Amid the familiar refrain of modest macroeconomic expansion, the Federal Reserve’s latest Beige Book section on the Southeast reports sluggish manufacturing activity, surging ecommerce sales, and downward pressure on prices resulting from the ease of online comparison shopping.

The report on economic conditions precedes each meeting of the Federal Reserve’s policymaking Federal Open Market Committee. The January 15 Beige Book covers the final six weeks of 2019.

Broadly, the outlook among Atlanta Fed business contacts across the six states of its district remained upbeat. (The district includes Alabama, Florida, Georgia, and parts of Louisiana, Mississippi, and Tennessee.)

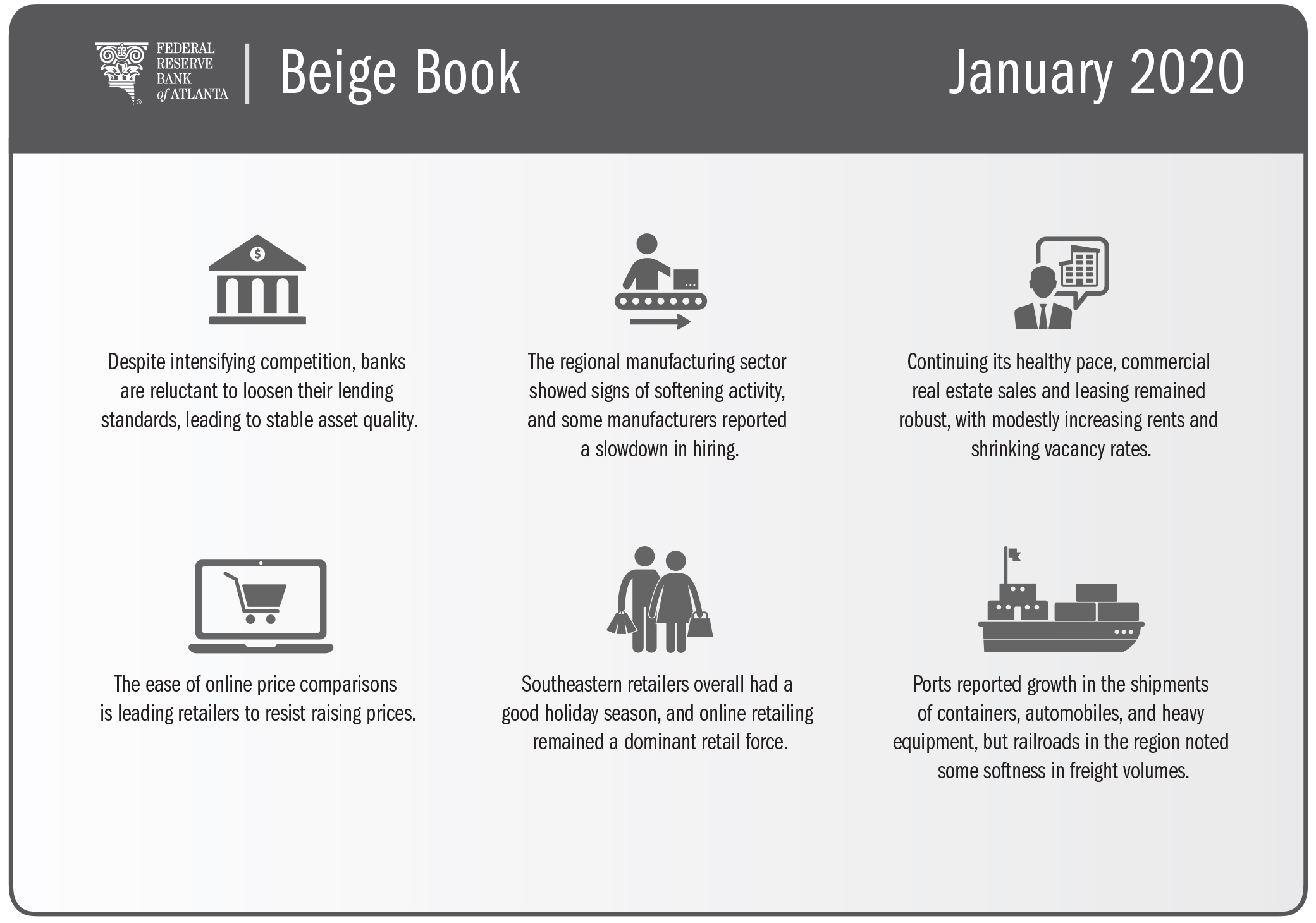

Much of the report details trends that have prevailed for a few quarters or longer, including widespread difficulty attracting and retaining qualified talent, strong leisure travel activity, improving residential real estate industry conditions, and healthy banking conditions.

More recently, signs of a regional manufacturing slump cropped up, mirroring a national slowdown. Firms in the sector reported slowing overall activity since the last Beige Book reporting period. Atlanta Fed factory contacts said order levels dipped, and they saw notable decreases in production. However, optimism recently rose, as just over a quarter of contacts expected higher production over the next six months, up from a fifth in the previous Beige Book reporting period in the fall.

Meanwhile, southeastern retailers reported robust holiday sales, with online purchases continuing to dominate the business. Upstream from the consumer, logistics firms noted major increases in ecommerce-related business compared to the holiday period a year earlier.

On the pricing front, some contacts reported downward pricing pressure resulting from pricing transparency, basically online tools that allow consumers and businesses to quickly compare prices among multiple sellers. The Atlanta Fed's Business Inflation Expectations survey showed year-over-year unit costs were up 1.6 percent in December. Survey respondents indicated they expect unit costs to rise 1.9 percent over the next 12 months.

In other sectors:

- Most financial institutions reported they are not easing loan underwriting standards even though competition is intensifying.

- Commercial real estate contacts reported leasing and sales activity remained steady, although some contacts mentioned growing uncertainty as a concern.

- Some chemical manufacturers described continued softening in output, largely related to declining activity in manufactured goods sectors and tepid global economic growth. Strong growth continued in the renewable energy sector, particularly in wind and solar.

- The December production forecast for Florida's orange crop was unchanged while the grapefruit production forecast increased. Both forecasts remain ahead of last year's production.