Most business contacts in the southeastern United States expect continued moderate improvement in economic conditions, according to the Federal Reserve's Beige Book report on economic activity published April 17.

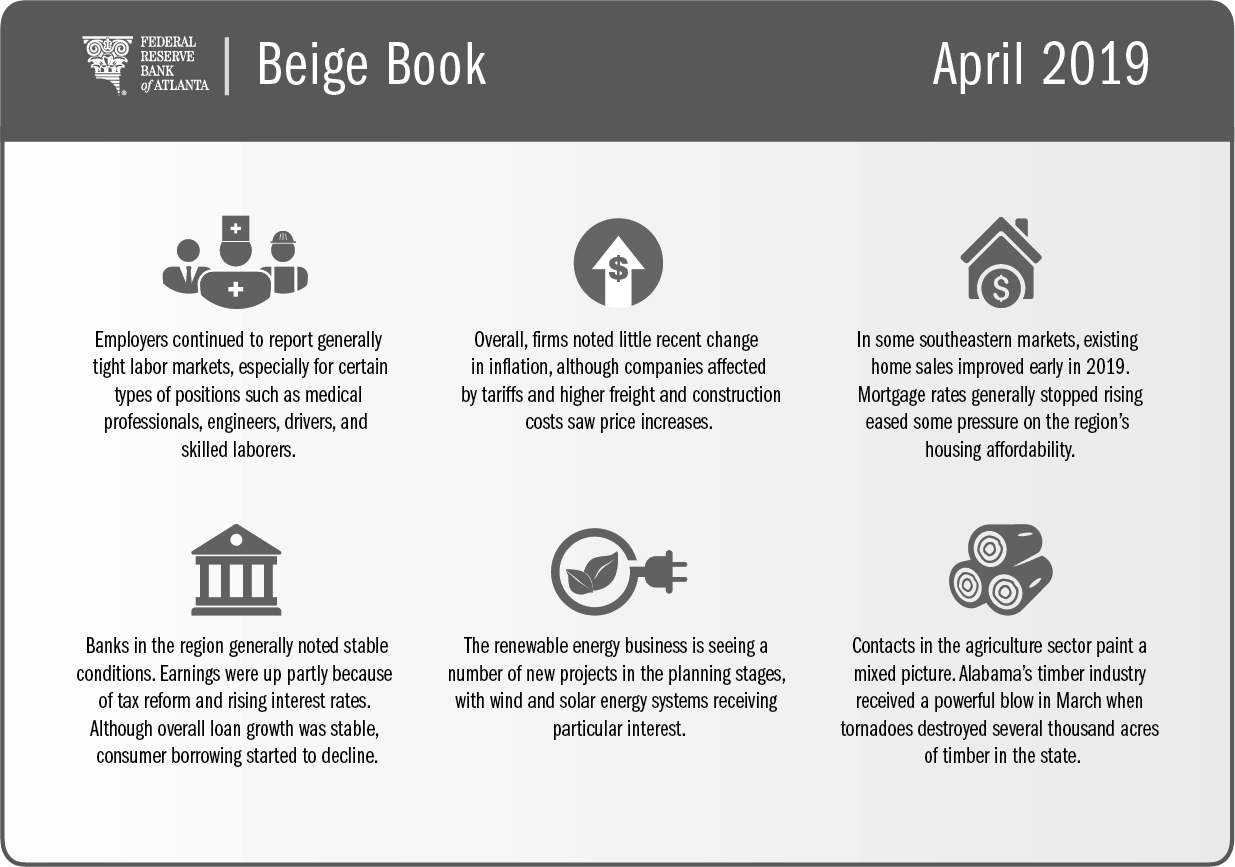

Labor markets remained generally tight, especially for tough-to-fill positions such as medical professionals, engineers, drivers, and skilled laborers. Businesses continued to refine their techniques to attract and retain workers, such as offering enhanced benefits and securing visas to employ immigrants. Nevertheless, some employers shared that that although higher pay had helped secure workers, the firms have little interest in upgrading pay for the rest of 2019.

On the inflation front, firms overall reported little change in pricing pressures from the previous Beige Book period. Meanwhile, companies affected by tariffs and higher freight and construction costs experienced price increases. The Atlanta Fed's Business Inflation Expectations Survey of Southeast firms found that year-over-year unit costs were up 2 percent in March. Respondents reported they expect costs to rise 1.9 percent over the next year, which is very near the Federal Reserve's objective of 2 percent.

The Federal Reserve's objective for inflation is 2 percent as measured by the personal consumption expenditures index. The 2 percent inflation objective represents the level of inflation over the longer term that members of the Federal Open Market Committee view as most consistent with stable prices.

Elsewhere:

- Reports from retailers were mixed. Although many contacts said sales growth slowed in February, they also noted that it ticked up in the first two weeks of March. Meanwhile, auto dealers reported declining demand in February compared to the same time last year.

- Though still unchanged or lower than year-ago levels, existing home sales in numerous markets across the Sixth District improved early in 2019 from low levels in late 2018. Mortgage rates generally stopped rising, helping ease housing affordability pressures for some buyers in the region.

- Macroeconomic growth continued to propel the commercial real estate business in much of the Southeast and in most property categories.

- Manufacturing contacts reported that general conditions remained solid. Nearly half of contacts said they expect higher production levels over the next six months.

- Transportation activity was largely unchanged since the previous Beige Book, published on March 12. Logistics contacts noted continued expansion of e-commerce shipments, but volumes of intermodal cargo—goods transferred from ships to trains to trucks—fell substantially compared to the end of 2018 and early weeks of 2019.

- Financial institutions reported stable conditions. Earnings were up partly because of tax reform and increasing interest rates. But while overall loan growth was stable, consumer borrowing started to decline.

- In the energy sector, utility companies said they were starting to plan power transmission and distribution projects. Likewise, contacts in the renewable energy business mentioned new projects in the works, particularly wind and solar energy systems.

- The picture in agriculture was mixed. Notably, tornadoes destroyed several thousand acres of timber in Alabama in early March.