The residential real estate market in South Florida boomed in the wake of the pandemic, driven by a surge in migration from residents seeking sunshine and relief from widespread business shutdowns. But, in June 2021, the tragic Surfside building collapse ushered in a new era of challenges for the condominium segment of the market. With the goal of keeping residents safe, the Florida legislature responded with a number of reforms aimed at improving building safety, but the resulting impact on condo owners has been significant. The outlook for many residents has become increasingly uncertain as they face the challenge of rising insurance costs coupled with special assessments and higher homeowners' association (HOA) fees, putting even more pressure on affordability in an already competitive housing market with even broader economic implications.

The collapse of the Champlain Towers South in Surfside triggered an immediate investigation and a statewide audit of any high-rise building at least 40 years old. In May 2022, the Florida Legislature passed SB-4D, a condo reform law that established a mandatory milestone inspection program for condominium buildings of three stories or more. This program requires buildings to complete an inspection certification process when they reach 30 years of age and every 10 years thereafter. Additionally, the new law mandates that HOAs maintain adequate reserve funds to cover the costs of maintenance, repairs, and replacements of damaged or worn-out building components.

Gauging the consequences for property owners

Although the safety of residents is the key consideration, the new building safety regulations have unquestionably placed a new and significant financial strain on condo owners. Prior to the reforms, many HOAs were not adequately maintaining their buildings, leading to the accumulation of deferred maintenance issues. Now, with the mandatory inspections and reserve fund requirements, HOAs are being forced to address these problems, often through the imposition of special assessments and increased HOA fees. The cost associated with these fees and assessments can reach thousands of dollars per unit. When combined with increasing insurance premiums, the financial burden for condo owners, many of whom are retirees on a fixed income or lower income households, is substantial.

These increased costs add more pressure on affordability for some residents, as the higher HOA fees and special assessments may exceed their budgets. According to the Atlanta Fed's Home Ownership Affordability Monitor—a data tool that offers a monthly assessment of the median-income household's ability to afford the median-priced home at the national, metropolitan, and county levels—the Miami-Fort Lauderdale-West Palm Beach area already exceeds the 30 percent affordability threshold. According to the latest data from February, the affordability rate for the Miami-Fort Lauderdale-West Palm Beach metropolitan area was 48 percent.

"Condominium ownership has often provided households with a home ownership opportunity at a more affordable price that, due to its potential density, can be located in amenity-rich parts of town," said Sarah Stein, a senior adviser on affordable housing and neighborhood stabilization on the Atlanta Fed's Community and Economic Development team. "For decades, households have turned to condominium ownership to stabilize housing cost expectations through a thirty-year fixed-rate mortgage. Efforts to ensure the safety of these buildings for residents are paramount. Likewise, creative solutions are necessary to address the financial shock that many lower- and fixed-income households may incur due to the HOA assessments triggered by safety policies so that their access to housing isn't sacrificed as its physical safety is managed." Also, higher assessments can affect the overall value of condo units as high ongoing costs of ownership might deter potential buyers.

The condo crisis in South Florida poses broader risks for the local economy and for consumers, particularly those in lower-income communities. As families struggle to afford the increased costs of ownership, some may face foreclosure or be forced to sell their units to investors who will rebuild them for mixed-use or more expensive housing, which in turn exacerbate the issue of housing affordability in the region as many individuals and families could be forced to seek alternative living arrangements, potentially outside of South Florida. This also has ripple effects for labor markets, business growth, and the overall longer-term competitiveness of the region.

In-migration, a longtime Florida strength, could suffer

Shifts in migration to the region add an additional layer of complexity. South Florida has long been an attractive destination for both domestic and international transplants, with an influx of residents from states such as New York, New Jersey, California, and Texas, as well as a diverse population of international newcomers. This steady influx of new residents has given a steady boost to the region's real estate market and contributed to robust condo sales over the past 15 years as well as provided a diverse labor force for businesses across sectors such as tourism, hospitality, construction, and healthcare.

