Some Atlanta Fed business contacts expect worker shortages, particularly for lower-wage jobs, to become less troublesome by the fall. Already, pressure to increase wages across the Southeast picked up from April through the middle of May, most notably for low-skilled positions, according to the new Beige Book report of regional economic conditions from the Federal Reserve Bank of Atlanta. The Beige Book covers the six-week information-gathering period preceding the June 15–16 meeting of the policymaking Federal Open Market Committee.

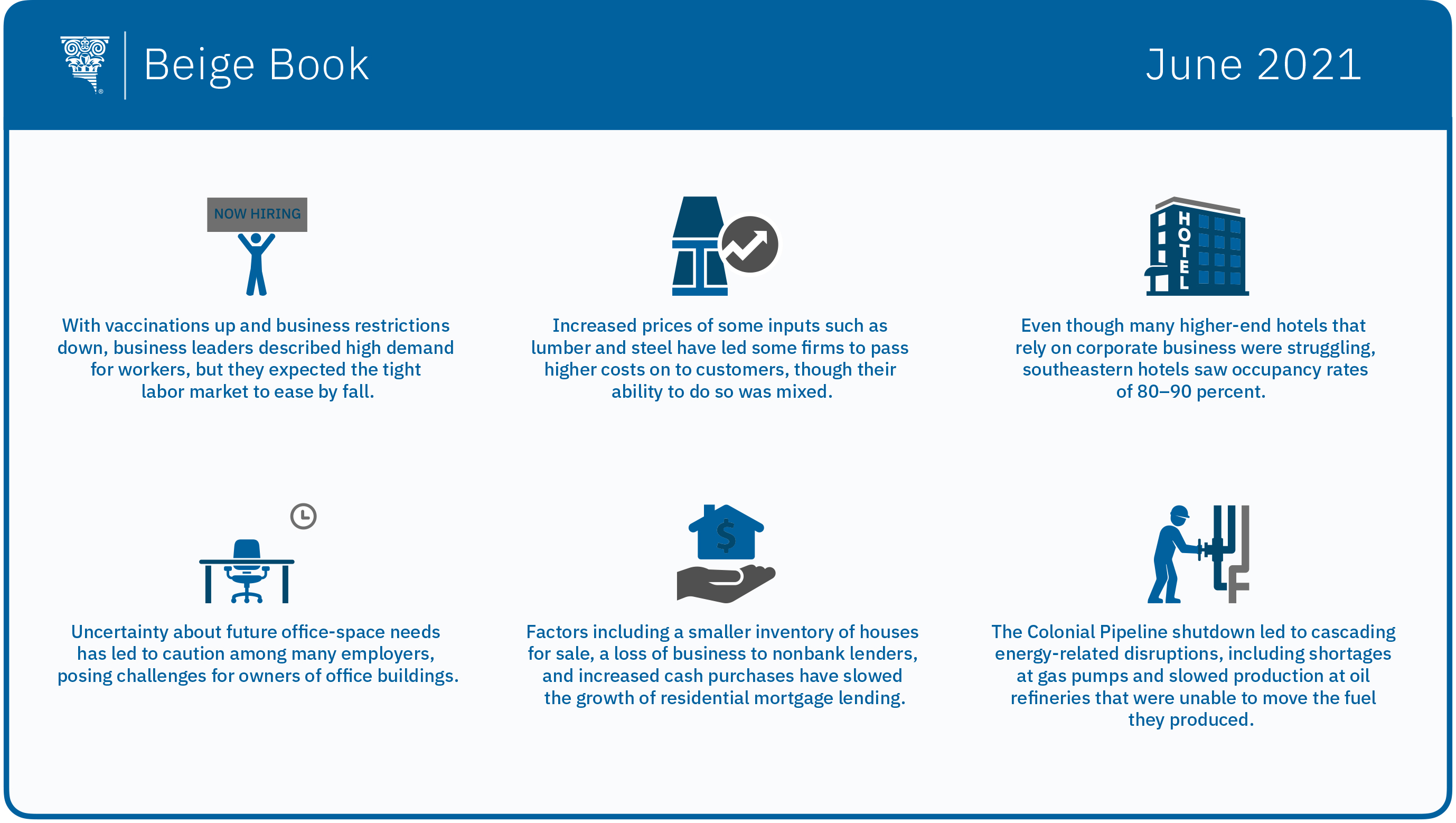

In the lower-wage segment of the labor market, reports of pay increases were more widespread in recent weeks as referral and signing bonuses proliferated. Employment generally increased. Business leaders reported intensified demand for workers as southeastern economies reopened amid widespread vaccinations and loosening public health restrictions.

Reports of labor shortages have been a recurring theme in anecdotes from business executives for several months. Many firm operators cited expanded unemployment insurance benefits as a primary reason why potential workers are staying on the labor market’s sidelines, along with childcare concerns, transportation issues, and employers’ inability to guarantee consistent hours. Research generally suggests expanded unemployment benefits are just one of many causes of labor shortages.

Worries about rising prices have also characterized feedback from business contacts in 2021. Southeastern contacts reported that input costs—particularly for lumber, steel, and transportation—remained high. Meanwhile, firms’ power to pass along higher costs to customers was mixed, though many contacts noted they withdrew promotional prices to maintain profit margins.

The Atlanta Fed’s Business Inflation Expectations survey showed year-over-year unit costs increased to 2.8 percent on average in May. Year-ahead expectations increased to 2.8 percent in May, up from 2.5 percent in April.

As summer approaches and health restrictions ease, tourism is largely driving vigorous retail sales, according to Atlanta Fed contacts. Leisure travelers filled hotels across the region, with occupancy rates in the 80–90 percent range. And while contacts said business travel bookings were rising for the second half of 2021, many higher-end hotels reliant on corporate business continued to struggle.

In other economic sectors, the Beige Book reported:

- Heavy investor demand added significantly to upward pressure on new home prices. Contacts reported that housing affordability is becoming more of a concern.

- In commercial real estate, owners of office buildings continued to face challenges as many employers remained cautious about their future need for space. Vacancies are rising as firms use less space and new construction adds space to the market.

- Even though supplier delivery times slowed, nearly two-thirds of manufacturing contacts said they expected higher production over the next six months.

- Transportation activity across the Southeast expanded. Managers of several seaports reported record volumes of containerized imports, and some noted they are making major investments to expand capacity to process containers.

- Conditions at financial institutions mostly remained stable. Some loan growth returned over the past six weeks, particularly in consumer loans. At the same time, residential mortgage loan growth slowed because of lower supplies of houses for sale, increased cash purchases, and a loss of business to nonbank lenders. In a positive sign, past due loan balances were largely unchanged despite declining numbers of loans in forbearance.

- Energy contacts noted some disruptions, including curtailed access to fuel, because of the Colonial Pipeline shutdown. Production slowed at oil refineries that were unable to offload fuel. Nonetheless, optimism about oil and gas demand among energy contacts continued to grow as economies across the country reopened.

- Agricultural conditions were mixed, as much of the region got unusually heavy rain while South Florida was atypically dry. Most of the Southeast’s cotton and peanut crops were behind the five-year planting average, while soybean planting was mixed and Tennessee’s corn crops were mostly on par with the five-year average.

The Fed issues the Beige Book before each meeting of its policy-setting Federal Open Market Committee. The next meeting is scheduled for June 15–16.