into and through the coming year for input costs, particularly labor, but also noted little to no pushback from customers over price increases.

"When I talk to business leaders, they tell me demand for their products is still extremely high and they're not worried about whether they're going to be able to sell products," Atlanta Fed president Raphael Bostic told the Wall Street Journal in an August 25 interview. "I think the biggest concern and consideration is really about the sustainability of the demand and how it moves forward."

Supply chain challenges, which became heightened during the COVID-19 pandemic, remained significant, though some logistics contacts suggested in the early part of the year that disruptions may have plateaued. This sentiment would largely reverse between the first and second quarter as the conflict in Ukraine erupted and COVID-19 outbreaks caused shutdowns in China and labor shortages broadly.

"We talk to business leaders around the District, and some of the trucking companies in particular have told us that they don't have excess demand," Bostic told Axios in a May 9 interview. “I have some other businesses who are telling me that their backlogs for orders have been worked through, and they're now much more in a normalized space."

As we moved into the second quarter, reports emerged of early signs of softening in consumer spending, largely driven by continued inflationary pressures. Rising fuel prices began to eat into spending power, causing consumers to trade down from full-service restaurants to either fast food or eating at home, or to cut out discretionary spending prevalent during COVID shutdowns, like on home décor.

Firms affected by this slowing demand employed various approaches to shore up their business, including drawing down inventory, reducing headcount, or increasing promotional activity. Alternatively, business travel and convention activity began to rebound from its low levels during the pandemic, and leisure travel approached a return to pre-pandemic levels.

Around the year's halfway point, it became clear that turbulent supply chains weren't resolving nearly as quickly as hoped. Congested ports faced labor supply issues, including uncertainty over union negotiations, along with other constraints like a mismatch between ship size and port capacity, and a strict regulatory landscape. The adverse effects of the Russia-Ukraine war lagged, and most contacts expected they would be realized later this year and into 2023. Input costs remained elevated, on balance, with some firms hinting at pricing pushback from customers and potential margin squeeze. Companies began indicating that their investment plans would be affected by both the increasing interest rate environment and prolonged inflationary stress.

Rounding out the third quarter, some businesses noted consumer spending moderating back to pre-pandemic levels, although premium retail and service providers described continued robust demand. Input costs continued to rise, though the pace had moderated, and retailers began to push back on suppliers' cost increases. Contacts in the energy sector also noted large price increases in natural gas and electricity, partially due to US liquefied natural gas becoming a global commodity for the first time. Supply chain issues continued, and most contacts predict that inflationary pressures will end only when these logistics issues are resolved.

"I talk to business leaders and people in communities across the Southeast," Bostic said in a September 25 interview on Face the Nation. "They are concerned [about an economic slowdown], but they do still feel that there's a way to get to 2 percent in terms of inflation that will still leave them in a good place."