However, the current condo crisis along with changing immigration policies may not only have an impact on the appeal of moving to South Florida but may also force current residents to migrate out of the area. As condo owners face increased costs, some may find themselves priced out of their homes, leading them to seek more affordable living options elsewhere in the state or in another state.

This trend is evidenced by various industry reports and supported by the Atlanta Fed's Regional Economic Information Network (REIN), a team focused on gathering business insights in our local economies within the Atlanta Fed District. The Southeast Florida Driver License Exchange Report published by Miami Realtors stated that "In 2025 Q1, out-of-state driver license exchanges fell from one year ago in Miami-Dade County (–11%), Broward County (–21%), Palm Beach County (–14%), Martin County (–21%), and St. Lucie County (–10%)" while "Foreign driver license exchanges also fell from the level one year ago in Miami-Dade County (–47%) , Broward County (–29%), Palm Beach County (–36%), Martin County (–26%), and St. Lucie County (–30%)". The Florida Chamber's latest report on migration trends, 2024 Florida Migration Trends, suggests an increase in the number of people leaving the state, with a rise of approximately 4.3 percent in outward migration during 2023. The reports indicate that the majority of departures are headed to North Carolina, Texas, and Georgia, where the cost of housing and labor market conditions are perceived as more favorable.

The Atlanta Fed's REIN team has continued to hear from their network of contacts that this trend of outmigration has persisted through 2024 and into 2025. Business contacts shared that many workers who have left the area were being priced out of the local housing market or having to endure very long commutes, which added substantial transportation costs. Affordability has made it difficult to attract and retain employees, not only in essential service industries but also middle management positions. REIN staff routinely hear that it is often hard to attract workers from out of state making six figures because what they can afford in Florida isn't comparable to what they would be leaving behind. Higher housing costs can affect business expansion and relocation to the area as well as consumer spending as families are forced to allocate more income toward housing, leaving less discretionary spending.

What effect have changes in migration patterns, increased HOA fees, additional assessments, and rising insurance costs had on the condo market? These challenges—along with higher prices and uncertainty—are causing the South Florida condo market to experience a significant shift in demand. In 2021, when the real estate market peaked in the region, inventory was extremely low, and buyers were often offering 20 percent or more above the asking price. However, this scenario has now almost completely reversed as inventory is plentiful, and demand has softened, most significantly in the under-$500,000 market (see the chart).

According to Ron Shuffield of EWM Realty, a normal or balanced market typically has a nine-month inventory supply of condos. Currently, condos priced under $500,000 are seeing a supply of about 11 to 12 months, making it a buyer's market. As a result, condo prices have begun to decline in the first quarter of 2025, with the under-$500,000 market seeing a 6 percent to 7 percent drop in prices in Broward and Palm Beach counties, respectively, while Miami-Dade has remained relatively flat compared to the same period last year.

