A now-familiar pattern—economic growth picking up but still below pre-COVID levels—prevailed across the Southeast over the past several weeks. But two new factors joined the pandemic to hamstring commerce, as Hurricanes Laura and Sally disrupted energy production and transmission and damaged crops, farming infrastructure, and property across coastal Louisiana, Alabama, and a sliver of Florida, according to the new Beige Book summary of economic conditions from the Federal Reserve Bank of Atlanta.

Laura struck Louisiana in late August, and Sally hit coastal Alabama in mid-September. The storms snarled energy supplies, as production, refining, and chemical processing stalled, according to Atlanta Fed contacts in the energy industry. Hundreds of industrial sites lost power for an extended period after Laura damaged electricity generation, transmission, and distribution infrastructure in southwest Louisiana.

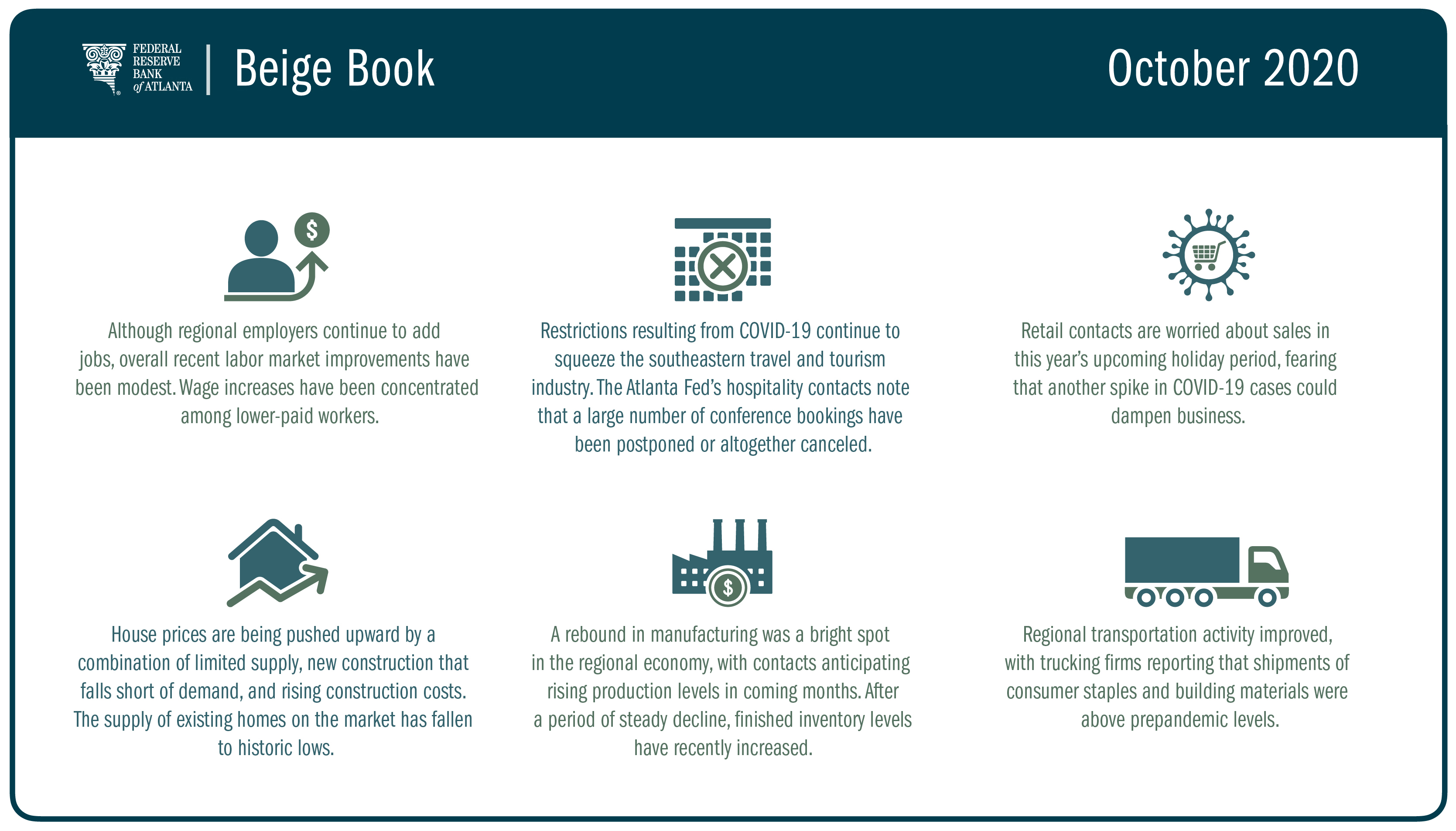

Meanwhile, residential real estate markets across the Southeast remained subject to a mixture of forces. Demand for housing continued to recover, according to Atlanta Fed contacts in the industry. And construction is not keeping pace with that demand. As a result, the supply of existing homes for sale dropped to historic lows. Limited supply and rising construction costs have forced prices upward. At the same time, though, low interest rates continued to partially offset higher prices.

Real estate contacts in certain markets such as Orlando and Miami shared concerns over possible higher numbers of mortgage defaults as delinquencies rise.

Like residential real estate, various and sometimes contrasting forces continue shaping labor markets. For instance, firms told the Atlanta Fed they continued slowly rehiring workers as demand returned. On the other hand, some contacts said they have made earlier staff cuts permanent, while others are using attrition to shrink their workforce. Employers also expressed concern about employees’ abilities to balance work with the demands of childcare and the return to school, in person or virtual.

Feedback on wages also varied among Atlanta Fed contacts. Some companies reversed pay cuts, while others maintained reductions and salary freezes. Wage hikes still are mostly happening at the low end of the pay scale.

In other sectors:

- Prices of some raw materials such as lumber and steel rose, along with spending on COVID precautions, testing, sanitation supplies, personal protective equipment, and technology as more people continued to work remotely. But firms continued to find little power to pass these costs through to customers.

- Retail contacts shared concerns about the upcoming holiday sales season based on political uncertainty and another potential spike in COVID-19 cases.

- Manufacturing contacts reported an increase in overall activity since the previous Beige Book report was published early last month. Firms indicated that new orders and production levels climbed, and expectations for production over the next six months rose as well.

- Transportation activity across the Sixth District also improved over the past several weeks. Trucking firms reported that shipments of consumer staples and building materials remained above pre-COVID levels. Port contacts reported significant growth in container traffic, powered by ecommerce, and ocean carriers were operating at full capacity and reinstating ships that were suspended because of the pandemic.

- Finally, conditions at financial institutions stabilized. Low interest rates continued to squeeze banks’ net interest margins, effectively dampening their profit margins. Persistently elevated deposit levels kept liquidity strong, and requests for additional forbearance in repaying loans declined.

The Federal Reserve issues the Beige Book report of economic conditions before each meeting of the Federal Open Market Committee, whose next meeting is scheduled for November 4 and 5.