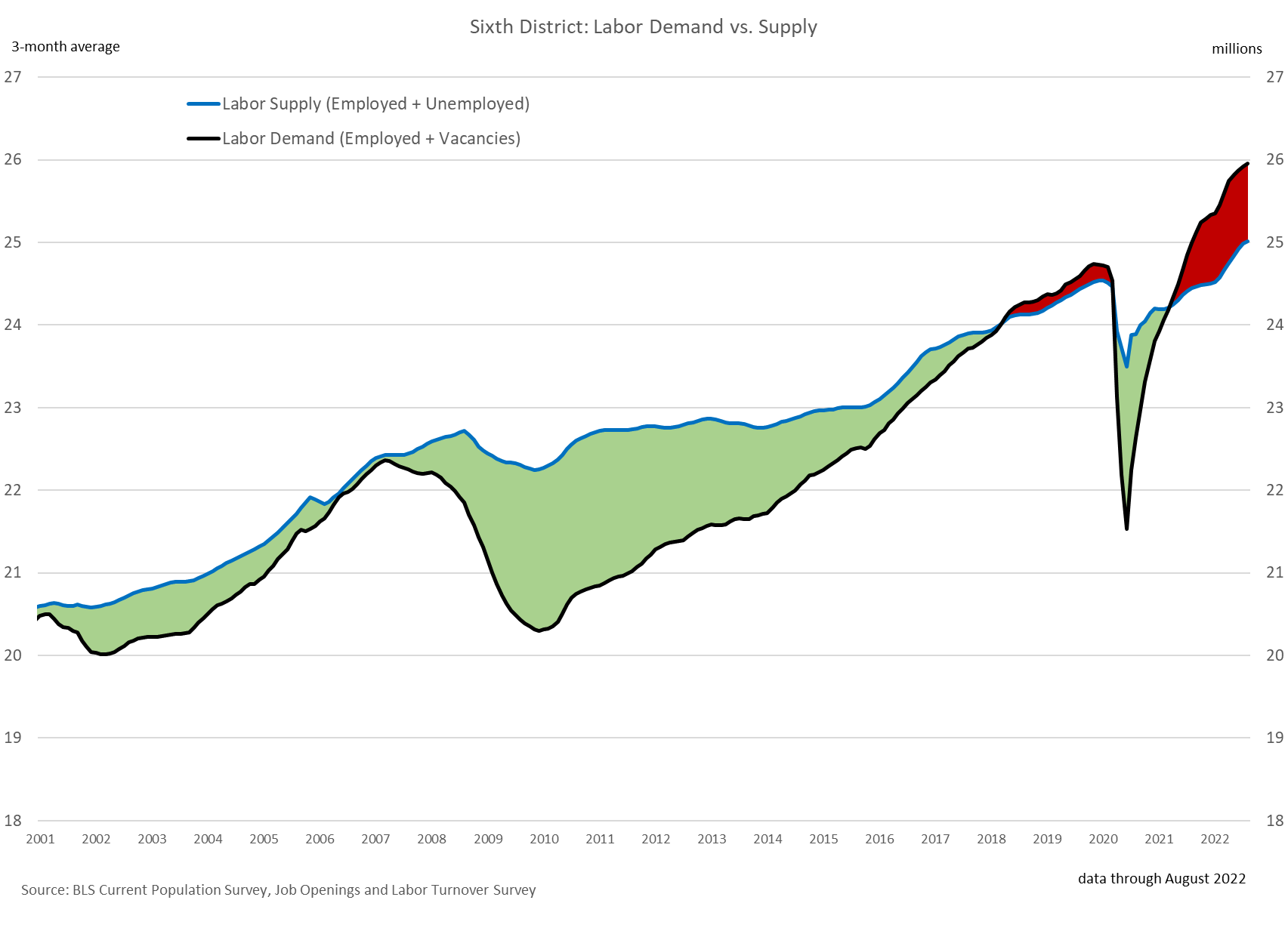

Labor markets

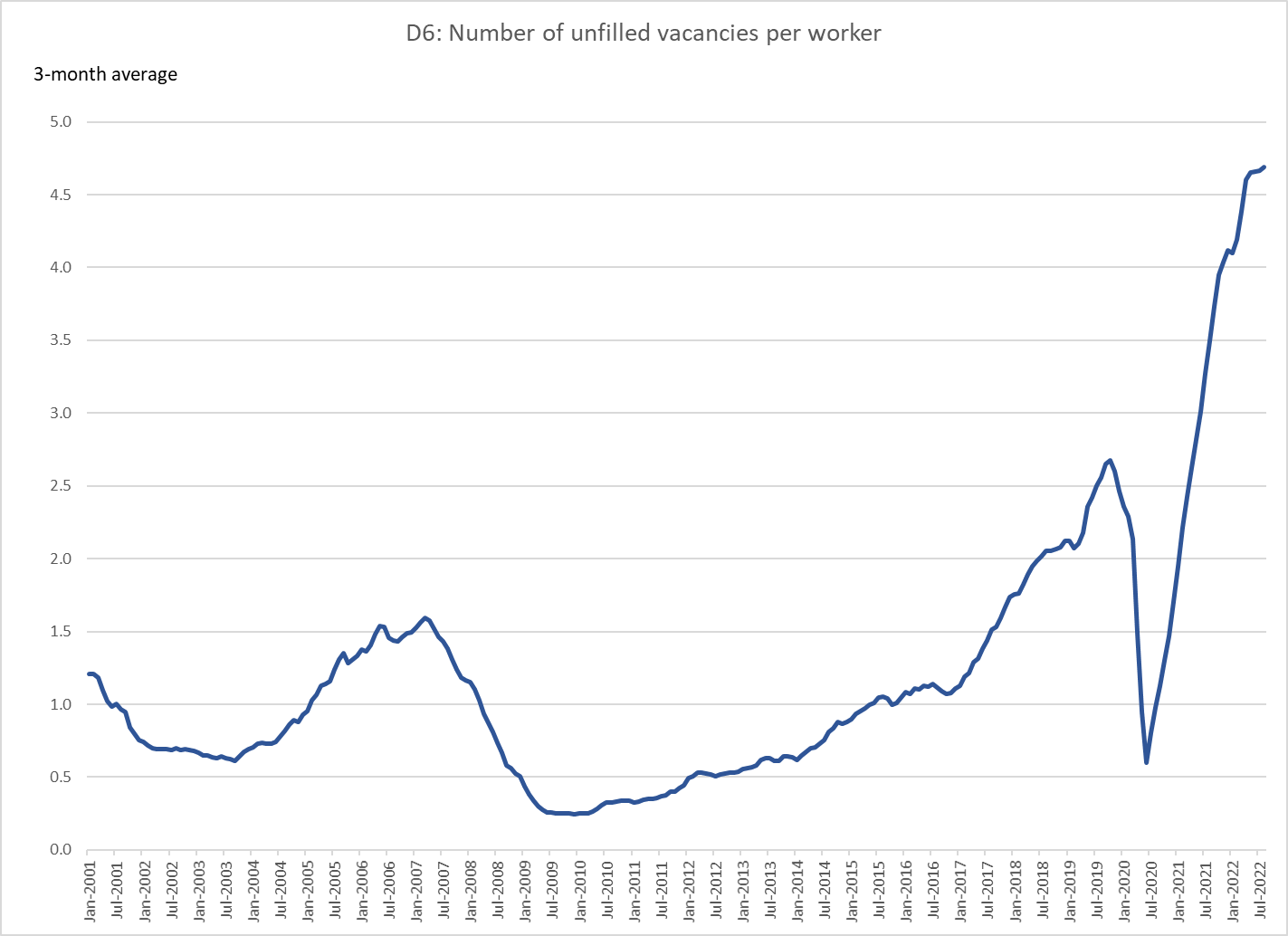

Labor conditions at the start of 2022 remained constrained by a tight labor market and robust wage pressure. For REIN contacts , this tightness in the labor market is defined as the prolonged struggle or inability to attract and hire workers. Labor tightness also factors in retention and a firm's capabilities in using its workforce. Although labor tightness is related to the unemployment rate, it is not a formal metric. REIN contacts across industries and states reported difficulties recruiting for open positions and noted the great lengths they would take to attract labor and retain it. Headcounts required to help handle high demand forced employers to adopt novel solutions to boost staffing levels.

One solution contacts have adopted is to raise wages more than 20 percent year over year, but some were also pressured to adopt additional benefits like part-time positions for workers hesitant to return or hybrid/remote working models for most employees. Contacts and data indicated that those seeking a job could readily find one, usually with above normal salaries and bonuses. Contacts indicated that, overall, sustained higher-than-normal wage pressure and unfilled positions were the norm for the first six months of the year.

"One of the things that I've been encouraged by is actually how strong the job growth has been, which suggests to me there's a lot of momentum in the economy," Bostic said in a July 29 interview with NPR's Morning Edition. "We can still continue to see people get jobs, get good incomes, and stay employed as we try to reduce the imbalance between demand and supply."

In the latter part of the year, commentary regarding labor markets shifted slightly. While hiring remained tight and wage pressure was higher than normal, both had moderated. Headcounts had begun to recover, and contacts commented that job applications increased. Long-term labor availability was and remains a top concern, even considering these early signs of labor market loosening, meaning it is slightly easier for contacts to find and attract labor. While headcounts remain down, workers seem to be reappearing, relaxing what was employers' very constrained ability to hire.

