Economic conditions in the Southeast continue to be shaped by the COVID-19 pandemic, as overall activity expanded modestly and scattered bright spots emerged from mid-November through December, according to the latest Beige Book report of economic conditions from the Federal Reserve Bank of Atlanta.

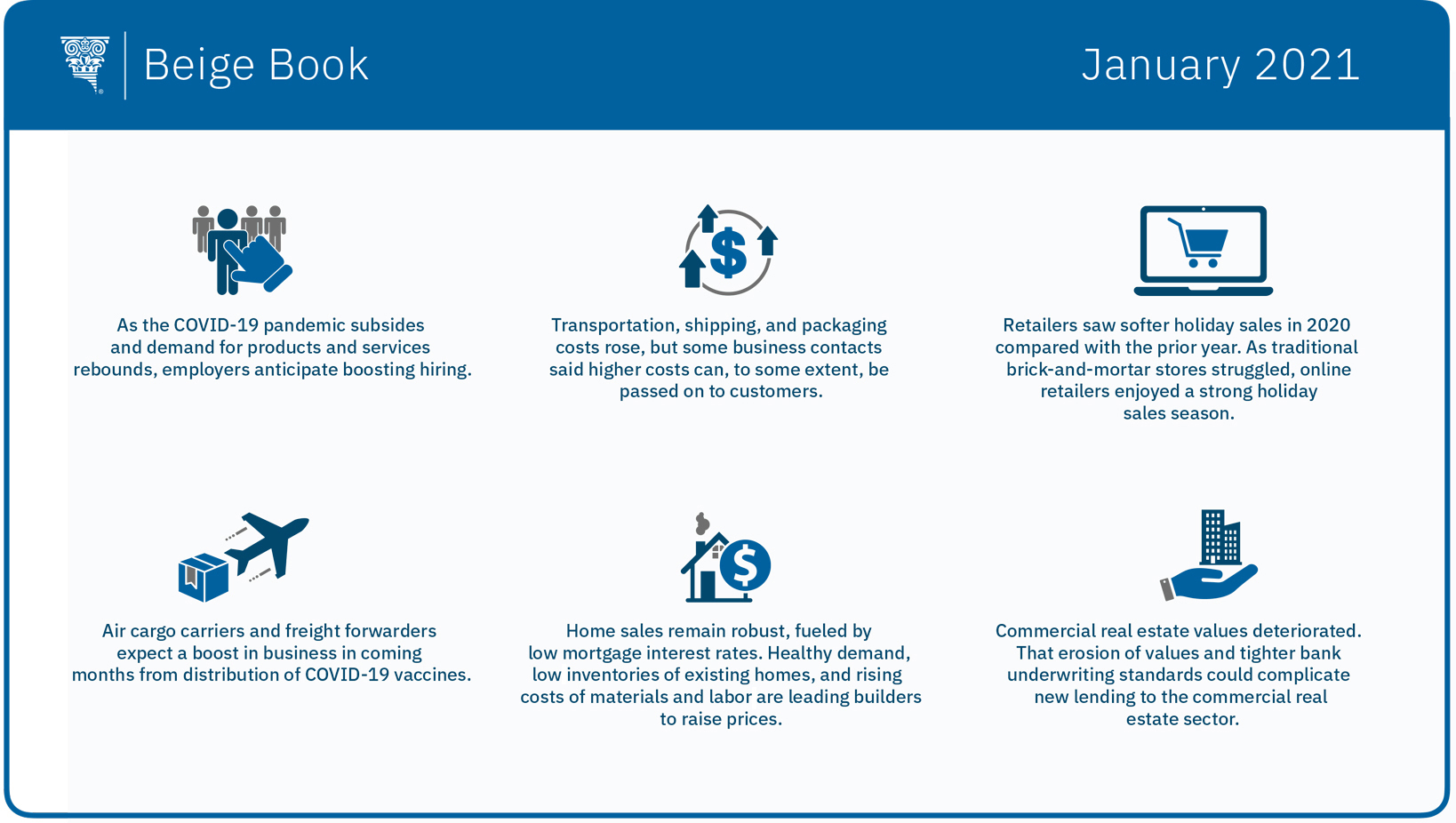

Labor markets remained divergent. Atlanta Fed business contacts reported small improvements among higher-skilled positions in which most people can work from home, in contrast to higher turnover and tighter markets for jobs that require in-person work, many of which are lower-paying. In coming months, many employers figure to add staff as the pandemic subsides and demand for products and services rebounds. However, because companies have learned to operate with leaner workforces amid the pandemic, staffing levels for some firms probably won’t return to prepandemic levels, contacts told the Atlanta Fed Regional Economic Information Network staff.

Meanwhile, the costs of raw materials—particularly lumber, aluminum, and steel—continued to climb. Transportation, shipping, and packaging costs also increased, but more business contacts said they can pass along higher costs to customers. Indeed, the Atlanta Fed’s Business Inflation Expectations survey showed year-over-year unit costs increased significantly to 1.7 percent on average in December, up from 1.3 percent in November. Expectations for one year ahead, however, remained steady at 2 percent, which is the Fed’s goal for consumer price inflation as measured by the personal consumption expenditures price index.

On the consumer spending front, not surprisingly, retailers reported holiday sales softer than in 2019. Traditional stores continued to struggle, while online sales were strong. Importantly, contacts said they are uncertain about prospects for 2021 as some expect changes in consumer spending behavior to last.

In other sectors, optimism cropped up even as conditions brought on by the pandemic and associated public health measures persisted.

- Transportation contacts said business is picking up, in part because of booming ecommerce. Freight forwarders said they handled robust volumes. Air cargo contacts noted year-over-year revenue growth as tight capacity pushed up rates and congestion in Asian seaports pushed some cargo, particularly expensive goods, to air transportation. Distribution of COVID-19 vaccines is also expected to boost business for air cargo carriers and freight forwarders in the next few months.

- Manufacturers appear optimistic. Contacts’ expectations increased notably, as half anticipate higher levels of production over the next six months.

- In real estate, low interest rates continued to fuel strong home sales, and builders are raising prices amid healthy demand, low inventories of existing homes, and rising costs for materials and labor. Though down from peak levels, the number of mortgages in forbearance or in delinquency remained high, especially in rural areas of Alabama, Mississippi, and Louisiana, as well as urban markets in north Georgia and south and central Florida. The story is quite different in commercial real estate as values deteriorated. That erosion of values, along with tighter bank underwriting standards, might complicate new lending to the commercial real estate sector.

- On the whole, conditions at financial institutions remained stable. Loan balances kept trending downward because of economic uncertainty, concerns about credit quality, and collateral valuations.

- Utilities contacts noted energy usage remained sensitive to COVID-19 conditions. Nevertheless, investments remained solid in renewables, grid modernization, and other infrastructure.

- Some farming counties in Alabama, Florida, Louisiana, and Tennessee were designated natural disaster areas after losses from hurricanes and storm damage.

The Fed publishes the Beige Book before each meeting of its policy-setting Federal Open Market Committee, which next meets on January 26 and 27, the first of eight scheduled sessions in 2021.