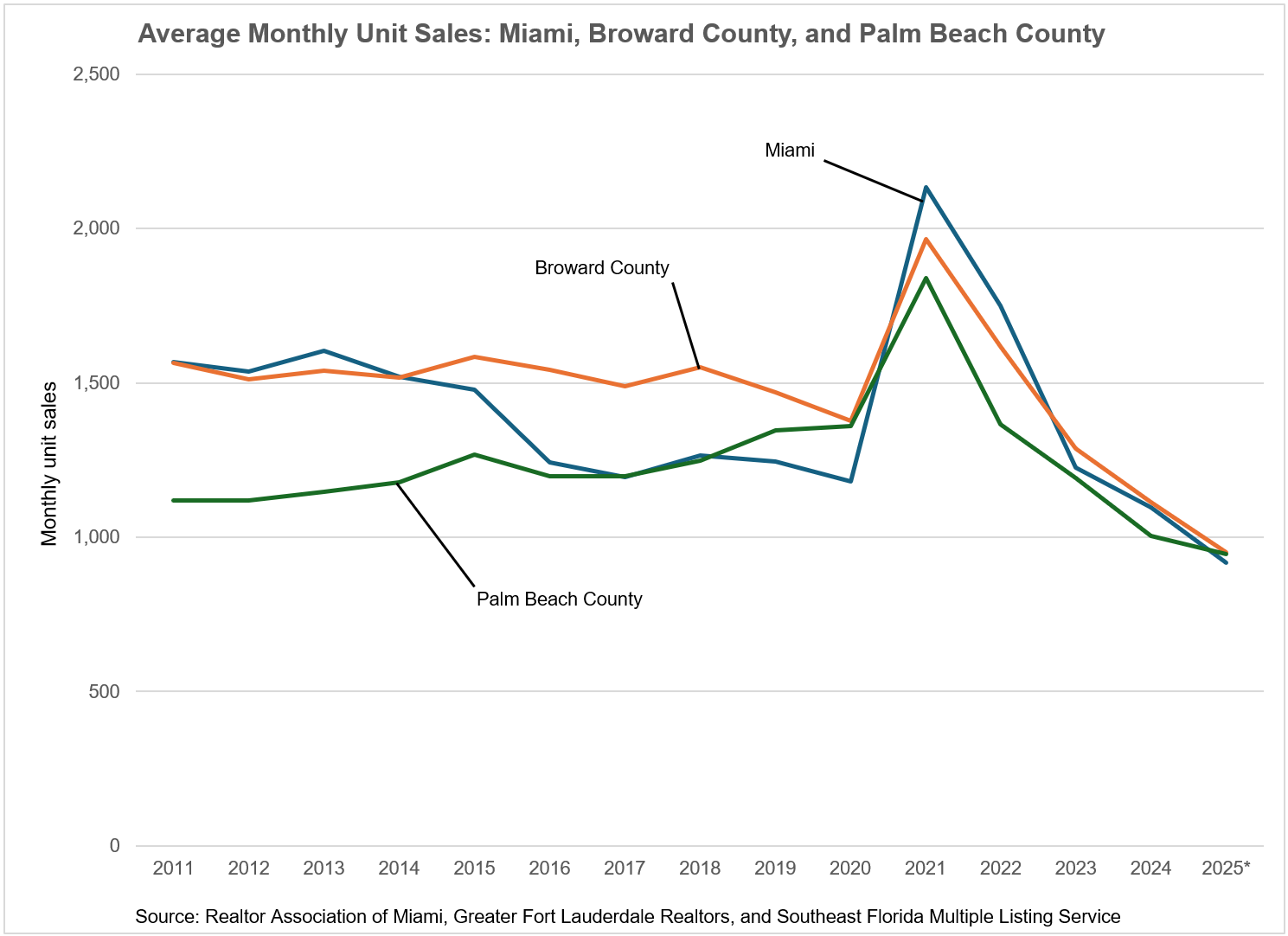

Further evidence of slowing is the decline in average monthly unit sales for all price points. Data show that average monthly condo sales in the tri-county area (Miami-Dade, Broward, and Palm Beach) peaked in 2021, with Miami-Dade averaging 2,134 units per month, Broward at 1,964 units per month, and Palm Beach at 1,839 units per month. To date in 2025, these numbers have dropped significantly. Reports indicate that Miami-Dade is averaging 917 units per month sold over the first five months of the year while Broward and Palm Beach Counties are averaging 950 and 945 units, respectively. Inventory in all three counties has also soared since the beginning of the year. "No question, it's sliding—inventory is growing and sales are slowing," Shuffield said.

Looking ahead to the remainder of the year, Shuffield said his outlook remains cautiously optimistic. "The end of this year may see a more positive outlook as sellers adjust their expectations and pricing [which may increase unit sales]," he said. "However, the long-term impact on the region's lower-income communities remains a concern." Florida's governor signed House Bill 913—the bill will allow some condo associations in certain situations to use special assessments, lines of credit, or loans to fund their reserves, and to pool reserve accounts—earlier this month, and it should provide relief for some condo owners. Although the long-term safety of residents is paramount, so is ensuring affordability for lower- and fixed-income households, and the historical role of condominiums in providing more affordable homeownership opportunities should be considered.

Editor's note: This story was revised to note that Florida's SB-4D mandates inspections for condominium buildings of three stories or more, not taller than three stories.

By Marycela Diaz, a REIN director in the Atlanta Fed's Miami Branch