Real estate and housing

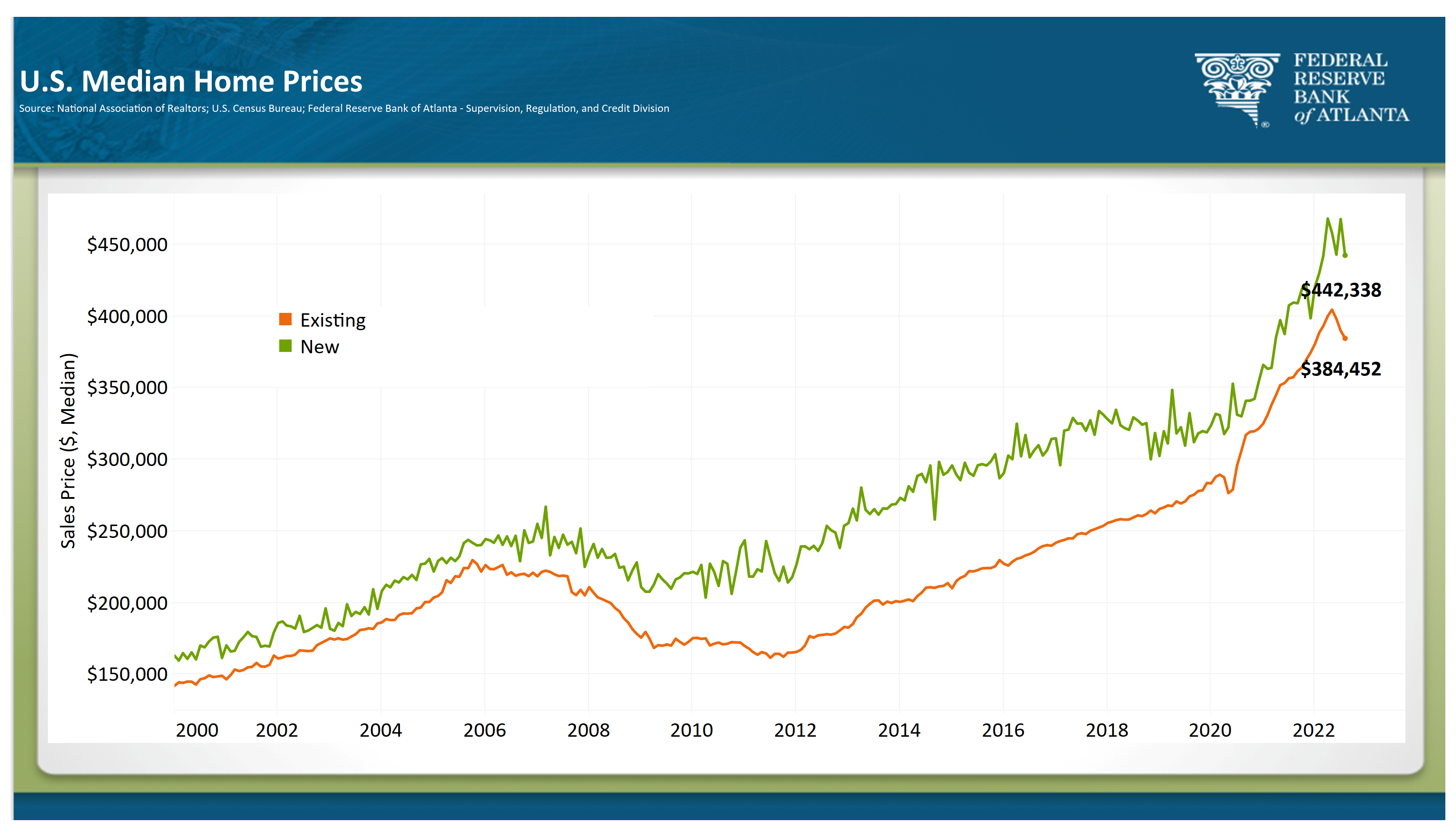

A confluence of events kicked off by the pandemic fundamentally changed the US workforce and the dynamics of residential and commercial real estate. When work-from-home policies saw stable productivity and employers relaxed their in-office requirements, remote workers began searching for the perfect home. Others decided it was time to renovate their current living space. Still others took the opportunity to switch jobs and locations entirely. All these factors contributed to driving housing demand, and thus home prices, through the roof (pun intended).

