During the six weeks leading up to the latest coronavirus surge, economic activity across the Southeast ticked up modestly, according to the November 2020 Beige Book summary from the Federal Reserve Bank of Atlanta.

In sum, labor markets continued a gradual recovery. Auto sales remained strong. Housing markets cooled a bit but stayed vigorous, and tourism and hospitality contacts signaled slow improvement. On the other hand, the commercial real estate and banking industries faced ongoing challenges.

In the labor market, some employers in high-cost places reported an interesting twist: hiring white-collar staff such as technology and accounting professionals to work remotely at pay rates above the local market where those workers live, but still below prevailing salaries in the companies’ home cities. Contacts said they generally were able to find qualified applicants for those high-paying jobs.

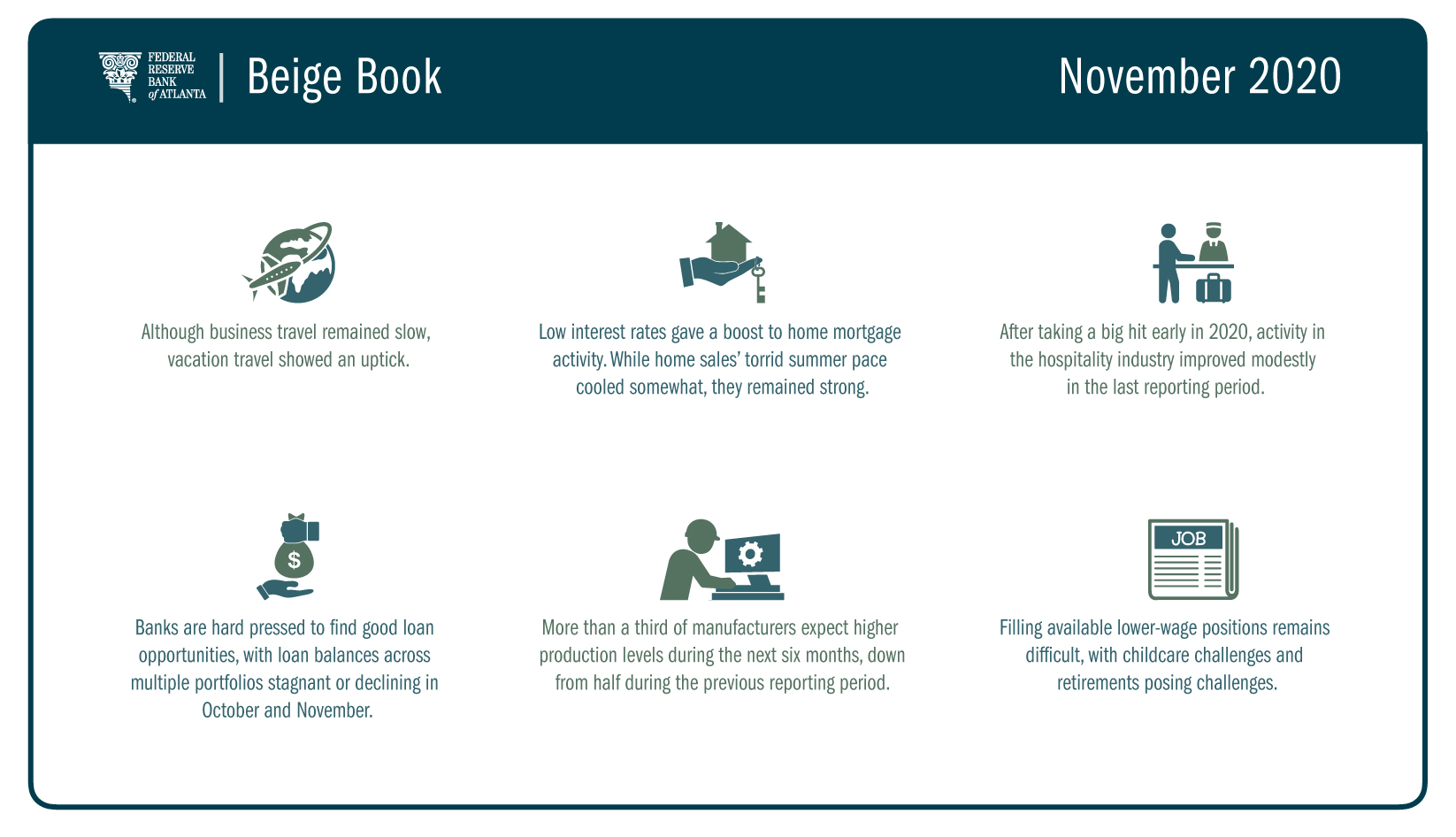

The story was different for lower-wage positions. The Beige Book notes that the pool of available workers for those occupations remained limited, in part because of childcare challenges and retirements.

With an unusual holiday season approaching, the retail outlook was uncertain. Some parts of the sector showed strength. Auto sales, for example, remained solid, though down, from September and October as fleet sales tumbled compared to a year ago. Similarly, hospitality contacts said vacation business picked up a bit while business travel remained sluggish. Based on the current trajectory, contacts don’t expect business travel to fully recover until 2023.

A two-sided residential real estate market—thriving at the top, struggling at the lower end of the price spectrum—generally prevailed during the latest period. Home sales moderated from summer peaks but stayed strong as low interest rates spurred demand. Existing home inventory remained tight and new home construction continued to lag demand. Ongoing high building costs pushed up house prices, putting pressure on affordability.

Contacts reported outsized shares of mortgage delinquencies in certain spots, including rural Alabama, Mississippi, and Louisiana; urban markets in south and central Florida; and the southern part of metropolitan Atlanta.

Meanwhile, the commercial real estate sector continued to suffer the effects of the pandemic. Hospitality, which was especially hard hit earlier this year, saw a modest improvement end, as occupancies declined from the previous reporting period. Retail remained challenged, though landlords reported limited improvement in rent collections.

Diminished travel has pummeled the hospitality and retail real estate sectors. In fact, recent asset valuations in public markets confirmed that property values are deteriorating, which—along with tighter underwriting standards—may hinder new lending.

Banks already appeared to have struggled to find good loan opportunities in October and November. Outside of residential real estate and commercial loans, loan balances across multiple portfolios were stagnant or declined, the Beige Book reports. Instead of increasing loans, banks held higher balances in cash accounts or securities portfolios.

In other sectors:

- Firms continued to report little to no pricing power, but some expect to pass through increased costs in 2021.

- Manufacturing contacts’ expectations dimmed. More than a third—down from half during the previous reporting period—expected higher production levels during the next six months.

- Transportation contacts indicated that demand was largely consistent with the previous report. Rail traffic rose compared to a year ago, and truckers noted solid demand, although driver shortages continued to constrain their capacity. In the Southeast, ports’ container volume increased while other cargo levels were still below year-earlier levels.

- Energy contacts said a recovery in commercial usage slowed in recent weeks because demand is sensitive to COVID-19 movements. Still, capital investment remained solid, including increasing investment in renewable energy sources in the ongoing pursuit of decarbonization.

- Agricultural conditions were mixed. Some growers reported crop damage from hurricanes. Contacts also noted increases in some commodity prices, and some said increased federal assistance helped strengthen their balance sheets.

The Federal Reserve issues the Beige Book report of economic conditions before each meeting of the Federal Open Market Committee, whose next meeting is scheduled for December 15 and 16.