The Beige Book has begun to sound rather ordinary again. After a year of pandemic-induced economic turmoil, that is welcome news indeed.

The Atlanta Fed’s portion of the report summarizes southeastern economic conditions in the six weeks preceding each meeting of the Federal Open Market Committee. For years, Beige Book descriptions of “modestly expanding” activity were routine before abruptly vanishing in February 2020.

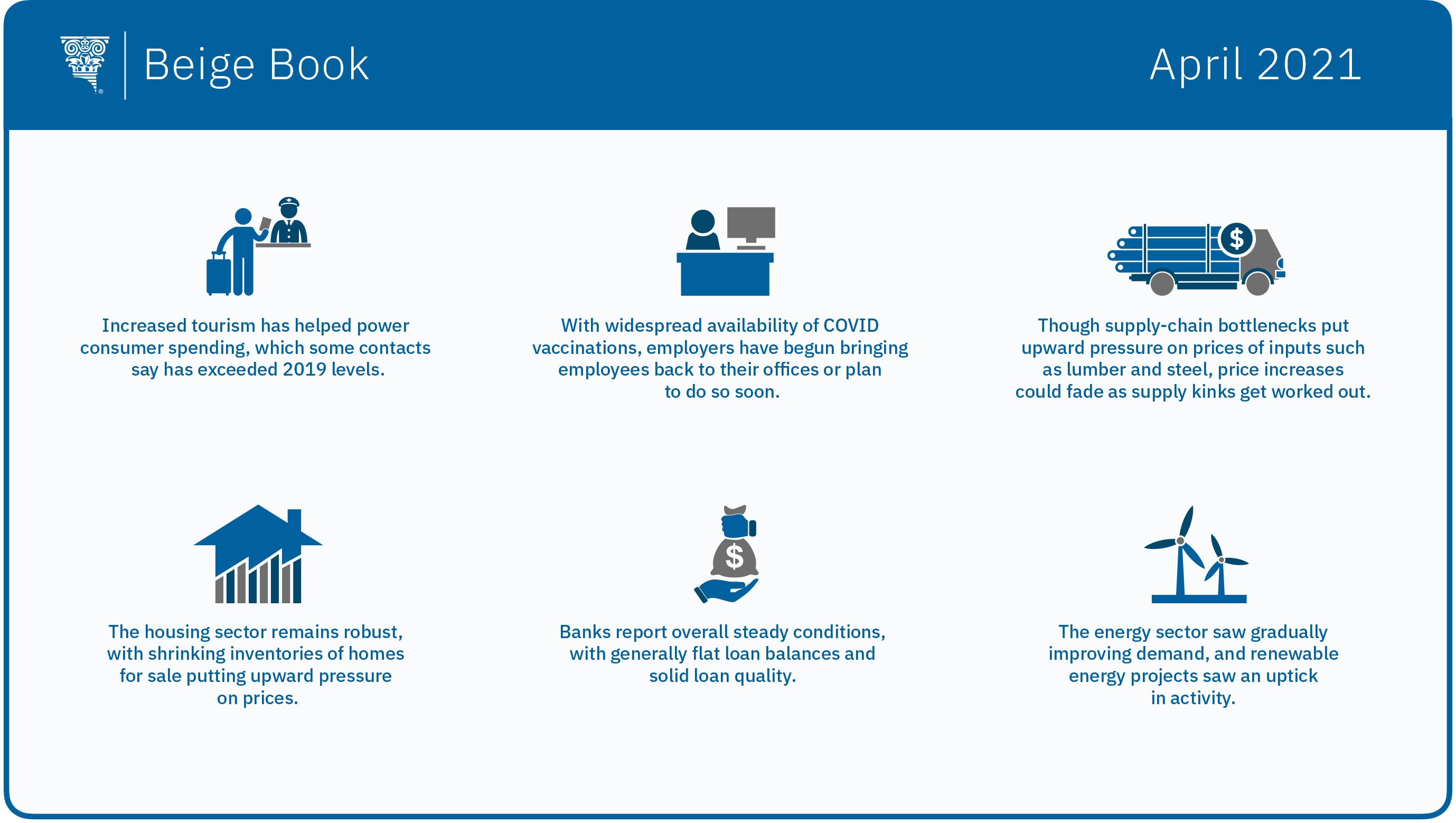

Modest expansion is back, according to the April Beige Book and the two before it. The labor market has improved, retail sales have climbed, and even tourism and the hospitality industry have strengthened across the Atlanta Fed’s six-state district from mid-February through March. Among the few downbeat notes were reports of mixed commercial real estate conditions, elevated levels of mortgages in forbearance or delinquency, and tepid demand for bank loans.

Hotels filling up

Consumer spending accounts for about two-thirds of the nation’s economic output as measured by gross domestic product, and that engine appears to be revving. Some contacts noted that, powered mainly by tourism, recent spending has exceeded 2019 levels. Industry contacts reported a “significant uptick” in leisure travel since February. Numerous hotels in the region fully reopened and reported occupancy of up to 90 percent in March. And while restaurants and tourist attractions largely maintained COVID-19 capacity limits, demand in some areas of the region exceeded capacity, according to contacts.

Meanwhile, in the labor market, some firms started bringing employees back to offices or planned to do so soon as vaccines become more accessible. A majority of Atlanta Fed business contacts plan to use hybrid work models, allowing workers to split time between the office and home. Some firms plan to make certain hard-to-fill jobs purely remote to attract and retain talent. Contacts also reported that illness-related absenteeism fell sharply, and some companies eliminated pay premiums and leave policies associated with COVID-19.

In other economic sectors:

- Input costs, particularly for lumber, steel, and shipping continued to rise. Some contacts expect price increases to fade as supply-chain bottlenecks clear up. Reports on pricing power were mixed. The Atlanta Fed’s Business Inflation Expectations survey showed contacts in March anticipated unit costs to increase 2.4 percent over the coming year, up from 2.2 percent in February.

- Manufacturing contacts were upbeat. Orders and production levels rose strongly, and expectations of future production remained optimistic even as supply-chain problems continued.

- Housing demand remained steady, as shrinking inventories of homes for sale kept prices rising. The number of mortgages either in forbearance or in delinquency remained high, especially in tourism-dependent markets like Central and South Florida, as well as rural areas along the Gulf Coast.

- Transportation activity expanded moderately, and most contacts expect growth to continue over the next six months, even though rail shipments of farm products, petroleum, and automobiles declined.

- Banking and finance conditions were steady. Loan balances remained generally flat, while on the plus side lenders noted loan quality remained solid.

- Energy contacts reported that domestic demand improved gradually. Fuel delivery and carrier capacity remained tight as trucks cleared backlogs resulting from February’s winter storms. Renewable generation projects geared up, especially solar power, biodiesel, and renewable diesel.

The Fed issues the Beige Book before each meeting of its policy-setting Federal Open Market Committee. The next meeting is scheduled for April 27–28.