A couple of pandemic-related hurdles continued to characterize economic activity in the Southeast from July through mid-August: an unusually shallow pool of available workers and logjammed supply chains, according to the latest Beige Book report of regional business activity by the Federal Reserve Bank of Atlanta. Nonetheless, overall economic activity expanded moderately.

Demand for labor intensified from earlier weeks. However, the number of job applicants continued to fall short of companies' job openings. Many businesspeople hoped the expiration of expanded unemployment benefits and the start of school would result in more people seeking jobs, but such an increase has not happened yet.

In fact, the recent rise in COVID cases fueled by the delta variant made available workers even scarcer. Also, illness and quarantines led to increased workplace absenteeism.

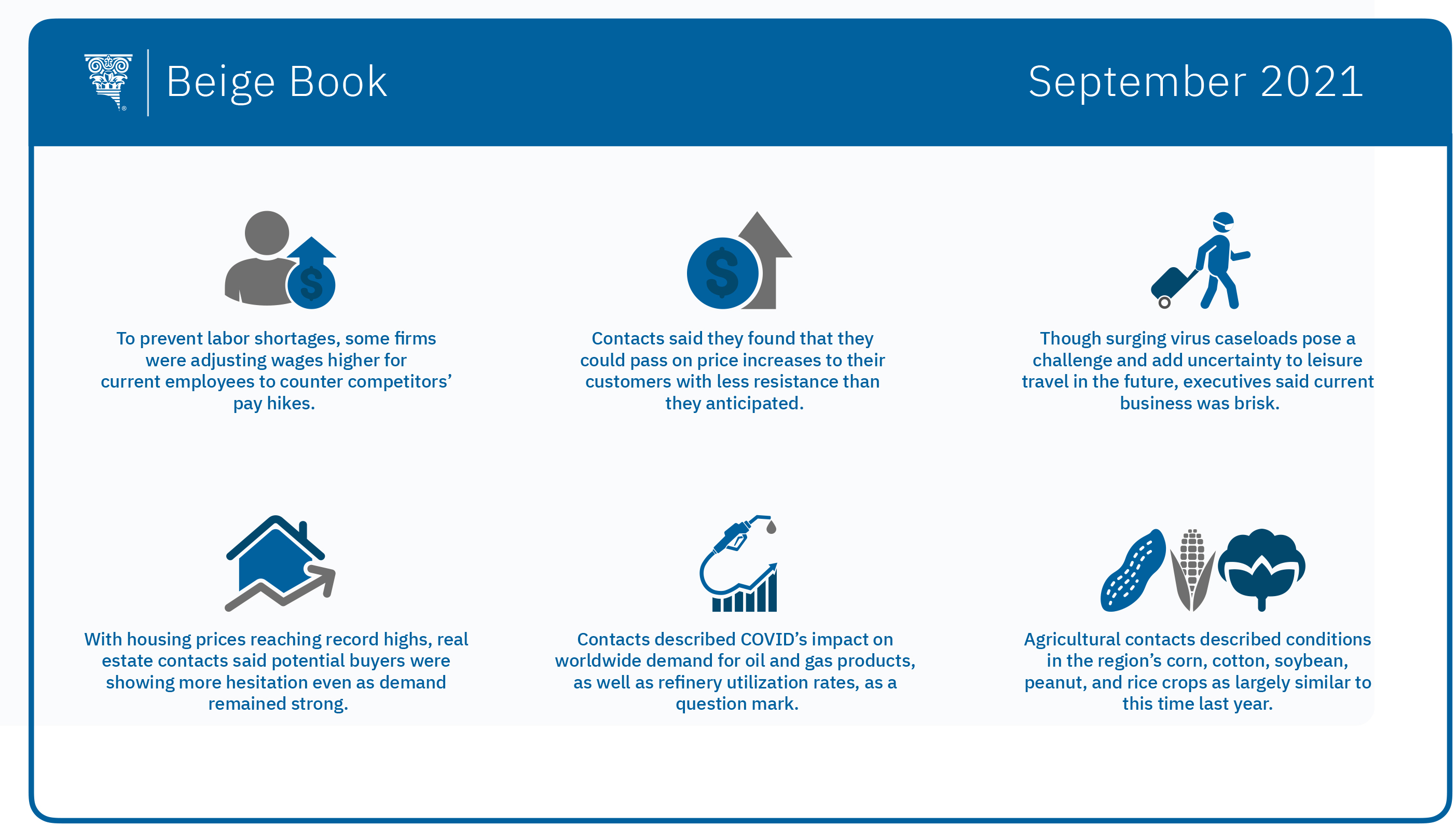

In response to the difficulty of hiring and keeping workers, employers reported widespread wage increases, most notably for entry-level jobs. To retain employees, several firms were adjusting wages to counter competitors' pay hikes.

As wages rose, so did other business costs, according to Atlanta Fed contacts. In particular, prices for steel and freight increased, as did the rates that firms pay to use the boxcar-style shipping containers that are stacked on ships and then placed on trains and trucks at seaports. One finding that is somewhat new: contacts said they were able to pass along price increases more often and with minimal resistance from customers.

Most contacts expect cost pressures other than wages to ease by 2022. Nevertheless, the Atlanta Fed’s August Business Inflation Expectations survey showed respondents anticipate inflation of 3 percent during the next year, up from 2.8 percent in July.

In other economic sectors:

- Retail contacts reported strong sales, especially in tourist destinations. Worker shortages made it challenging for restaurants and retail stores to meet demand, contacts said. Though leisure travel remained brisk, executives said they expect surges in virus cases to curb business and increase uncertainty.

- Housing demand remained strong, but real estate contacts said potential buyers were more hesitant as prices continued to reach record highs. Multifamily housing activity strengthened, but contacts expressed uncertainty over the lifting of the eviction moratorium.

- Manufacturing contacts said demand had increased since the previous Beige Book report. But receiving supplies took longer, which—coupled with labor shortages—continued to impede production for many manufacturers.

- Transportation contacts said business remained healthy. They expect further strengthening but no relief from supply chain disruptions that they foresee over the next three to six months.

- Conditions at financial institutions were stable, on net, yet deposit growth slowed, and loan demand declined.

- Activity in the energy sector remained solid during the reporting period. However, contacts were unsure about the impact of COVID on global demand for oil and gas products and, consequently, refinery utilization rates.

- Agricultural conditions remained mixed. With planting completed, the region’s corn, cotton, soybean, peanut, and rice crop conditions were mostly on par with this time last year.

The Fed issues the Beige Book before each meeting of its policy-setting Federal Open Market Committee, which meets eight times a year. The next meeting is scheduled for September 21–22.