The construction industry was hampered by supply chain disruptions, causing extended project timelines, but demand remained strong into the beginning of 2022. This included industrial real estate, as firms building up inventory in response to supply chain disruptions had greater storage needs. As more businesses returned to an office setting in the first quarter, commercial real estate began to improve. Although commercial real estate bounced back somewhat, demand for office and retail space has cooled recently, with buyer pools shrinking and demands for concessions growing.

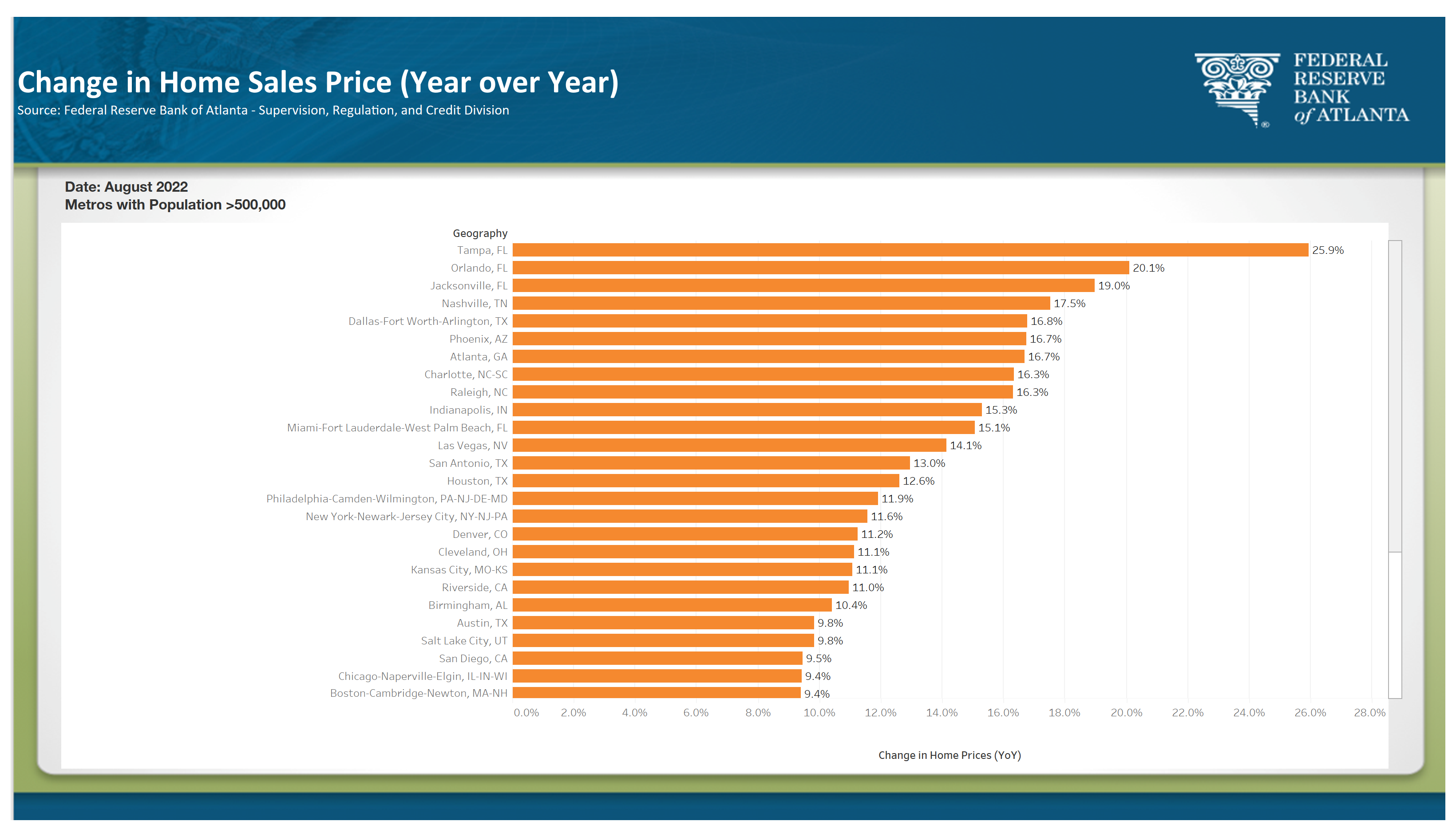

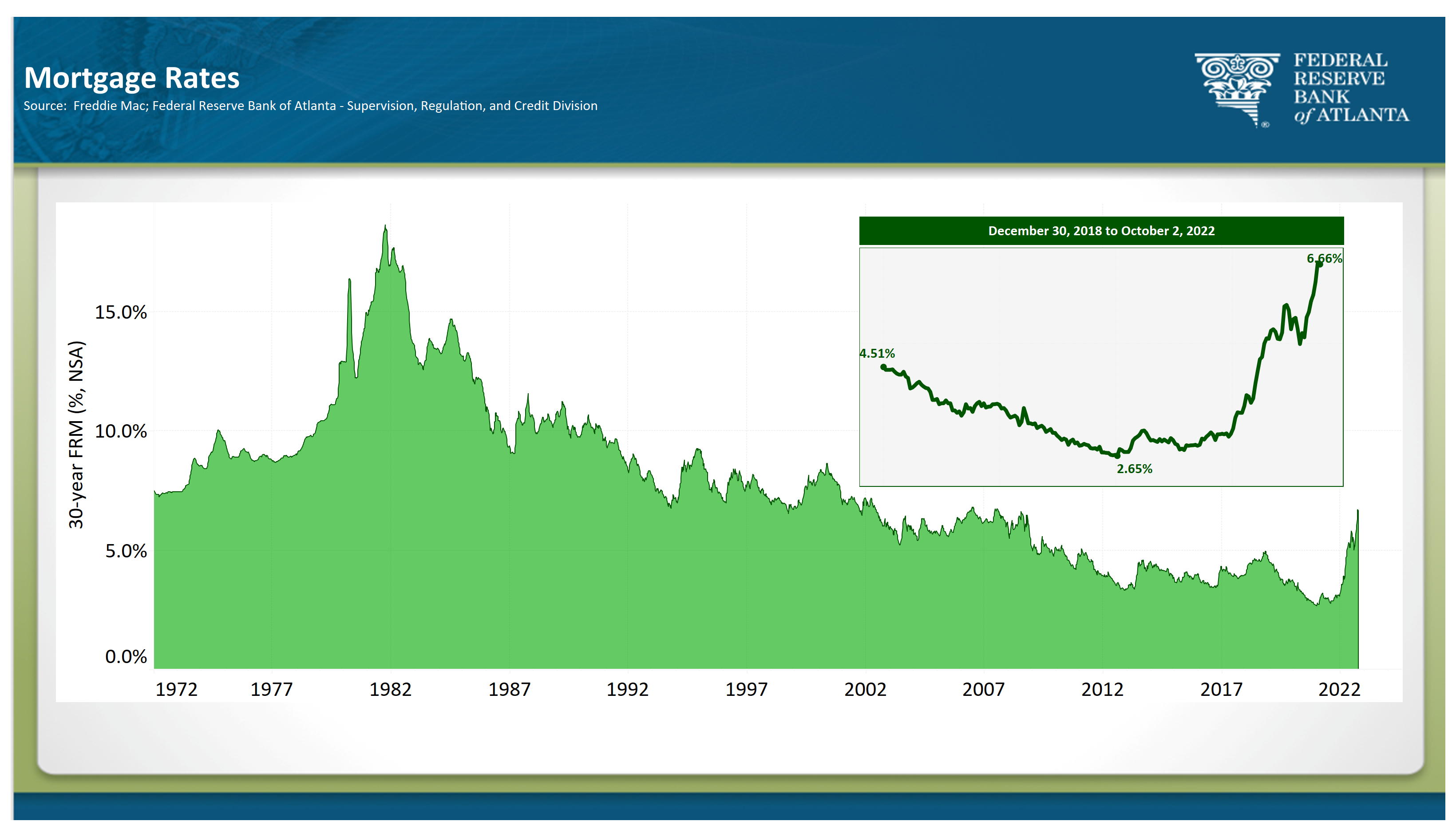

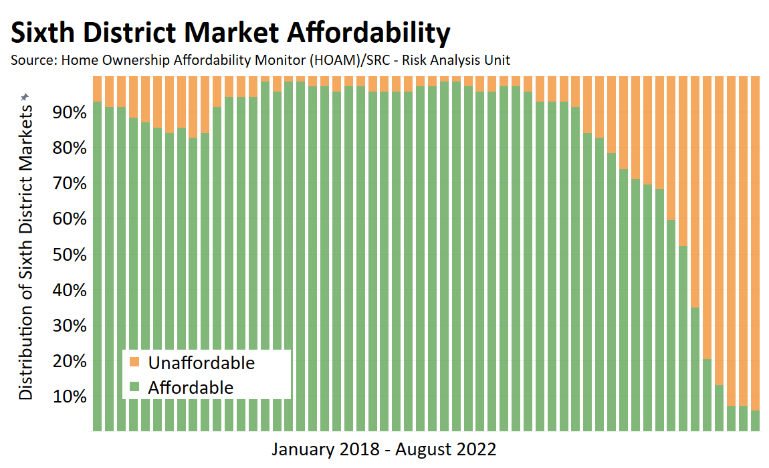

Over the course of the second and third quarters, interest rate increases slowed housing demand. Affordability remained at all-time lows in various areas of the Sixth District like Atlanta, Nashville, Tampa, and Orlando, particularly as rising rates priced some buyers out of the market. Still, the share of homes with reduced asking prices has risen recently, and more new home builders have offered incentives to entice buyers.

Risk

