Several themes continue to characterize economic activity in the Federal Reserve Bank of Atlanta's six-state district, according to the latest Beige Book report.

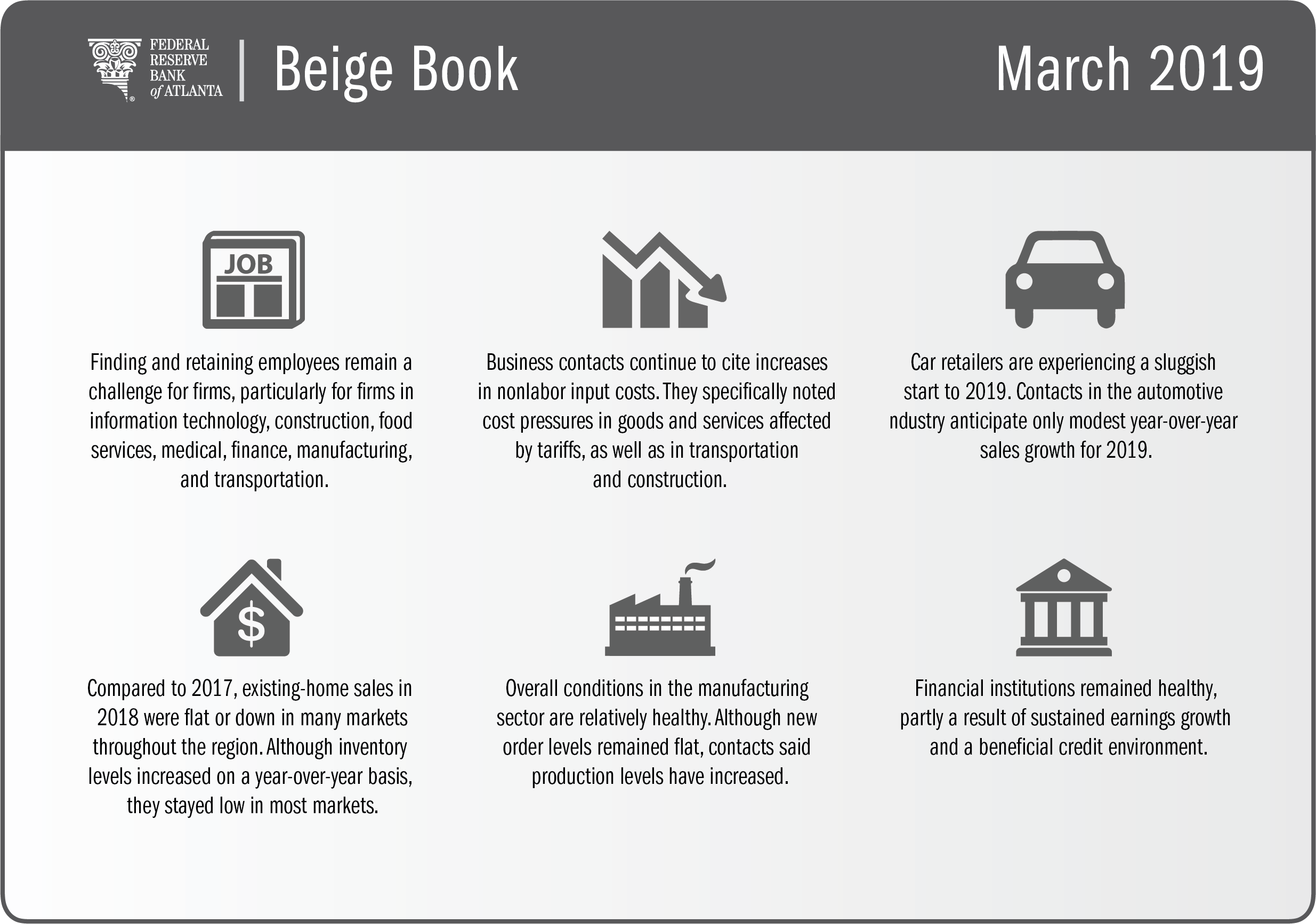

Employers still face challenges finding and retaining workers in a range of fields, including technology, construction, manufacturing, and finance. Some firms have said they have moved certain operations to larger population centers with bigger labor pools. Other companies report considering such moves, particularly for functions including information technology, finance and accounting, customer service, and upper management, according to the Atlanta Fed's portion of the February 2019 Beige Book. Companies continued to indicate they are hiking pay and offering more nonwage benefits such as additional vacation time, flexible work arrangements, and reduced hours.

Reports of rising nonlabor costs also continued, mainly from contacts in industries affected by tariffs and from transportation and construction companies. The Atlanta Fed's Business Inflation Expectations survey showed unit costs in February were up 1.9 percent from the same time a year earlier, which nearly matches the Federal Reserve's objective of 2 percent inflation as measured by the personal consumption expenditures price index. Survey respondents likewise reported they expect unit costs to rise 1.9 percent over the next year.

Overall, the Atlanta Fed's contacts reported that activity grew moderately, and the outlook remained positive. Reports from the hospitality industry were upbeat. Hoteliers and travel firms reported seeing solid growth in business and leisure travel compared to a year ago.

Meanwhile, retailers reported flat sales growth during the past few weeks. Car dealers said 2019 was off to a slow start. Still, retail and automotive contacts said they expect modest sales growth for this year versus 2018.

In housing, the slowdown continued. Although affordability remains a challenge, declining interest rates eased some of that pressure and fed growing optimism among sellers and homebuilders as they enter the peak spring selling season.

Commercial real estate leasing and sales activity remained steady across most markets in the Sixth District, which includes Alabama, Florida, Georgia, the southern halves of Louisiana and Mississippi, and the eastern two-thirds of Tennessee. Overall, commercial rents increased and vacancies declined.

In other economic sectors:

- Manufacturing contacts reported general conditions as relatively healthy. New orders were relatively unchanged, but production reportedly increased and expectations were high for future production levels.

- District transportation firms reported mixed results. Most transportation contacts foresee higher demand this year, though.

- Financial institutions remained healthy. Rising interest rates boosted earnings, but funding costs pinched net interest margins a bit at a number of institutions.

- In the energy industry, new discoveries of oil and gas in the Gulf of Mexico intensified offshore exploration and production. Some refinery and chemical projects slowed during the first quarter, but contacts expect activity to pick up later in the year.

Finally, agricultural conditions across the region varied. Since November, weekly cash prices were up for corn, soybeans, beef, and broilers, but down for cotton and rice.