The Federal Reserve Bank of Atlanta's Beige Book survey of regional economic conditions reported that economic activity in the Southeast softened slightly in recent weeks.

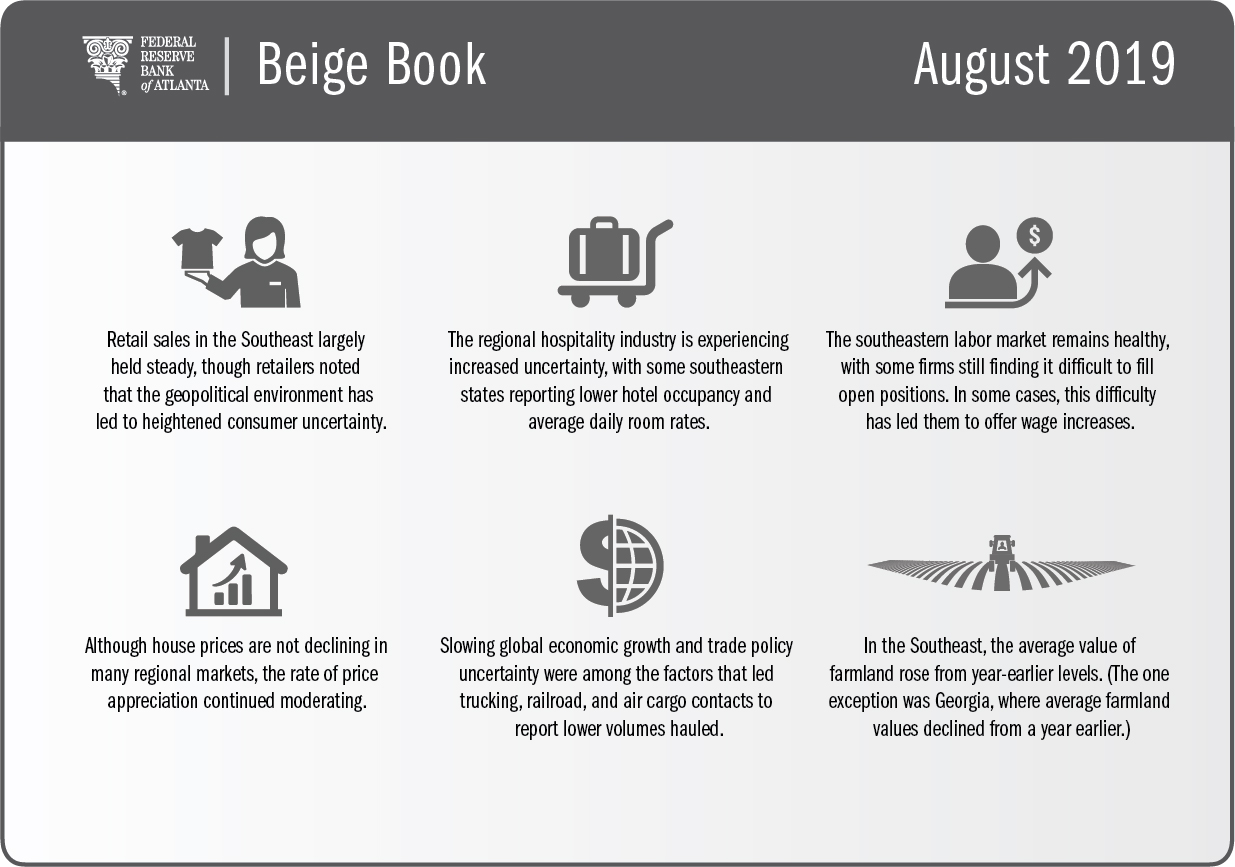

Published September 4, the report says business contacts reported slowing activity during late July and August in sectors including manufacturing, hospitality, and residential real estate. Although sales remained steady, retailers noted increased uncertainty among consumers because of the geopolitical environment. Retail contacts voiced concerns about whether this uncertainty will affect consumer confidence and spending in the upcoming holiday season. Hospitality contacts in Florida and Louisiana also reported greater uncertainty along with lower hotel occupancy and average daily room rates compared to a year earlier.

The Federal Reserve publishes the Beige book eight times a year, before each meeting of the Federal Open Market Committee, which sets monetary policy. The 12 regional Reserve Banks, including the Atlanta Fed, publish Beige Books surveying business decision-makers in their own districts, along with a national version of the report from the Fed Board of Governors.

The region's labor market remains healthy, with firms reporting continued difficulty filling open positions, leading to annual wage increases of between 3 percent and 4 percent. New and used vehicle sales increased in July from June, conditions at financial institutions were stable, and investment in gas pipeline infrastructure on the Gulf Coast remained high.

In particular sectors, highlights from the August Beige Book include:

- Employment and wages: Employers continued to collaborate with workforce development organizations and schools to create pipelines of potential employees.

- Prices: Companies affected by tariffs were generally successful in passing along price increases to their customers. The Atlanta Fed's Business Inflation Expectations Survey showed that year-over-year unit costs rose 1.9 percent in August. Survey respondents said they figure unit costs will rise 2 percent during the next year, which is the Fed's objective for price inflation.

- Construction and real estate: Constraints on the housing supply helped keep home sales lower than they were a year ago in several markets. House prices are not declining in many markets, but the rate of price appreciation continued to moderate. Industrial real estate remained strong.

- Manufacturing: Numerous companies indicated that new orders and production declined. Just over a quarter of contacts expect higher production levels over the next six months.

- Transportation: Trucking, railroad, and air cargo contacts reported lower volumes hauled, in part because of slowing global economic growth and trade policy uncertainty.

- Agriculture: Average farmland values in the Southeast increased from a year earlier except in Georgia, where values fell.