The year started with a pronounced risk on the minds of our contacts. The emergence and rapid spread of the COVID-19 omicron variant threatened to impact demand, labor markets, and still-constrained international supply chains. As with previous virus variants, contacts feared that a sickened workforce would be unable to return to work to help meet high levels of demand.

Additionally, contacts feared that closures and lockdowns of international suppliers would exacerbate supply chain woes. Omicron proved much less severe than previous variants, so work stoppages were minimal. A return to lockdowns in China did challenge the supply chain, but the effect of the lockdowns was minimized because many international suppliers had not fully returned to normal. This kept the abrupt reemergence of the virus comparatively less meaningful than before.

Omicron risk was quickly replaced with risk from the war in Ukraine. Contacts experienced a rapidly changing geopolitical reaction regarding expectations on outlook and firm behavior. Contacts reported rising commodity prices and difficulties rerouting suppliers out of Europe, especially from Russia and Ukraine. Energy contacts noted that a lack of infrastructure in the United States would accelerate short-term energy price woes. Gradually, these issues moderated moving into late third and fourth quarters, but ongoing geopolitical tensions and conflicts continue to pose a risk for contacts. All these issues were made worse by mounting inflationary pressures as the US economy recovered from the last two years of the pandemic and the first war in Europe in more than 20 years.

As we enter the holiday season, "uncertainty" remains the buzzword used by many contacts. The effects of Hurricane Ian on southwestern Florida may further exacerbate supply chain issues as the region rebuilds. Additionally, concerns remain regarding worker availability and the rate at which inflation persists, though price increases appear to be moderating. Consumers are becoming ever more sensitive to prices as interest rates slowly affect the cost of doing business.

The Atlanta Fed and the Regional Economic Information Network will continue to keep close watch on the data and keep in constant contact with those affected by the uncertainty in today's economy.